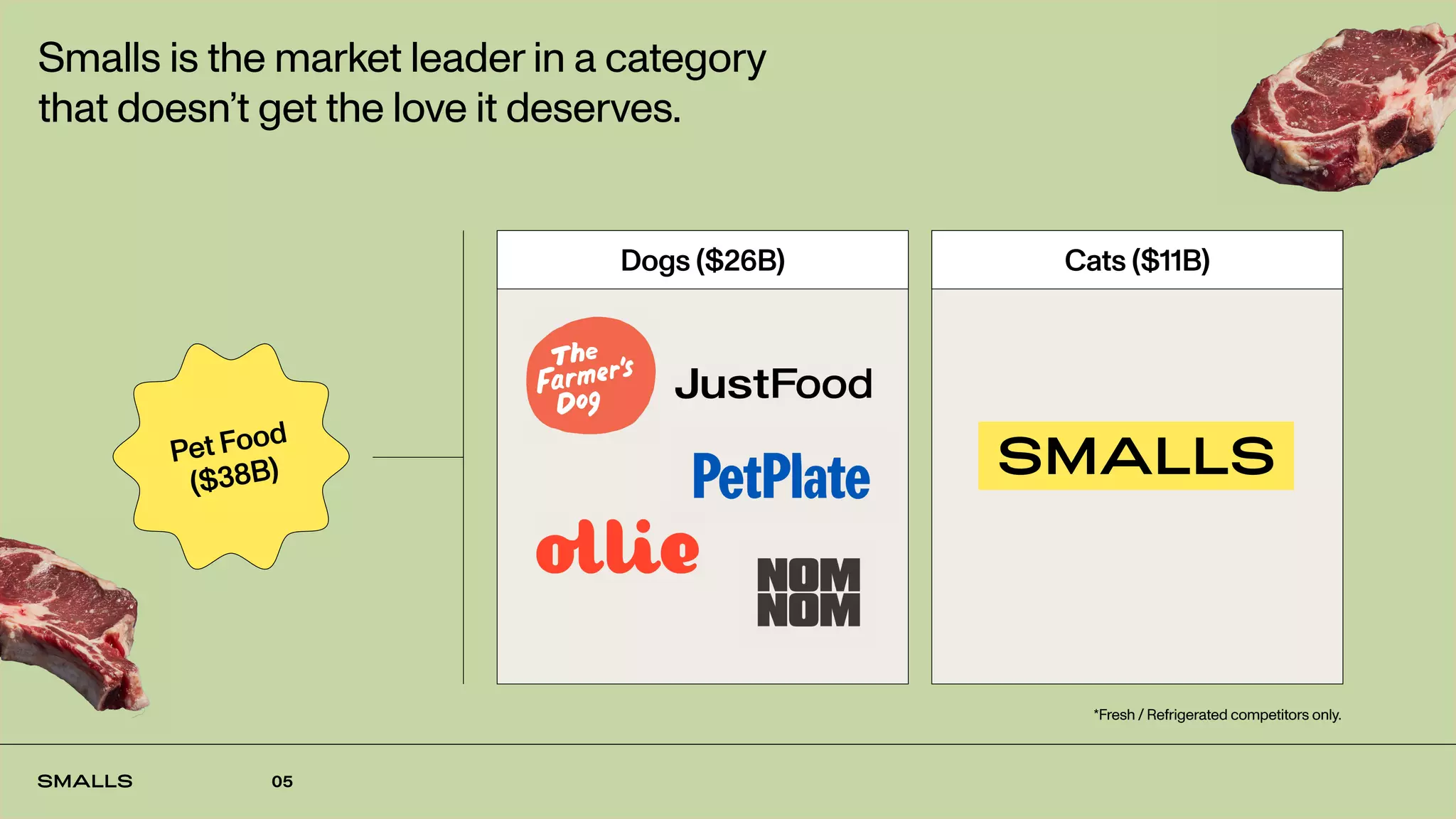

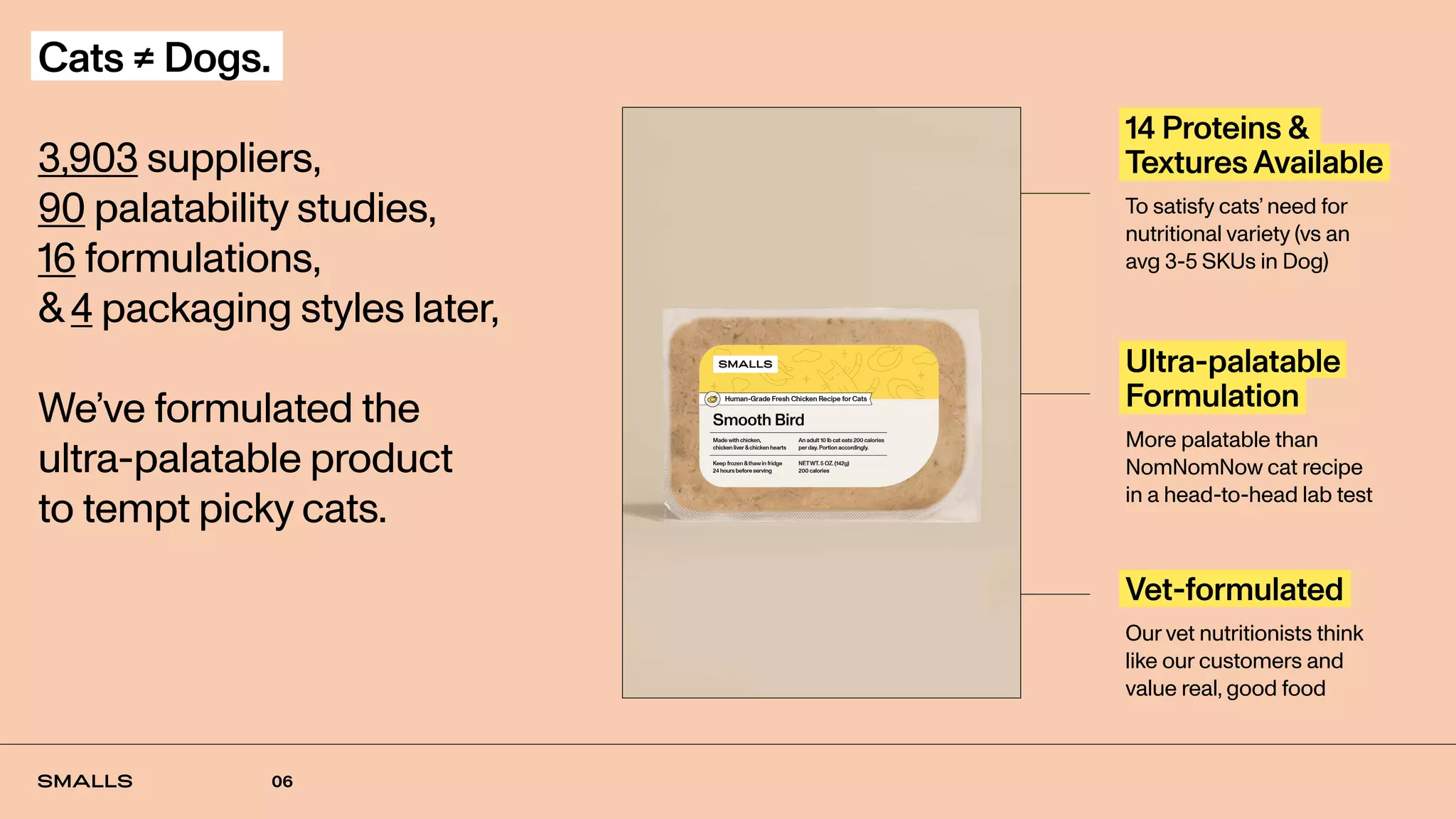

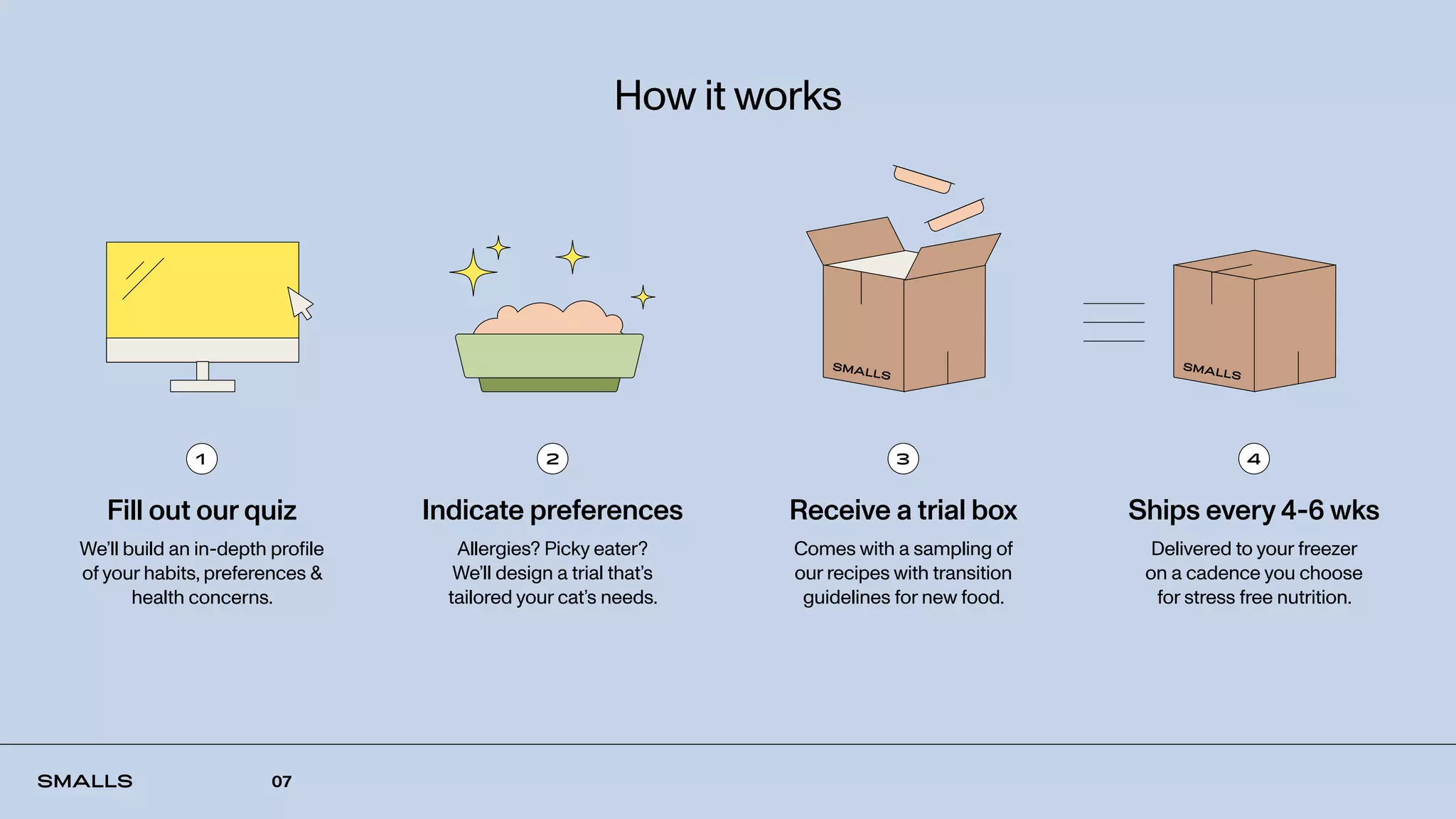

This document discusses a pet food company called Smalls that provides personalized cat food subscriptions. It summarizes that:

