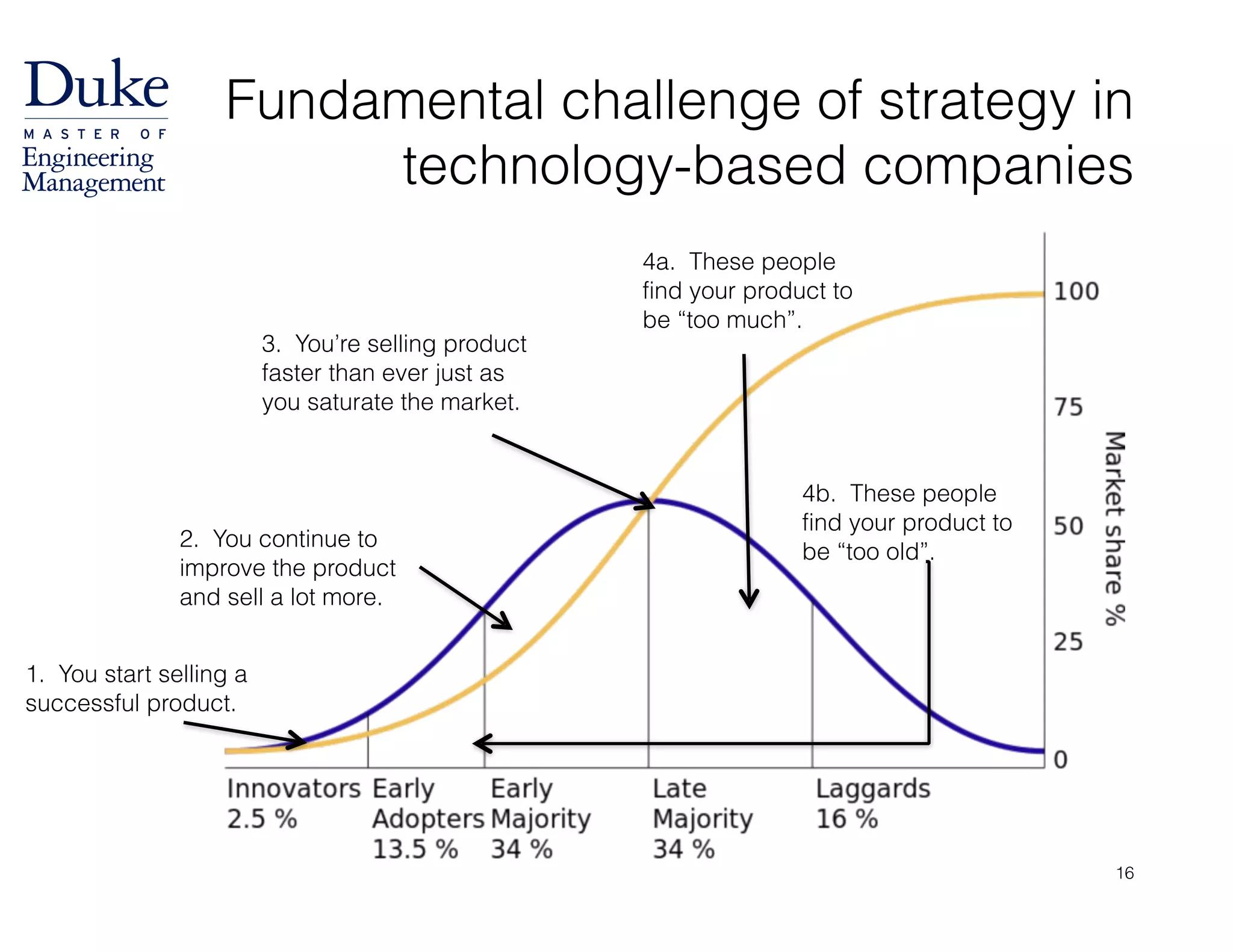

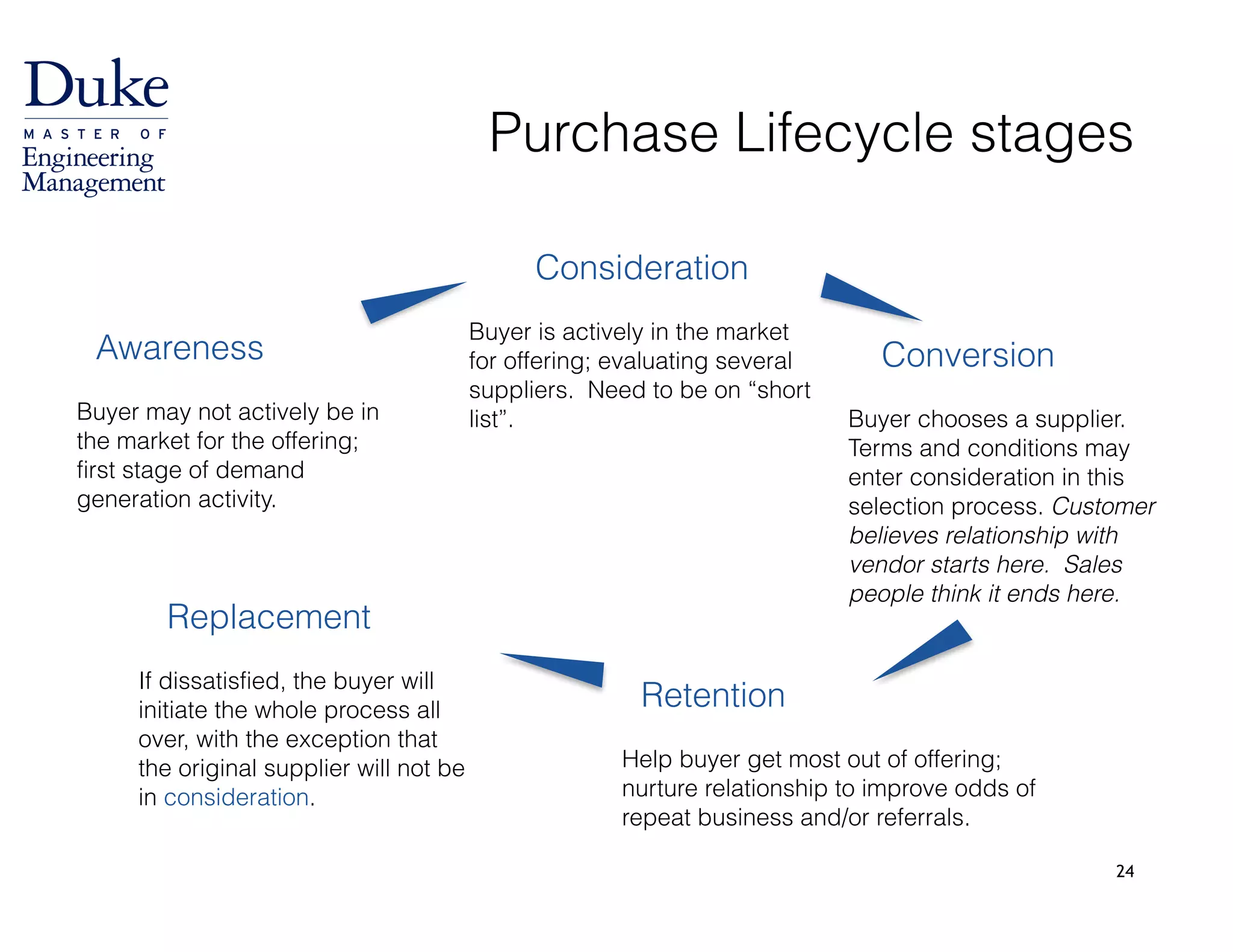

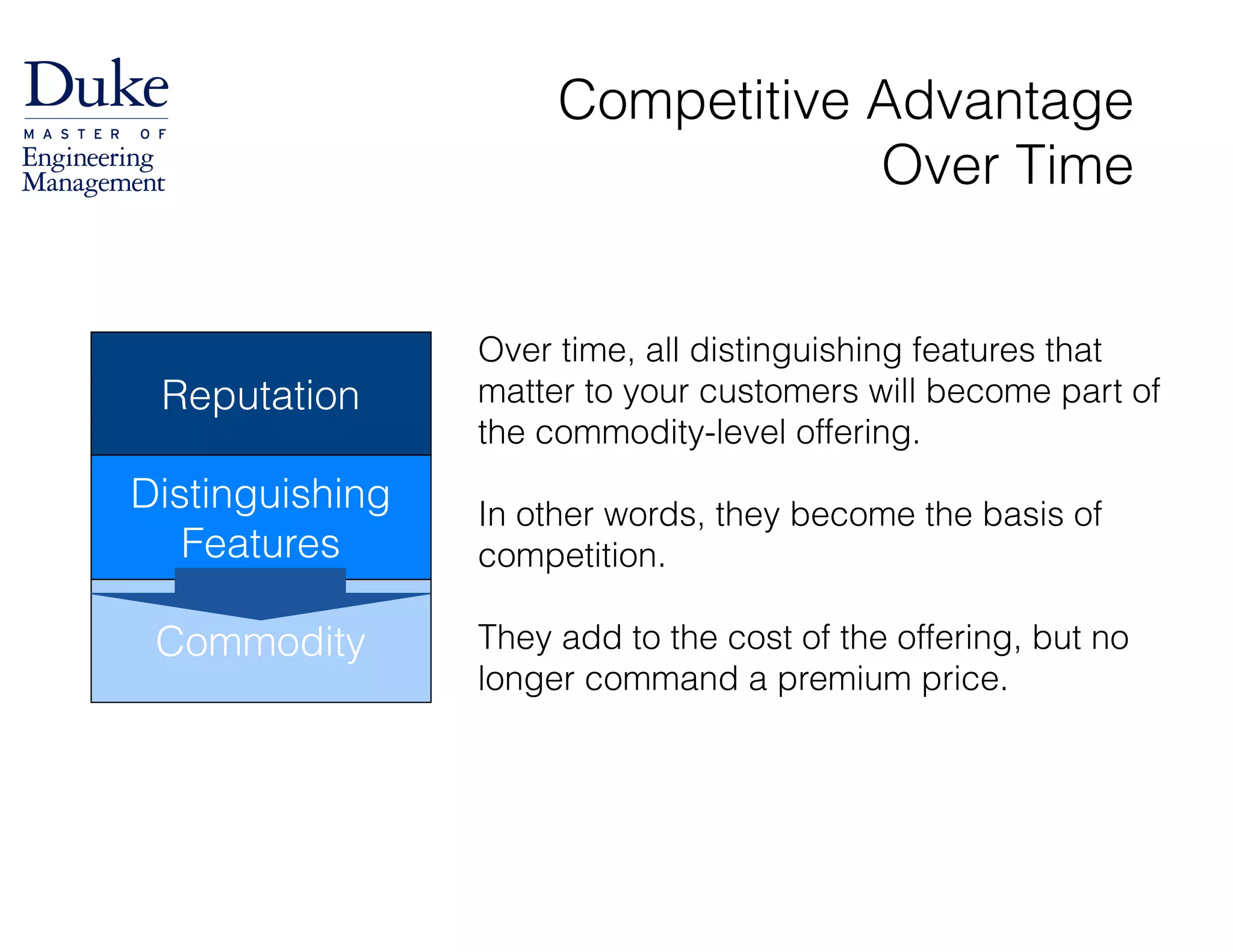

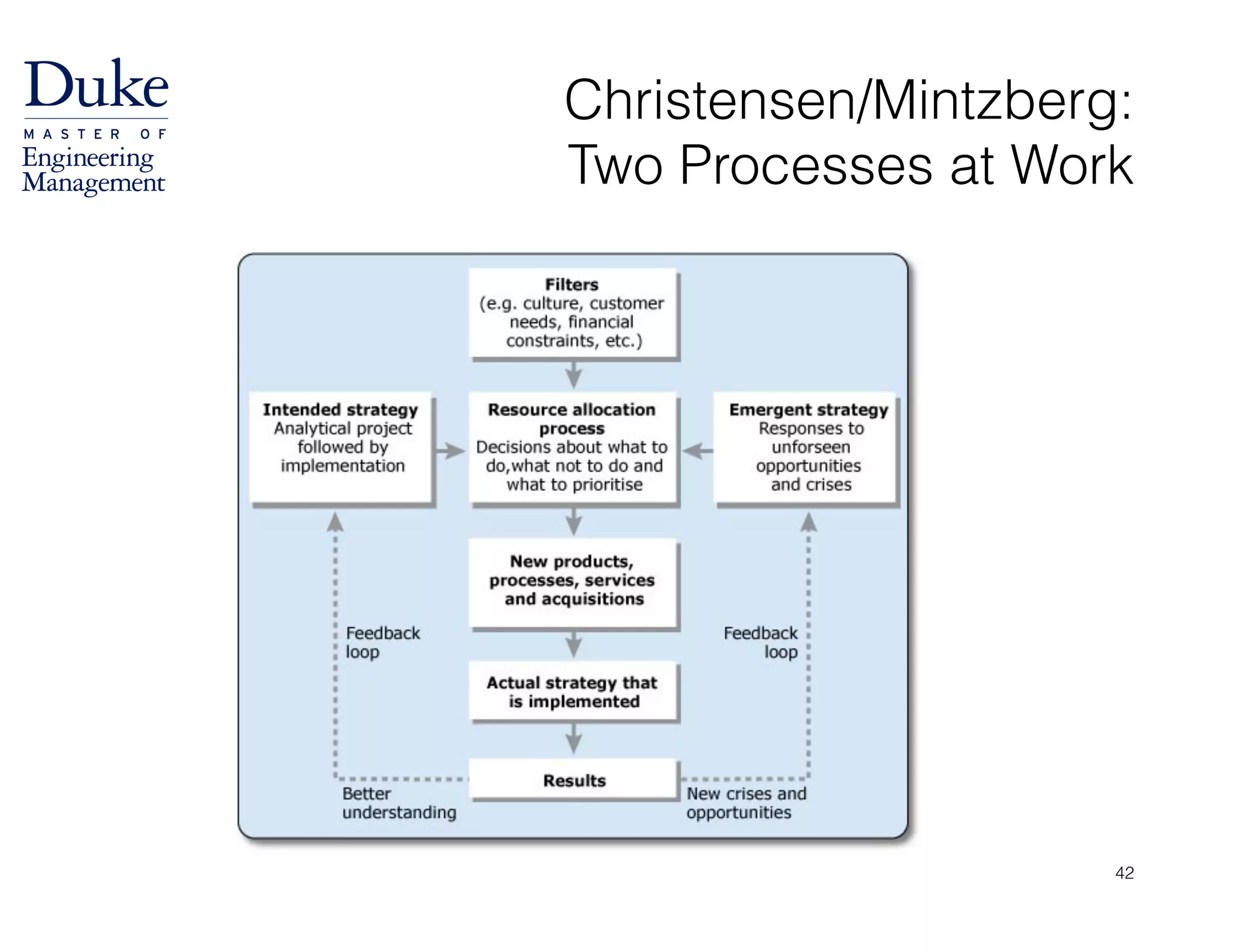

