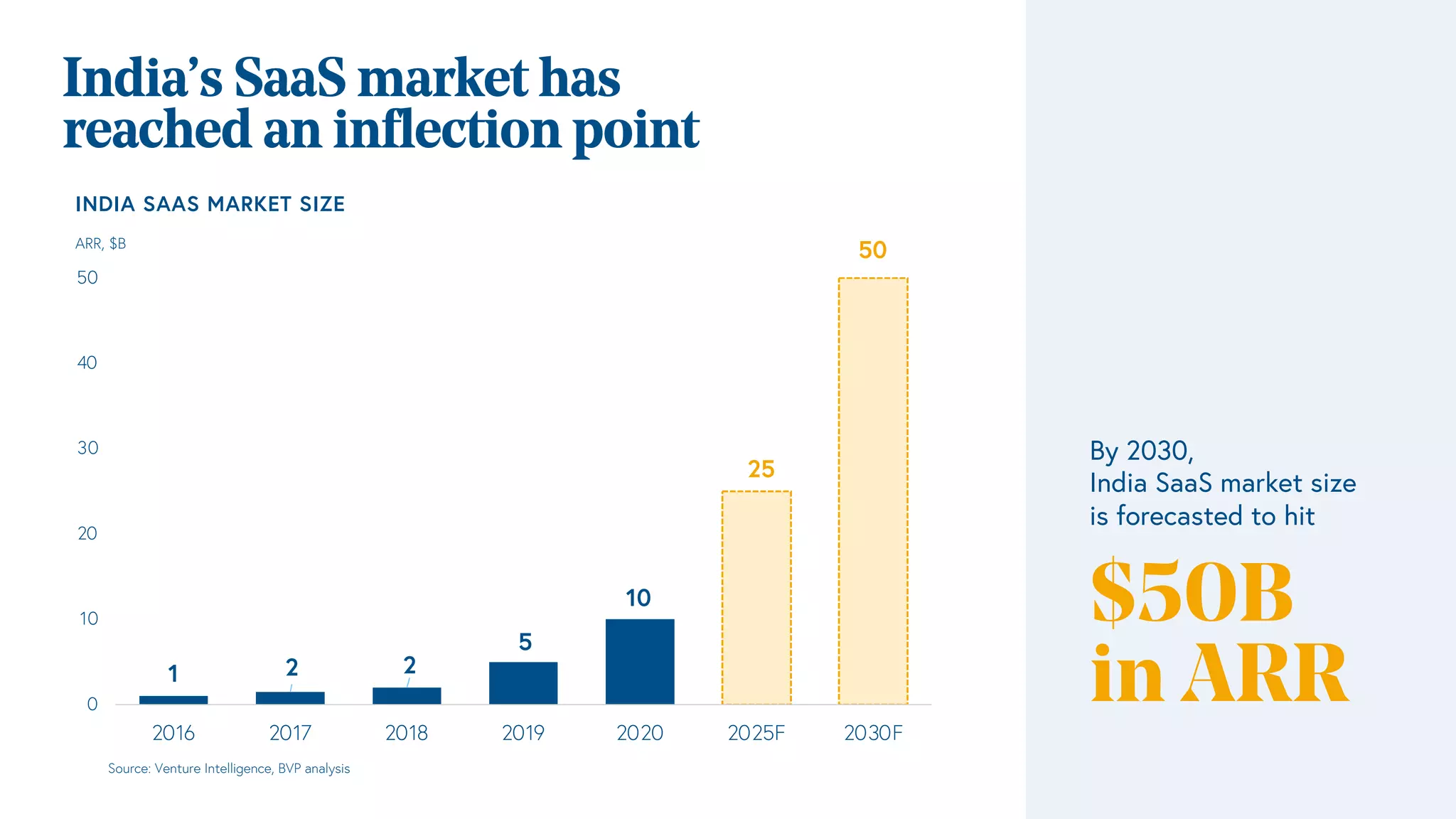