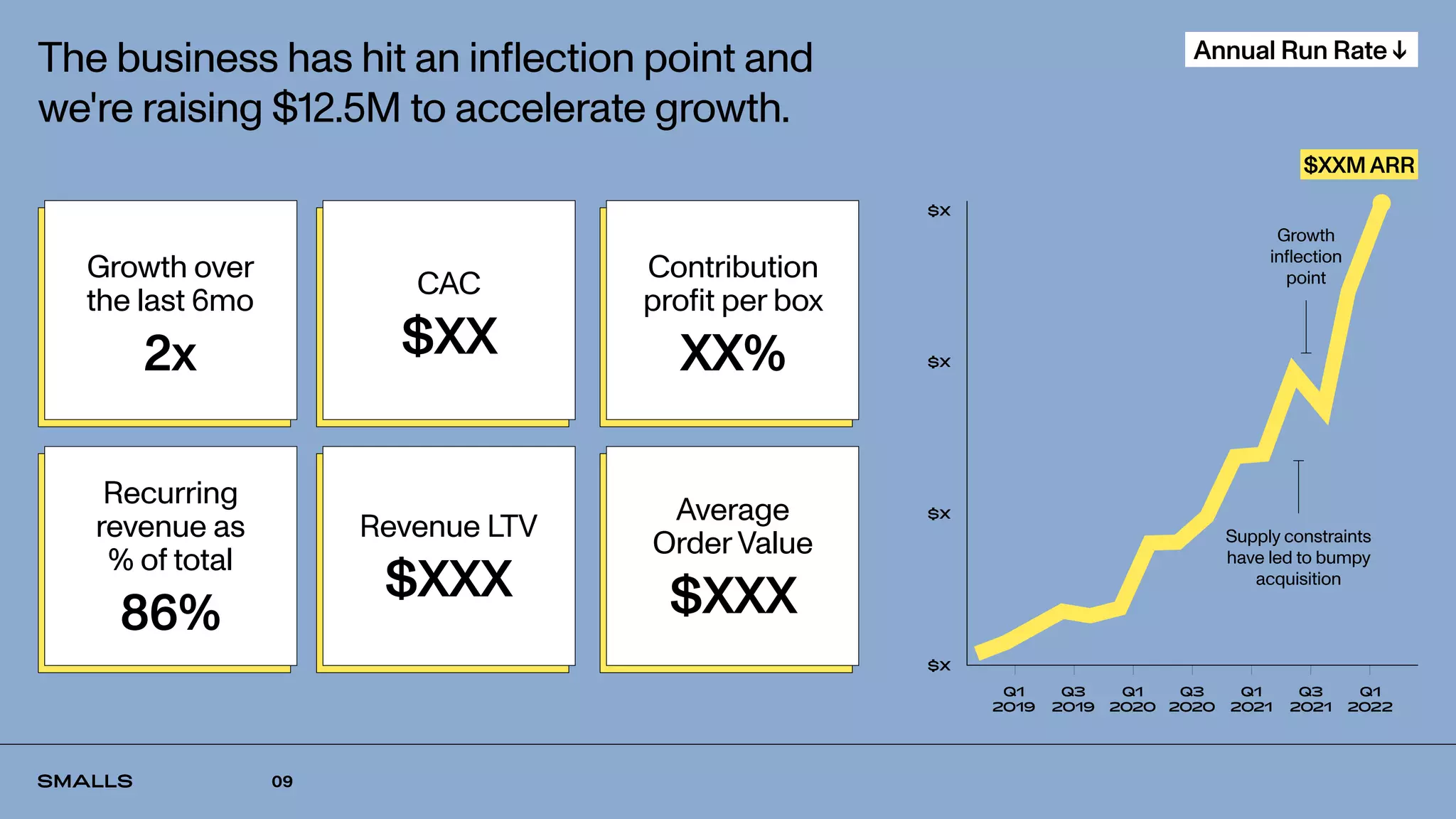

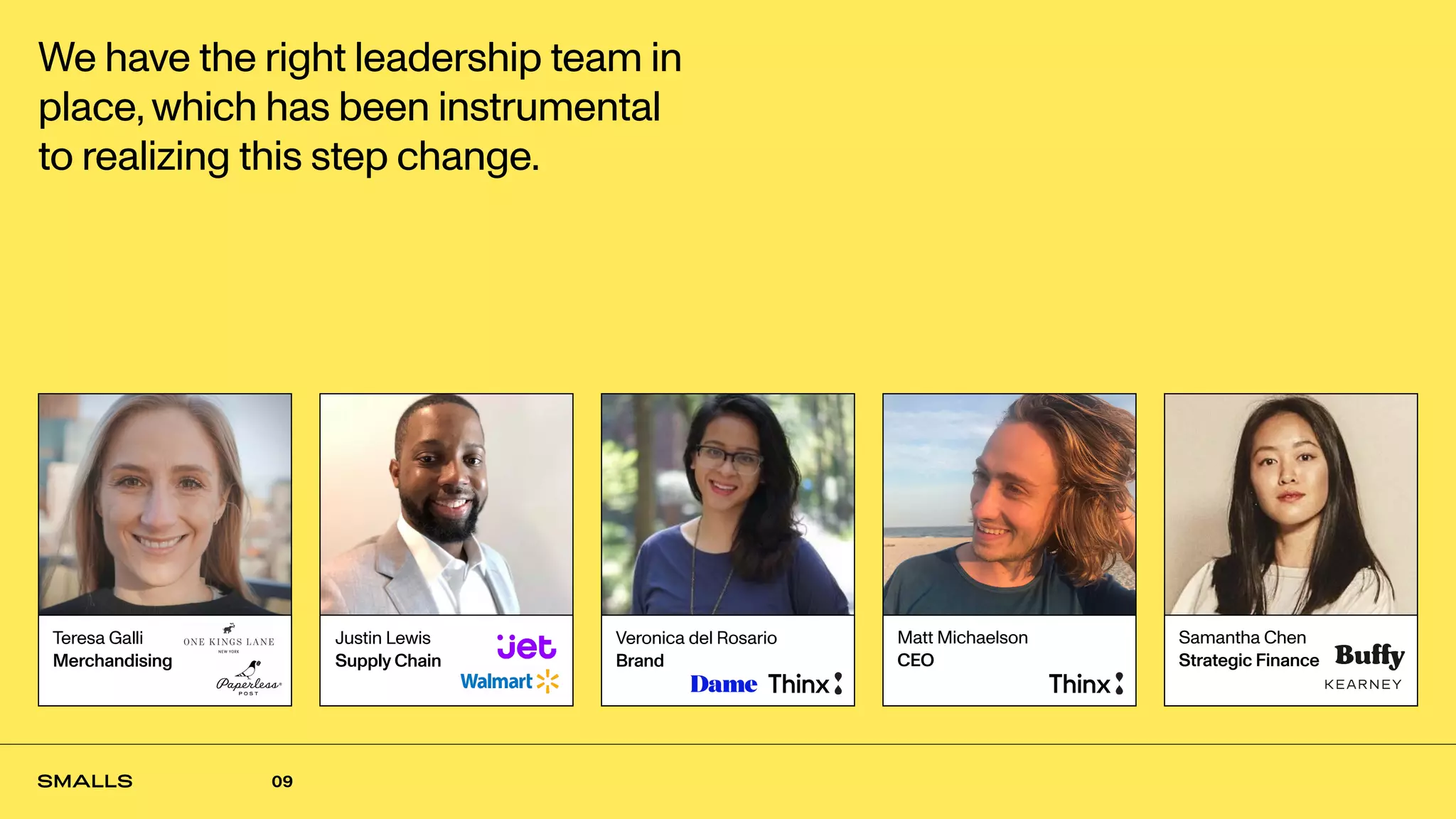

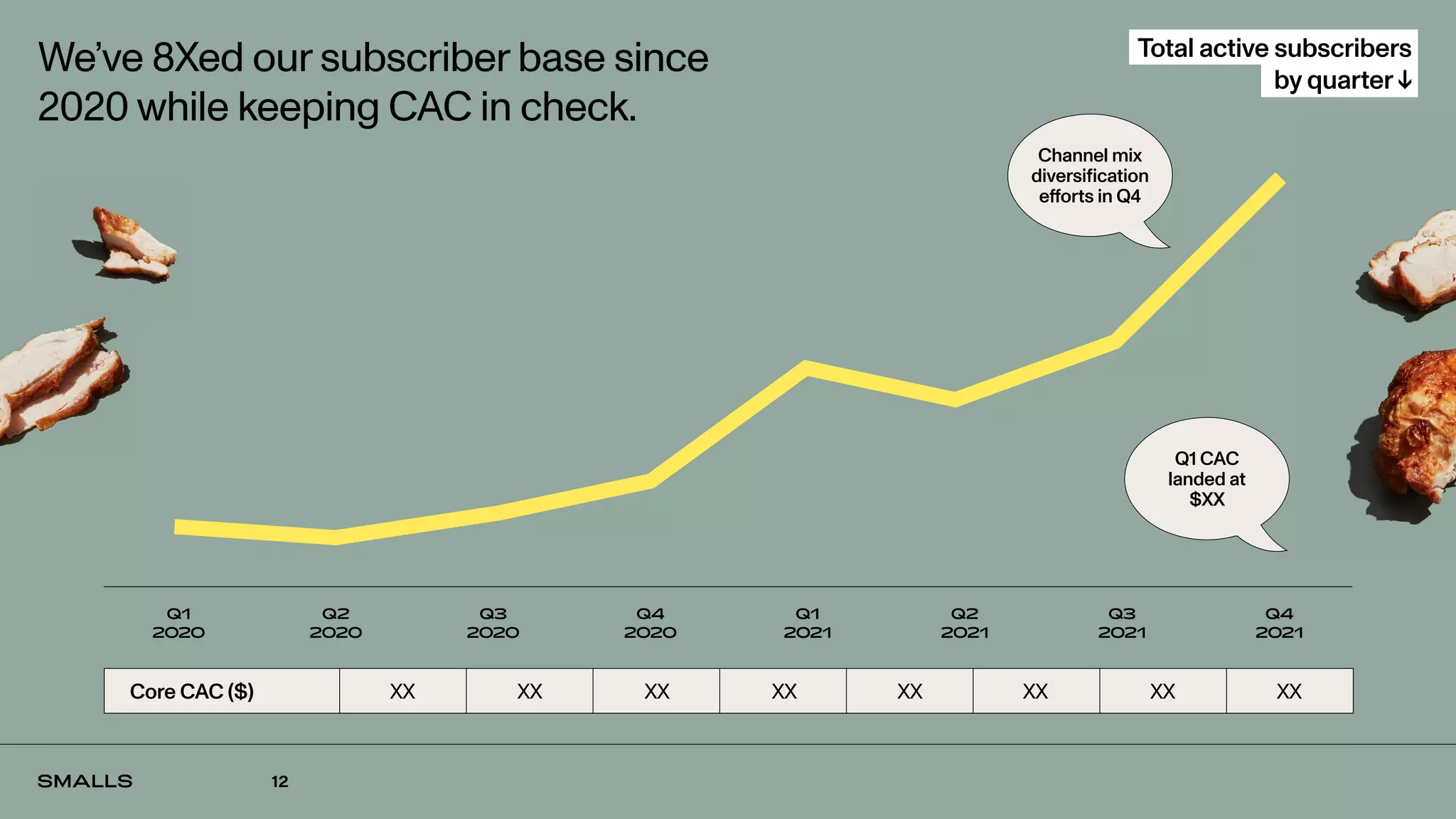

