0% found this document useful (0 votes)

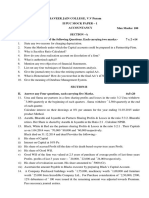

25 views14 pagesBhagya Achievers Test Series CA Foundation Paper 1: Accounting Total Marks: 50 Test 3: Detail Test Series Time: 90 Min

The document contains a test series for CA Foundation Paper 1: Accounting, including detailed questions and answers on manufacturing accounts, partnership dissolution, goodwill calculation, private practice income and expenditure, and revaluation of partnership accounts. It provides specific financial data and calculations required for each scenario. The document is structured with questions followed by comprehensive answers, including working notes and capital accounts.

Uploaded by

akshars4uCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

25 views14 pagesBhagya Achievers Test Series CA Foundation Paper 1: Accounting Total Marks: 50 Test 3: Detail Test Series Time: 90 Min

The document contains a test series for CA Foundation Paper 1: Accounting, including detailed questions and answers on manufacturing accounts, partnership dissolution, goodwill calculation, private practice income and expenditure, and revaluation of partnership accounts. It provides specific financial data and calculations required for each scenario. The document is structured with questions followed by comprehensive answers, including working notes and capital accounts.

Uploaded by

akshars4uCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 14