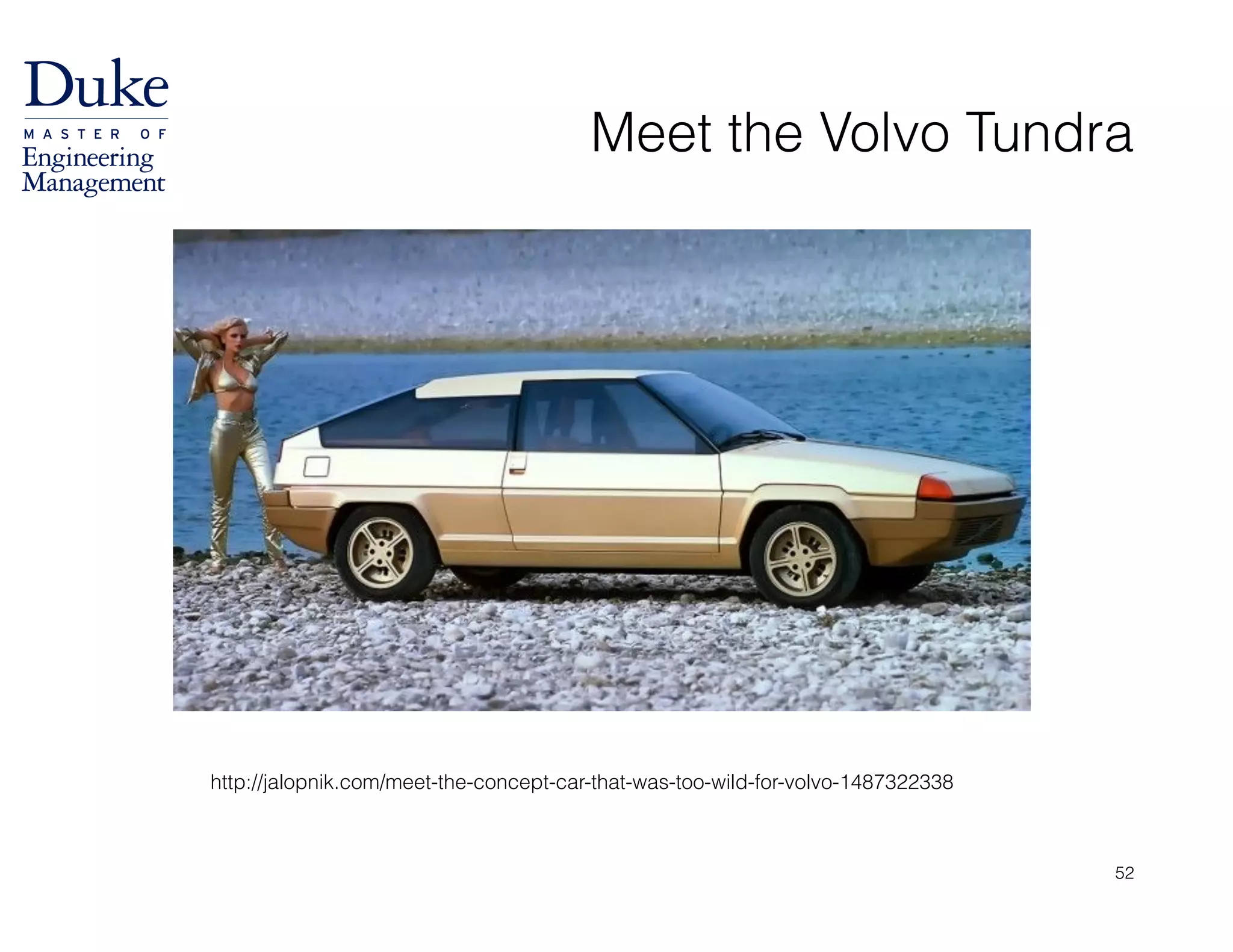

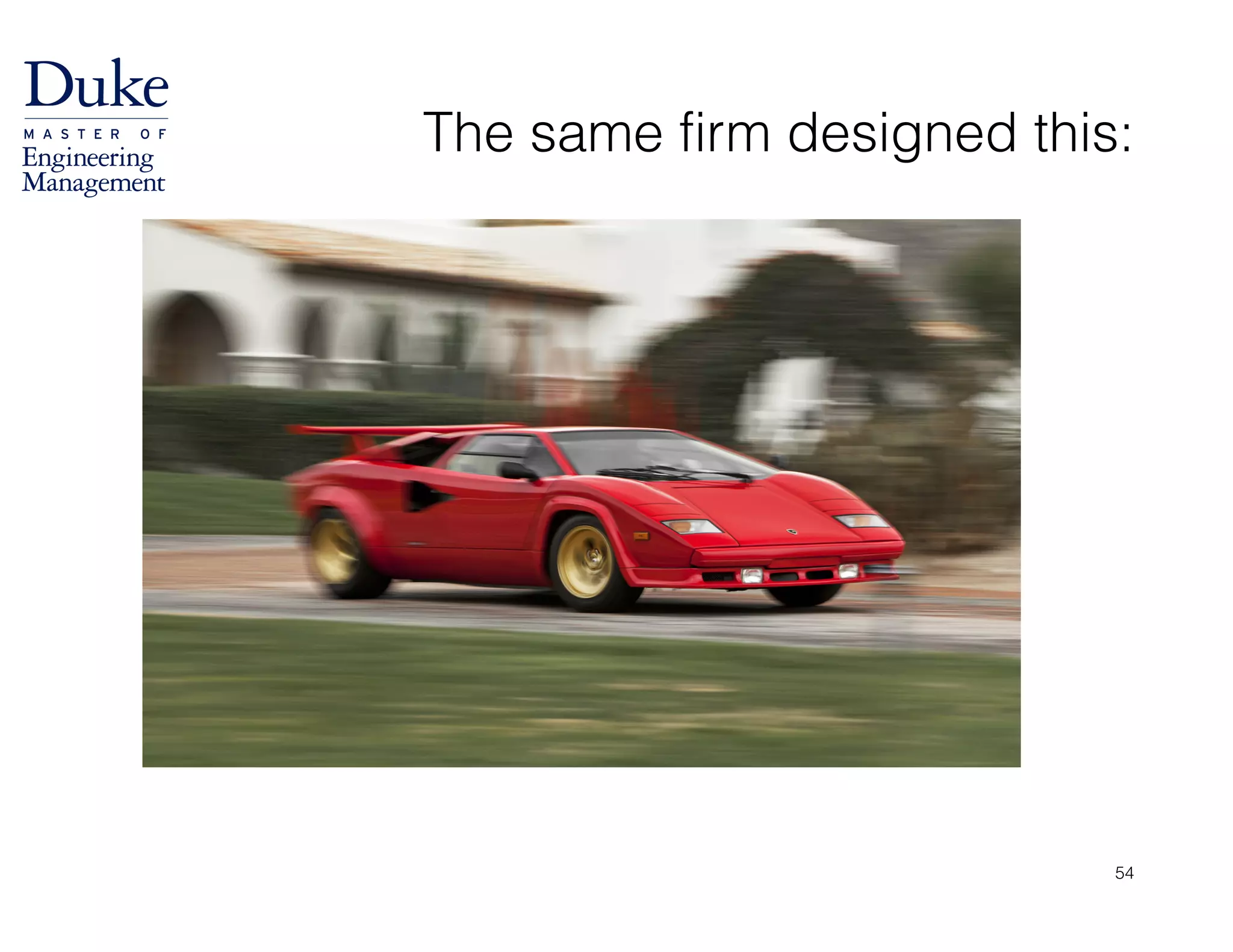

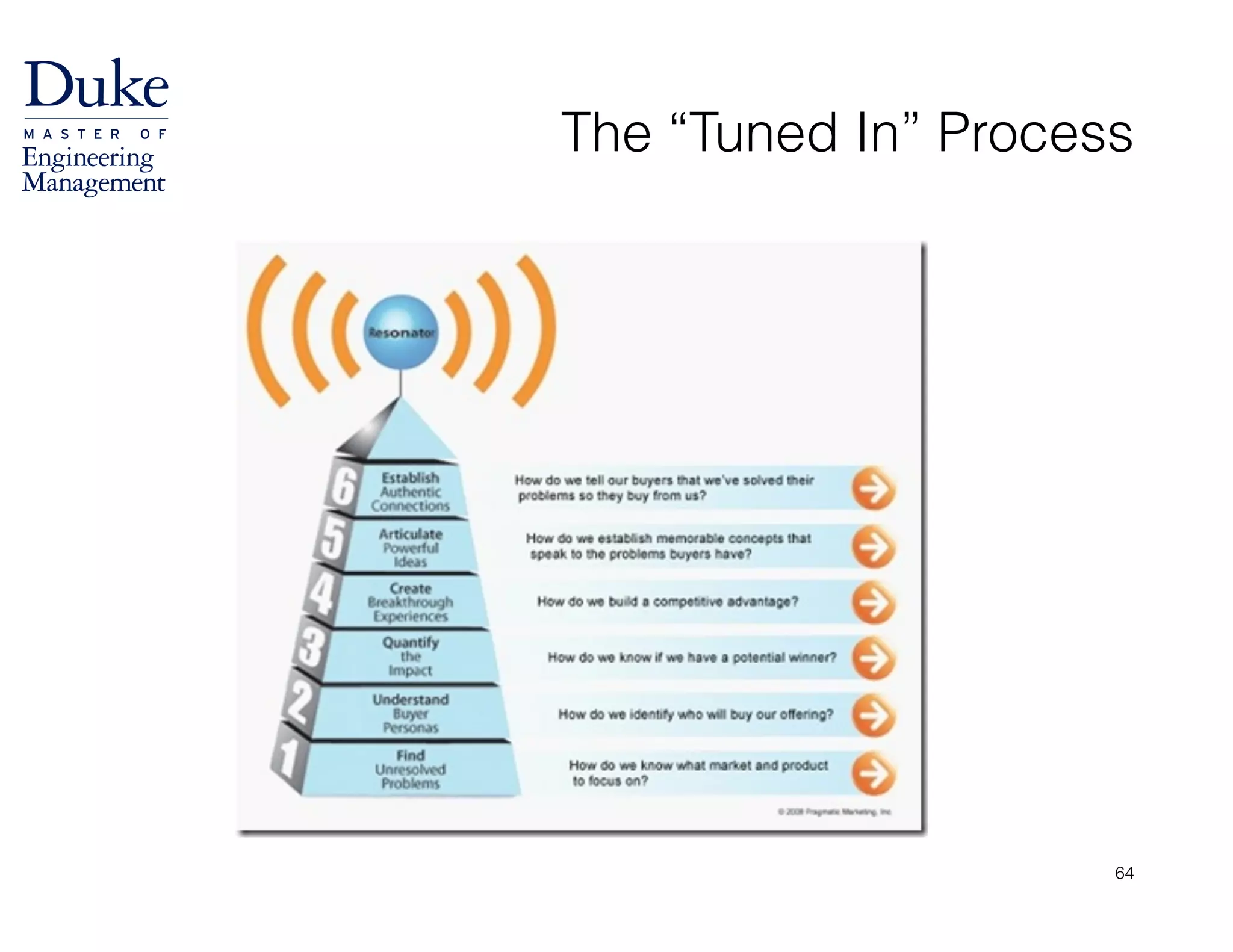

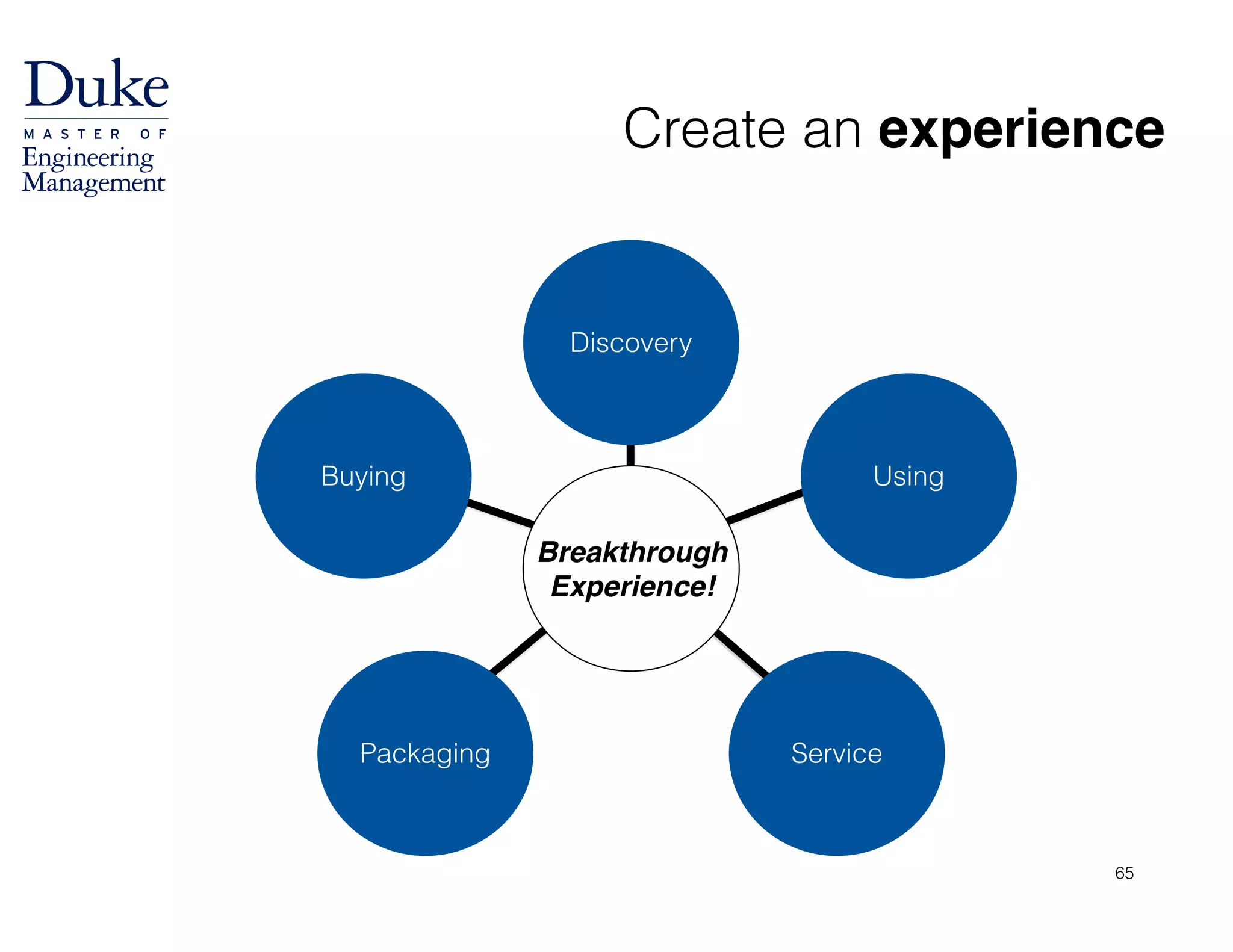

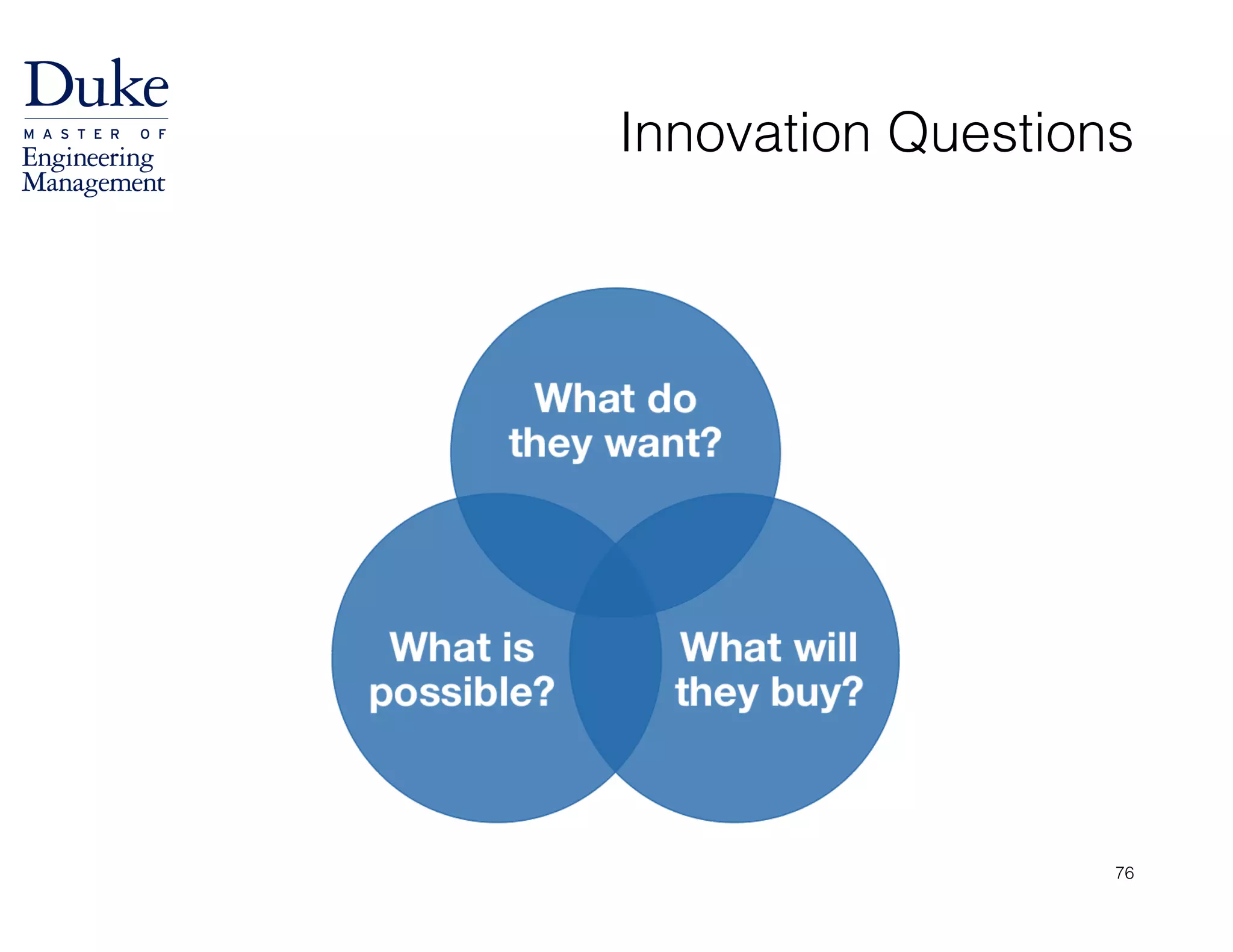

