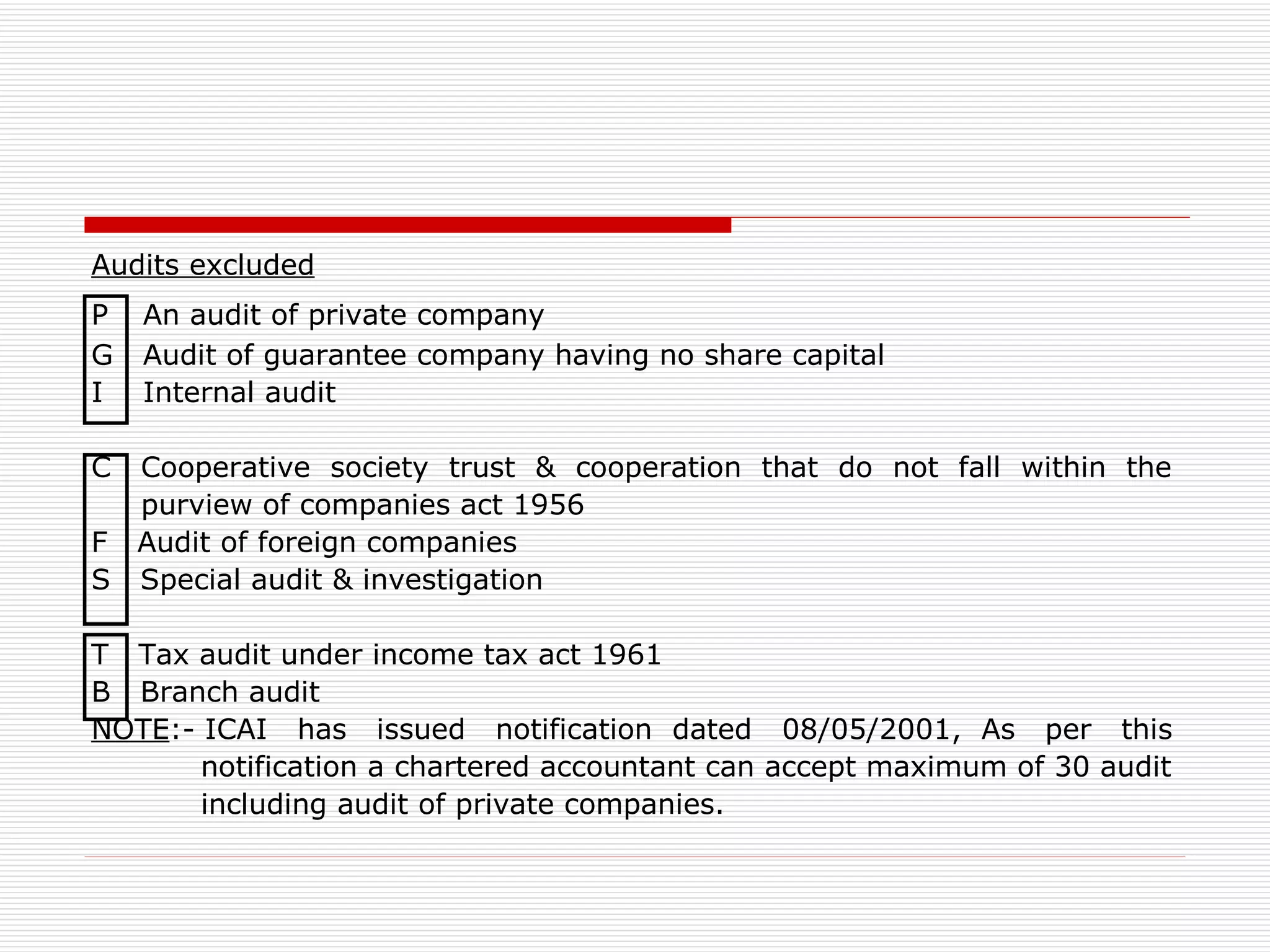

The document summarizes the key provisions around appointment and qualifications of auditors under the Companies Act. It discusses who can be appointed as an auditor, circumstances for disqualification, appointment of first, subsequent and casual vacancy auditors, appointment through special/ordinary resolution, remuneration of auditors, ceiling on number of audits, and provisions for special, cost and branch audits.