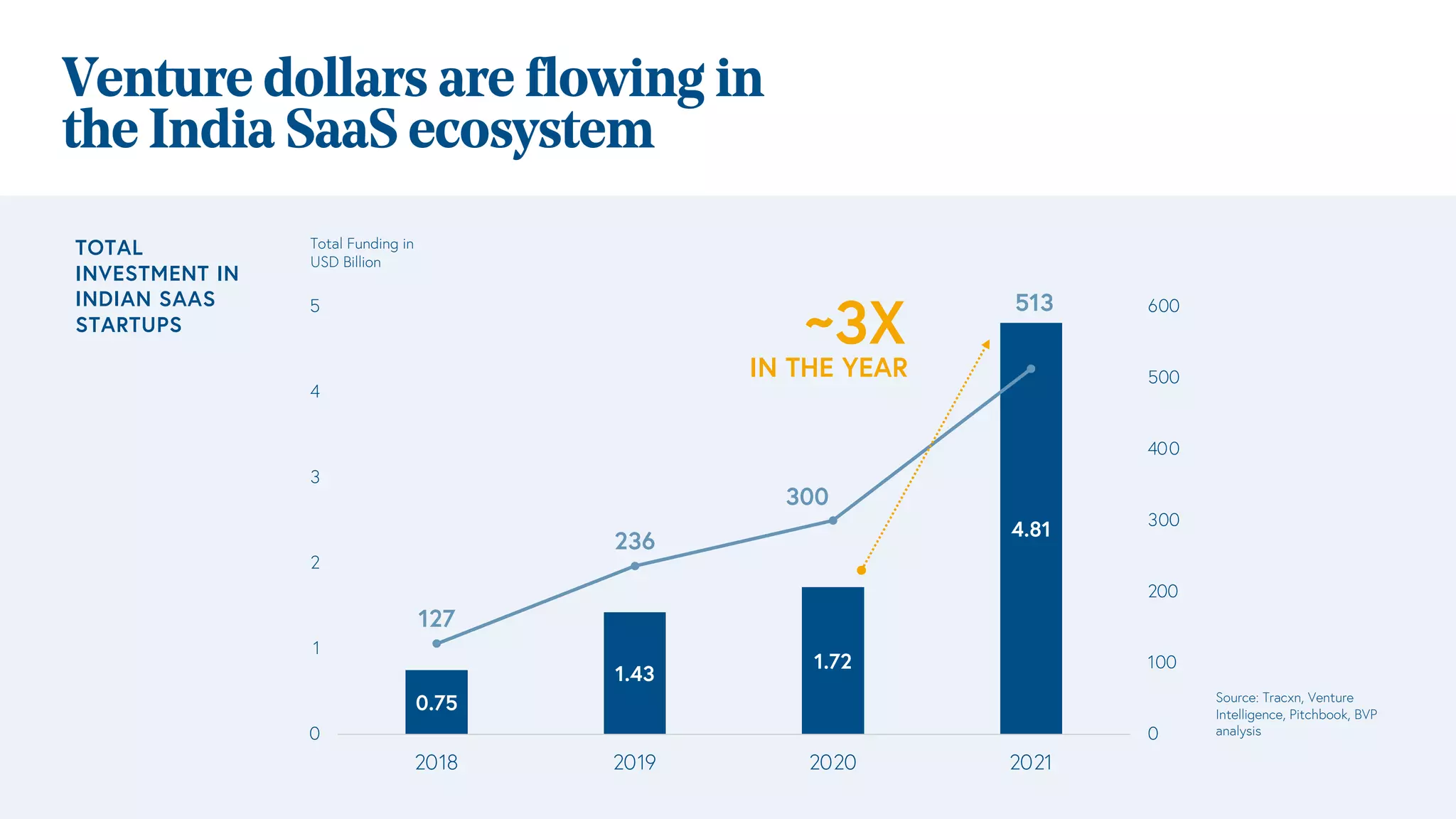

