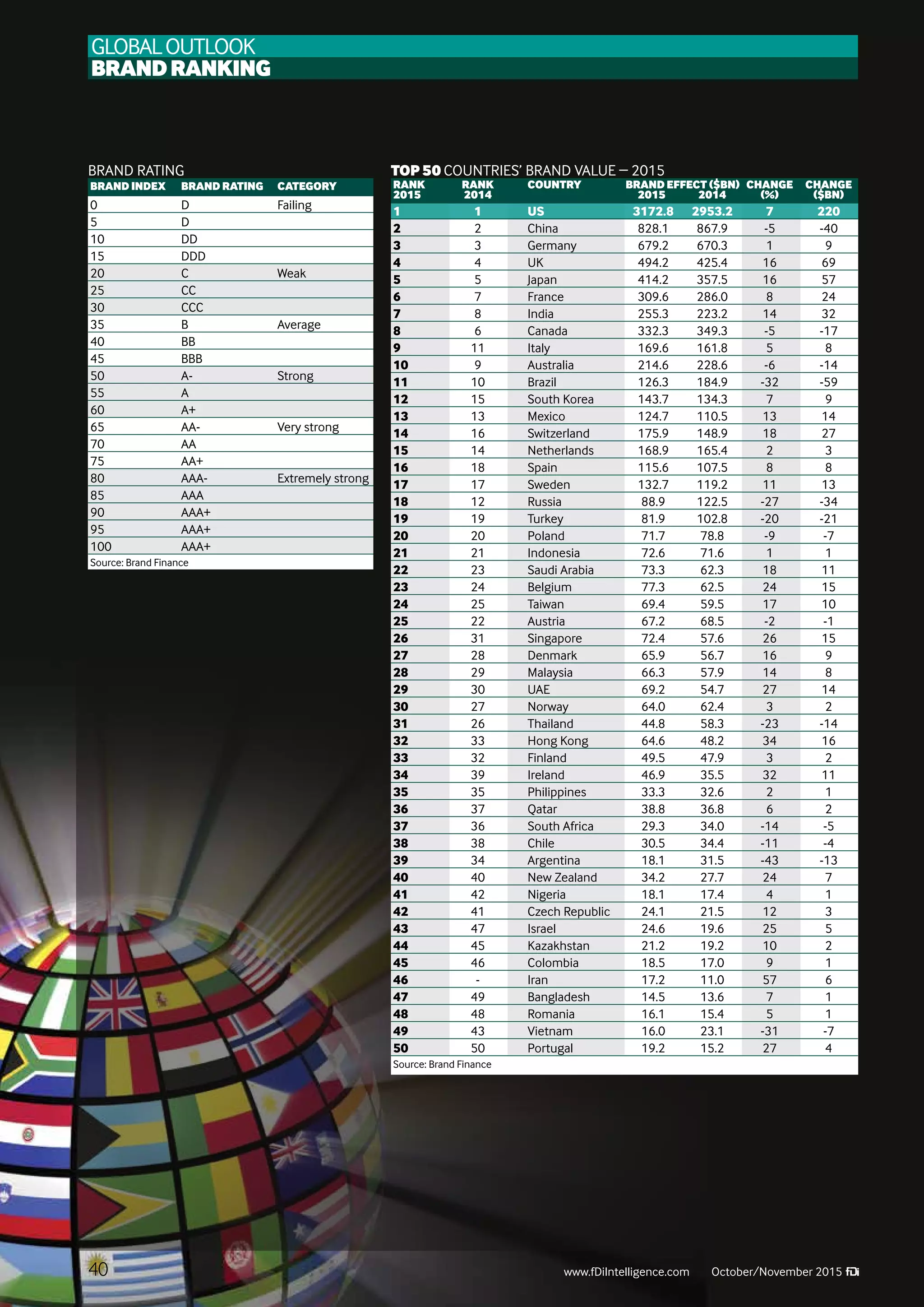

The US has the most valuable country brand according to the Nation Brands 2015 report. It also happens to be the number one destination for foreign direct investment (FDI) projects. Singapore has the strongest country brand, though it will never challenge the US for most valuable due to its smaller economy. Countries with strong brands, like the US, China, Germany, and others, tend to be top destinations for FDI.