![Qualification of an Auditor [section 226 (1) & (2)] Following persons are qualified to act as Auditor of a company : A CA within the meaning of CA Act 1949, Holding COP (certificate of practice). A Firm where off all the partners are practicing in India, any partner may act as Auditor on behalf of firm. A holder of Certificate of Part B State.](https://image.slidesharecdn.com/chapter1-101222005851-phpapp01/75/Appointment-of-Auditor-2-2048.jpg)

![Disqualification of an Auditor [section 226 (3) & (4)] Following persons are not eligible for appointment as an Auditor : Body Corporate An Officer or Employee of a Company. A person who is in partnership or who is in employment of an officer on employee of the company. A person who is indebted to the company for an amount exceeding Rs. 1000/- A person who has given Guarantee of any person to the company for an amount exceeding Rs. 1000/- A person holding Security of the company carrying Voting Power.](https://image.slidesharecdn.com/chapter1-101222005851-phpapp01/75/Appointment-of-Auditor-3-2048.jpg)

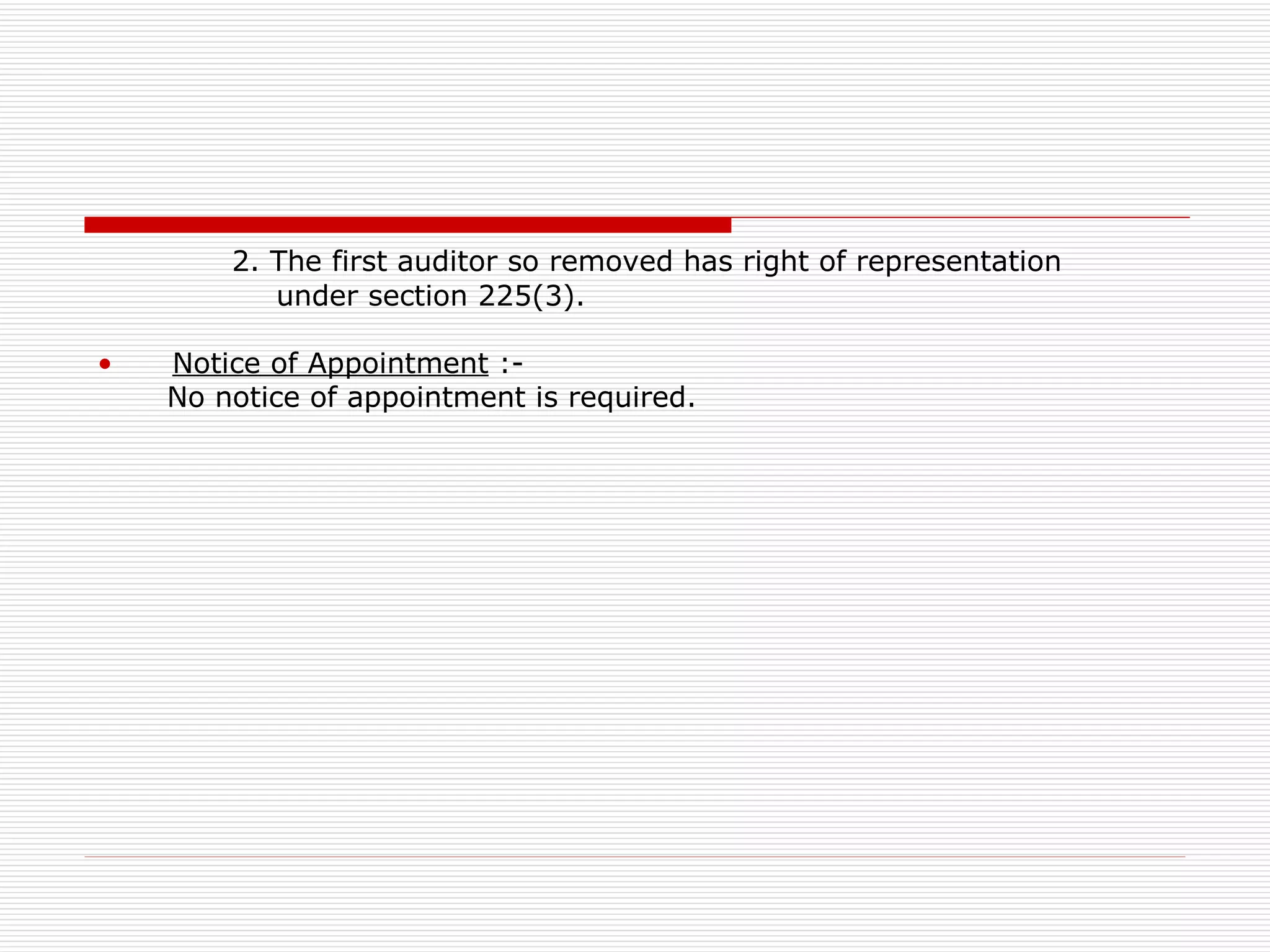

![Appointment of First Auditor [section 224(5)] Manner of Appointment :- The first auditor of the company shall be appointed by BOD within 1 month of registration of company. If BOD fails to appoint the first auditor within said period of 1 month, the first auditor may be appointed by company in General meeting by passing OR. Tenure of first Auditor :- The first auditor will hold office untill the conclusion of first AGM. Removal of first Auditor before expiry of tenure :- The first auditor can be remover by the company before expiry of tenure by passing OR in General meeting. No special notice is required for removal. However the company should follow the procedures prescribed under section 225(2)&(3). Note :- 1. Where some other person is to be appointed as auditor by members of company, members should give 14 days notice to the company.](https://image.slidesharecdn.com/chapter1-101222005851-phpapp01/75/Appointment-of-Auditor-6-2048.jpg)

