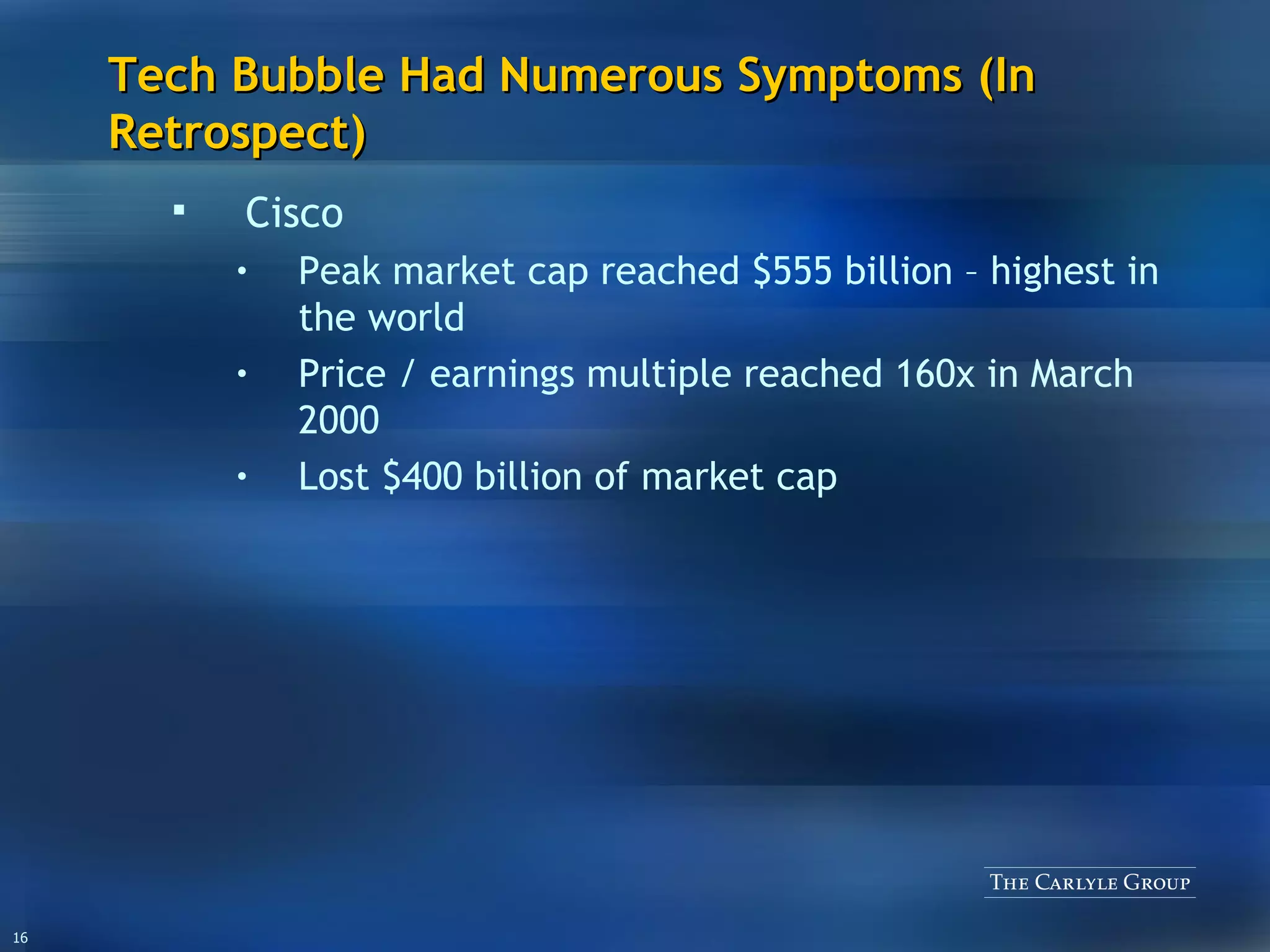

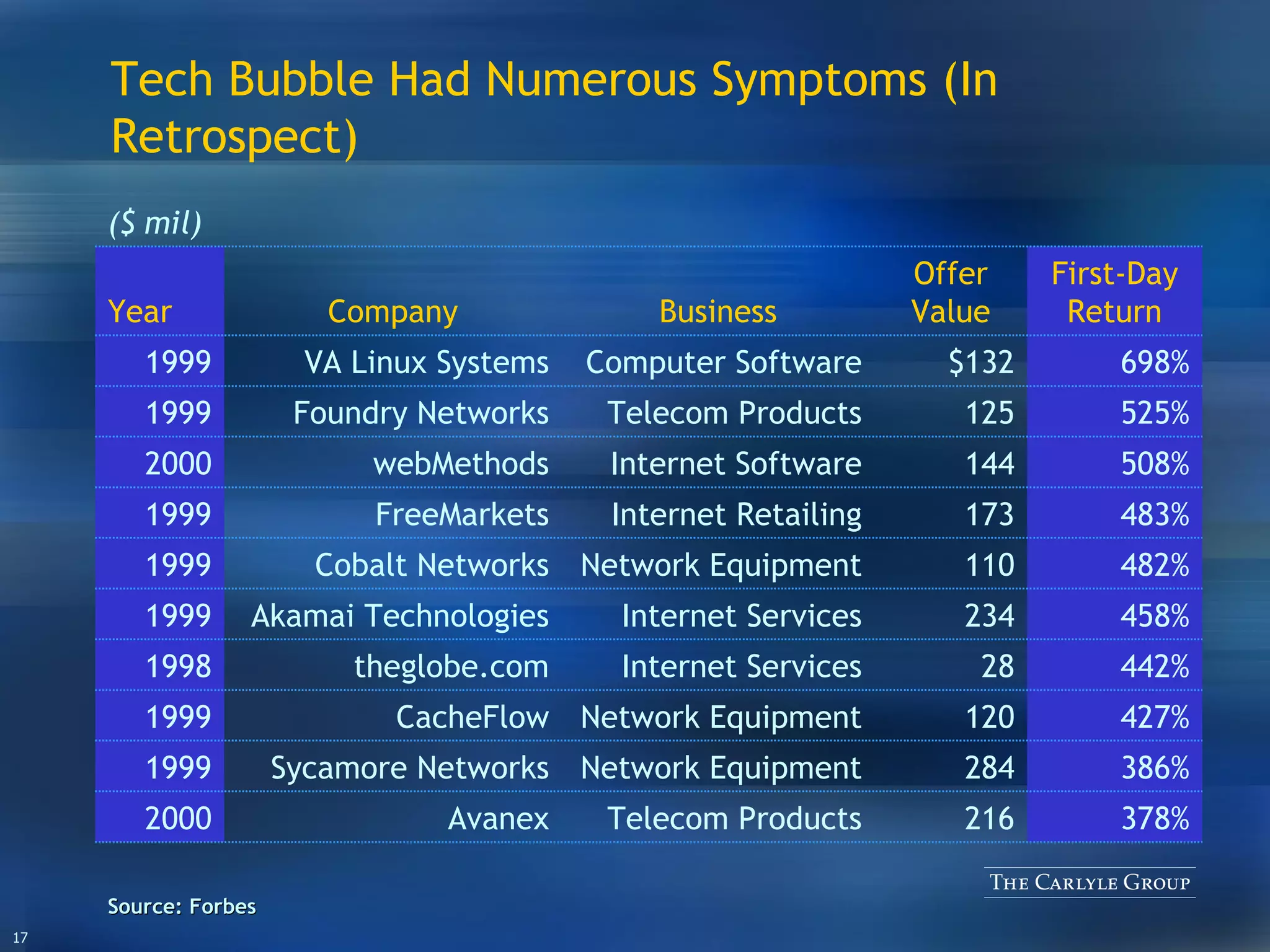

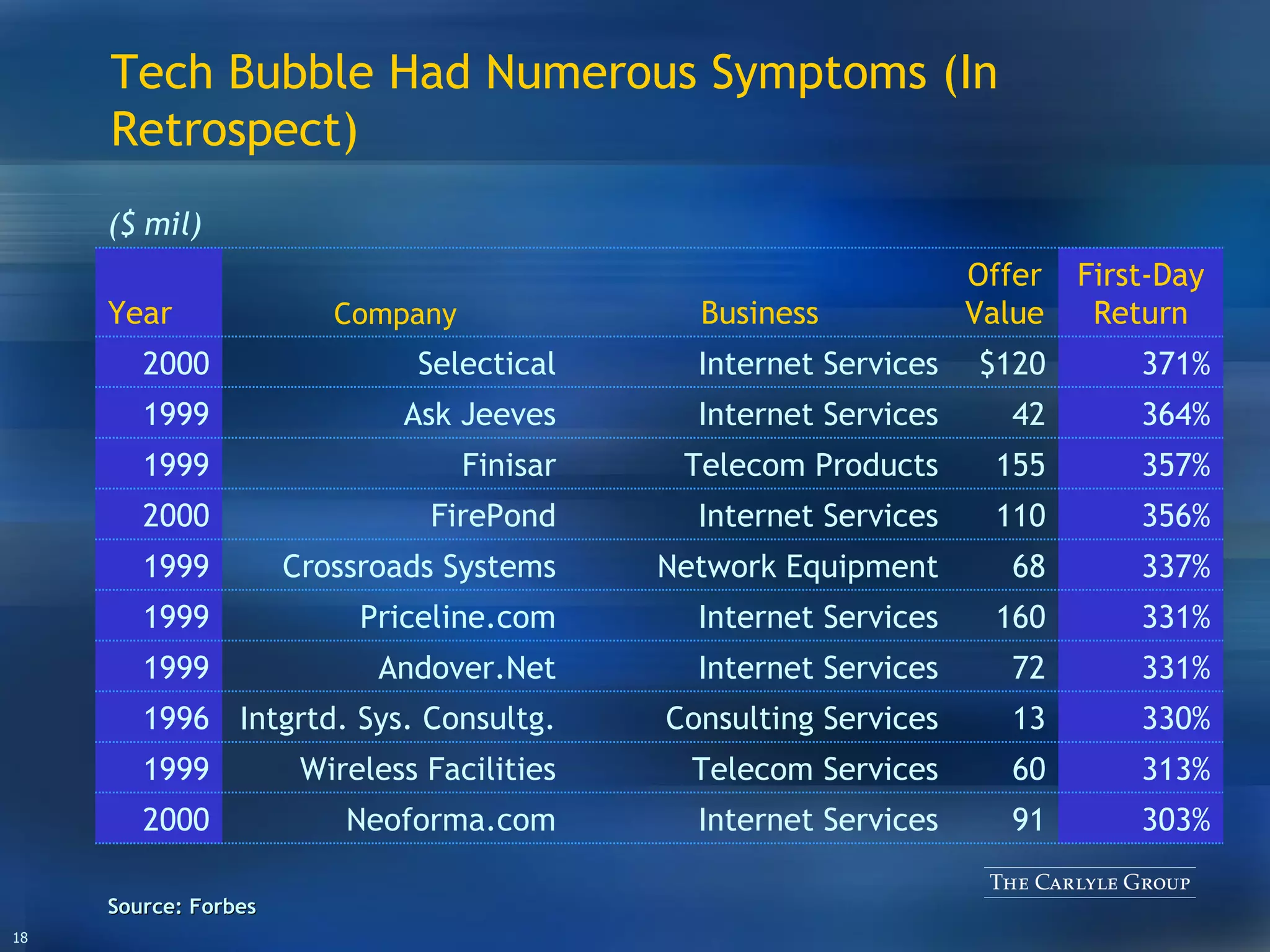

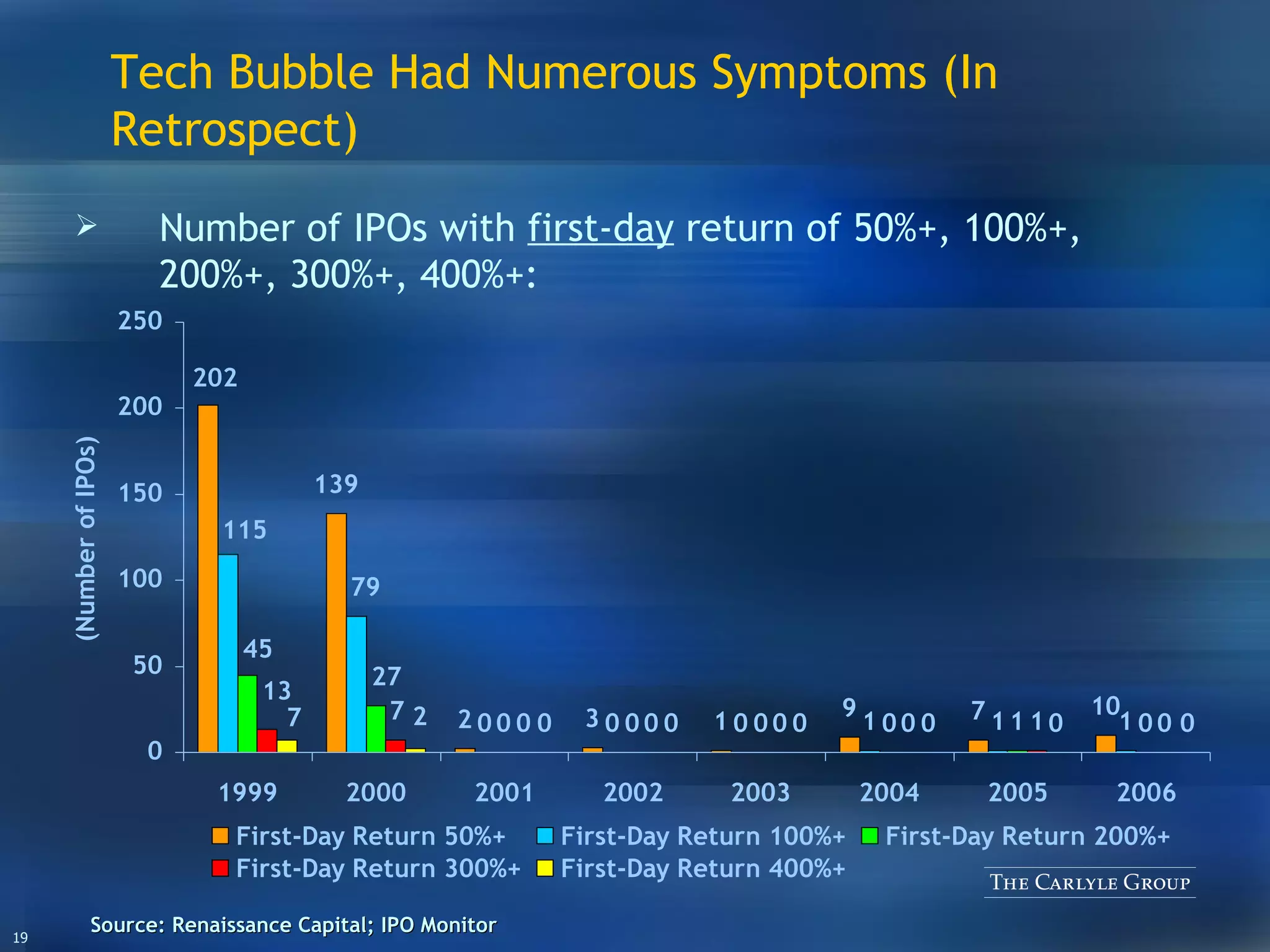

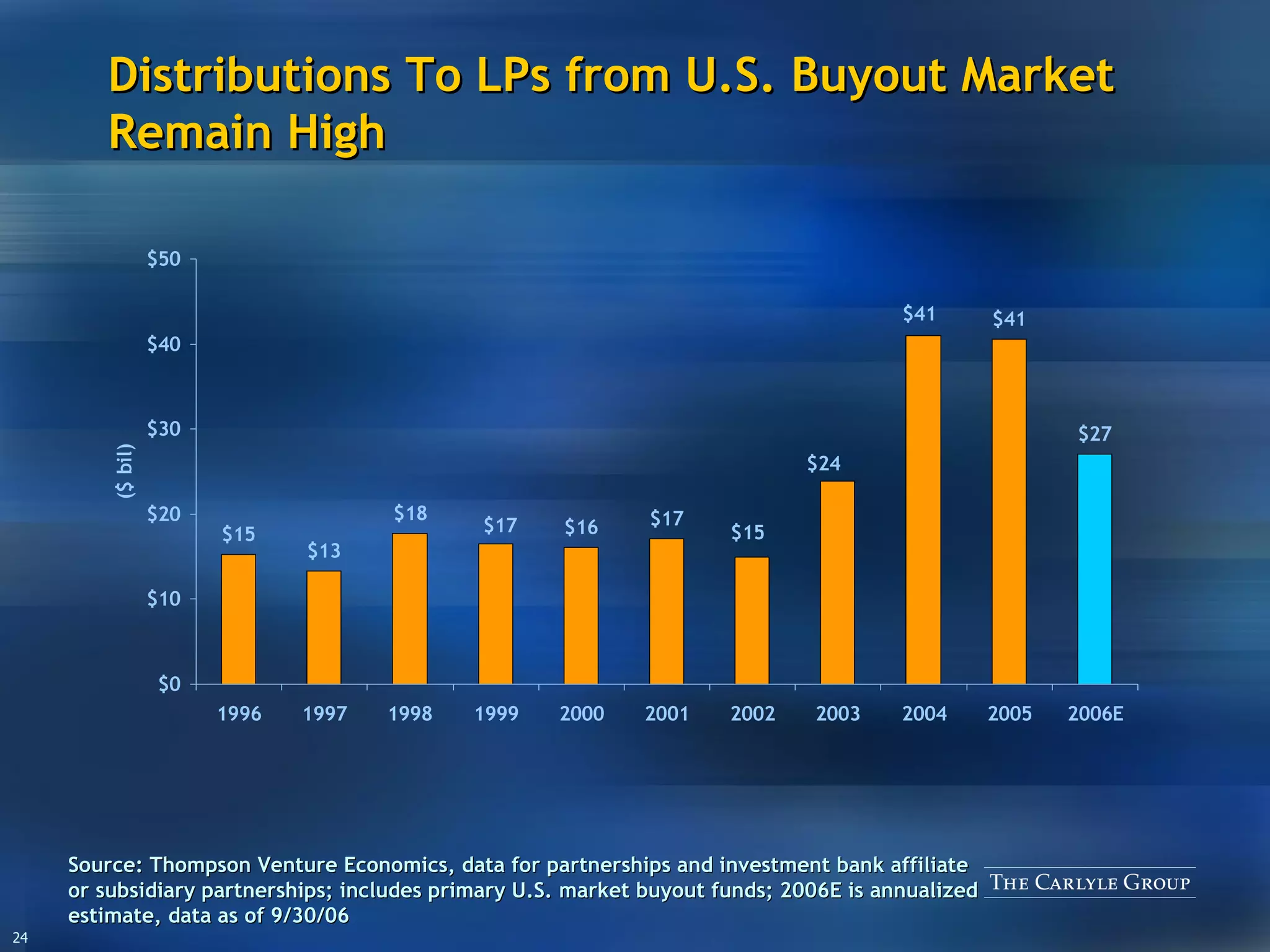

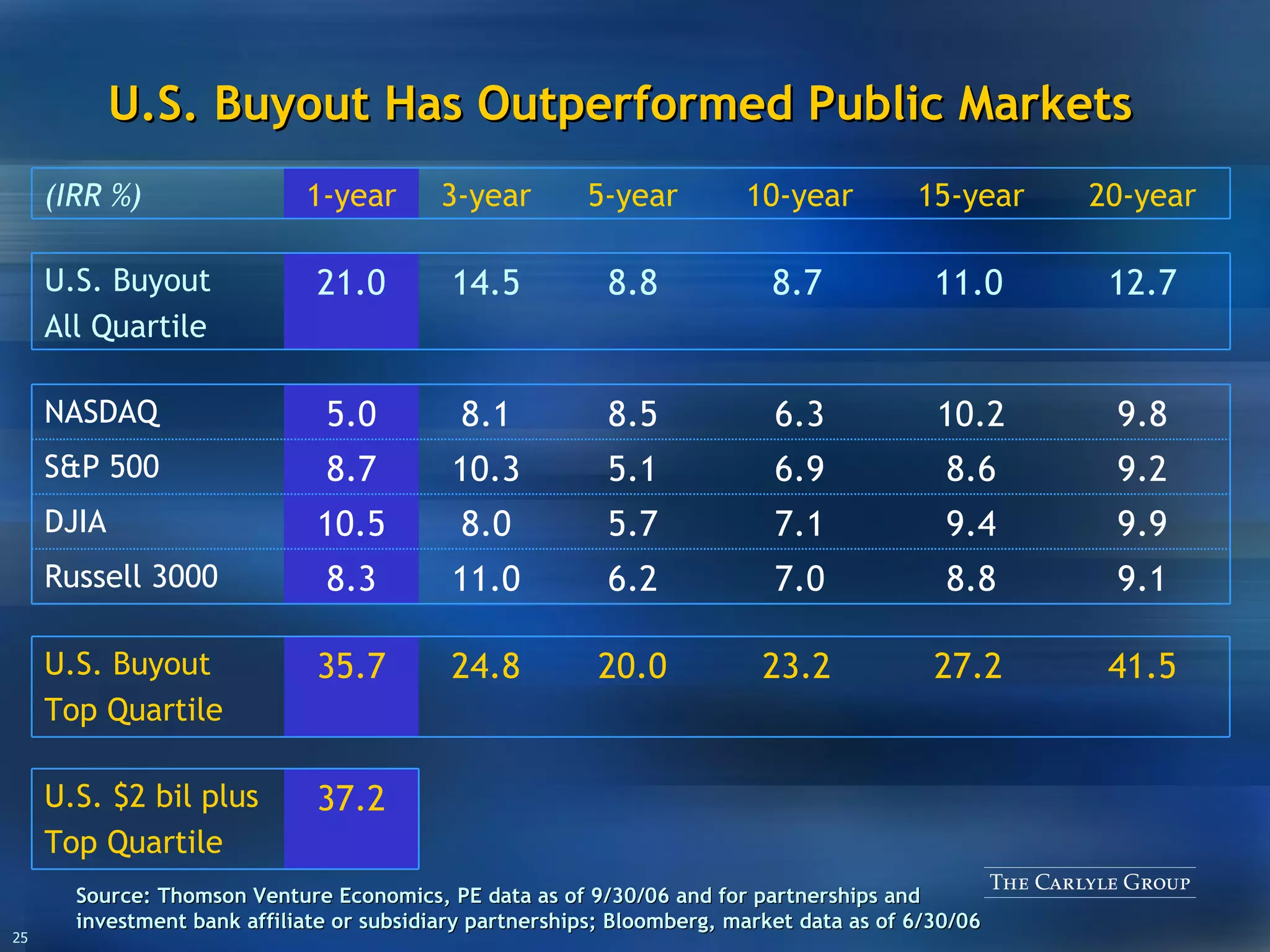

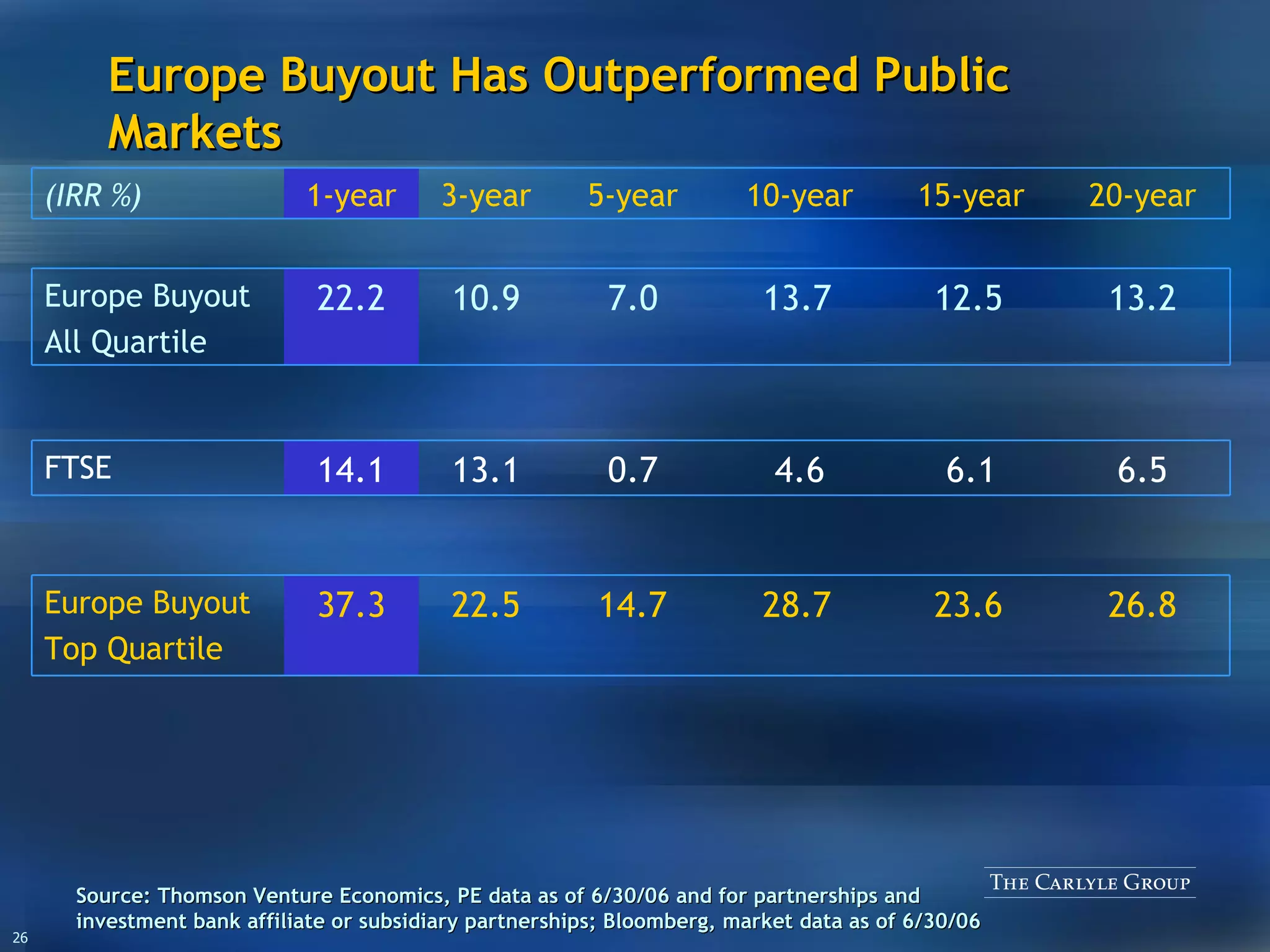

