100% found this document useful (1 vote)

800 views17 pagesSeparate Consolidated FS-Problem 3

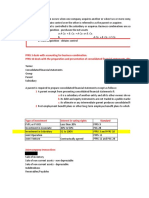

1. The document provides instructions and examples for preparing consolidated balance sheets using two approaches: the proportionate basis approach and the fair value basis approach.

2. Under the proportionate basis approach, the investment in the subsidiary is eliminated against the stockholders' equity accounts of the subsidiary. Under the fair value basis approach, the investment is eliminated against the allocated excess values of the subsidiary's assets and liabilities.

3. Worked examples are provided to demonstrate the consolidation entries and resulting consolidated balance sheets under each approach. Intragroup balances and transactions such as inventory and buildings are eliminated.

Uploaded by

Jeane Mae BooCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

100% found this document useful (1 vote)

800 views17 pagesSeparate Consolidated FS-Problem 3

1. The document provides instructions and examples for preparing consolidated balance sheets using two approaches: the proportionate basis approach and the fair value basis approach.

2. Under the proportionate basis approach, the investment in the subsidiary is eliminated against the stockholders' equity accounts of the subsidiary. Under the fair value basis approach, the investment is eliminated against the allocated excess values of the subsidiary's assets and liabilities.

3. Worked examples are provided to demonstrate the consolidation entries and resulting consolidated balance sheets under each approach. Intragroup balances and transactions such as inventory and buildings are eliminated.

Uploaded by

Jeane Mae BooCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

/ 17