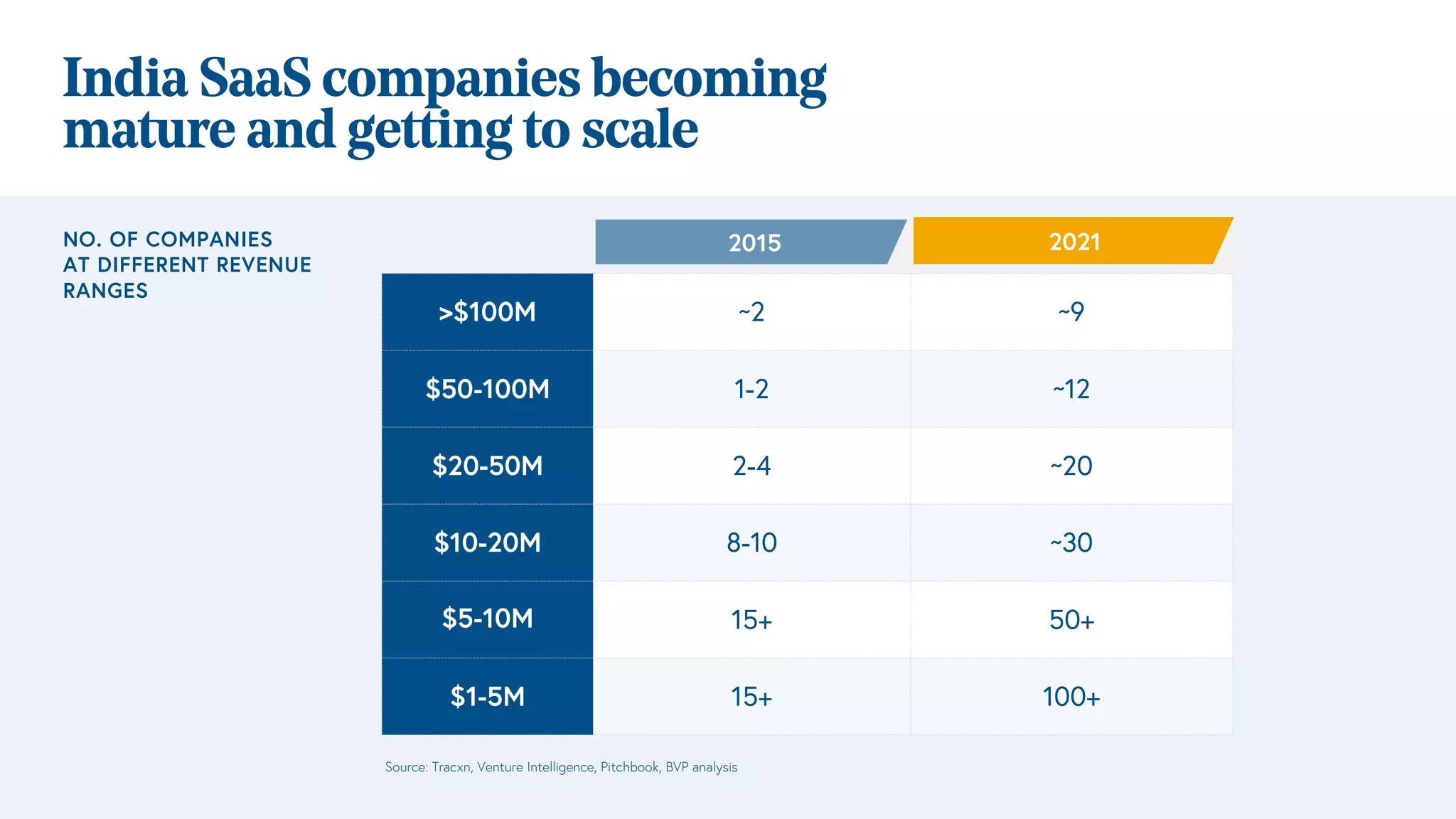