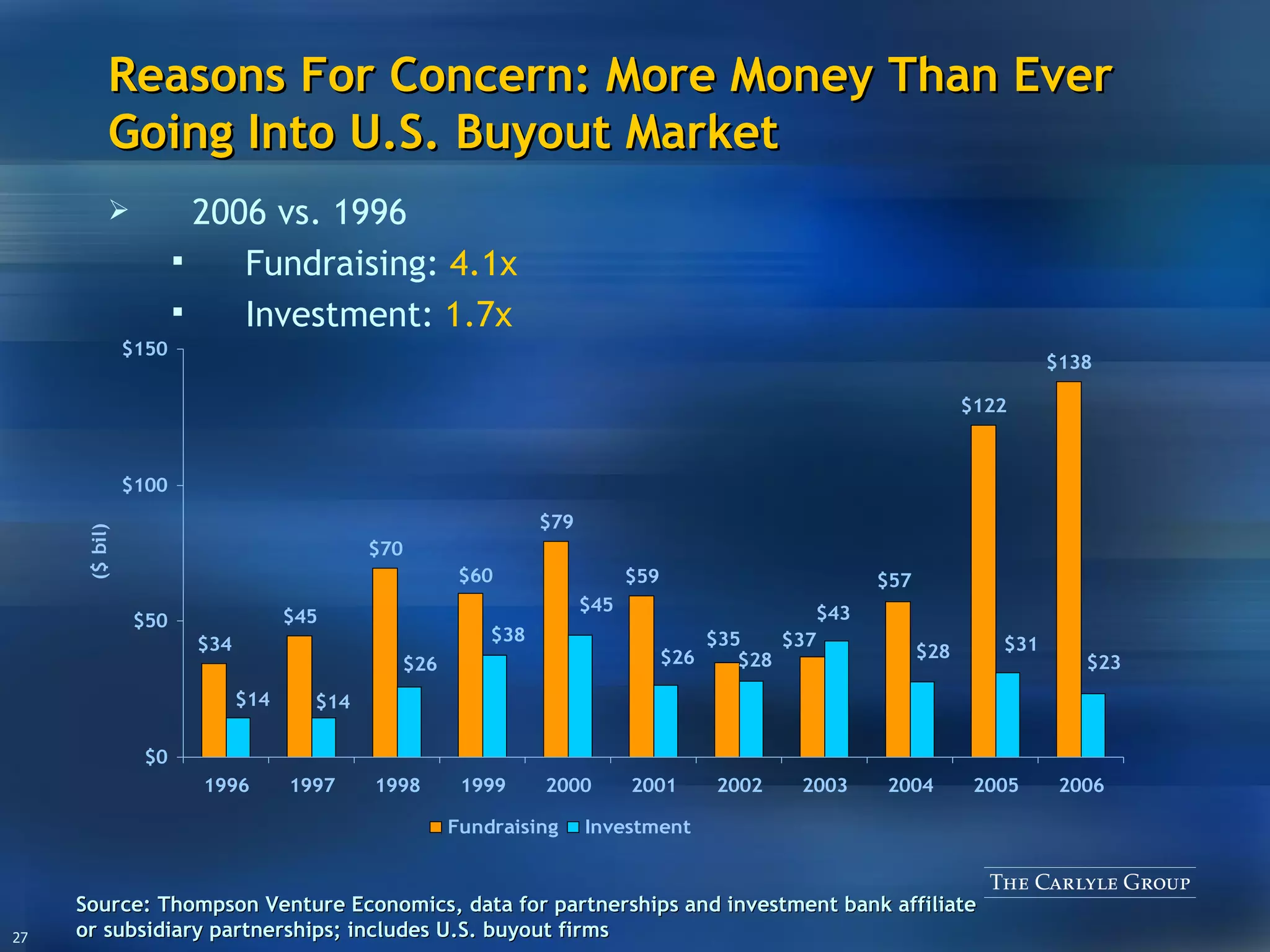

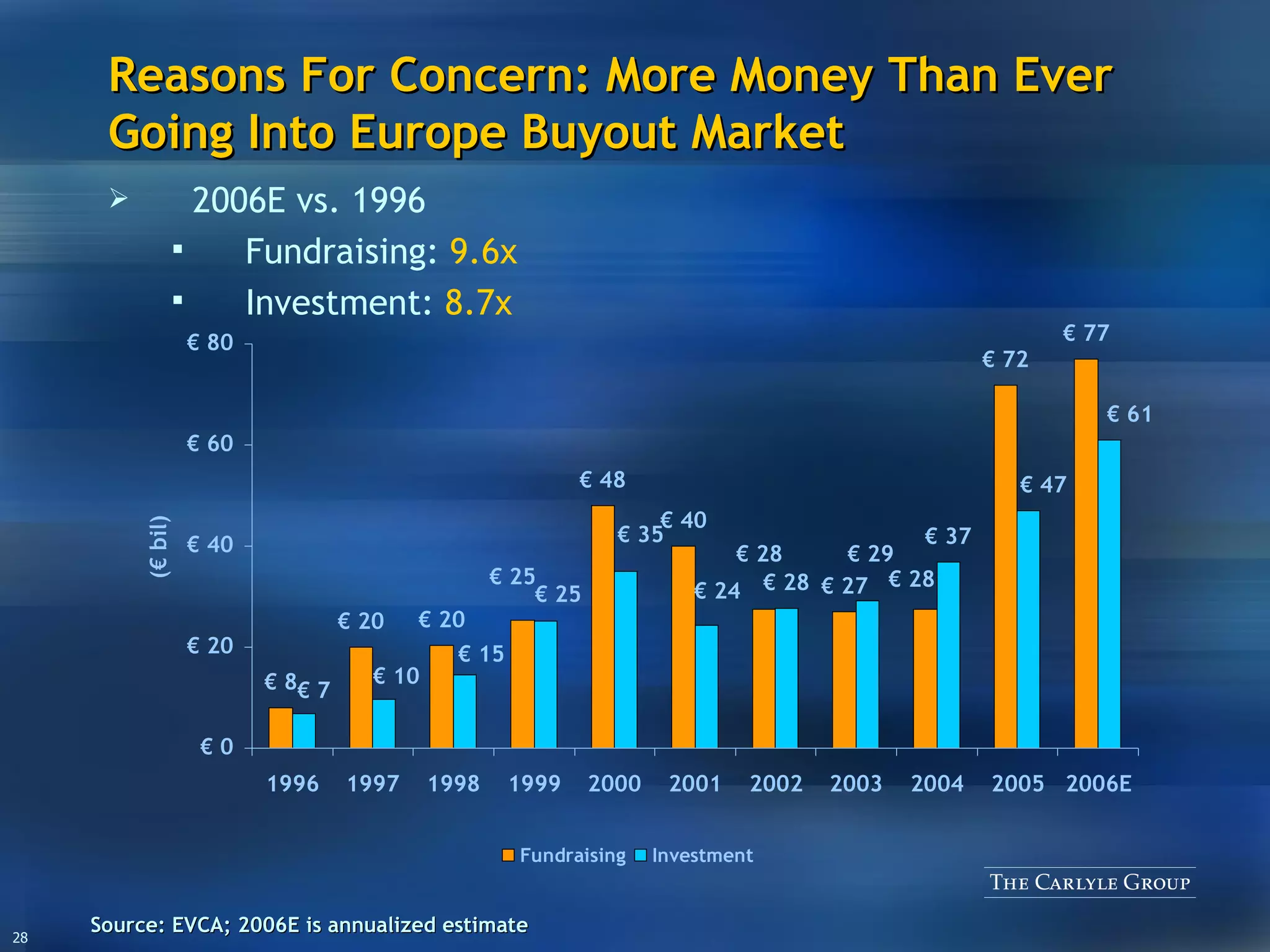

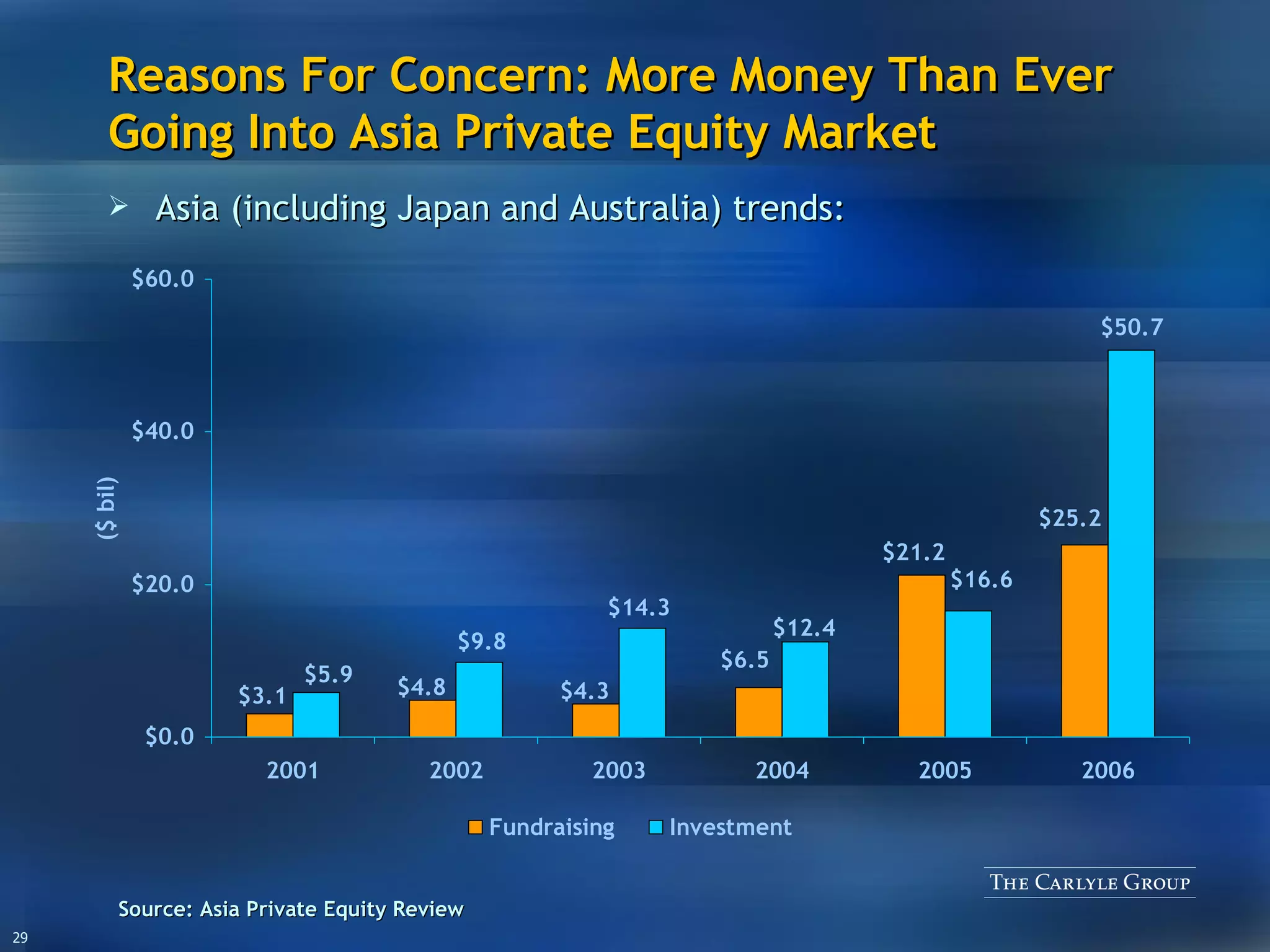

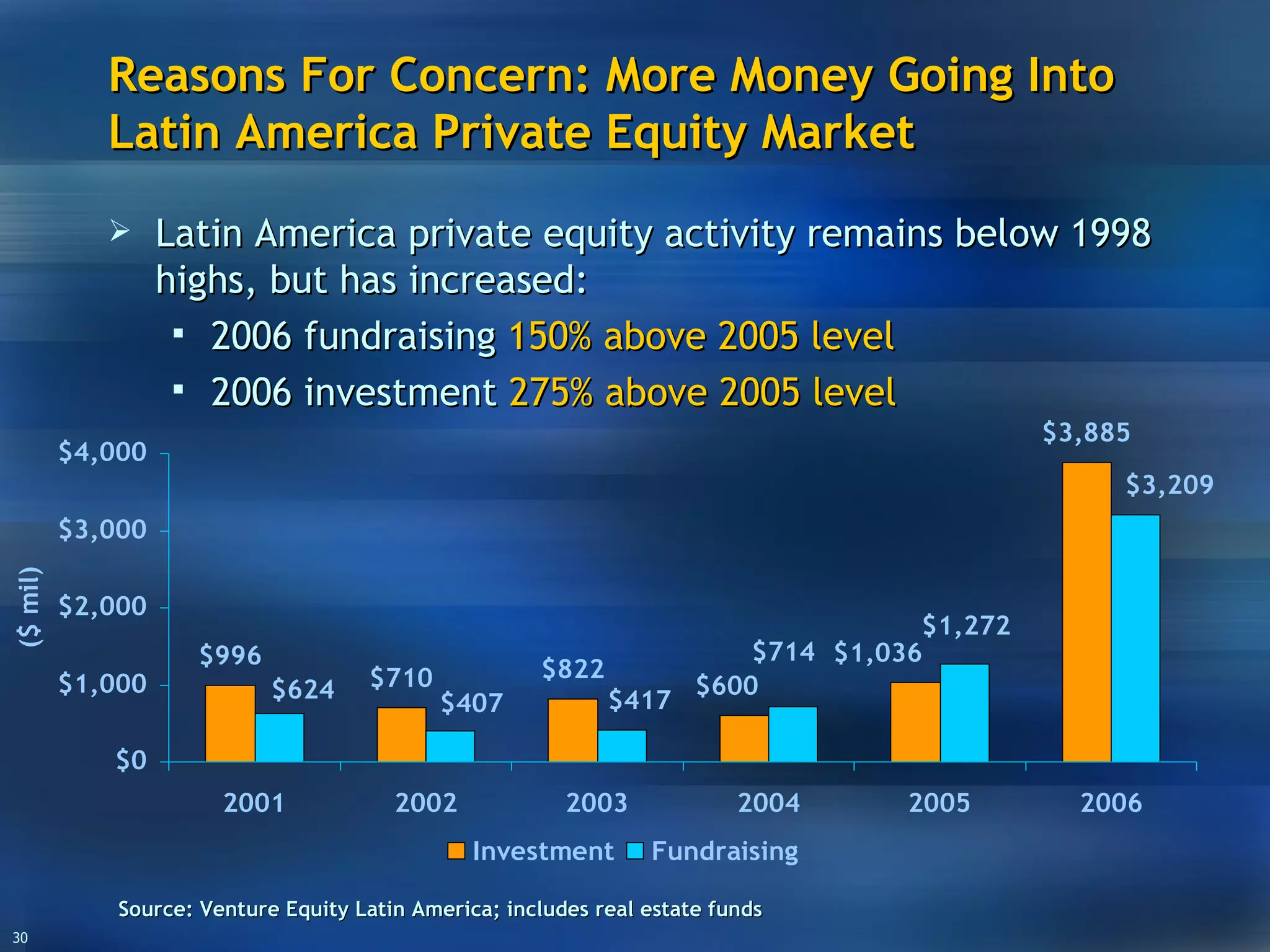

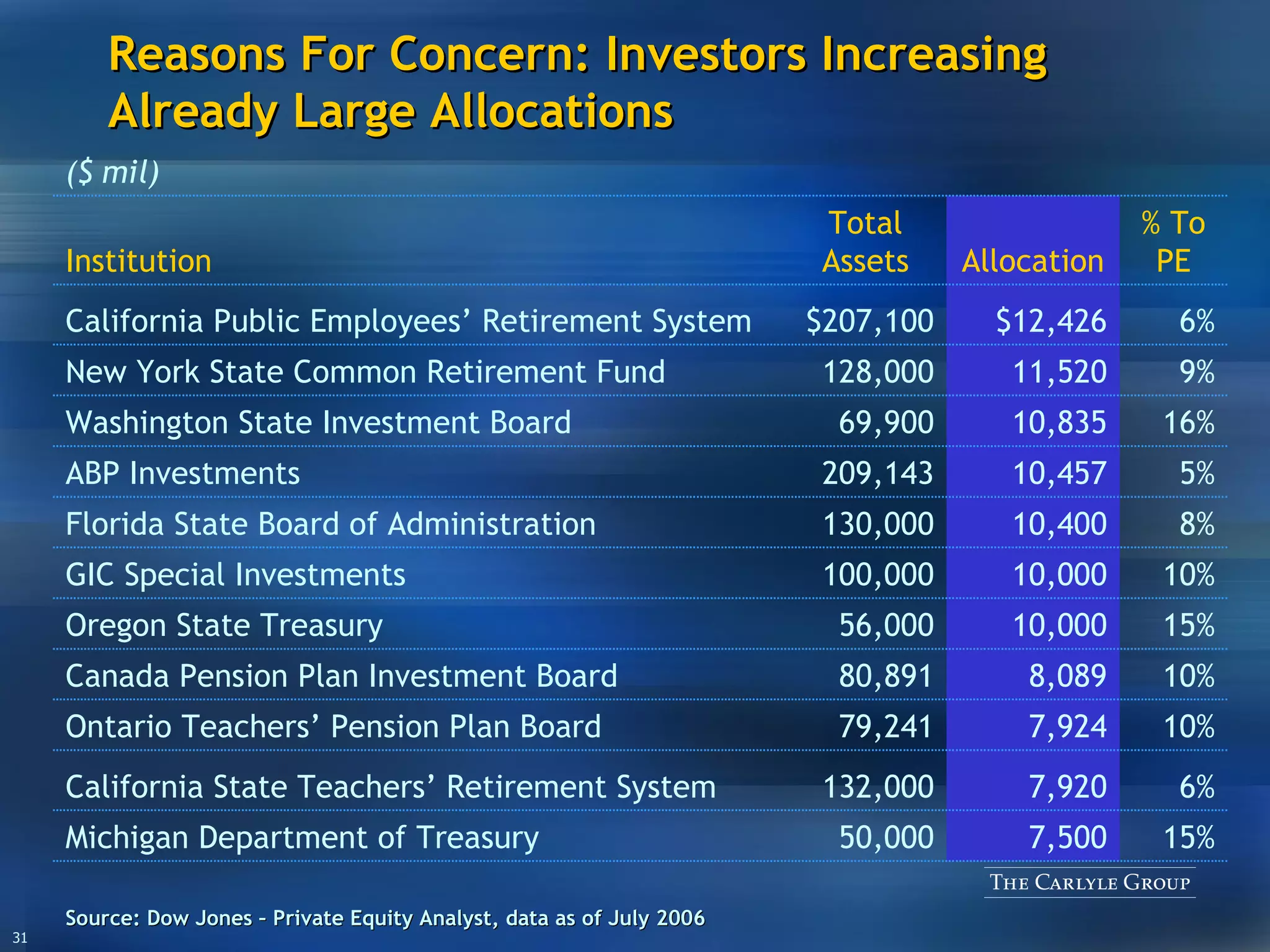

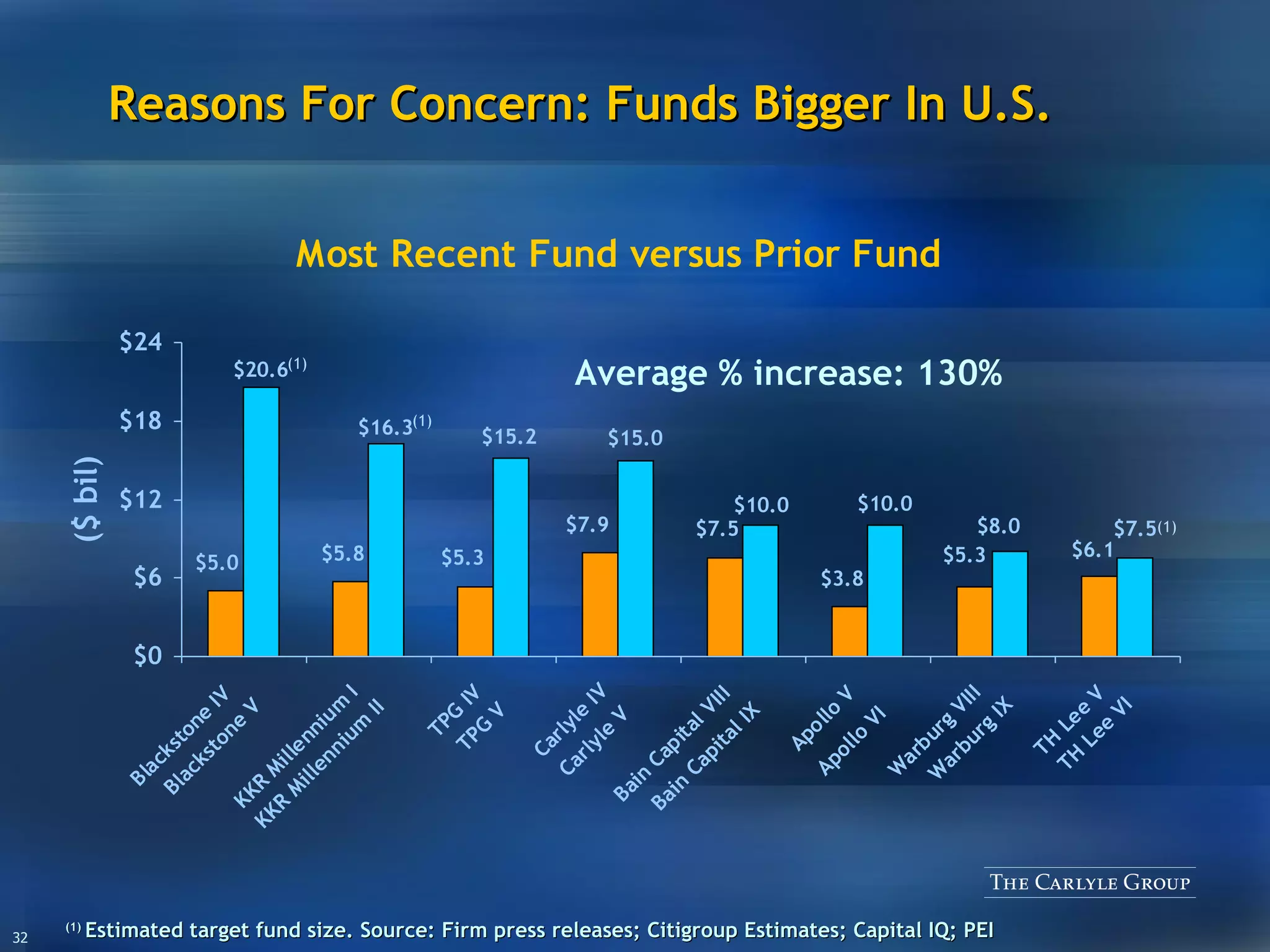