![Appointment of Subsequent Auditor [section 224(1)] Manner of Appointment :- At Every AGM auditor/auditors is/are appointed/reappointed by company by passing OR. Tenure of first Auditor :- The auditor so appointed holds the office from conclusion of AGM in which he is appointed till the conclusion on next AGM. Removal of first Auditor before expiry of tenure :- After obtaining previous approval of CG, the auditor can be removed by company by passing OR. No special Notice is required for removal. However the company should follow the procedure prescribed under section 225(2)&(3). Notice of Appointment :- After appointing the auditor, the company should intimate the auditor of his appointment within 7 days of appointment. In term, auditor shall give notice to ROC in form no. 23B within 30 days, as to whether he has accepted the appointment or not.](https://image.slidesharecdn.com/chapter1-101222005851-phpapp01/75/Appointment-of-Auditor-8-2048.jpg)

![Appointment by CG [section 224(3)] Where at any AGM no auditor is appointed or reappointed by the company, the company shall give notice of the facts to CG within 7 days. On receipt of notice auditor shall be appointed by CG. NOTE :- Since power has been delegated to regional director notice shall be given to regional director. DEFAULT :- If default is made by the company in giving notice, than company & every officer who is in default shall be punishable with fine which may extent to Rs. 5000/- NOTE :- Circumstances when no auditor is appointed. Where appointment is void ab initio. Where SR is required but OR is passed.](https://image.slidesharecdn.com/chapter1-101222005851-phpapp01/75/Appointment-of-Auditor-9-2048.jpg)