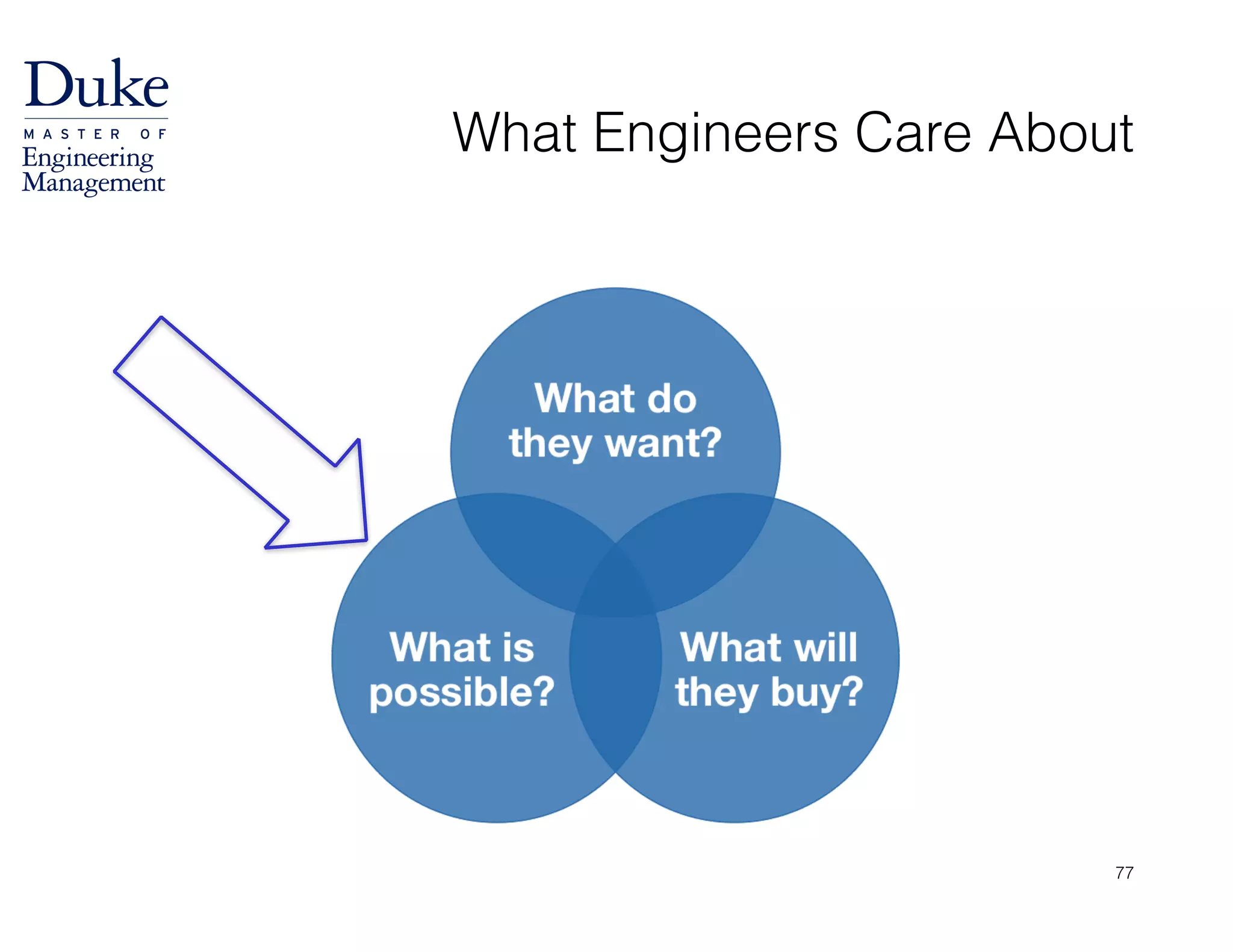

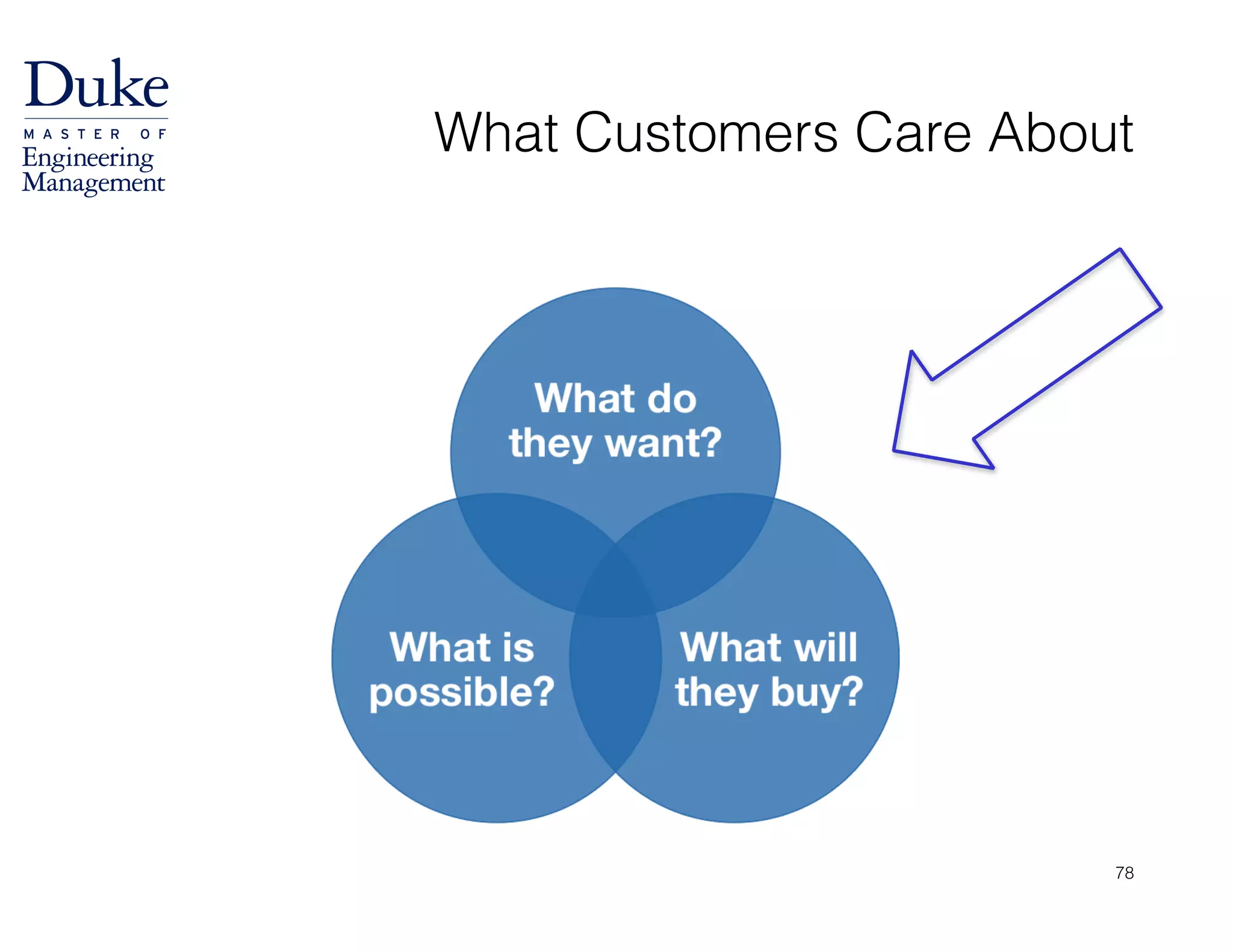

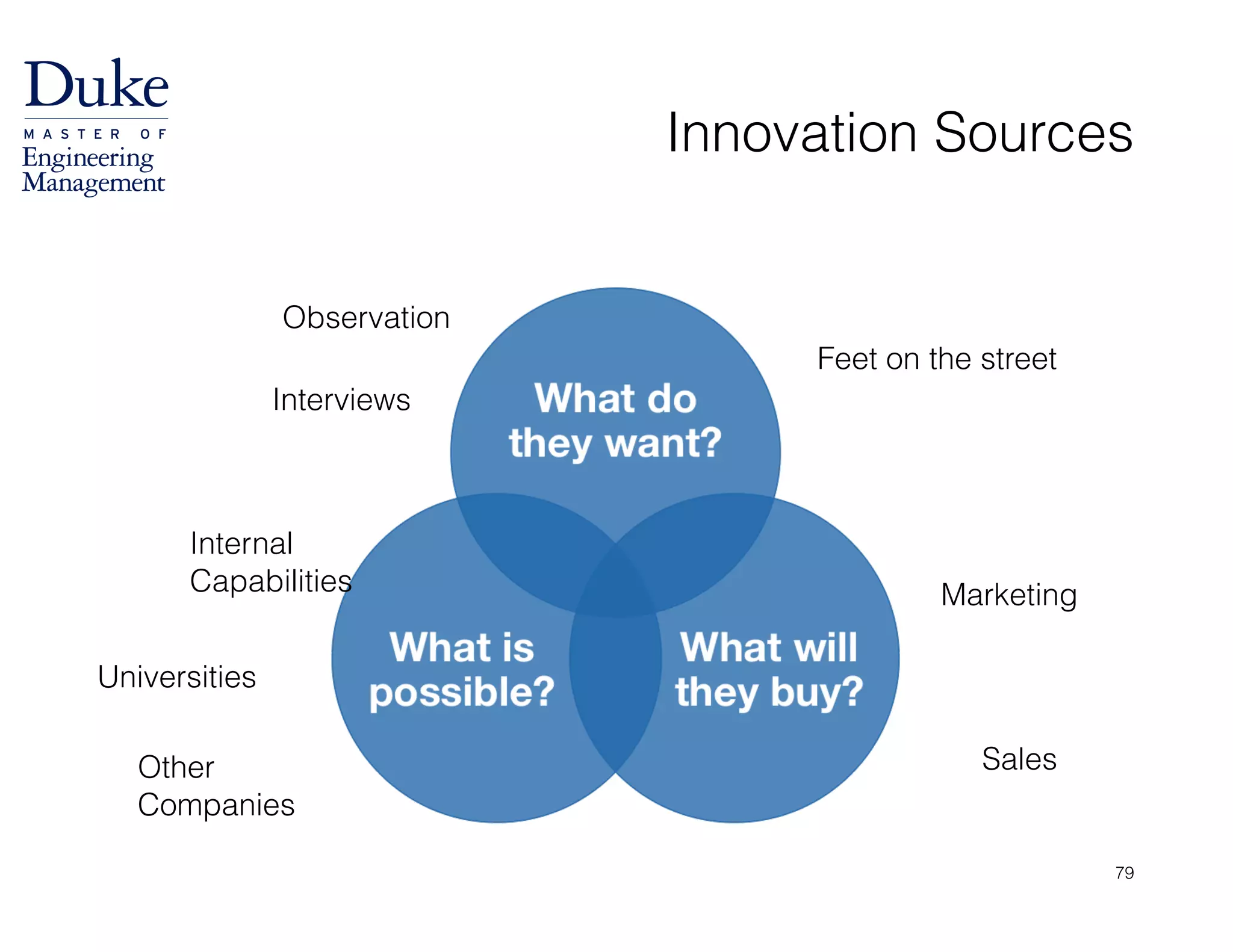

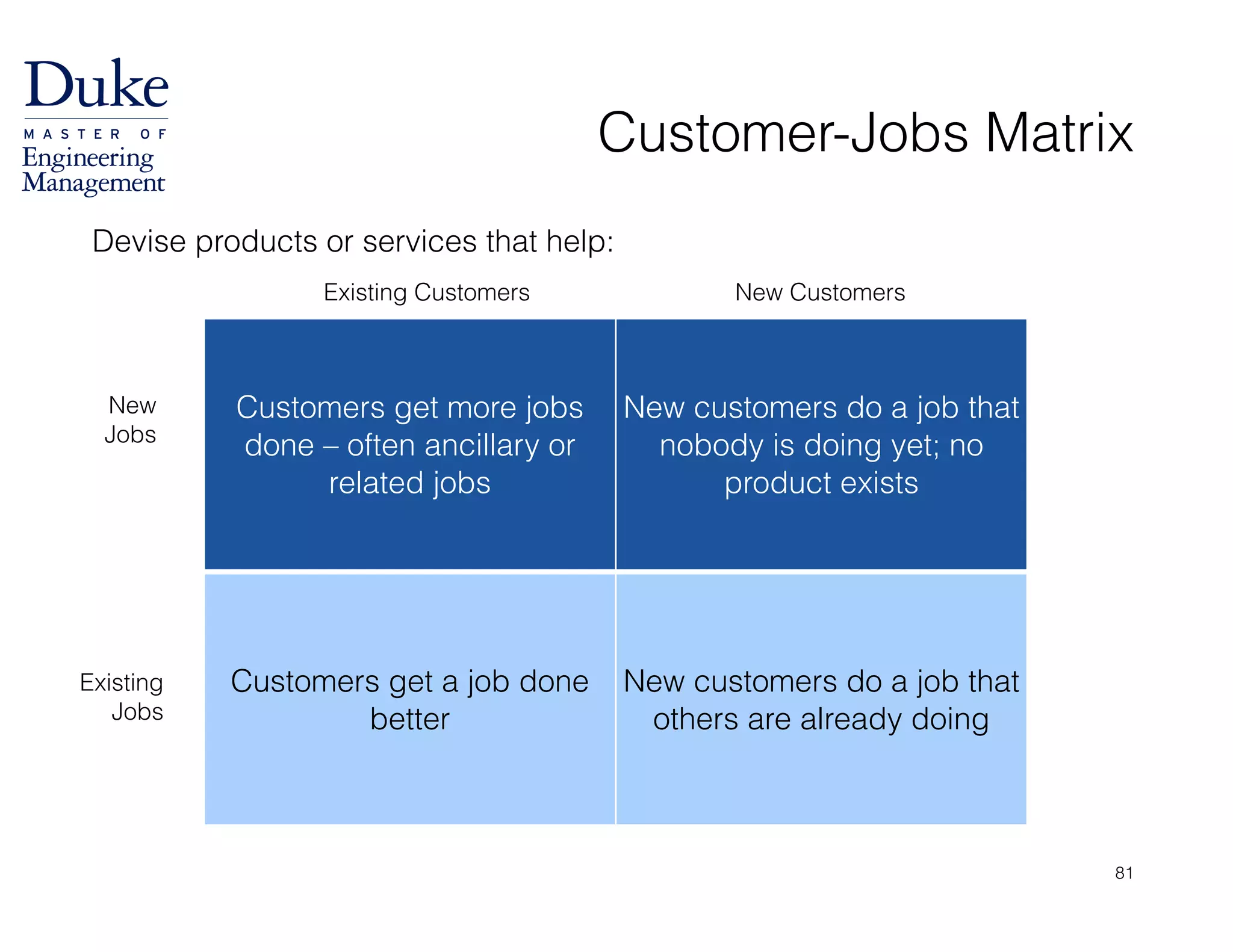