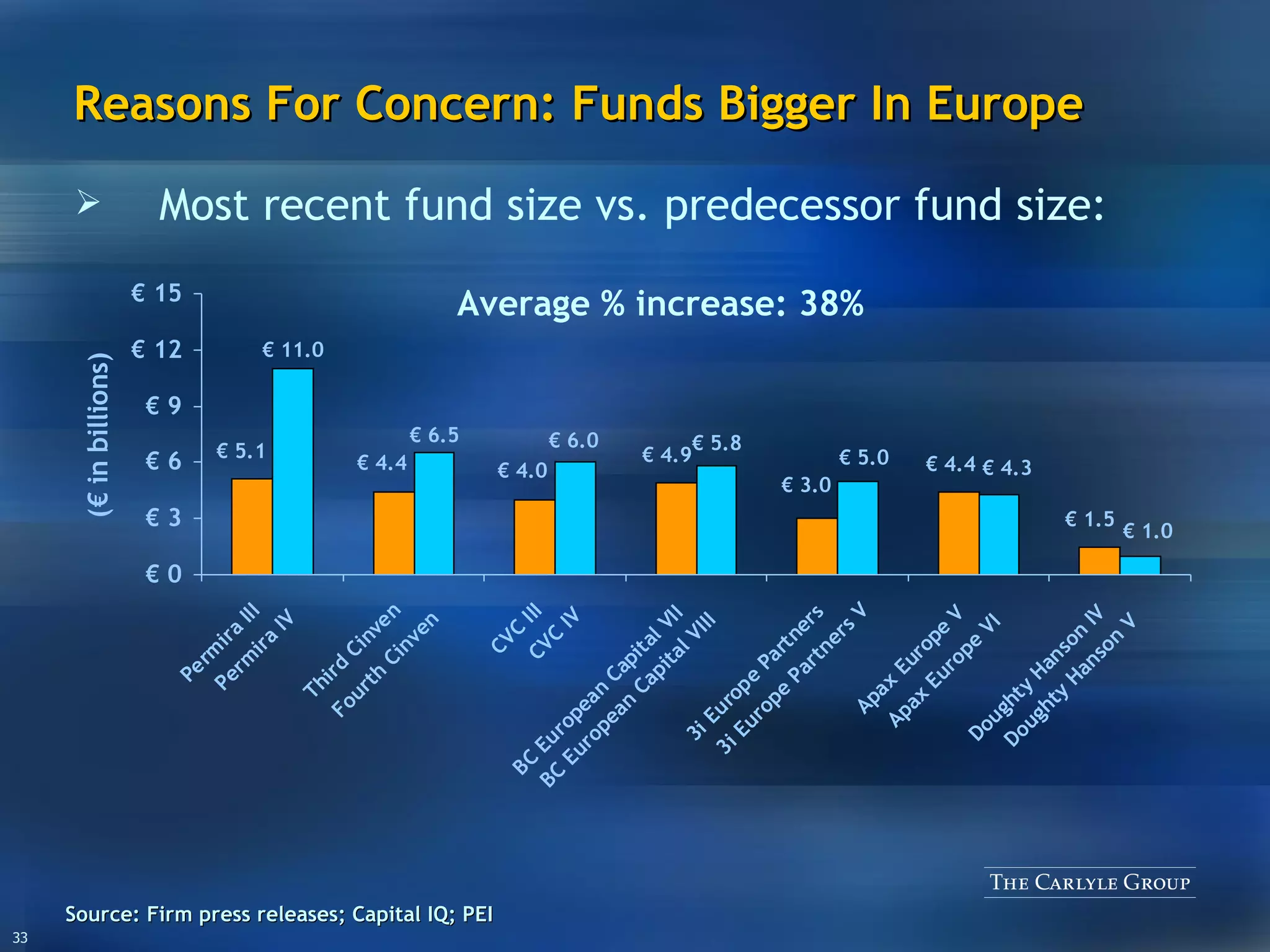

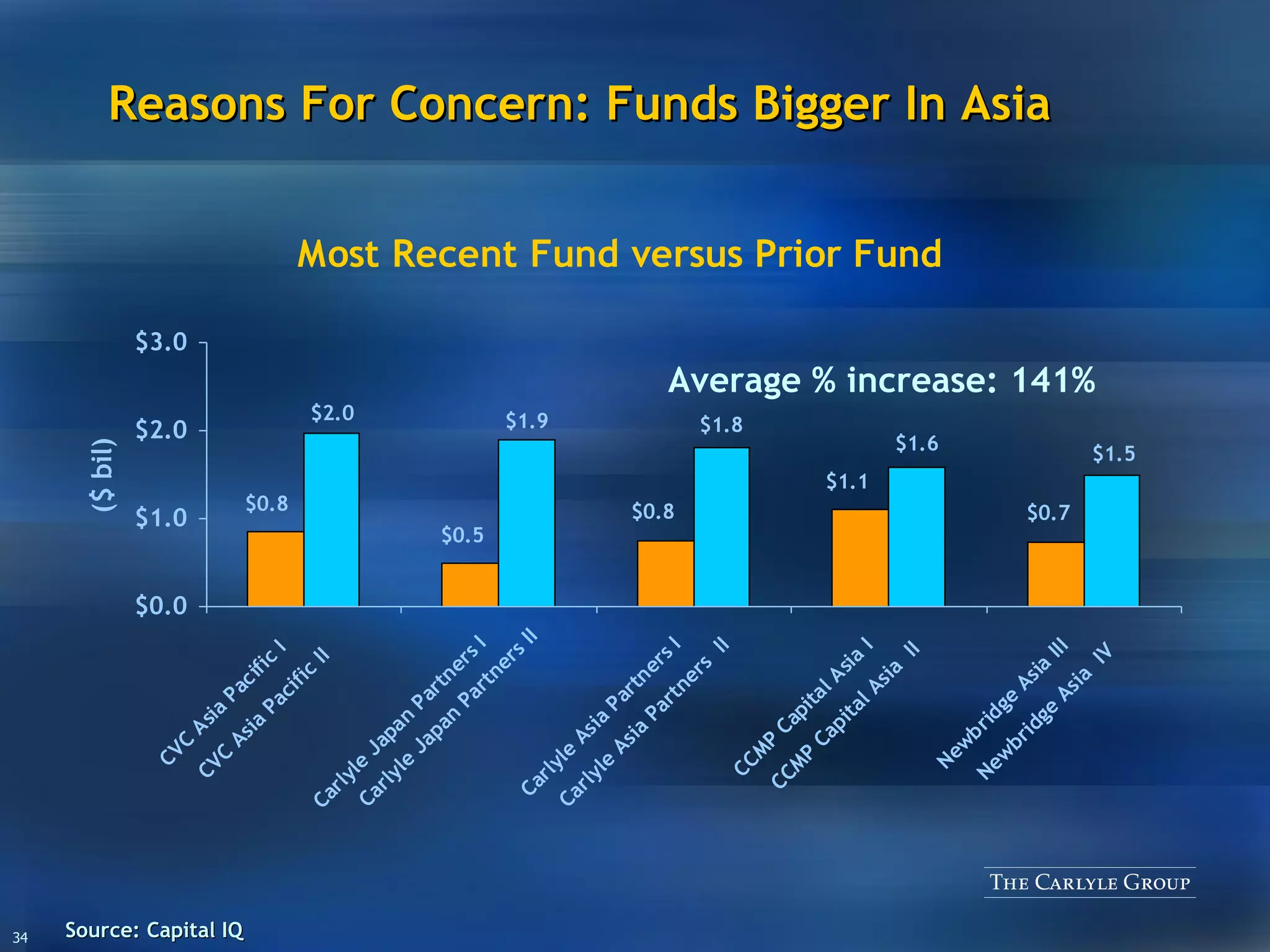

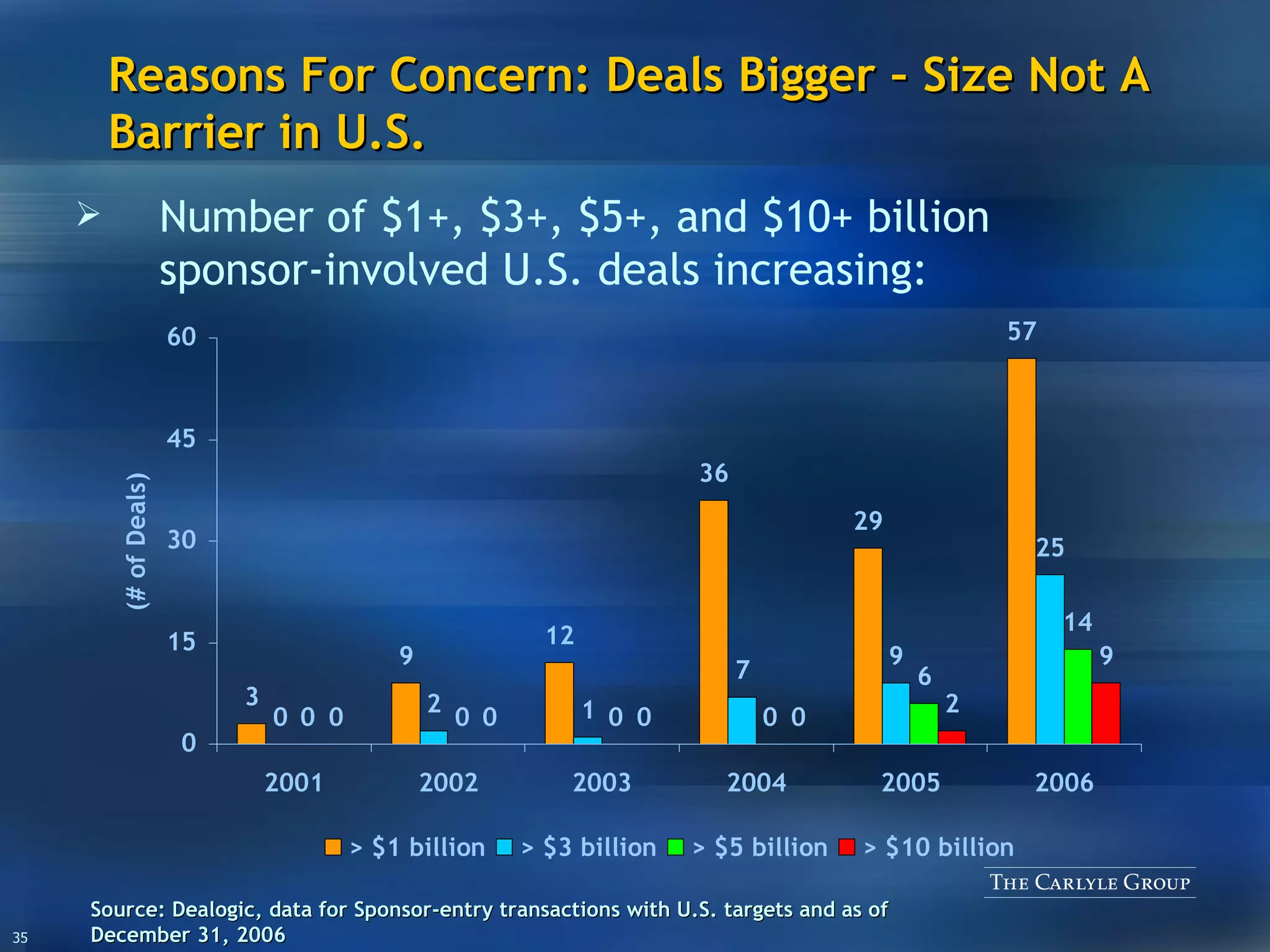

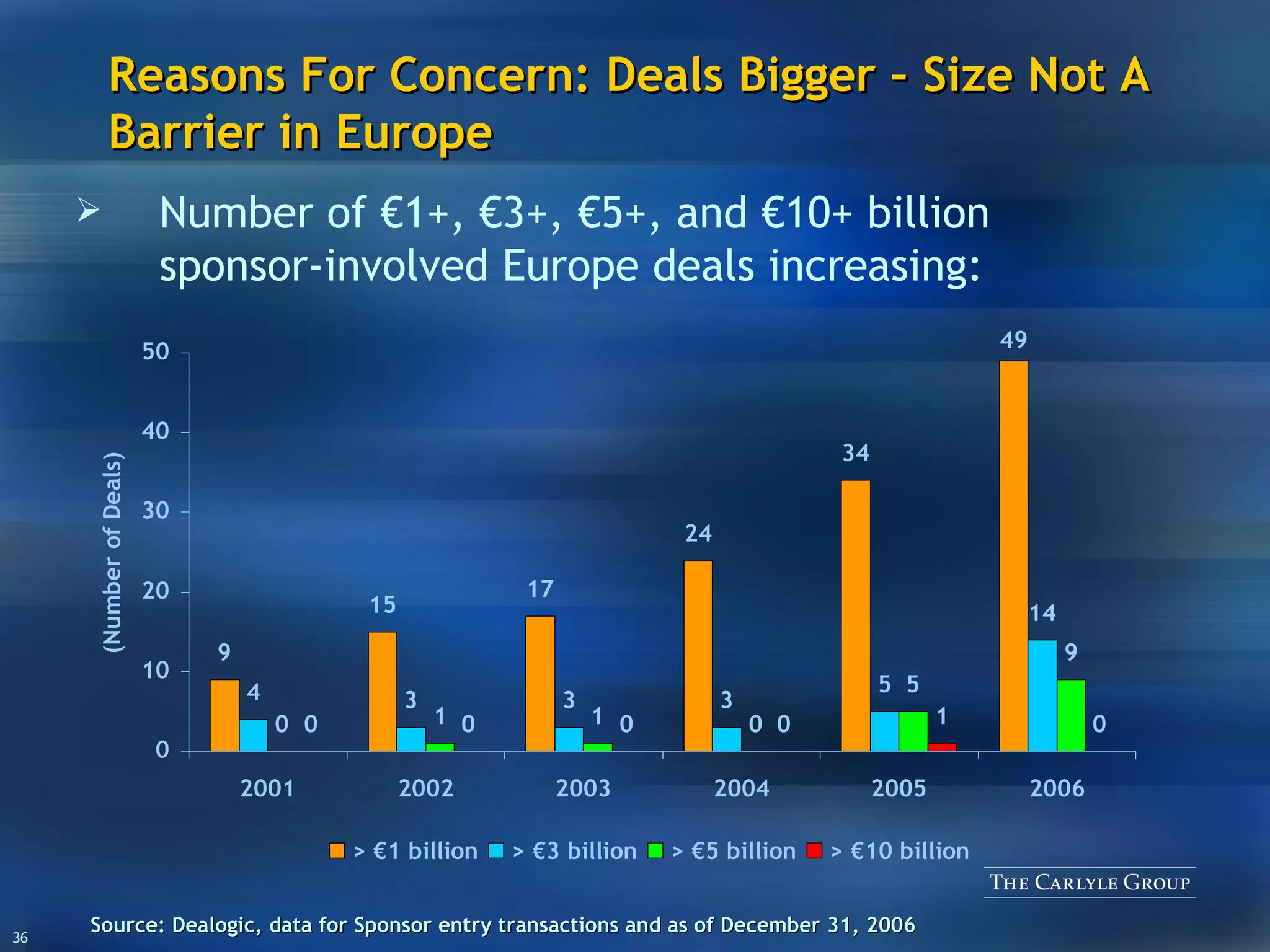

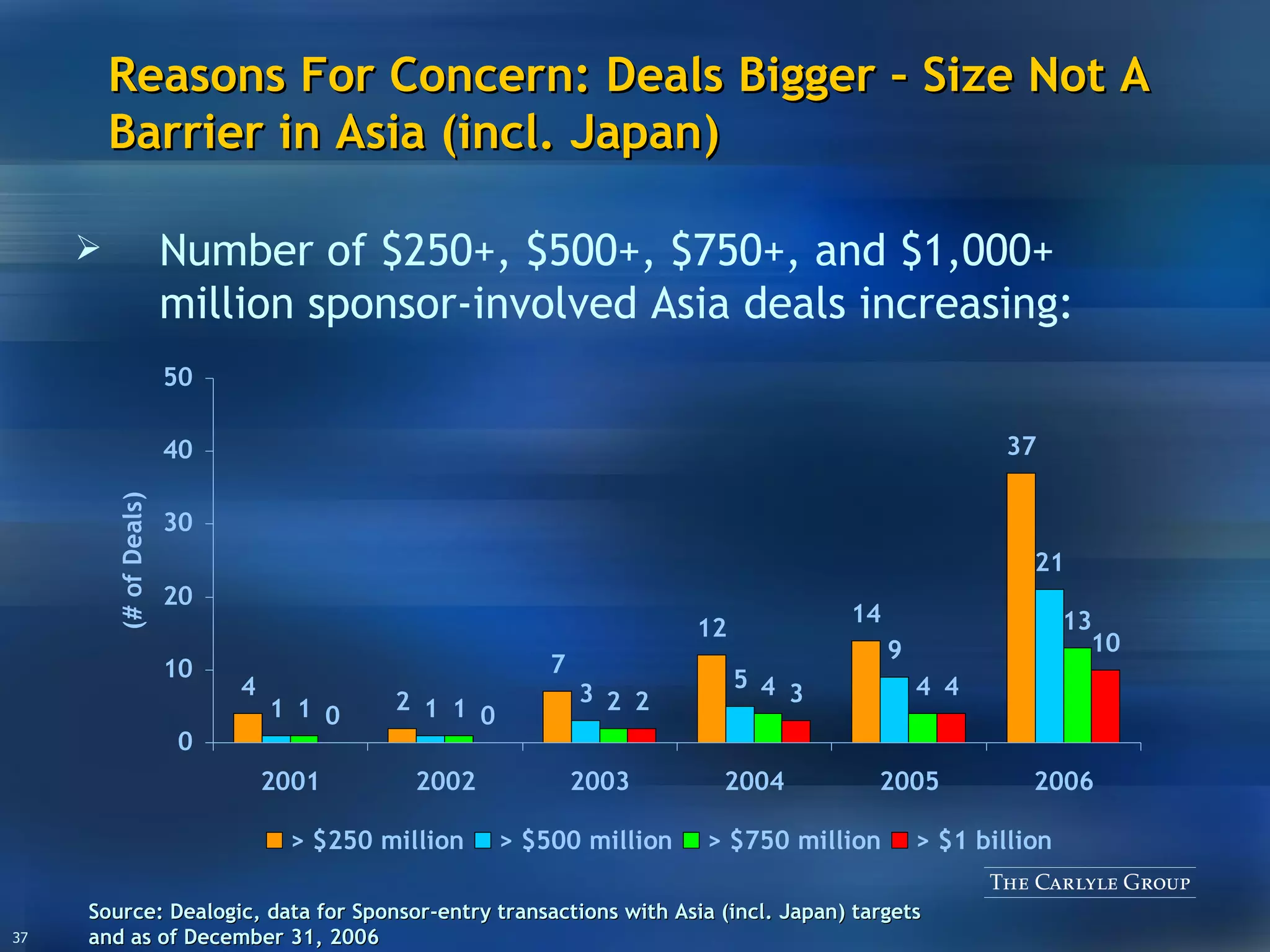

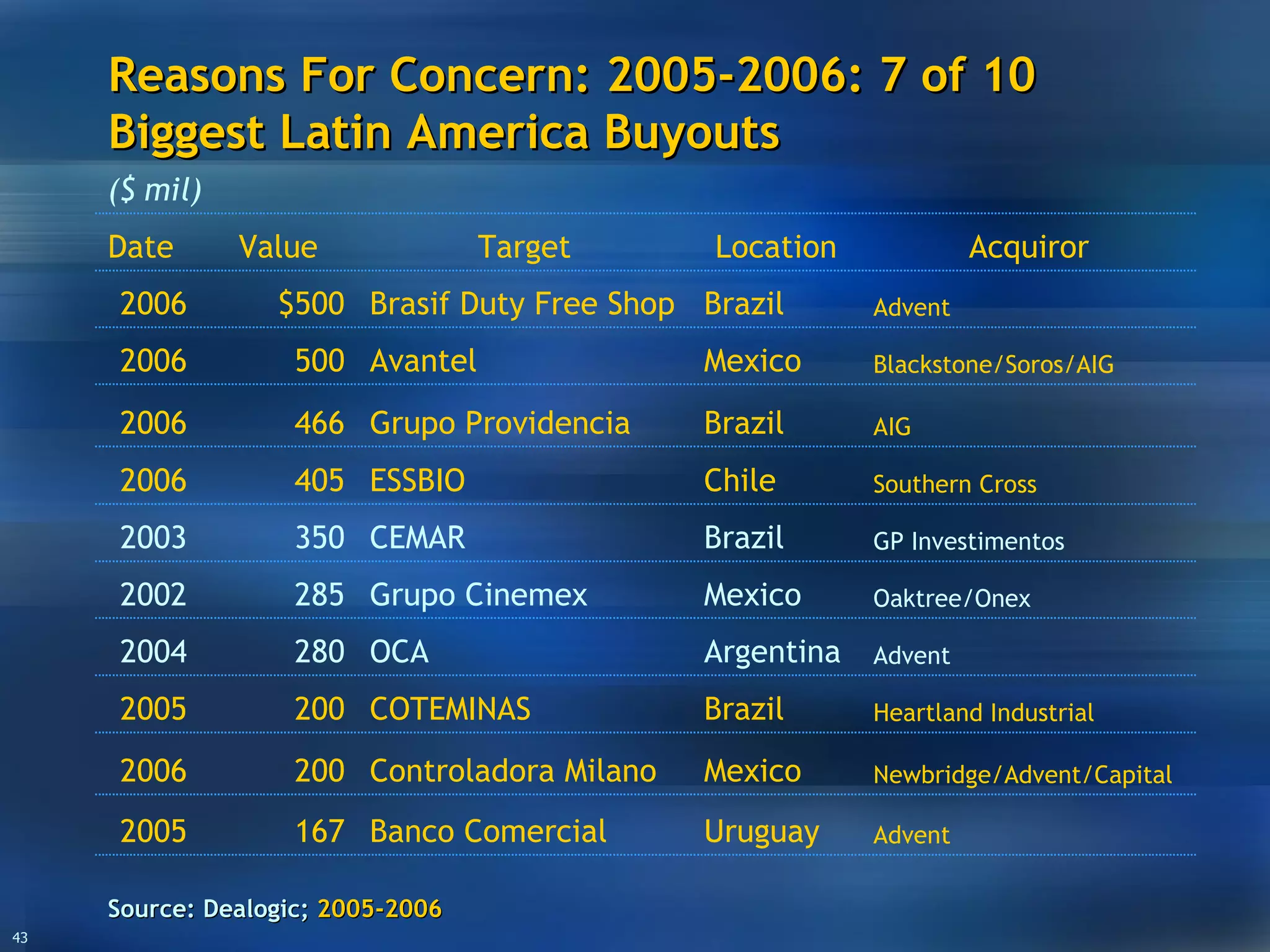

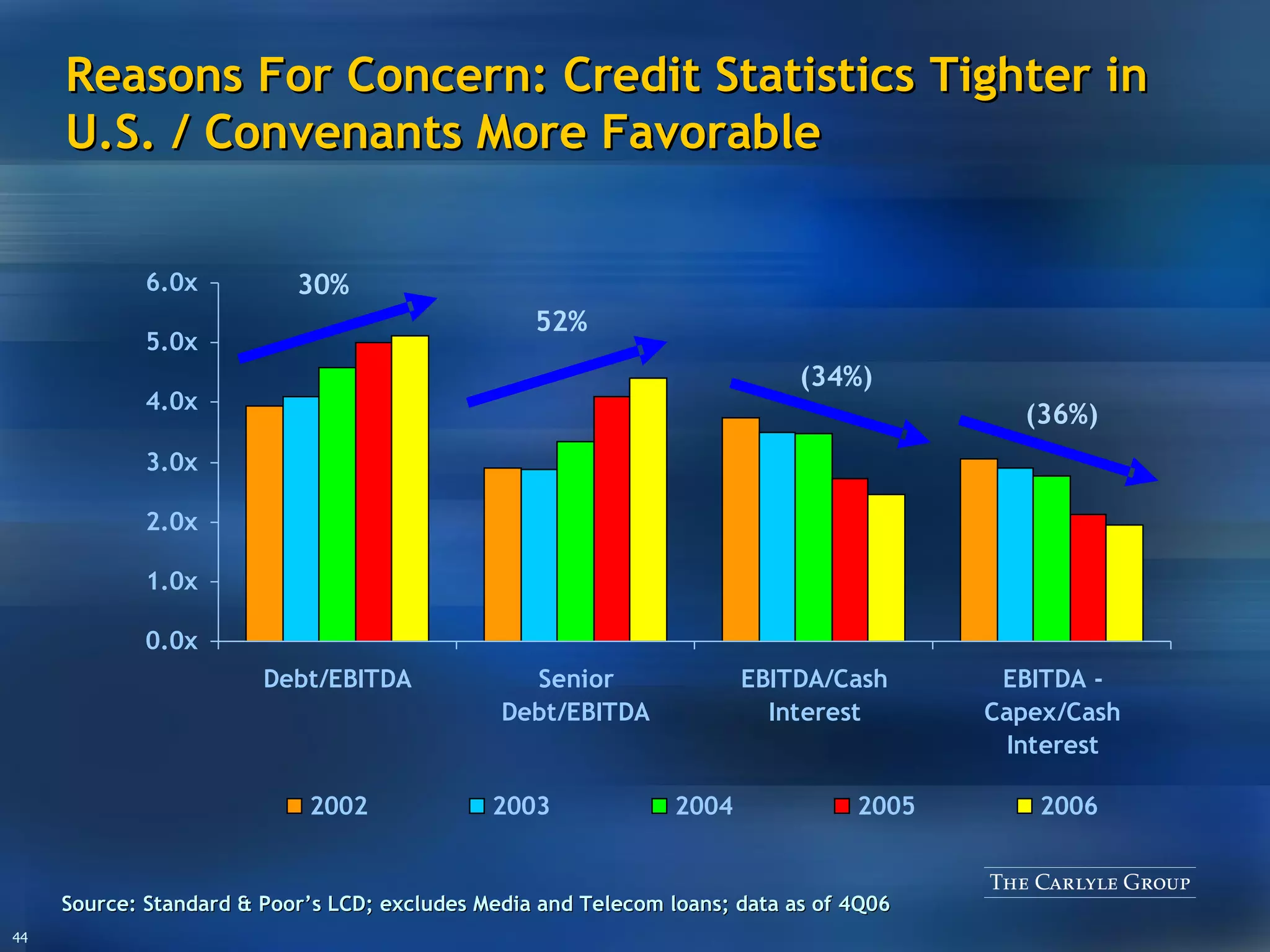