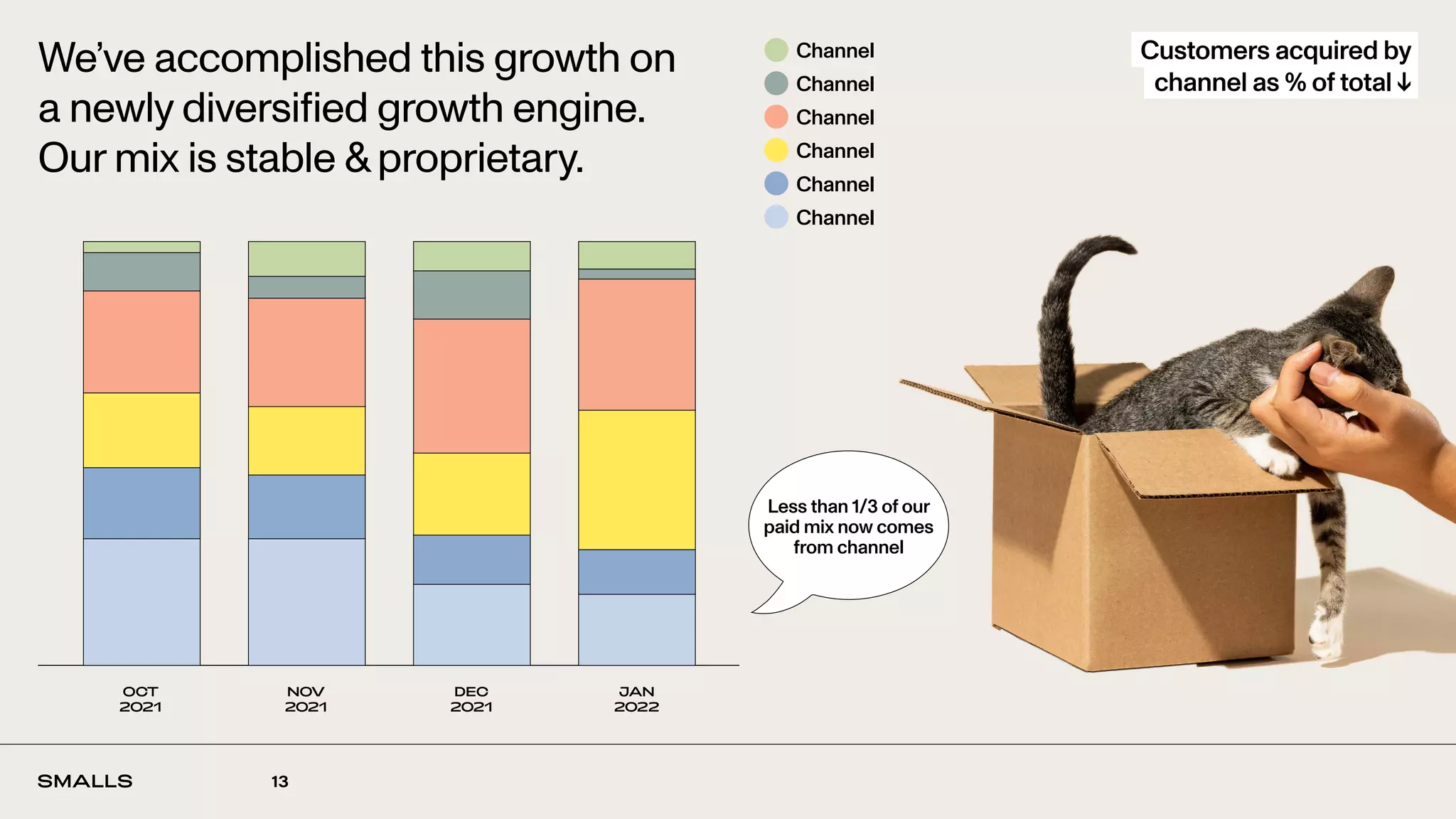

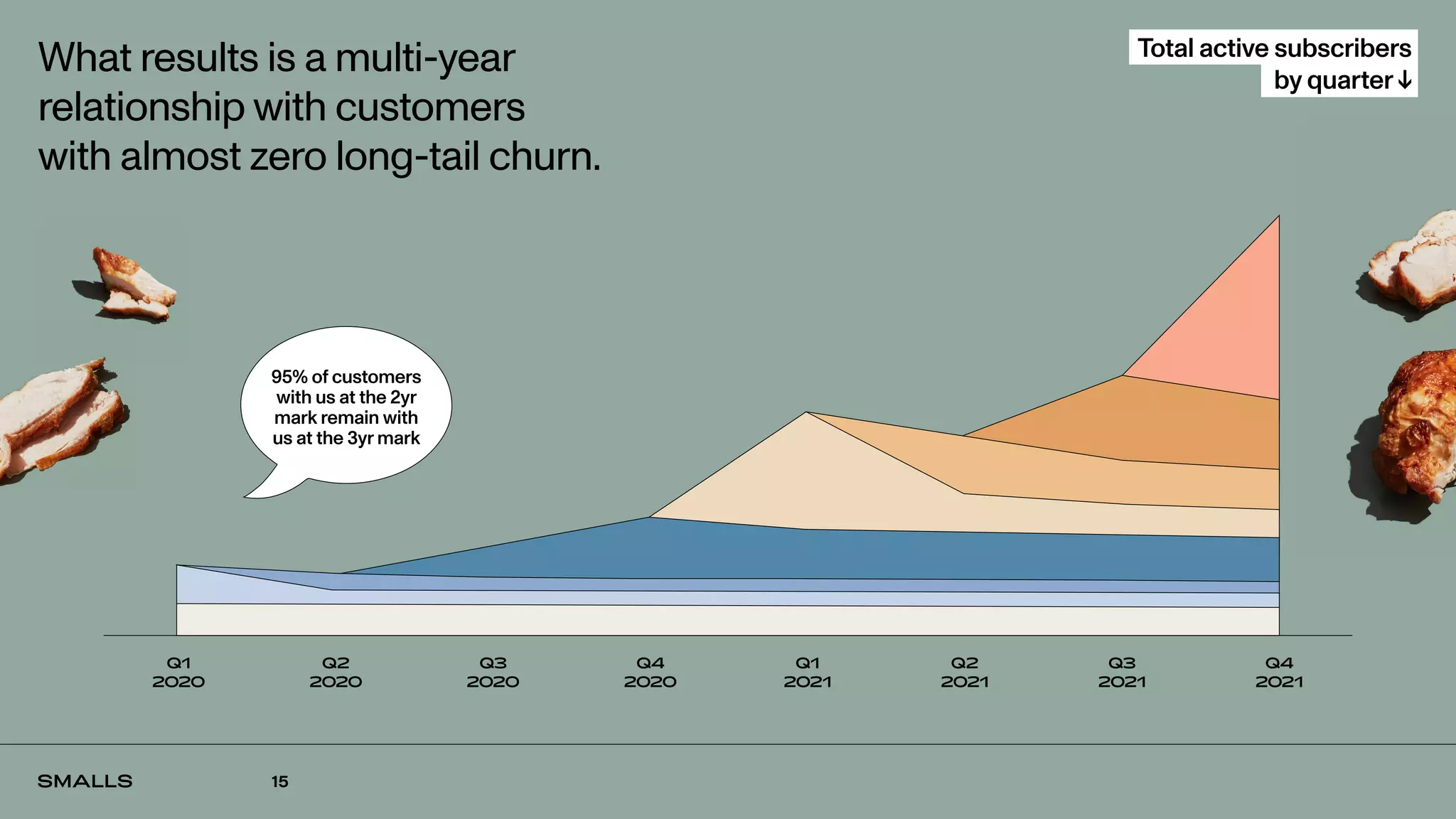

