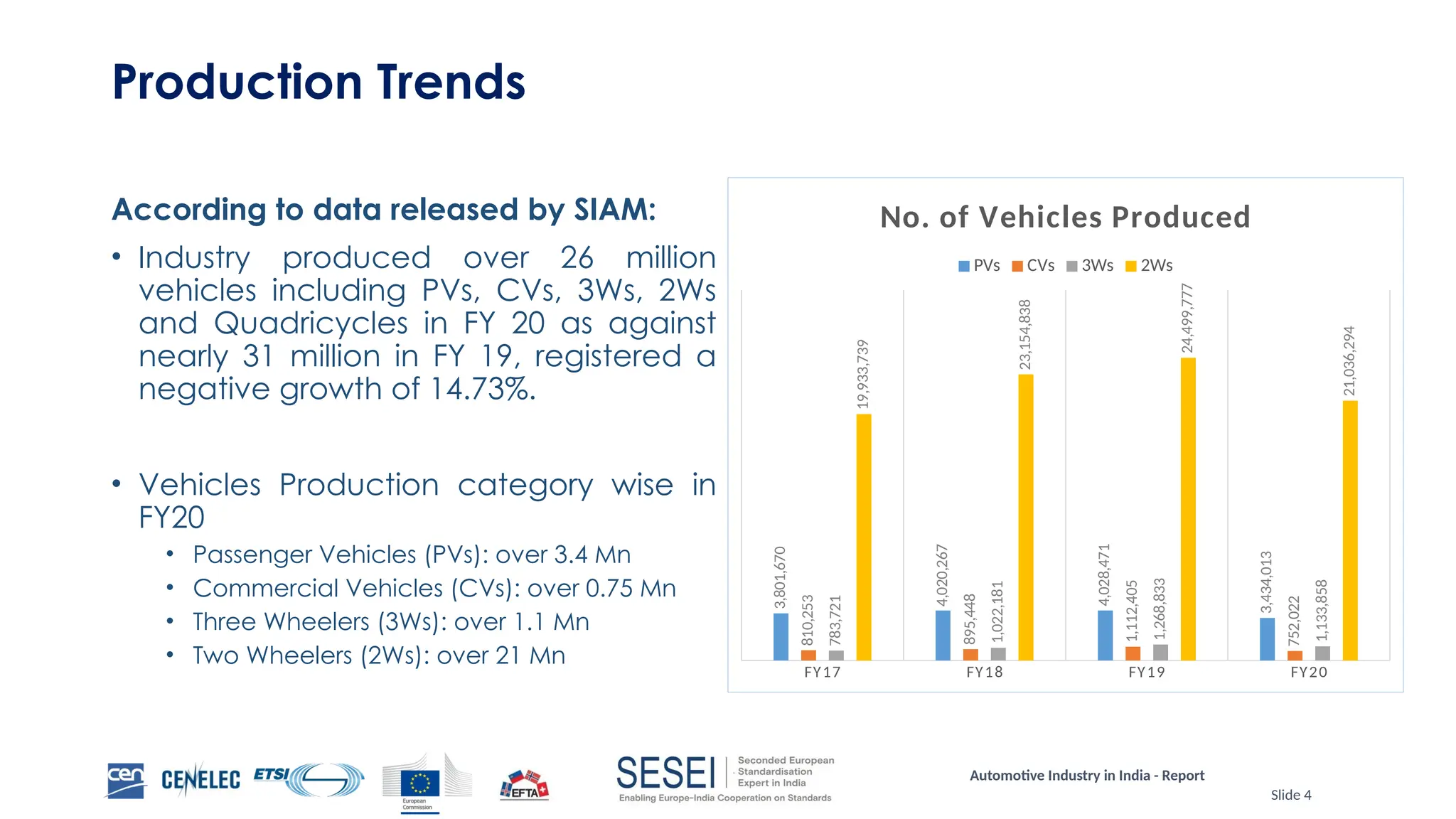

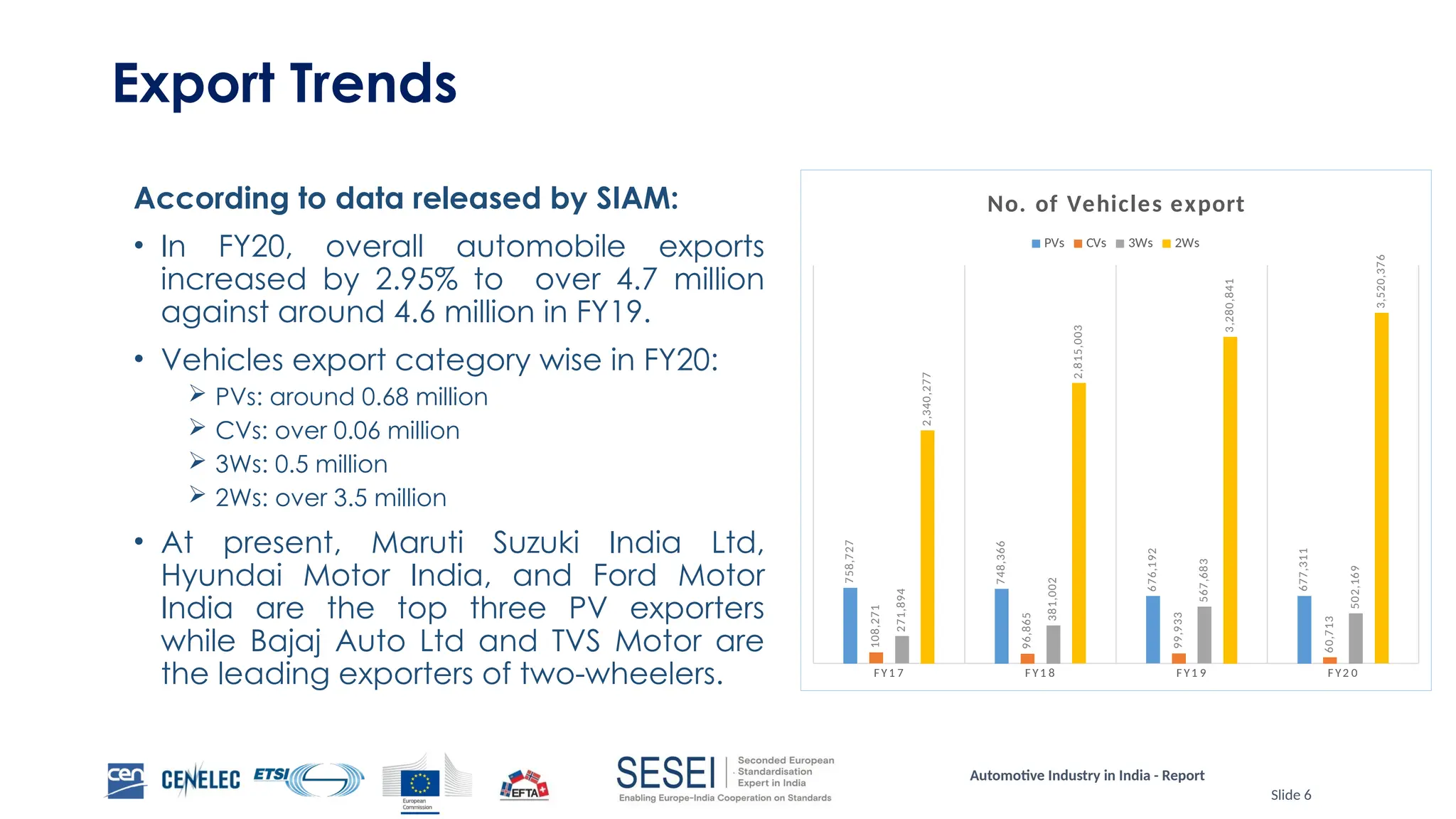

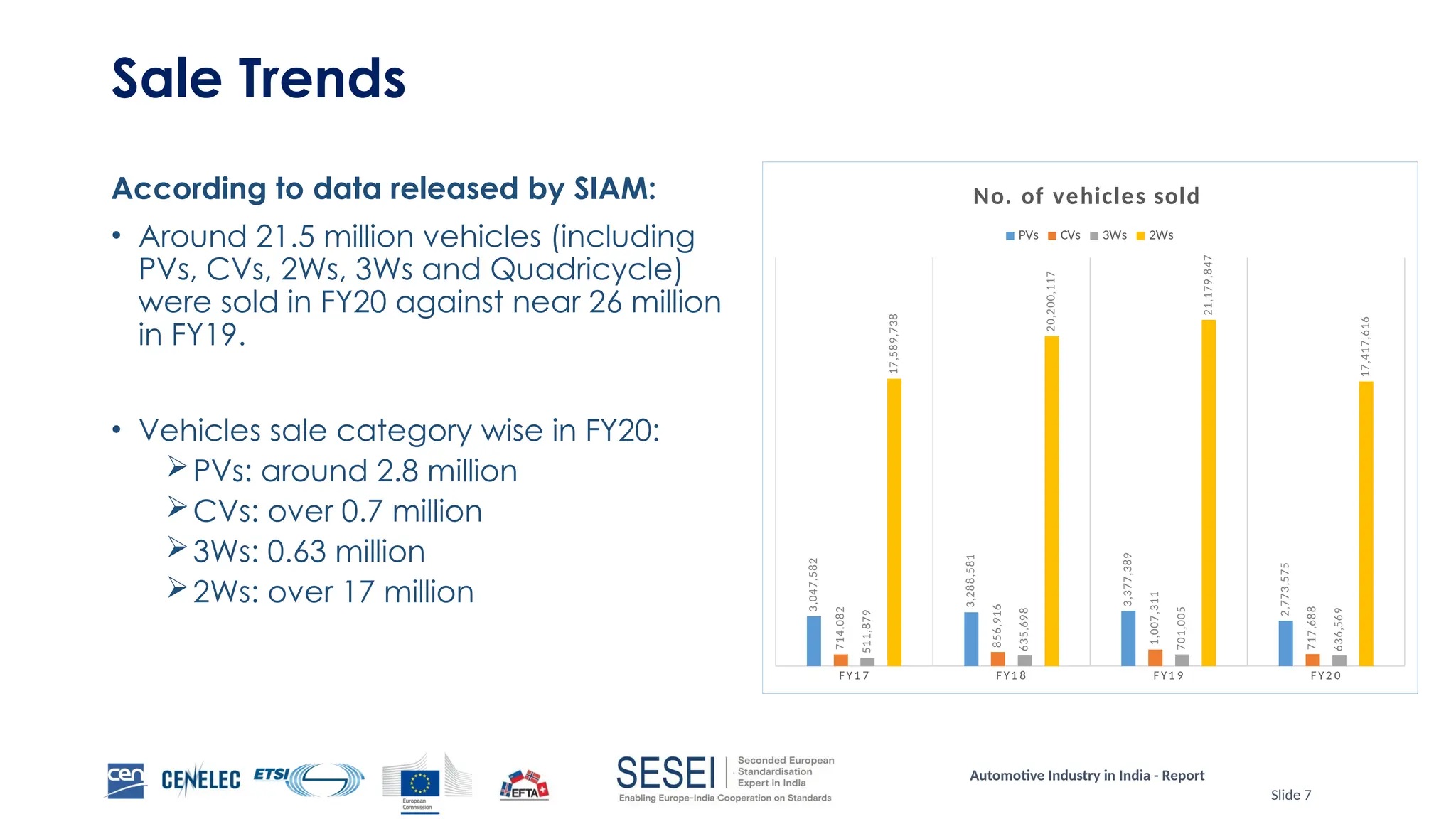

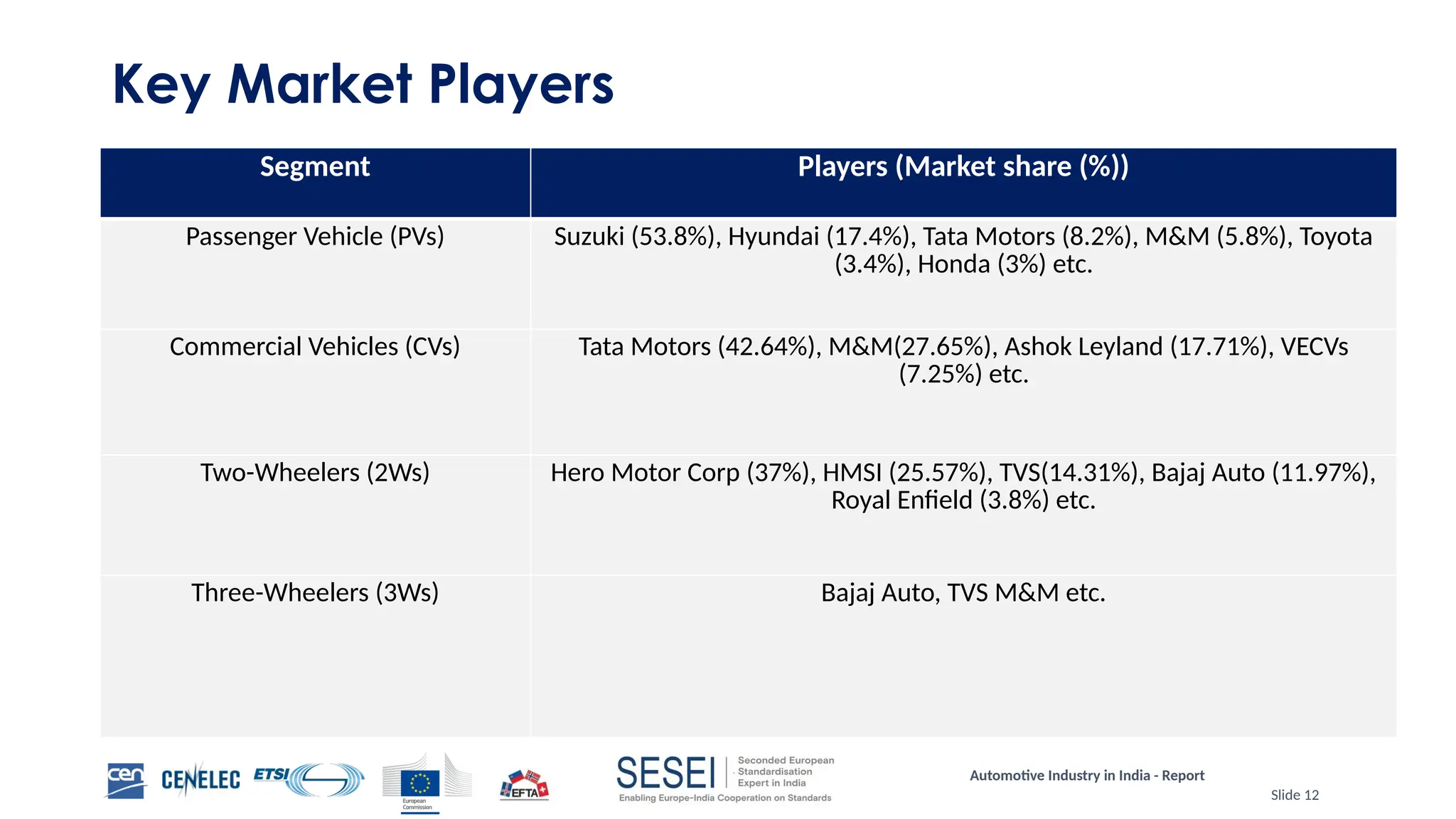

The Indian automotive industry is the fourth largest globally, with a production of 26 million vehicles in FY20, contributing significantly to the GDP and employing 29 million people. The market is expected to grow to INR 16-18 trillion by 2026, driven by rising personal mobility, government support, and the emergence of electric vehicles and intelligent transport systems. Key players include Maruti Suzuki and Tata Motors, with significant policies in place like the National Automotive Policy and initiatives promoting electric mobility.