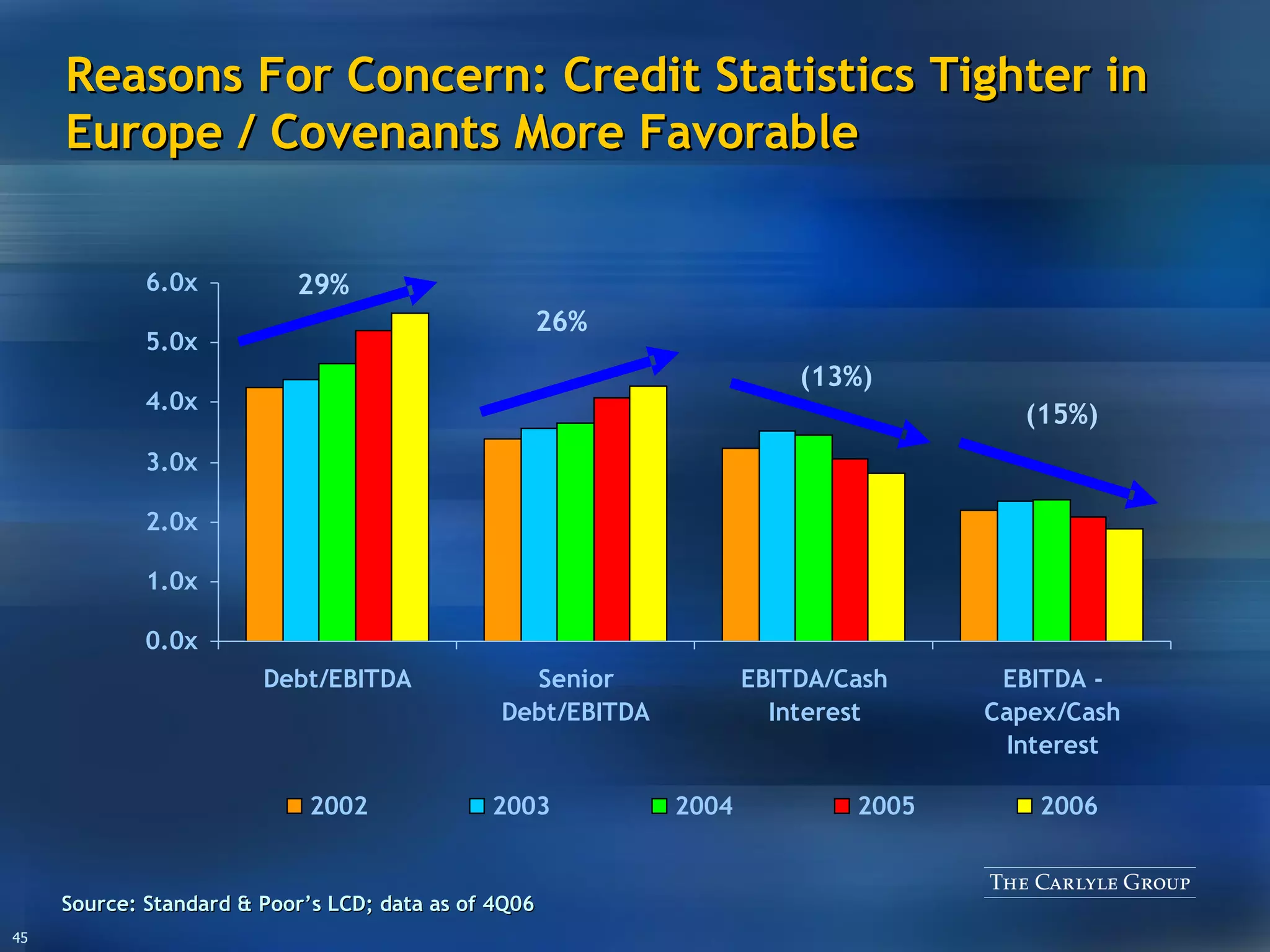

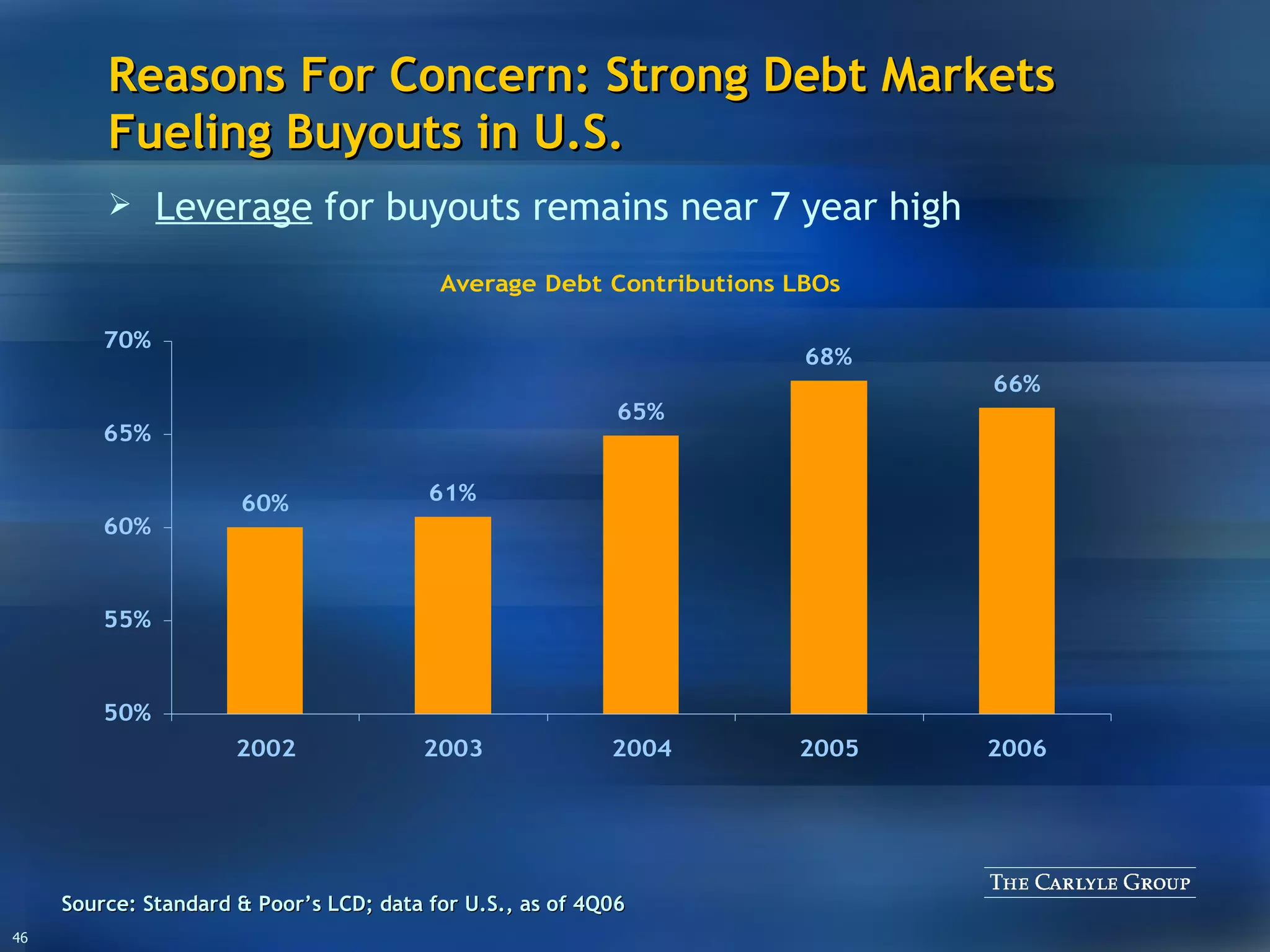

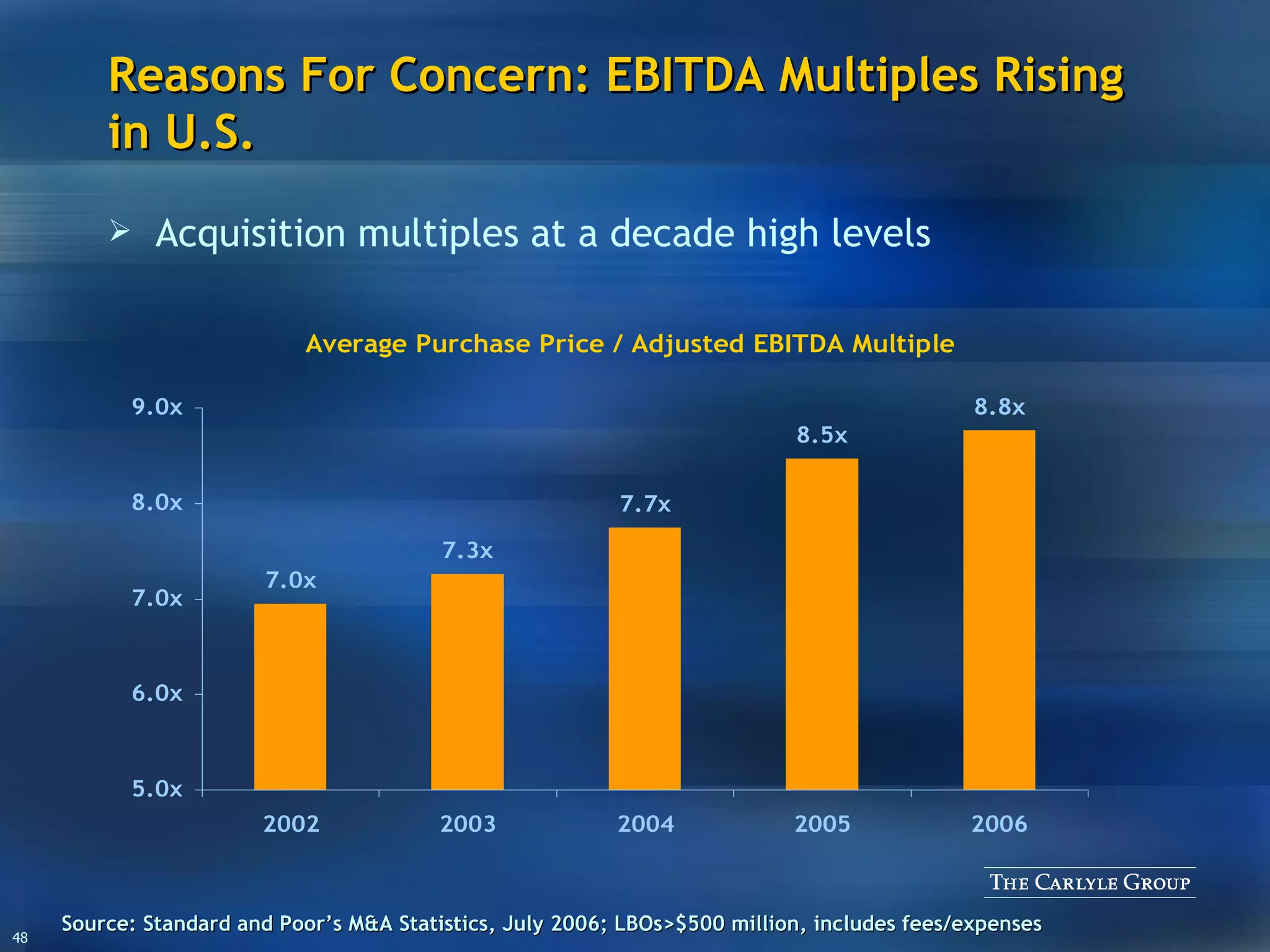

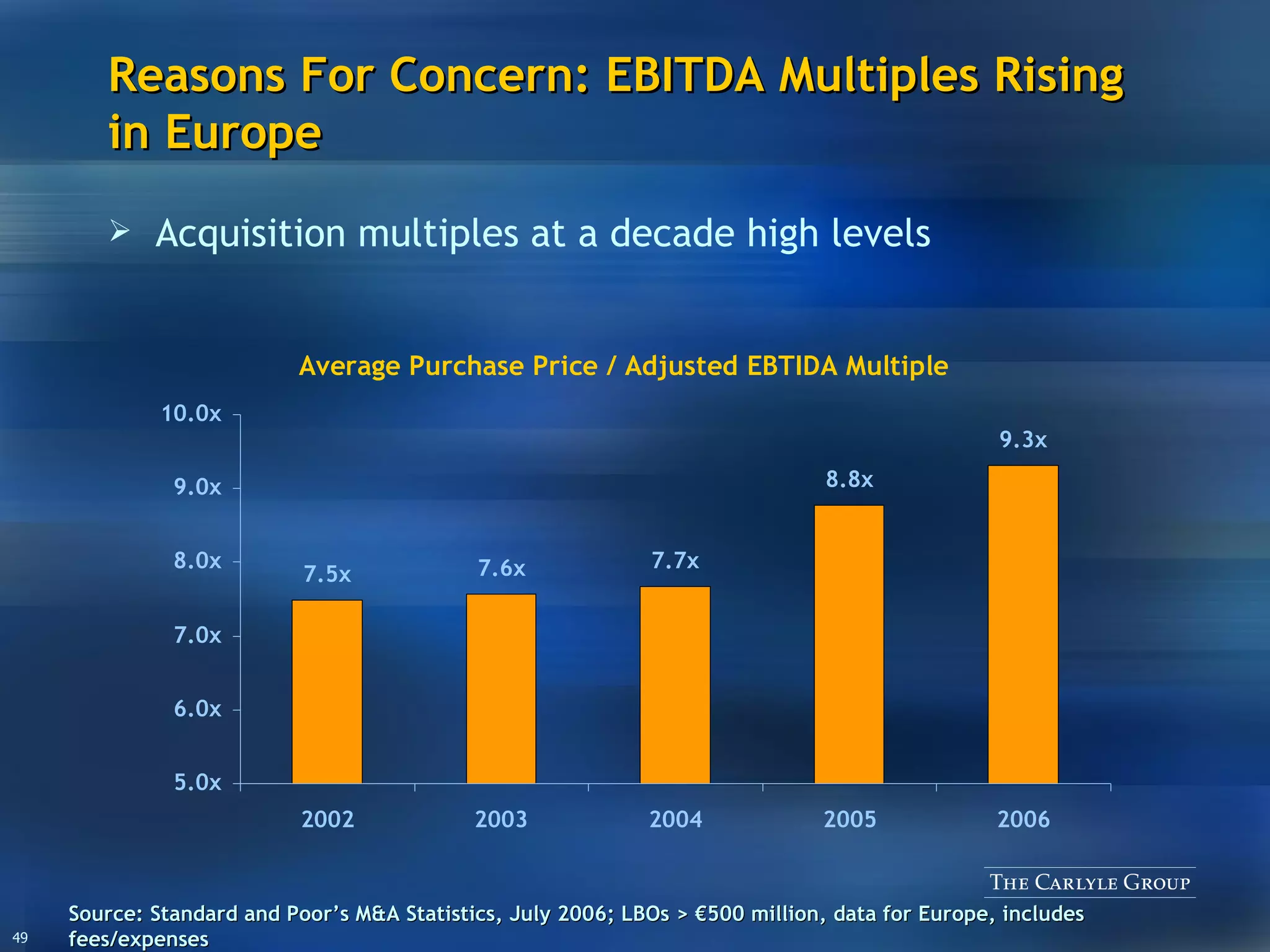

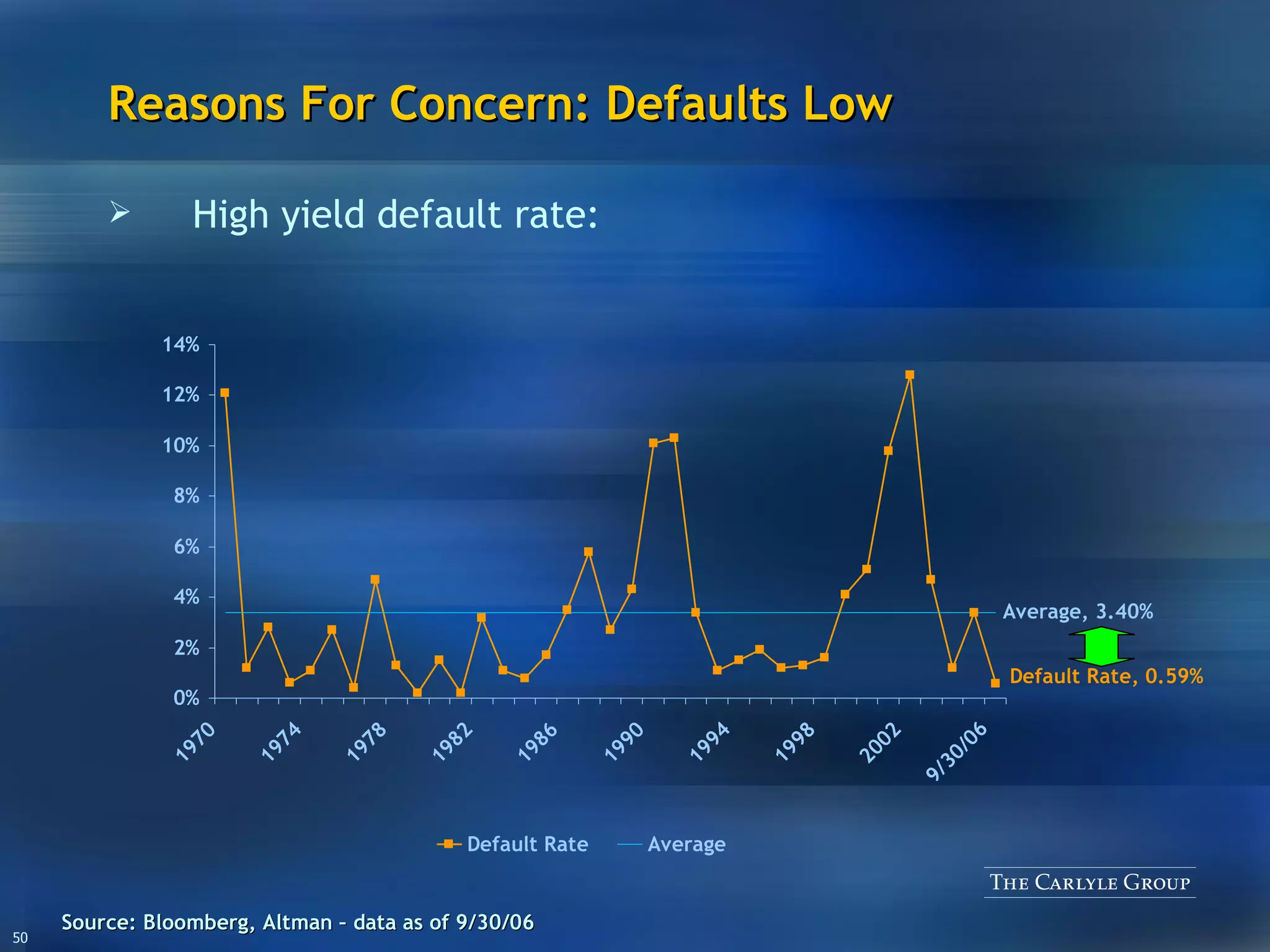

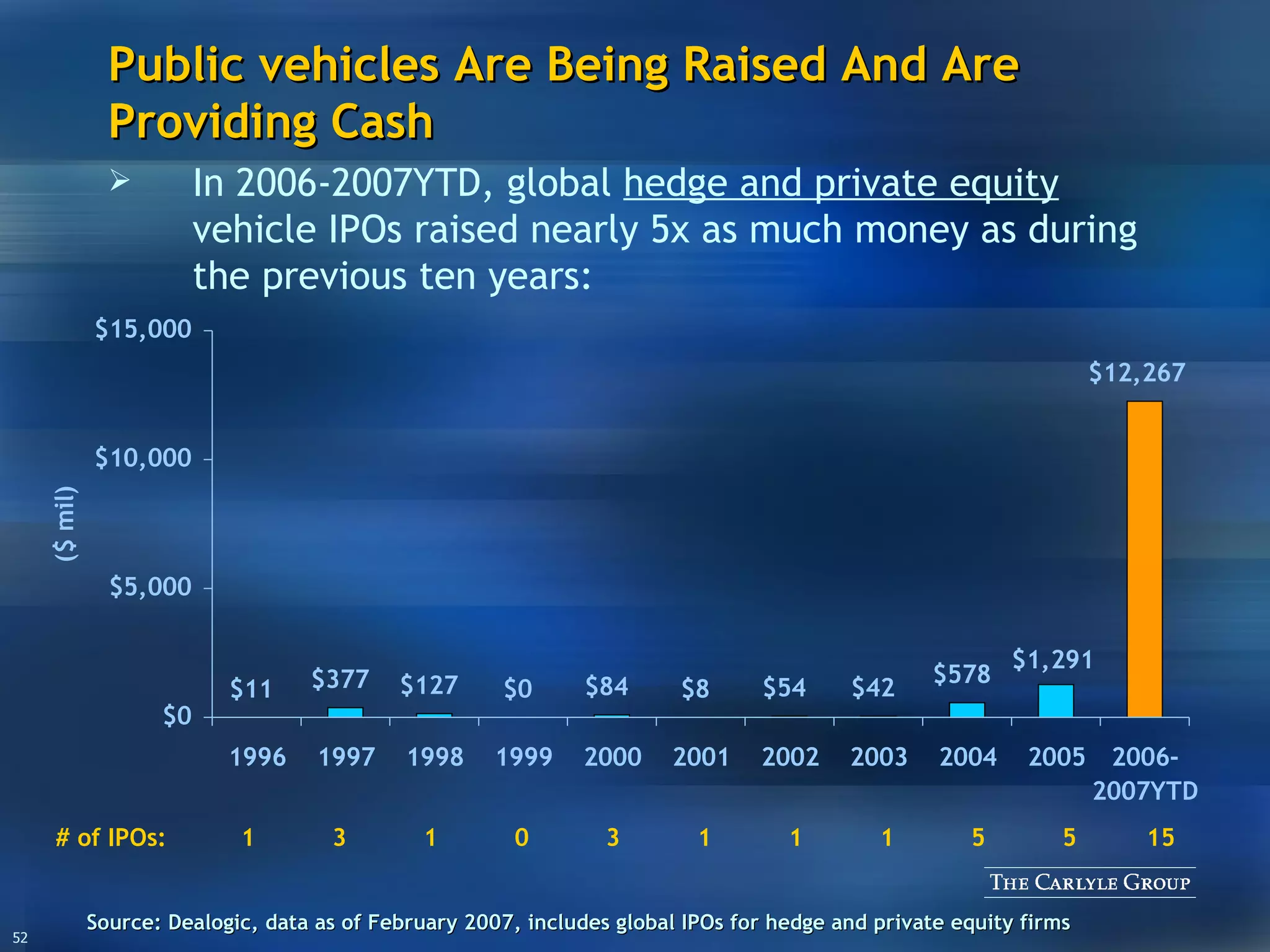