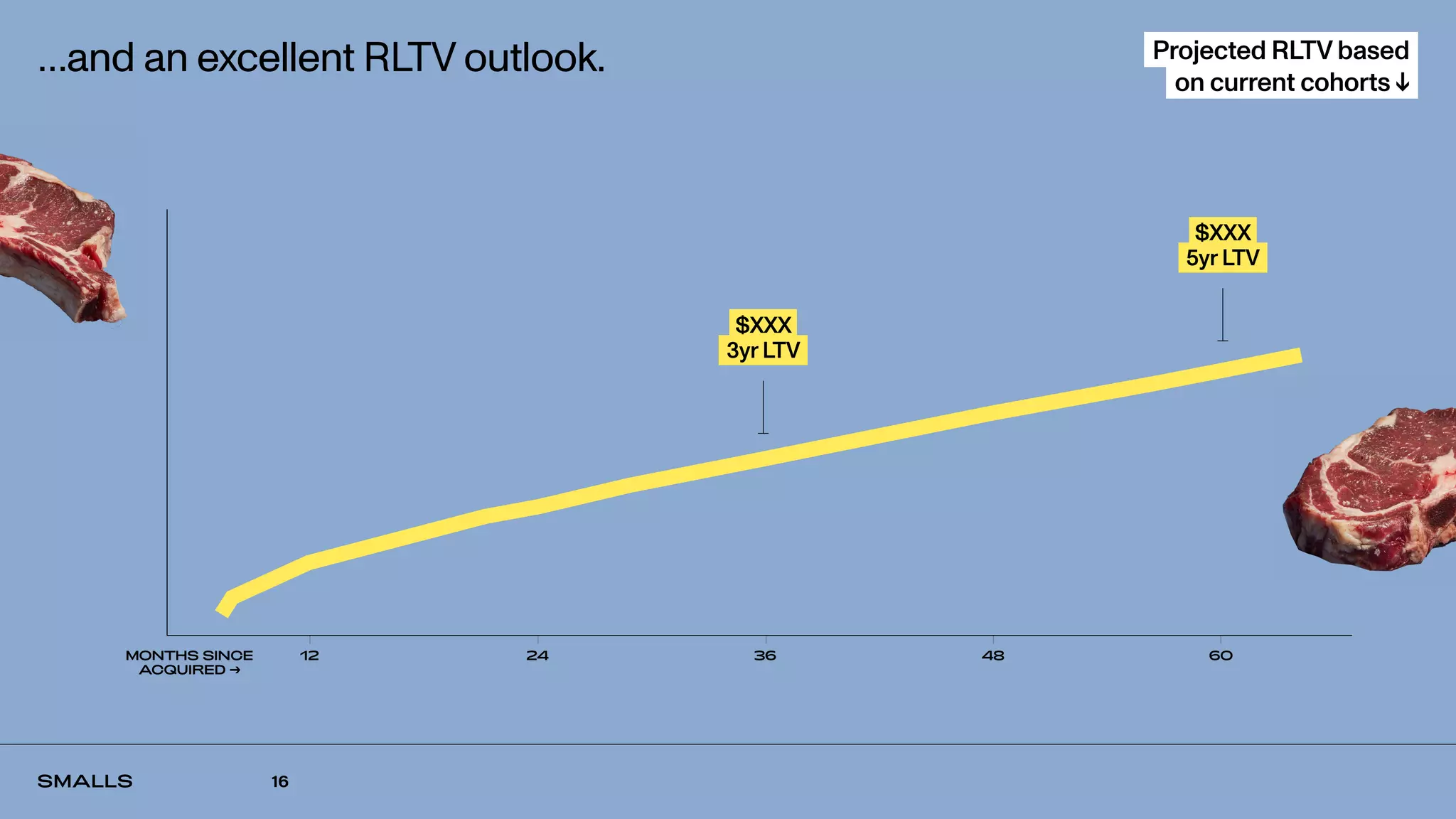

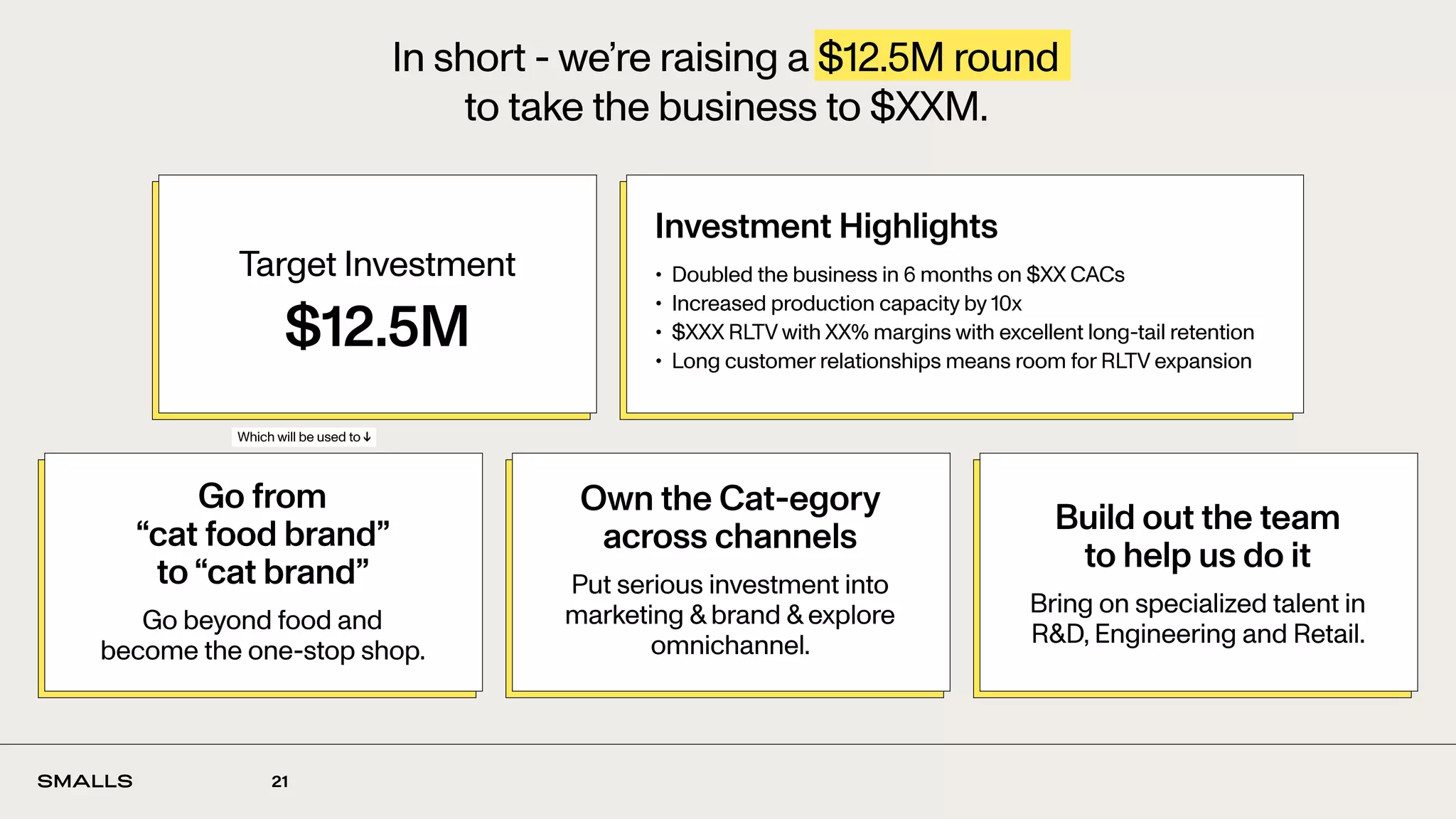

- Smalls has experienced rapid growth, doubling its business in the last 6 months while maintaining low customer acquisition costs.