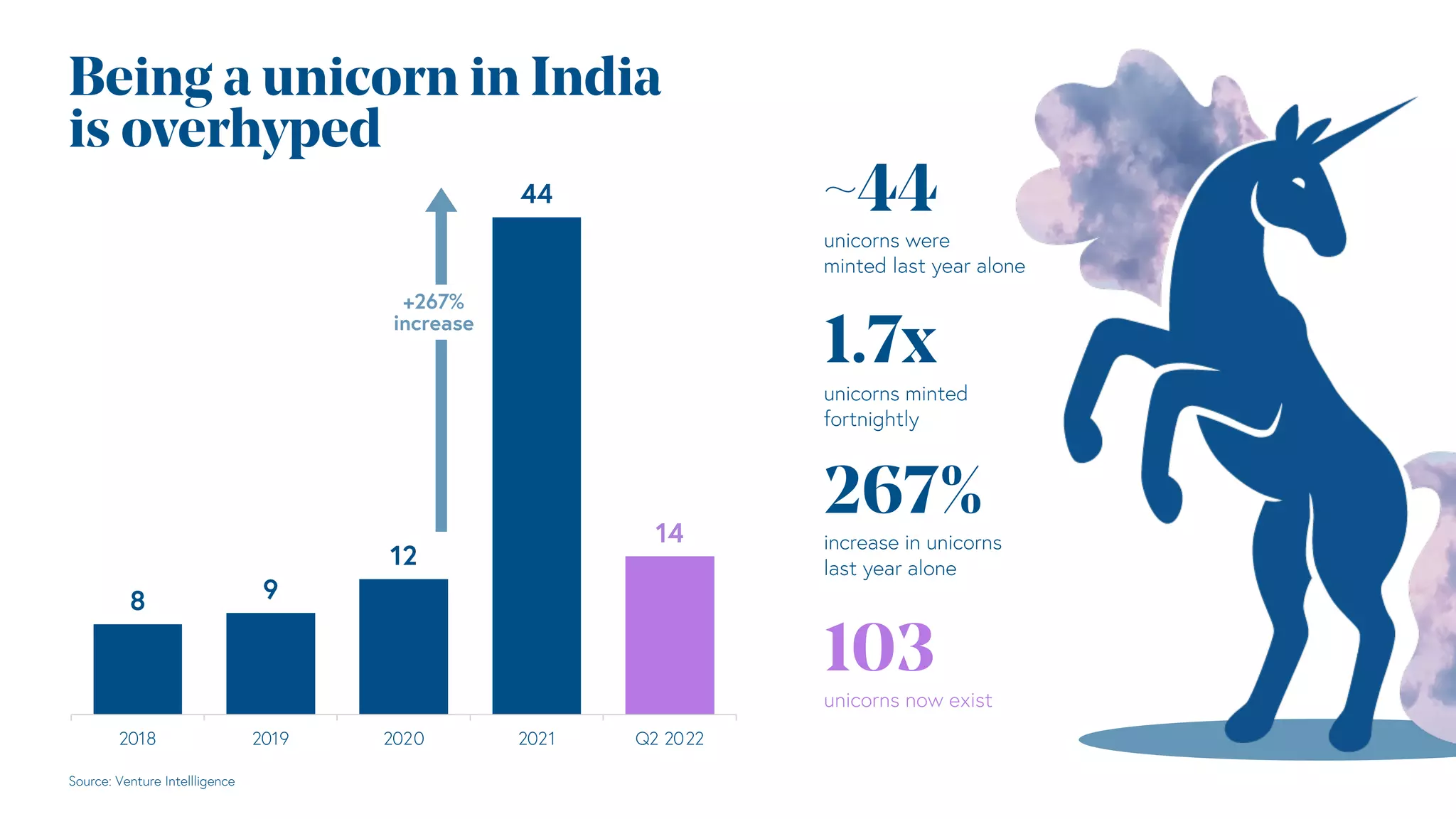

