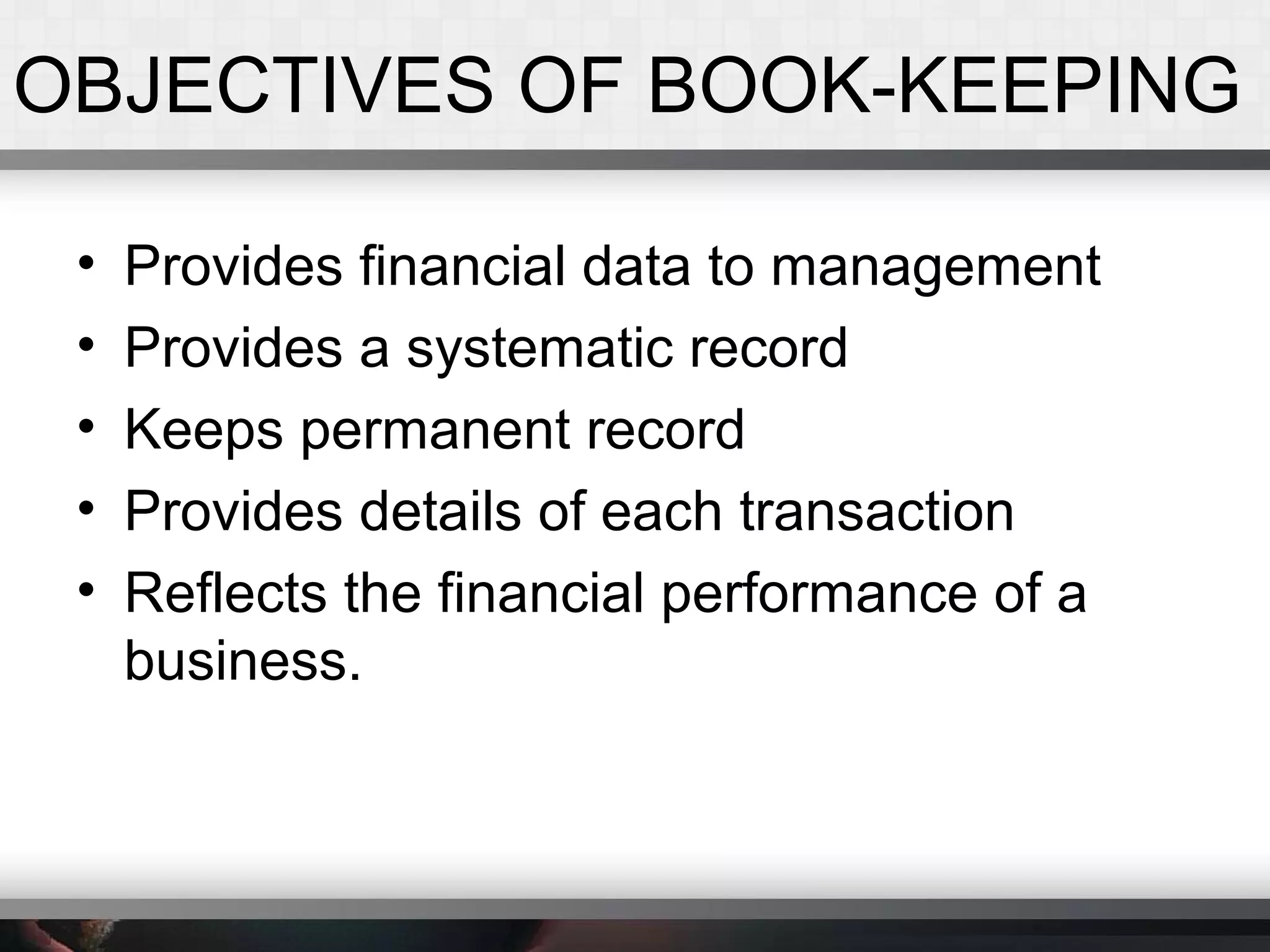

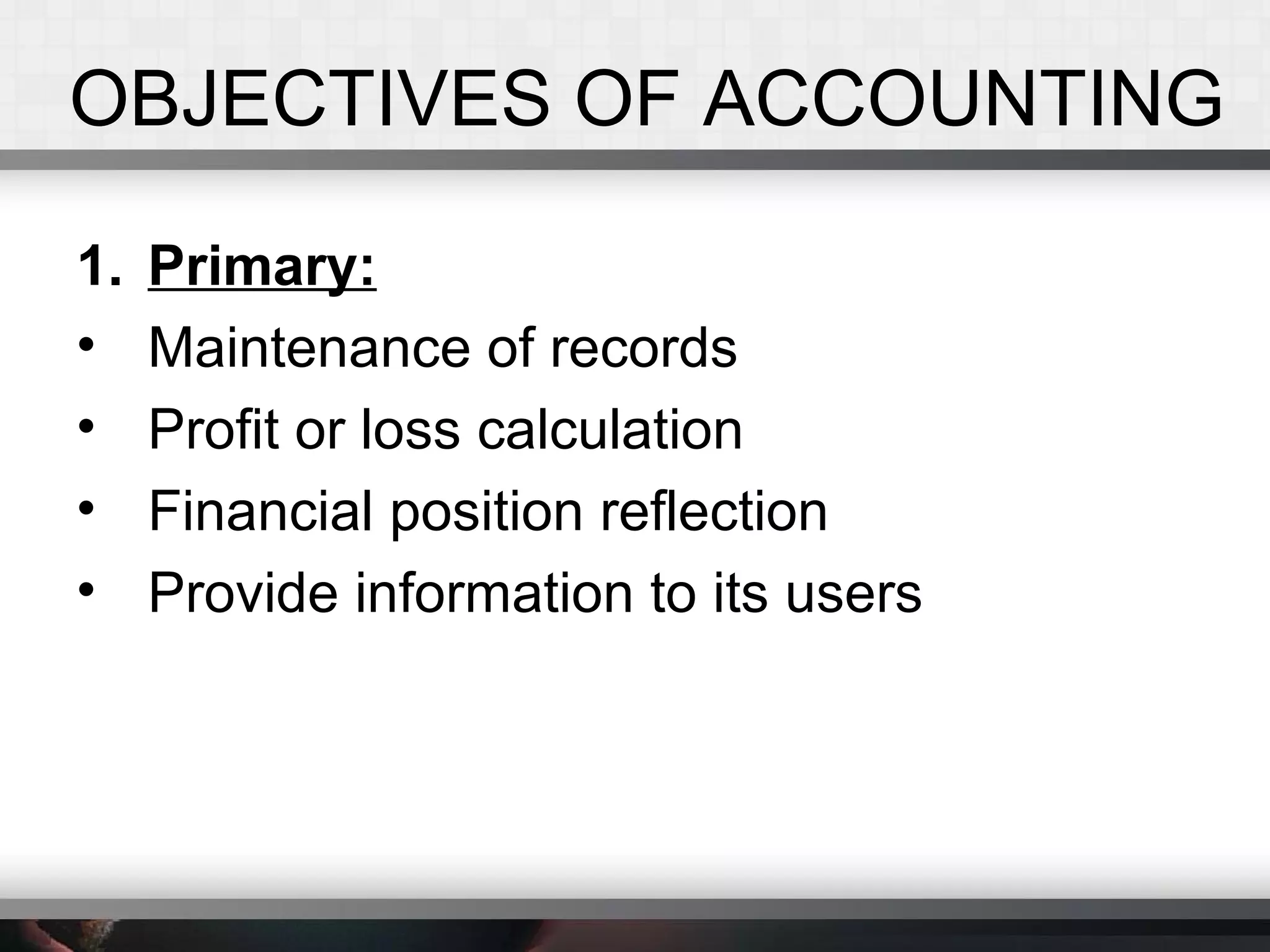

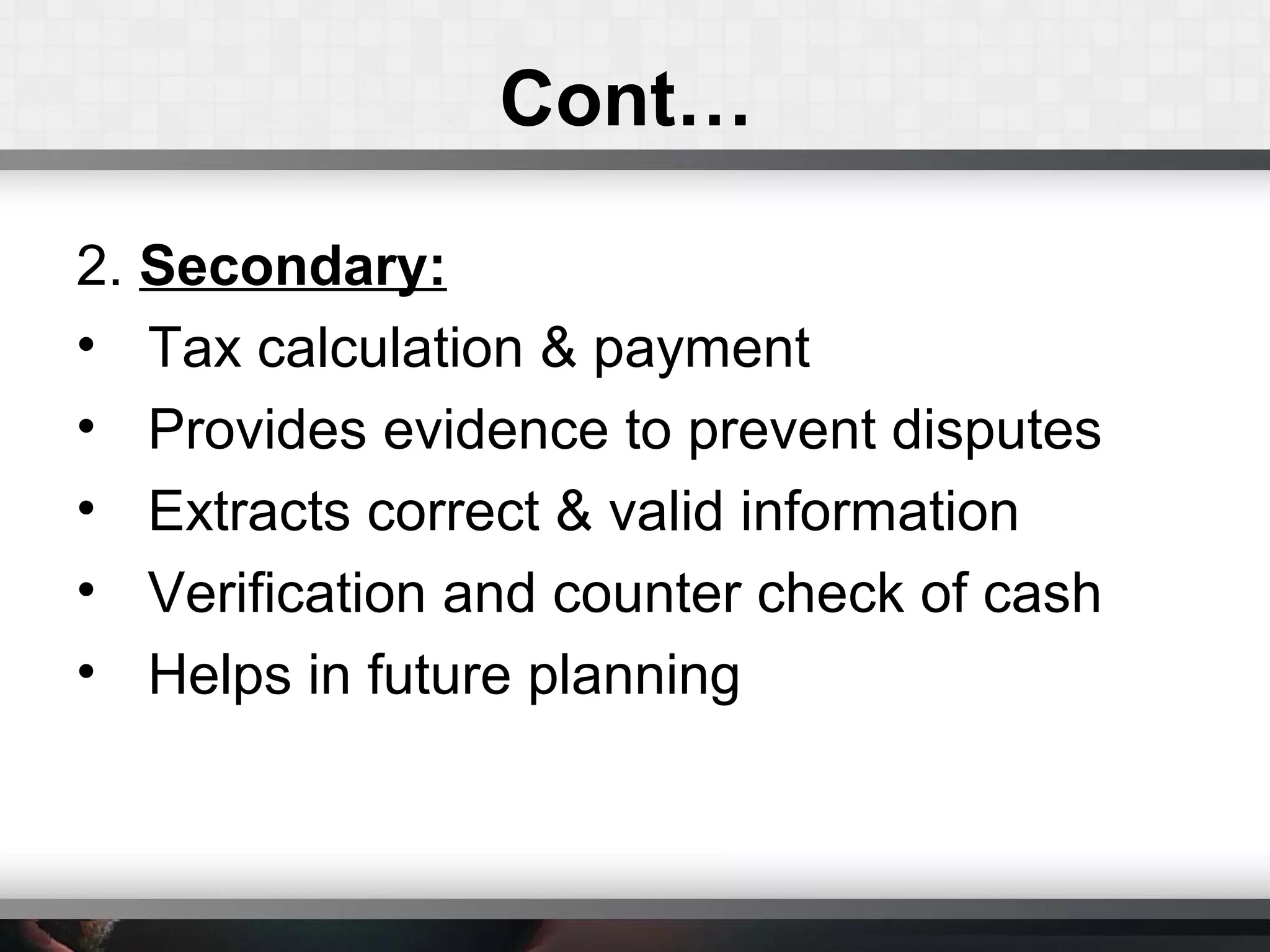