![Appointment in Casual Vacancy [section 224(6)] Meaning of casual vacancy :- The term casual vacancy has not been defined in companies act. However it means vacancy caused by an auditor ceasing to act as such after accepting valid appointment. Casual vacancy may arise due to death, resignation, disqualification etc. Manner of appointment :- Generally vacancy in the office of auditor is filled by BOD. However in case of resignation, casual vacancy is filled by shareholders in general meeting by passing OR. Tenure of auditor appointed in casual vacancy :- The auditor appointed in casual vacancy will hold office till the conclusion of next AGM. NOTE :- Generally casual vacancy will not Arise due to Fault of company.](https://image.slidesharecdn.com/chapter1-101222005851-phpapp01/75/Appointment-of-Auditor-10-2048.jpg)

![Appointment by SR [section 224A] Auditor shall be appointed or reappointed by passing SR, if not less than 25% subscribed share capital is held singly or jointly by following institutions. PFI :- Public Financial Institution. CG :- Central Government. SG :- State Government. GC :- A Government Company. NB :- A National Bank. IC :- A Insurance Company carrying on general insurance business. FI :- Any Financial or other Institution stabilized under provisional or state act & in which state government holds not less than 51% of subscribed share capital. NOTE :- As per section 224A subscribed share capital means equity as well as preference share capital.](https://image.slidesharecdn.com/chapter1-101222005851-phpapp01/75/Appointment-of-Auditor-11-2048.jpg)

![Remuneration of an Auditor [section 224(8)] General Rule :- Authority appointing the auditor fixes the remuneration of the auditor. If Auditor is appointed by Shareholders :- Remuneration shall be fixed by shareholders in general meeting alternatively they may determine he manner in which remuneration shall be fixed. If Auditor is appointed by BOD :- Remuneration shall be determined by BOD. Extra Remuneration :- Extra remuneration can be paid to the auditor for other services rendered such as consultancy fee, tax audit fee, etc. No sanction from shareholders would be required for making such extra payments. However profit & loss account shall disclose following information in respect of amounts paid to the auditor. As auditor As advisor or in any other capacity in respect of company law matters, taxation matters or management services. In any other matter [clause 4B, part II, schedule VI]](https://image.slidesharecdn.com/chapter1-101222005851-phpapp01/75/Appointment-of-Auditor-12-2048.jpg)

![Ceiling on No. of Audits [section 224(1B)] Section 224(1B) places a ceiling on number of audits, that a CA can conduct. This ceiling is referred as specified numbers. Specified No. is 20 Out of 20 an Auditor Remaining 10 companies Can accept Maximum should have paid up Of 10 companies having share capital less than Paid up share capital of 25 Lacks. Rs. 25 Lacks & more.](https://image.slidesharecdn.com/chapter1-101222005851-phpapp01/75/Appointment-of-Auditor-13-2048.jpg)

![Special Audit [section 233A] Circumstances in which special audit is conducted :- Special audit is ordered by CG if any of the following circumstances Exist in the company. Affairs of the company are not being conducted in accordance with sound business principles & prudent commercial practices. Affairs of the company are being conducted in a manner likely to cause serious injury to the interest of trade, business or industry to which company pertains. Financial position of the company is such that there is a danger of its solvency. Can shareholders apply to CG :- If shareholders are of the opinion that any of the above circumstances exist in the company, they can make an application to CG. The CG is of the opinion that circumstances do exist in the company, it may order special audit. However such an application is not binding on the CG even if application is made by all shareholders.](https://image.slidesharecdn.com/chapter1-101222005851-phpapp01/75/Appointment-of-Auditor-15-2048.jpg)

![Cost Audit [section 233B] When required :- Cost audit is required to be conducted if all the following reasons are satisfied. i.e. company is engaged in 2P & 2M. 2P 2M Production Processing Manufacturing Mining The company belongs to such class of company which are required by CG to maintain cost records. The CG has invade an order directing company to conduct cost audit. Qualification of cost auditor :- The cost auditor shall be cost accountant within the meaning of cost & works accountant act 1959.](https://image.slidesharecdn.com/chapter1-101222005851-phpapp01/75/Appointment-of-Auditor-18-2048.jpg)