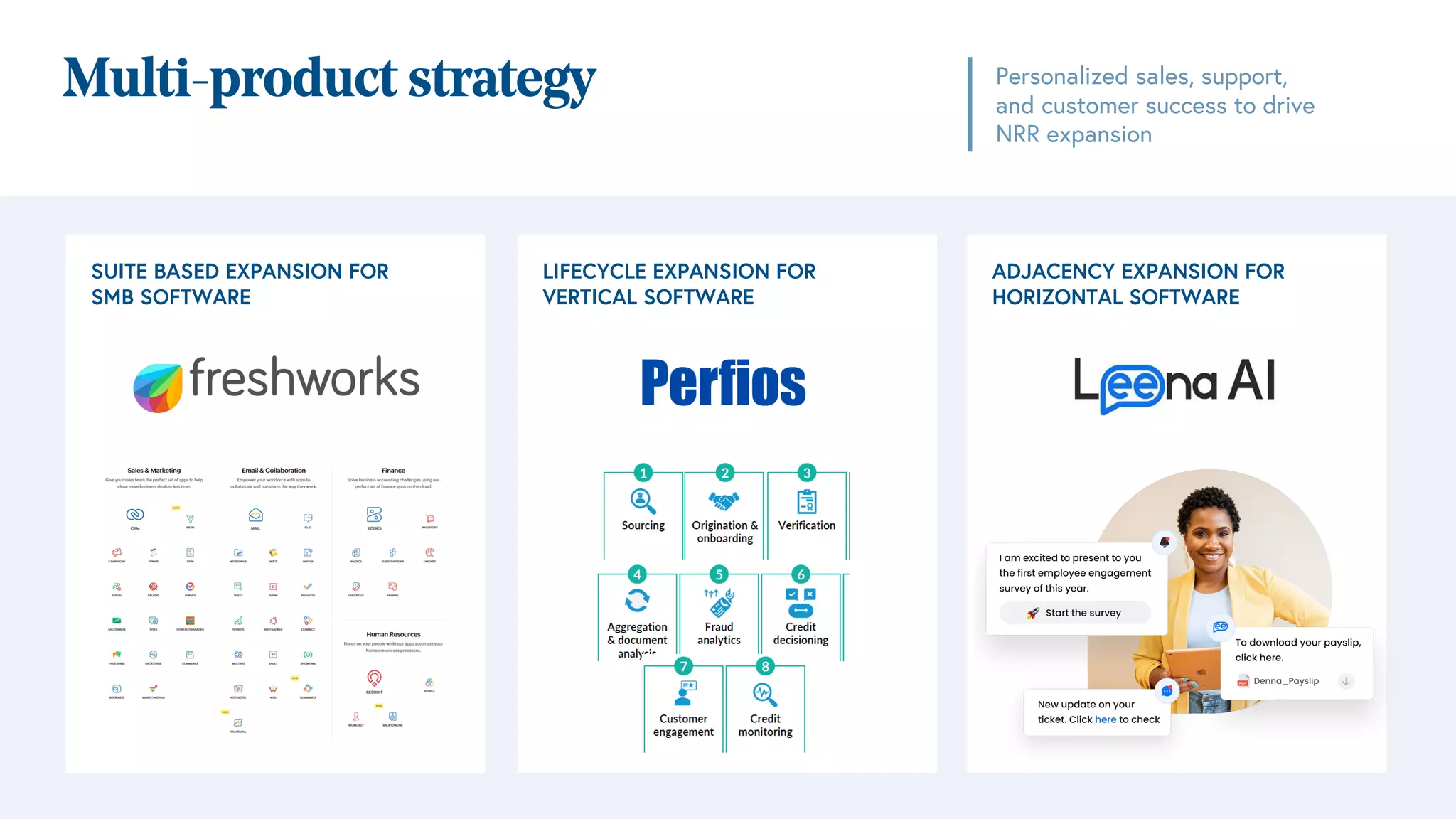