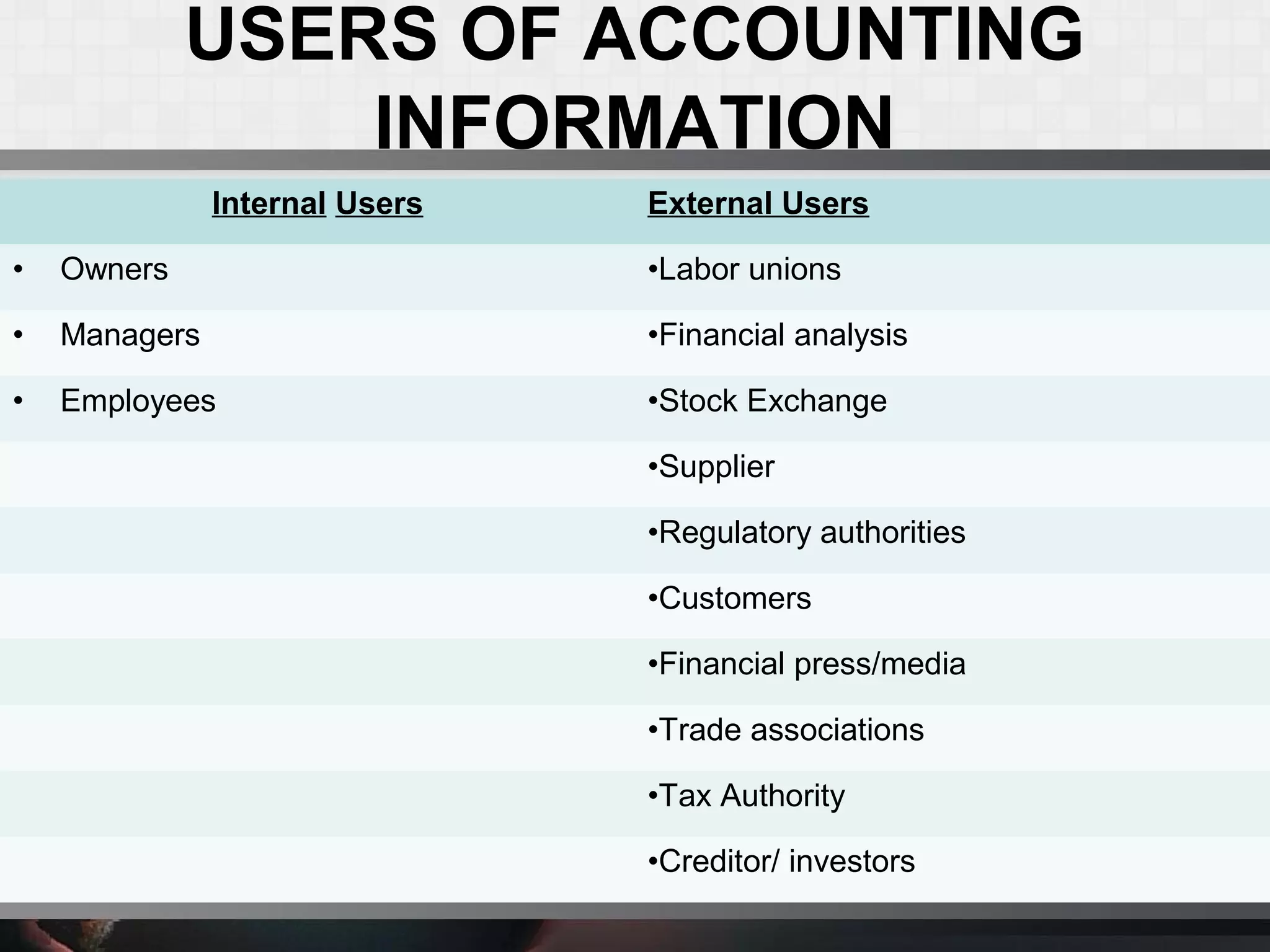

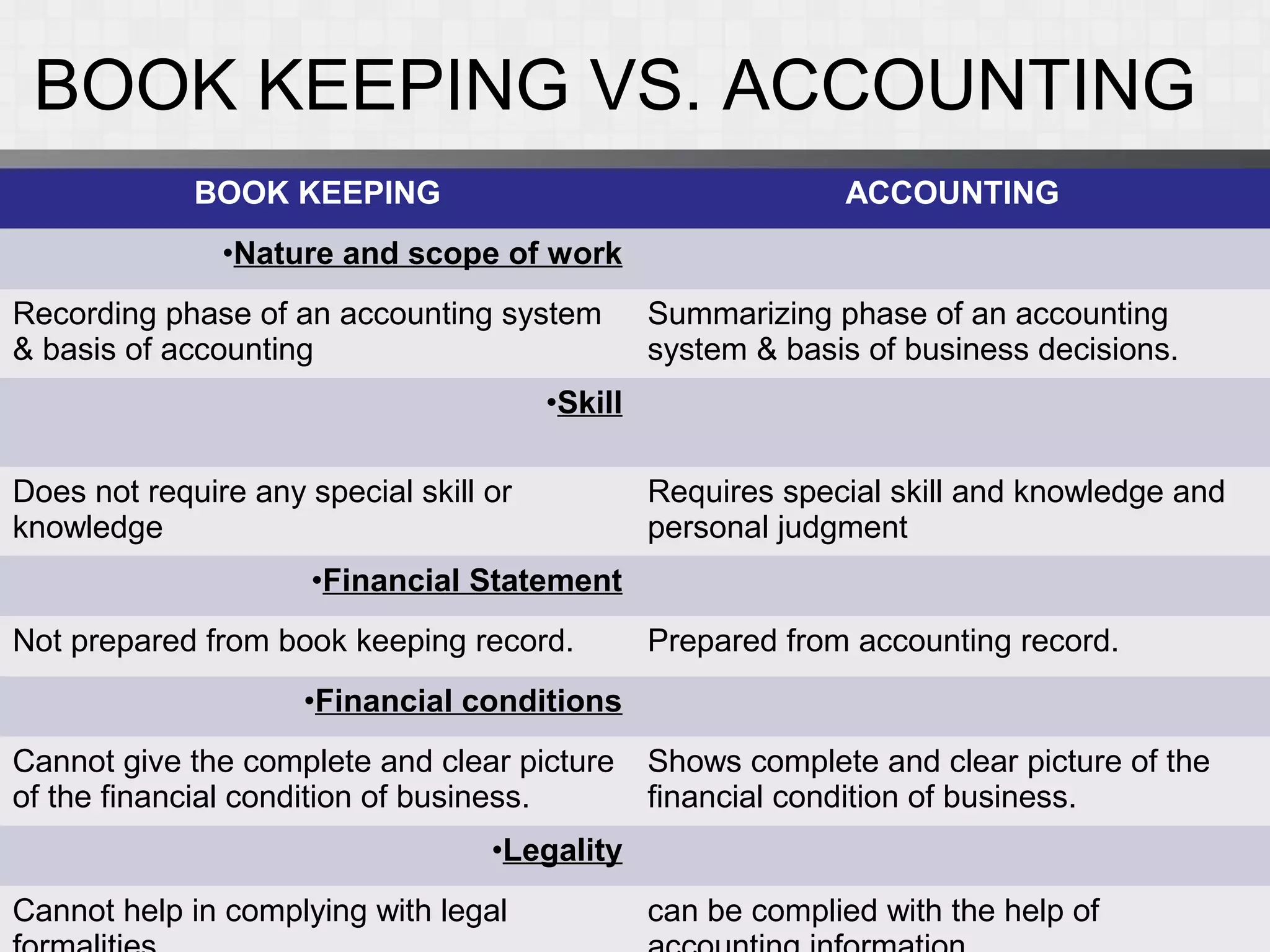

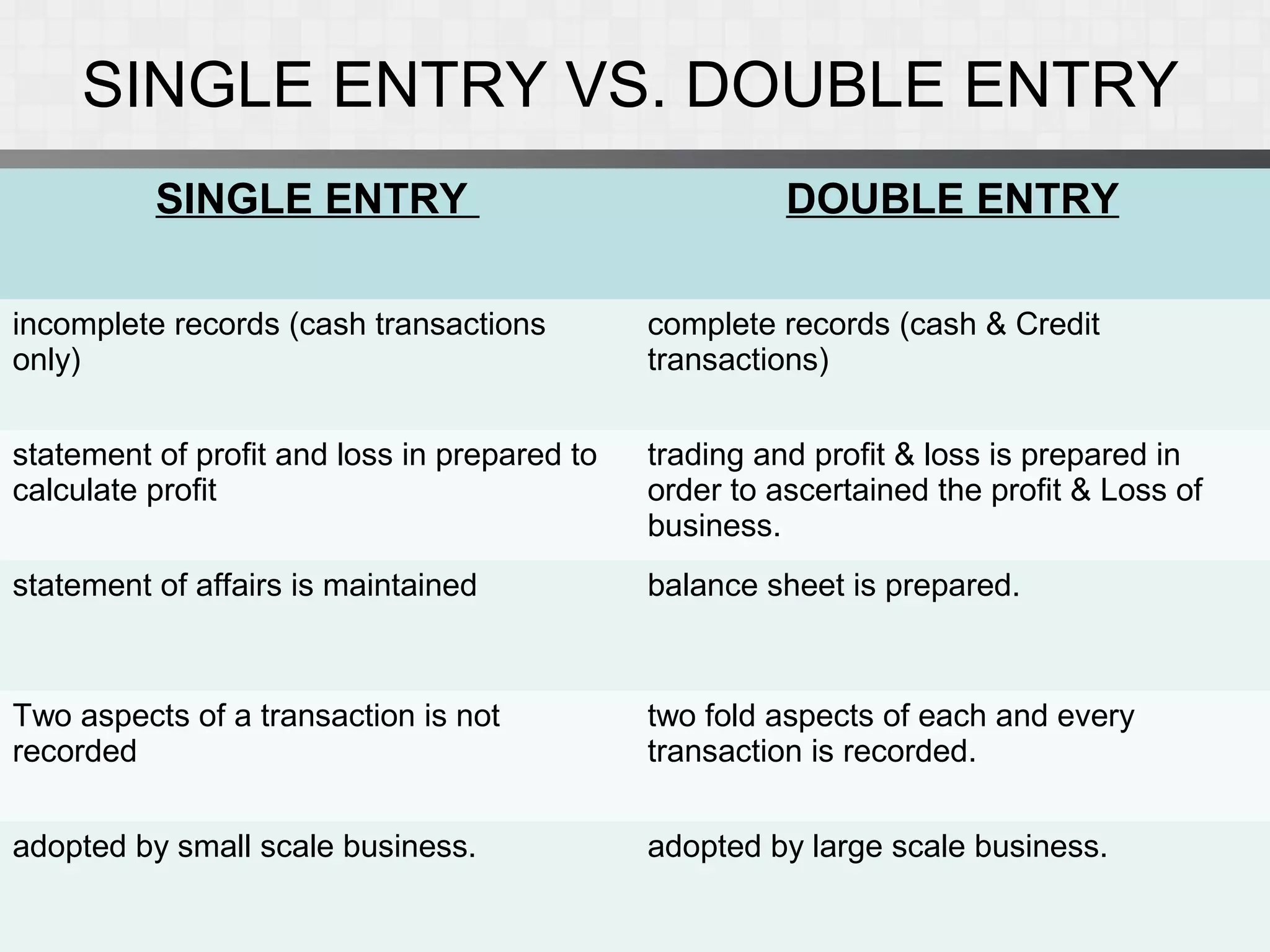

