Derivatives & Risk

Management

Case Study: Walmarts Use of Interest Rate Swaps

� Walmarts emergence as a global behemoth began

with the opening of the first Walmart store by Sam

Walton in 1962 in Rogers, Arkansas.

Introduction

Walmarts success was due to a disciplined adherence

to the strategy of purchasing high volumes directly

from manufacturers combined with pioneering

investments in information technology that allowed it

to effectively manage its supply chain and distribution

networks.

Walmart closed the twentieth century as the United

States largest generator of sales and the worlds

largest private-sector employer.

It targeted an increase in its share of U.S. retail share

sales from 8% to 15%.

� To reach this target, Walmart company officials bet on

growth of its Supercenter stores, which were larger

versions of its flagship stores that added groceries to

the normal product offerings.

Introduction

Having firmly established itself as the prominent U.S.

retailer, Walmart sought to build on its international

expansion.

In 2000, Walmart announced that international sales

would account for 30% of total sales by 2005.

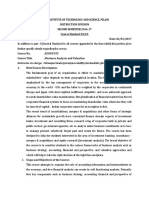

�Net Sales (in Billions)

312

285

Growth and

Challenges:

2000 -2005

244

256

217

191

165

2000.0

2001.0

2002.0

2003.0

Net Sales

2004.0

2005.0

2006.0

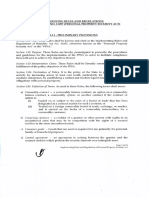

�Walmart Stores

1980

Growth and

Challenges:

2000 -2005

1736

1713

1647

1568

1478

1353

1258

1066

942

982

2002.0

2003.0

888

612

648

2000.0

2001.0

Discount Stores

Supercenters

1431

1175

1209

2004.0

2005.0

International Stores

�Growth and

Challenges:

2000 -2005

� Between 2000 and 2005, Walmart raised $26.3 billion

from bond issuances and only $581 million from

equity issuances.

Walmarts long-term debt grew from $18.8 billion in

2000 to $35.1 billion in 2006, an increase of 87%.

Walmarts

Reliance on

Debt

In connection with its bonds, Walmart also entered

into interest rate swaps, which impacted its exposure

to changes in market interest rates.

The proportion of Walmarts fixed-rate debt that was

exposed to floating rates as a result of Walmarts

interest rate swap activity increased steadily from

5.8% in 2001 to a high of 51.3% in 2004.

Walmart typically swapped the fixed rate payment

obligations on its outstanding debt for payments that

would fluctuate with London Interbank Offered Rate

(LIBOR).

�Walmarts

Reliance on

Debt

�Walmarts

Reliance on

Debt

November 16, 2004 Q3 2005 Conference Call:

While we are all pleased to see that the general

improvement in the economy has been strong enough

to trigger the Fed to raise interest rates, rising rates

will obviously have an adverse effect on our

borrowing costs.

�Analysis

At the end of Wal-Marts 2001 fiscal year, during

which the yield curve was inverted on average

(specifically, the average 1-year Treasury yield was

higher than the average 10-year Treasury yield by 9.5

basis points making floating rates higher then fixed

rates), Wal-Mart had swapped only 3.9% of its debt

from a fixed to a floating interest rate exposure,

resulting in an overall floating debt exposure of

18.7%.

During the 2002 fiscal year, the average Treasury

yield spread (the 10-year Treasury yield minus the 1year Treasury yield) had risen to 1.75%, making

floating rates significantly lower than fixed rates. WalMart commensurately increased its pay-floating

interest rate swaps to 17.3% of its debt, bringing

25.3% of its debt to a floating exposure.

� The Treasury yield spread rose even further during

the 2003 fiscal year, to an average of 2.59%. WalMart again increased its pay-floating interest rate

swaps to 32.6% of total debt, resulting in 40.8% of its

debt with a floating exposure.

Analysis

In fact, its interest expense fell by $269 million

(18.5%) even though its total debt increased by $3.5

billion (16.1%). Their resulting earnings exceeded

their consensus analyst earnings per share forecast

by three cents in 2003.

Consistent with the steep yield curve of 2003, by the

end of Walmart's 2005 fiscal year, short-term interest

rates had risen considerably. This higher interest rate

environment led Walmart to issue an earnings

warning stating that it expects interest expenses to

raise as much as $500 million this year, due in part to

higher interest rates that could hurt earnings by eight

cents a share

�Analysis

In effect Wal-Mart chose to drastically reduce their

interest expense from 2002 to 2003 by swapping to

floating when they could have locked in low fixed

rates and avoided the anticipated increase in floating

rates that materialized in 2005.

This strategy resulted in a near term gain in 2002 at

the expense of future earnings in 2005.