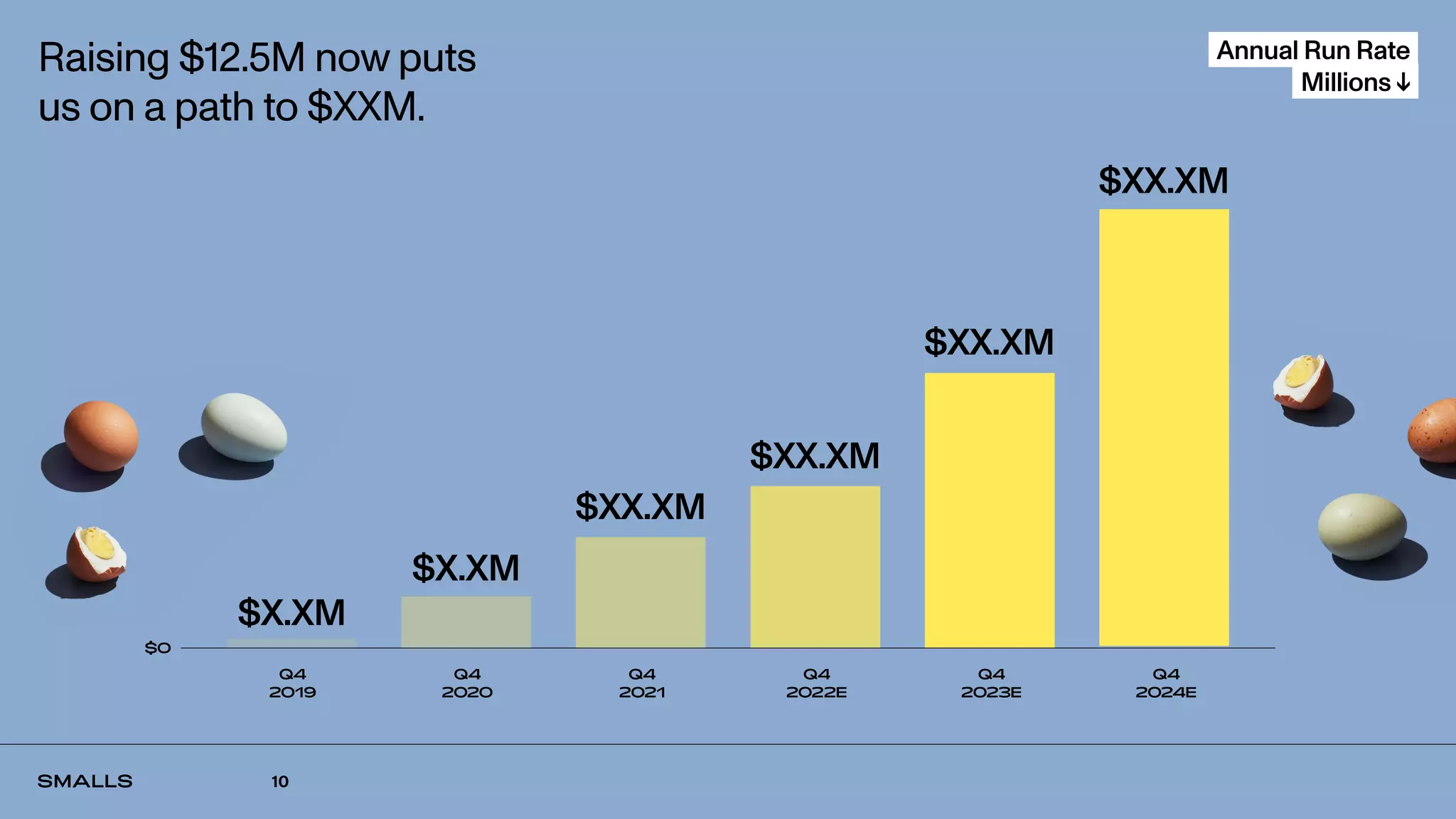

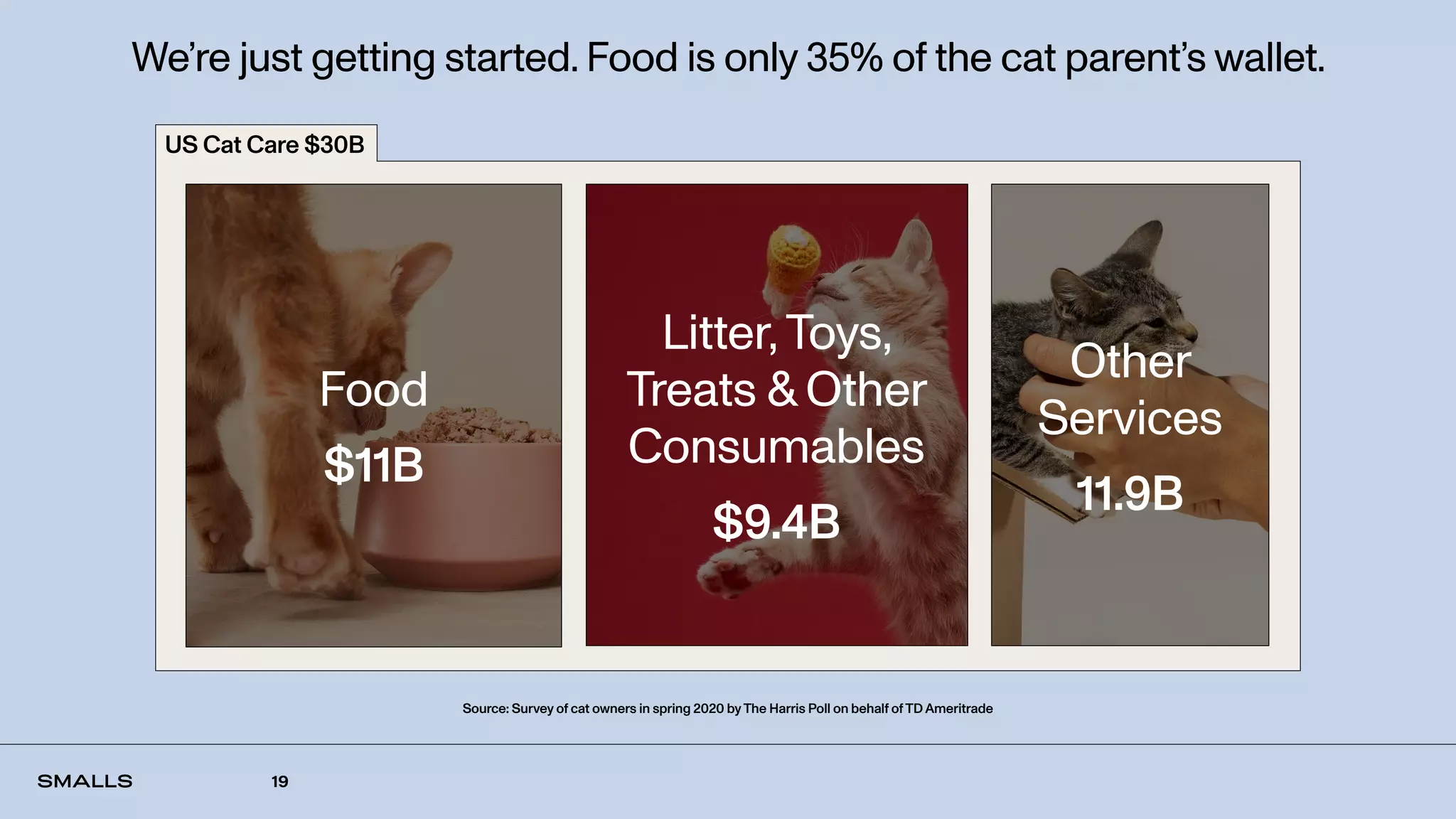

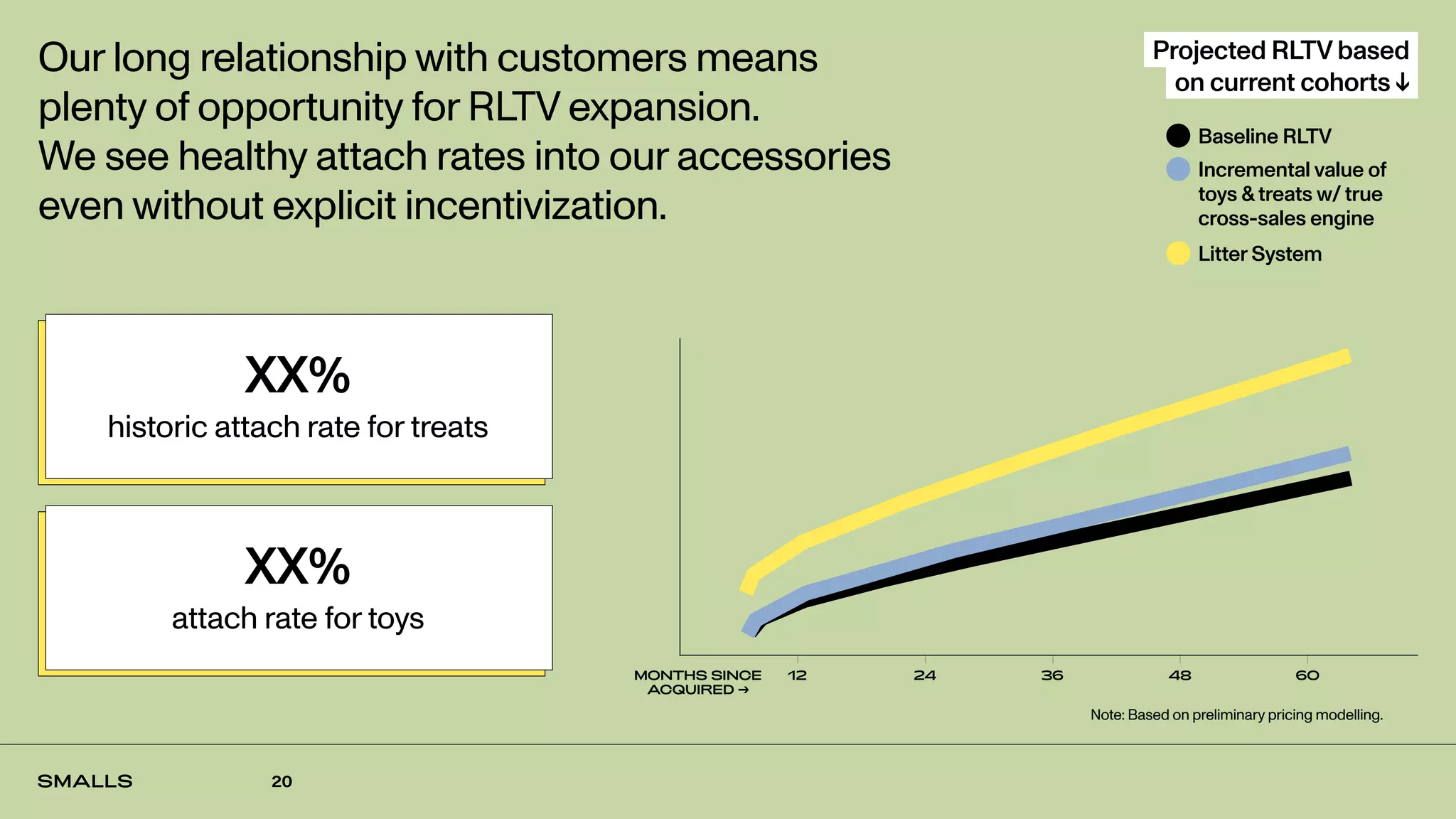

- It aims to raise $12.5 million to further expand its production capacity 10x, develop new product lines like litter and toys, and explore omnichannel opportunities to become a one-stop shop for cat owners.

- The funding would allow Smalls to reach $XX million in annual recurring revenue and build out its team to diversify beyond its core cat food subscriptions.