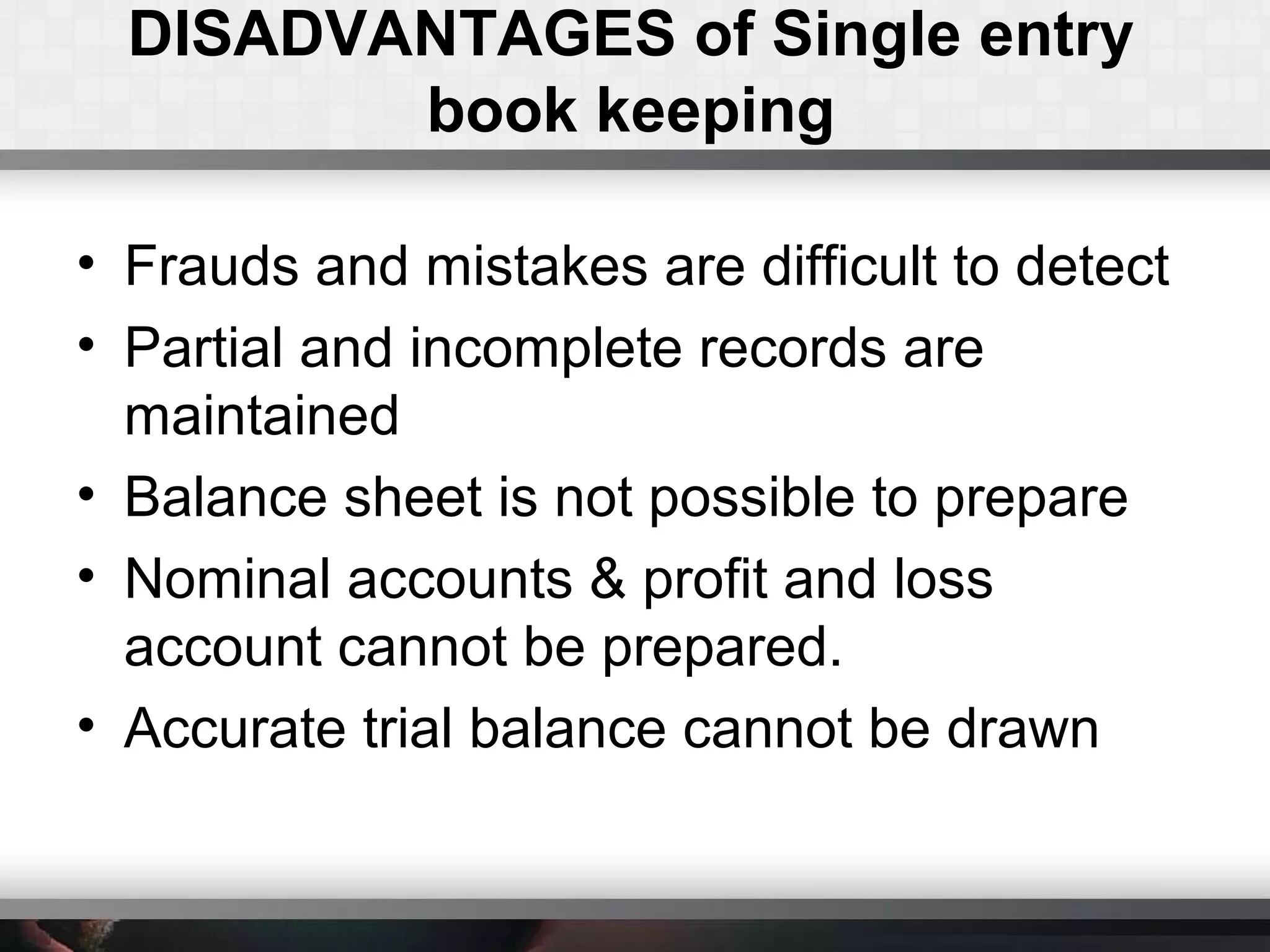

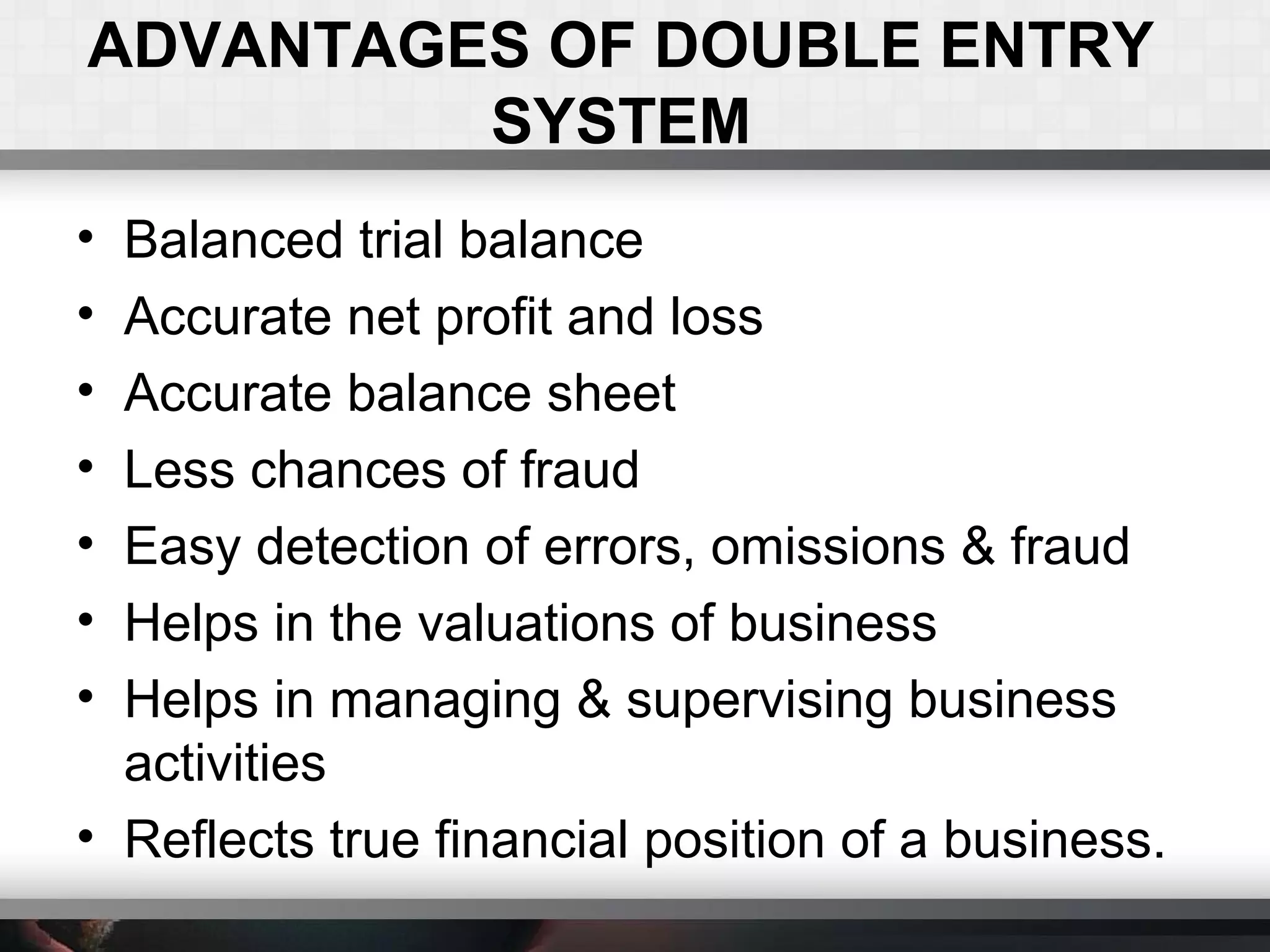

This document discusses accounting concepts such as transactions, bookkeeping, and the differences between single-entry and double-entry accounting systems. It defines a transaction as a financial activity between two parties that involves an exchange of goods, services, or future payment. Bookkeeping is described as the systematic recording of financial transactions and is part of the accounting process. The objectives of bookkeeping are to provide financial data to management and maintain a permanent record of transactions. Double-entry accounting is said to provide a more complete and accurate reflection of a business's financial condition compared to single-entry accounting through features like a balanced trial balance.