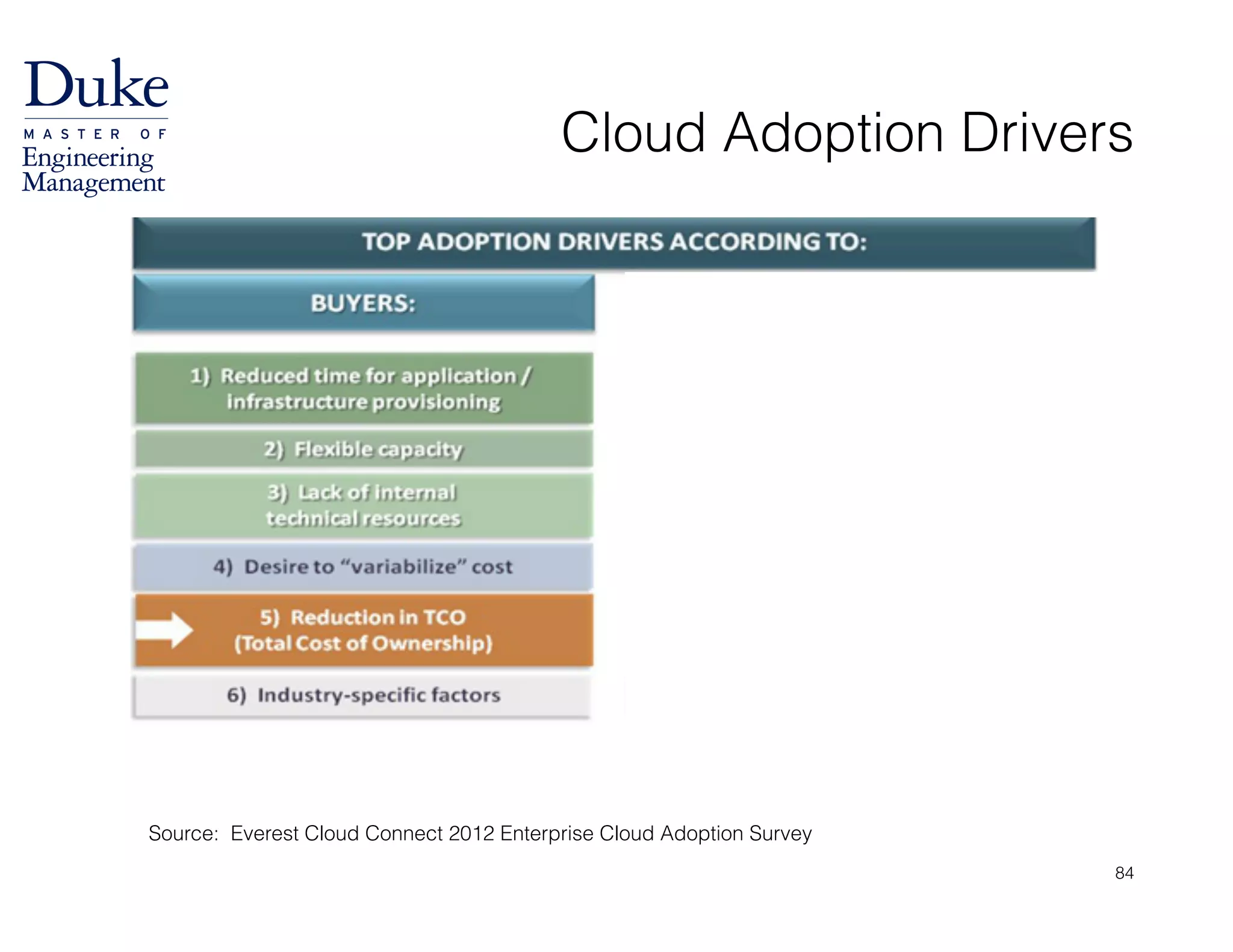

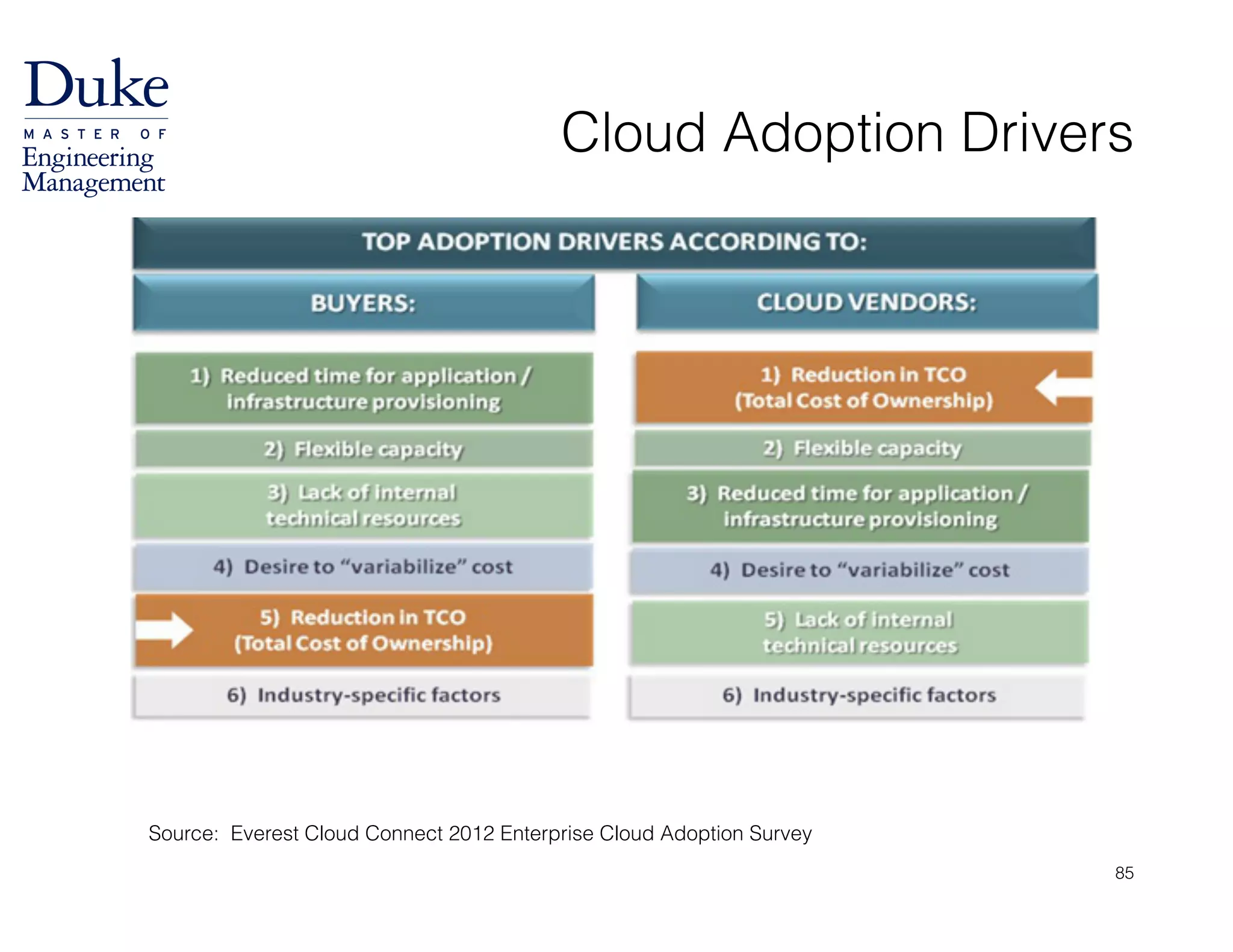

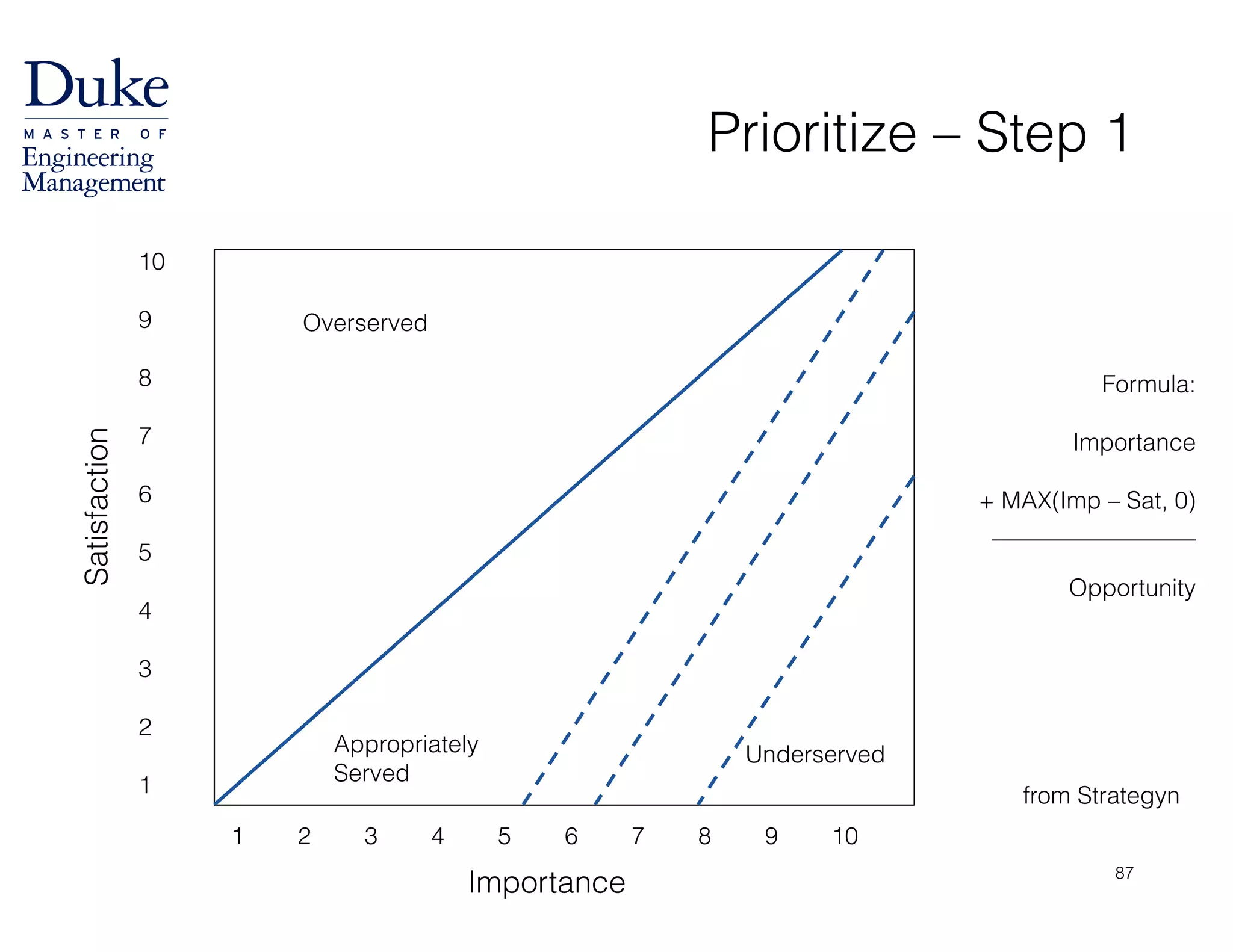

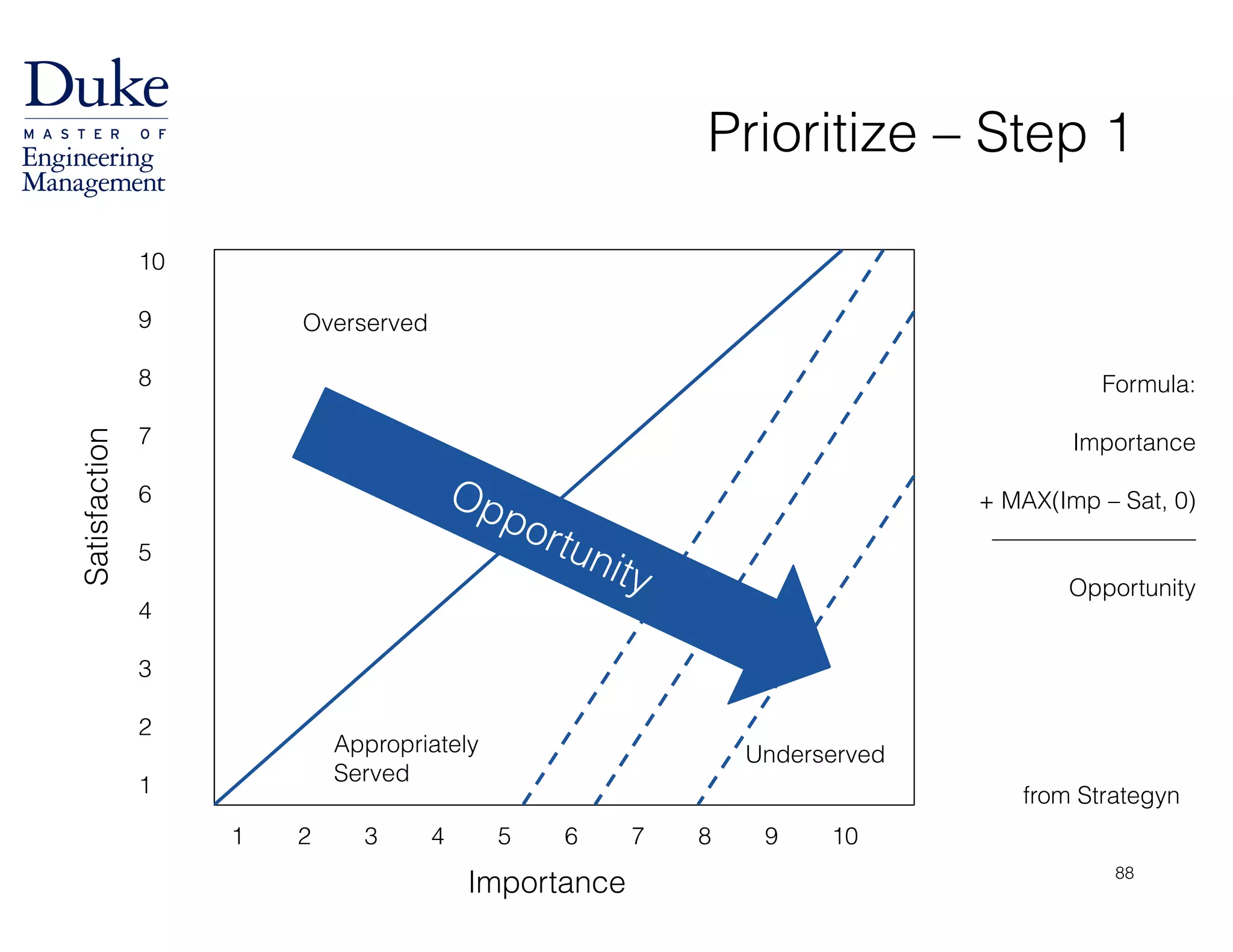

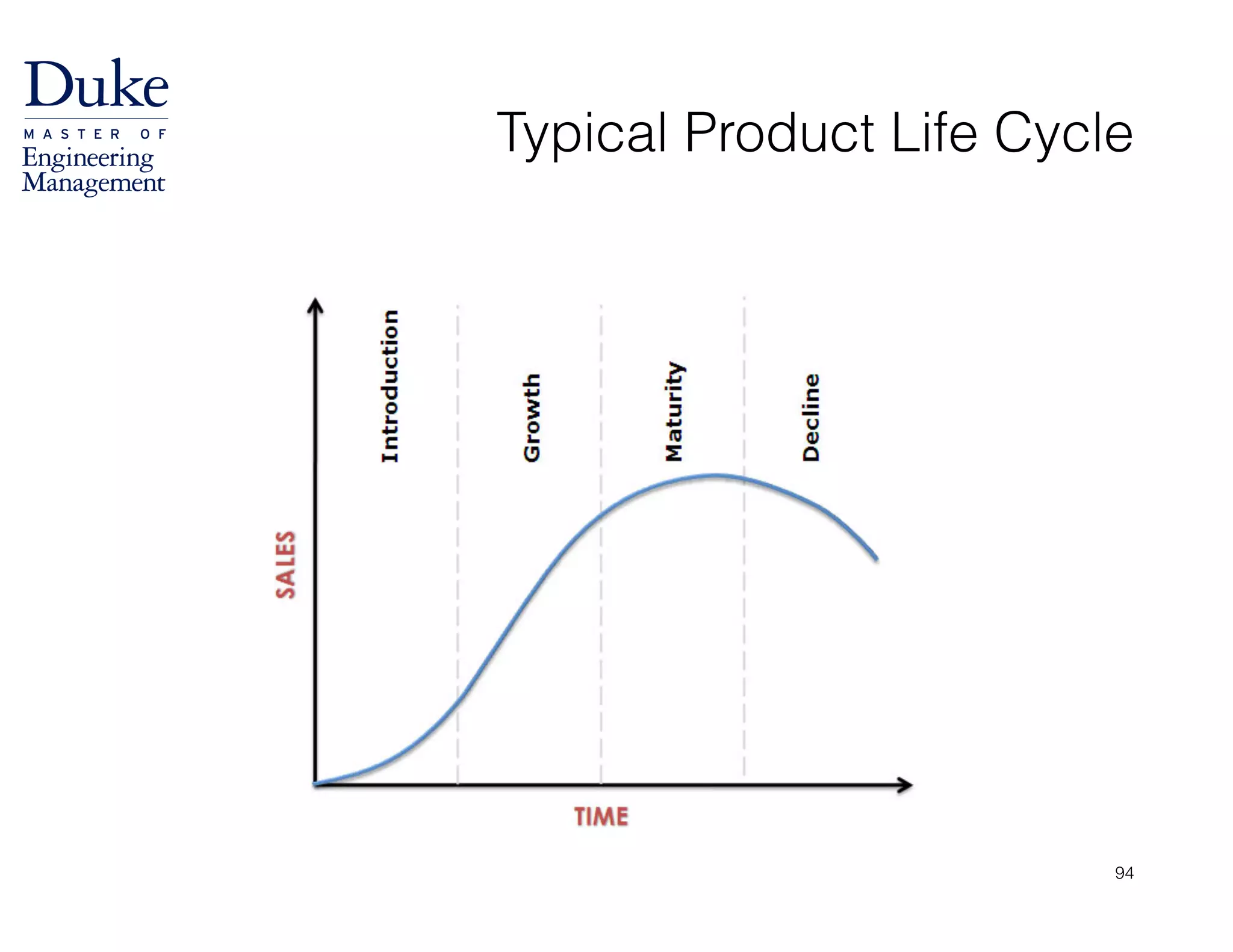

