100% found this document useful (2 votes)

2K views42 pagesTitle Iv Import Clearance and Formalities Goods Declaration

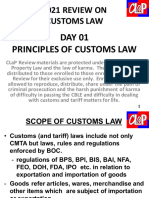

The document discusses import clearance and formalities in the Philippines. It defines key terms related to import entry such as goods declaration, formal entry, and informal entry. For goods declaration for consumption, goods can enter through a formal or informal entry process. Formal entry is required for commercial goods valued over PHP 50,000 while informal entry can be used for personal goods or commercial goods under PHP 50,000. The document also outlines the documentary requirements for different import procedures.

Uploaded by

dennilyn recaldeCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

100% found this document useful (2 votes)

2K views42 pagesTitle Iv Import Clearance and Formalities Goods Declaration

The document discusses import clearance and formalities in the Philippines. It defines key terms related to import entry such as goods declaration, formal entry, and informal entry. For goods declaration for consumption, goods can enter through a formal or informal entry process. Formal entry is required for commercial goods valued over PHP 50,000 while informal entry can be used for personal goods or commercial goods under PHP 50,000. The document also outlines the documentary requirements for different import procedures.

Uploaded by

dennilyn recaldeCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

/ 42