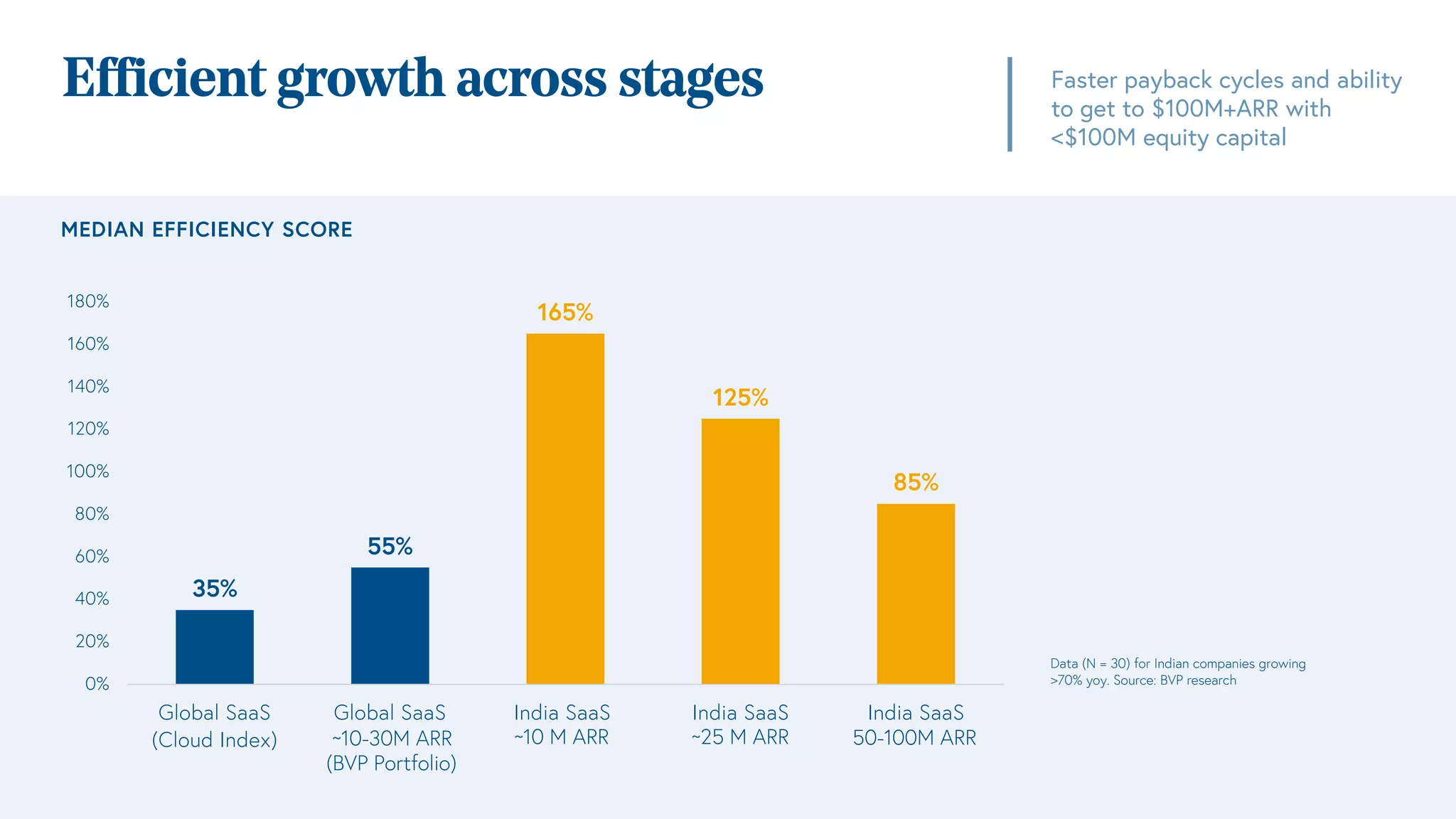