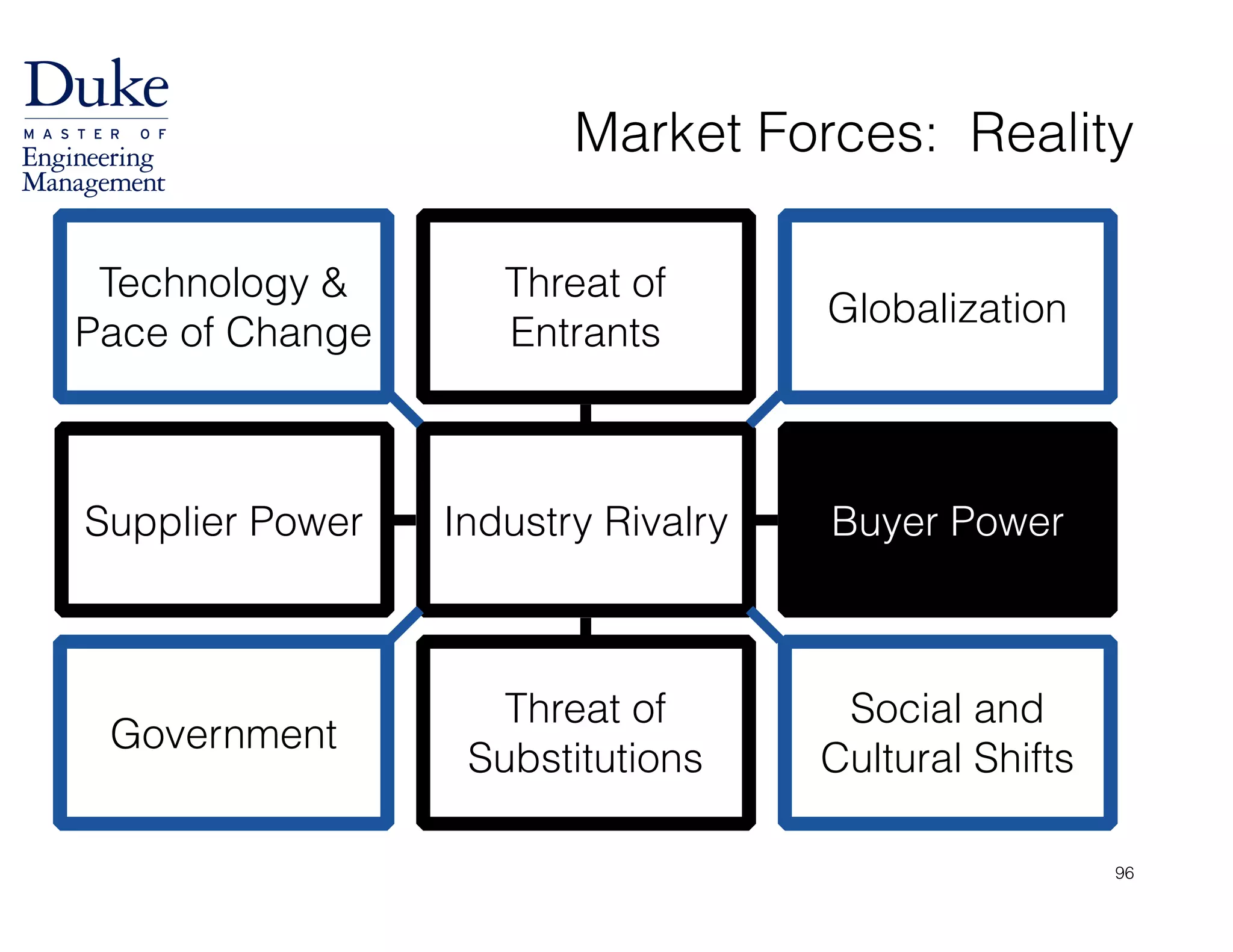

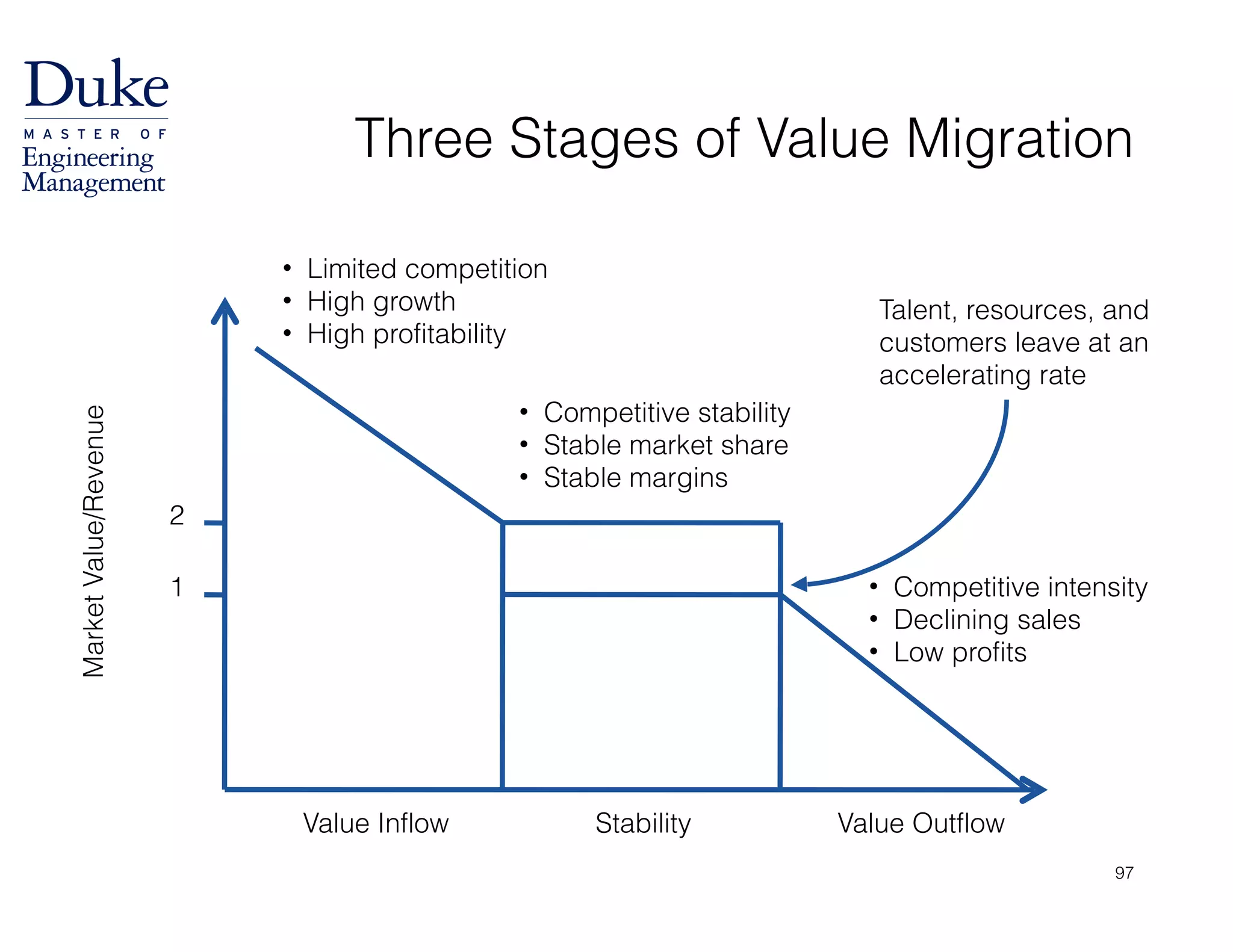

This document provides an overview of a class on creating customer value from technology. The class covers topics like competition, value identification, jobs to be done, and value migration. It discusses how technology-based strategy differs from classical strategy due to factors like discontinuous change and new value propositions. The document emphasizes understanding customer needs by focusing on the "jobs to be done" rather than traditional customer segmentation. Firms are advised to observe customers, understand the outcomes they want, and develop products and services to help customers get jobs done better or in new ways.