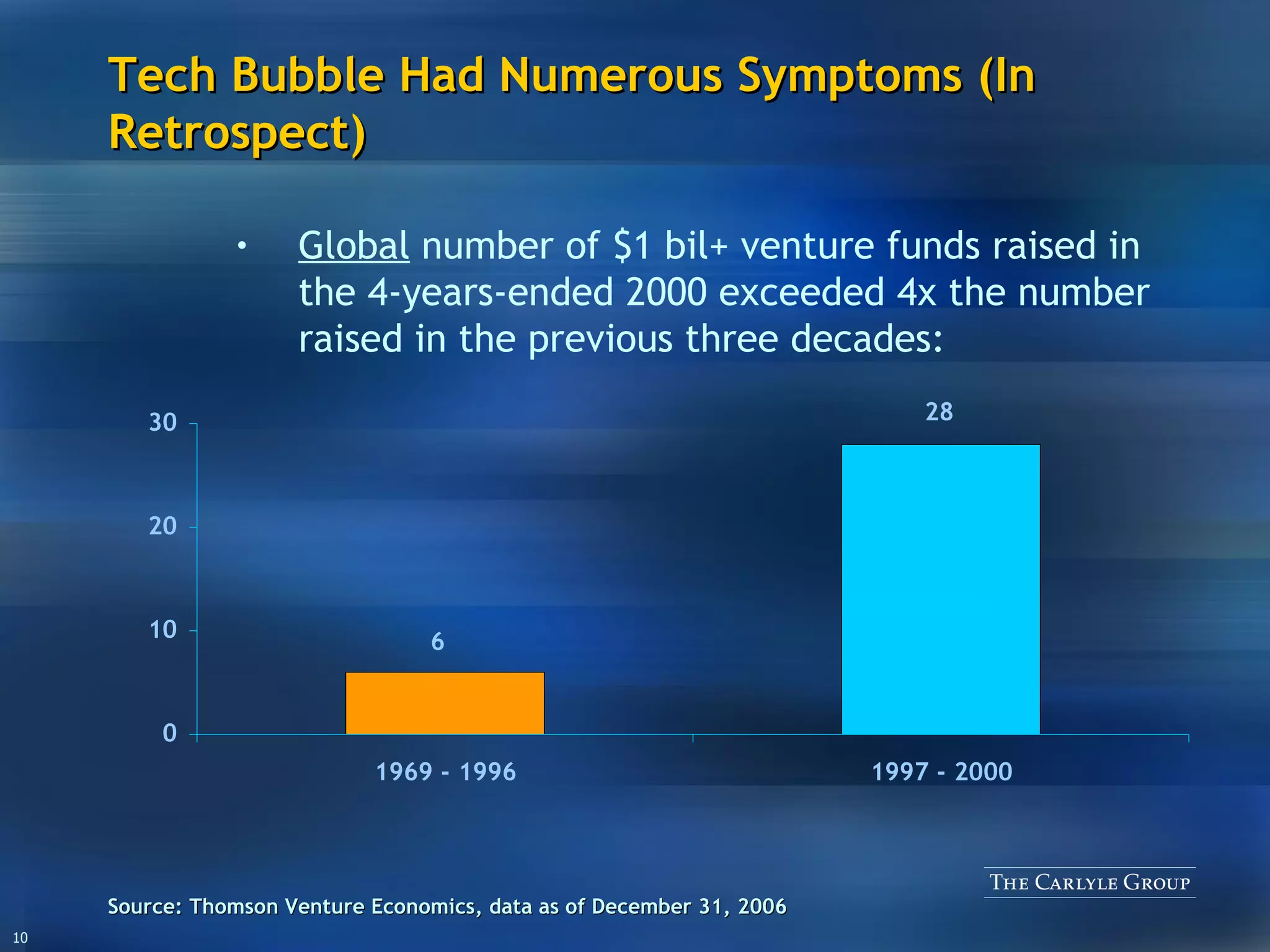

The document discusses similarities between the tech bubble burst of 2000 and current private equity markets, examining whether a PE bubble may be forming. It notes huge increases in money flowing into PE, larger fund and deal sizes