0% found this document useful (0 votes)

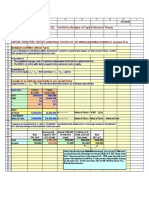

213 views56 pagesDynamics Capital Structure Decisions: Part II

This chapter discusses Modigliani and Miller's capital structure theories and how they have evolved over time as additional assumptions were introduced. It begins by outlining the key assumptions of the MM and Miller models with zero taxes and no growth. It then discusses how the models change when corporate taxes, personal taxes, and growth are considered. The chapter demonstrates through examples how leverage affects values, costs of capital, and the tradeoff between tax benefits of debt and costs of financial distress. Overall, it analyzes how capital structure theory has developed and its implications for corporate managers.

Uploaded by

Dhani Devonne BieberCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPT, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

213 views56 pagesDynamics Capital Structure Decisions: Part II

This chapter discusses Modigliani and Miller's capital structure theories and how they have evolved over time as additional assumptions were introduced. It begins by outlining the key assumptions of the MM and Miller models with zero taxes and no growth. It then discusses how the models change when corporate taxes, personal taxes, and growth are considered. The chapter demonstrates through examples how leverage affects values, costs of capital, and the tradeoff between tax benefits of debt and costs of financial distress. Overall, it analyzes how capital structure theory has developed and its implications for corporate managers.

Uploaded by

Dhani Devonne BieberCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPT, PDF, TXT or read online on Scribd

/ 56