0% found this document useful (0 votes)

19 views2 pagesAssignment On Statement of Cash Flows

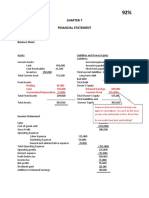

The document outlines the financial statements for Elm Inc. at the end of 2020, including the Statement of Financial Position and Income Statement. It provides detailed figures for assets, liabilities, and shareholders' equity, alongside revenue, expenses, and net income. Additionally, it includes requirements for cash flow analysis using both the indirect and direct methods, as well as a brief explanation of the differences between these methods.

Uploaded by

Zhijun ZhangCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

19 views2 pagesAssignment On Statement of Cash Flows

The document outlines the financial statements for Elm Inc. at the end of 2020, including the Statement of Financial Position and Income Statement. It provides detailed figures for assets, liabilities, and shareholders' equity, alongside revenue, expenses, and net income. Additionally, it includes requirements for cash flow analysis using both the indirect and direct methods, as well as a brief explanation of the differences between these methods.

Uploaded by

Zhijun ZhangCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 2