without barriers, and similarities to classic bubbles like abandonment of downside caution and rapid price growth beyond fundamentals. Reasons for concern include more capital than ever searching for deals and investors increasing already large PE allocations.

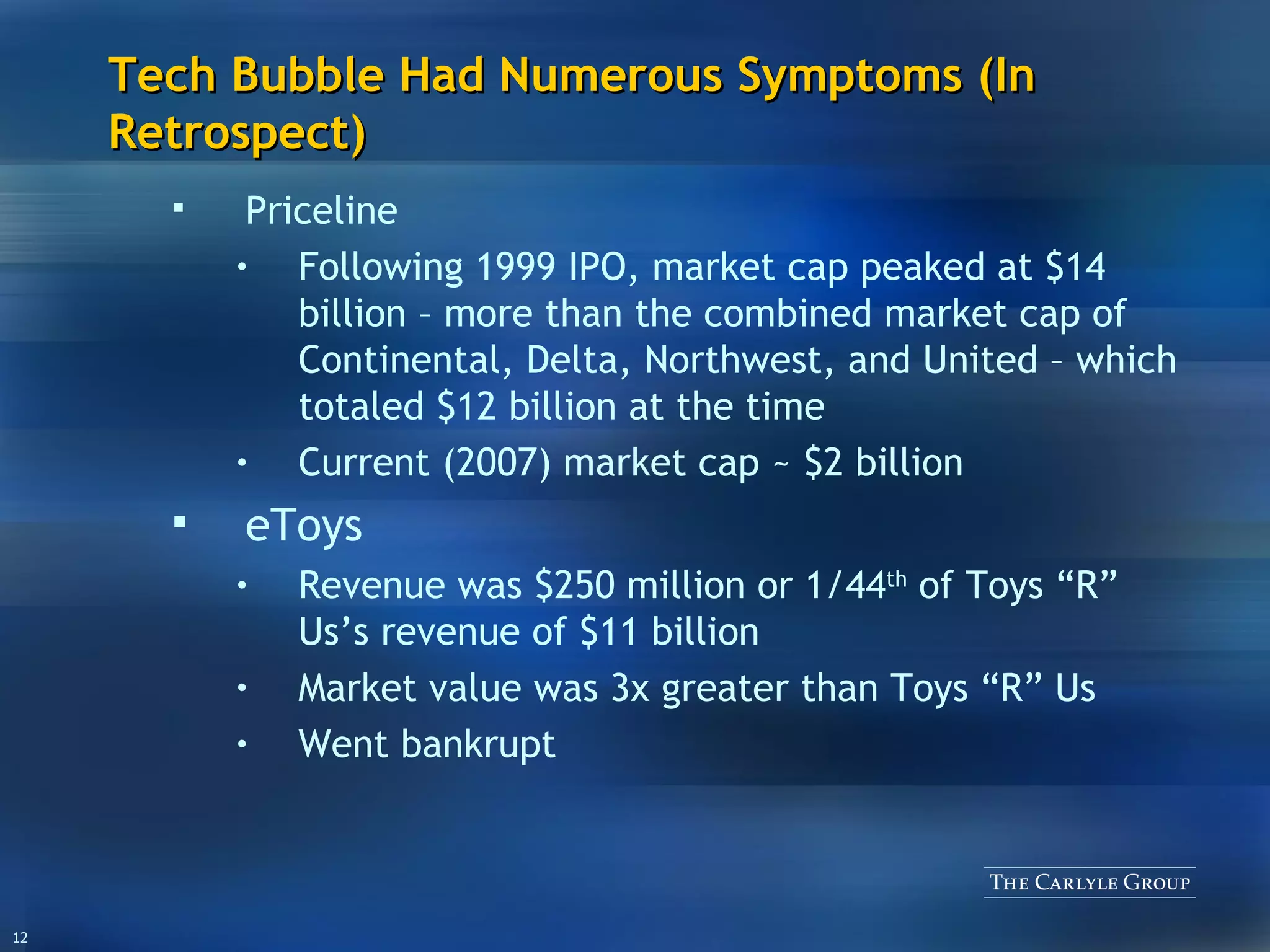

![Tech Bubble Had Numerous Symptoms (In Retrospect) Kozmo.com Internet delivery service with no service charge Spent $280 million to build service Bankrupt Globe.com Designed by two 23 year olds to sell ads on its website Stock went from $9 / share to $97 / share One of the largest first-day gains of any IPO No longer in business [email_address] $35 billion of market cap at peak Bankrupt](https://image.slidesharecdn.com/rubenstein-superreturn-presentation-16847/75/Rubenstein-SuperReturn-Presentation-15-2048.jpg)