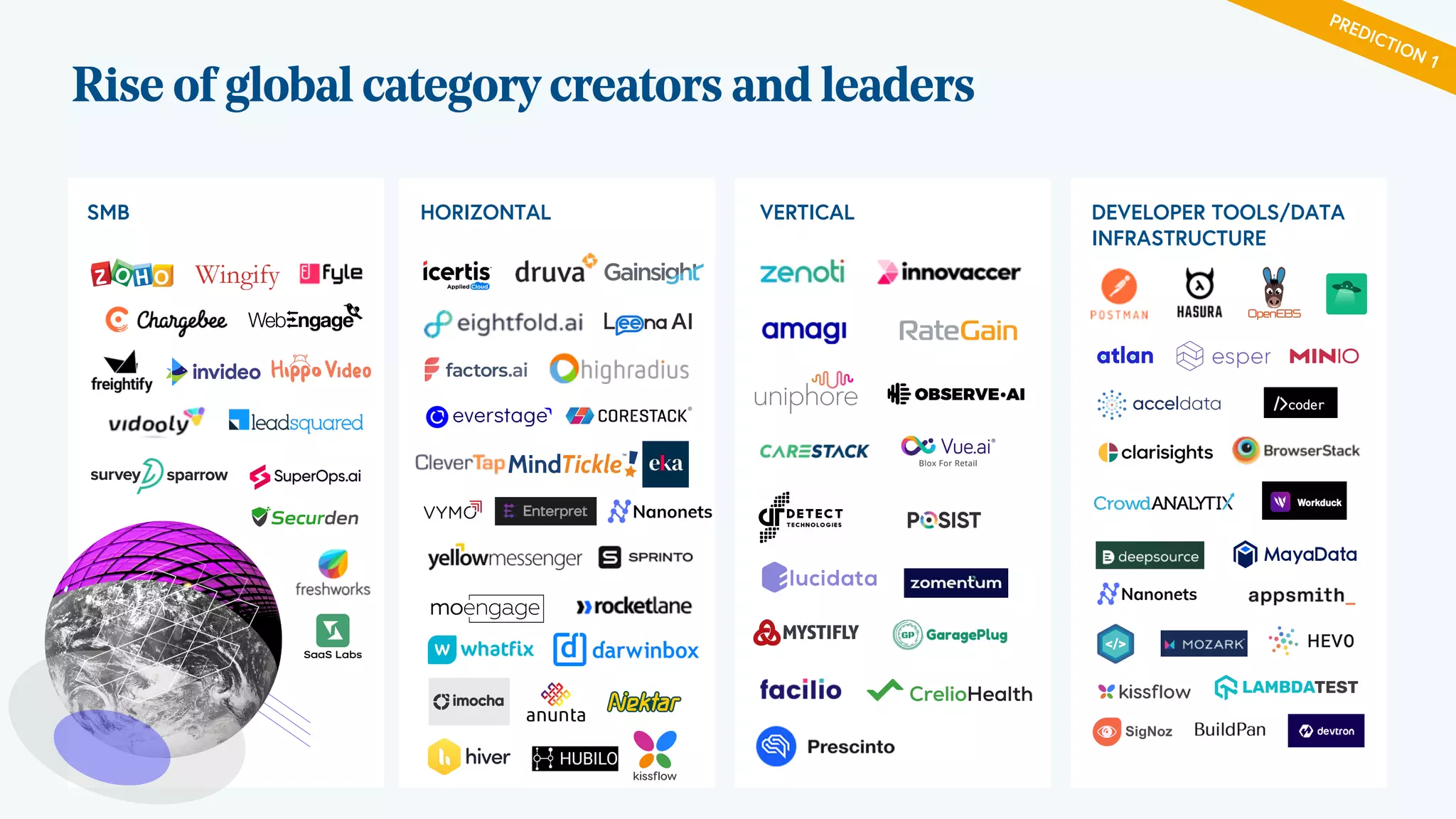

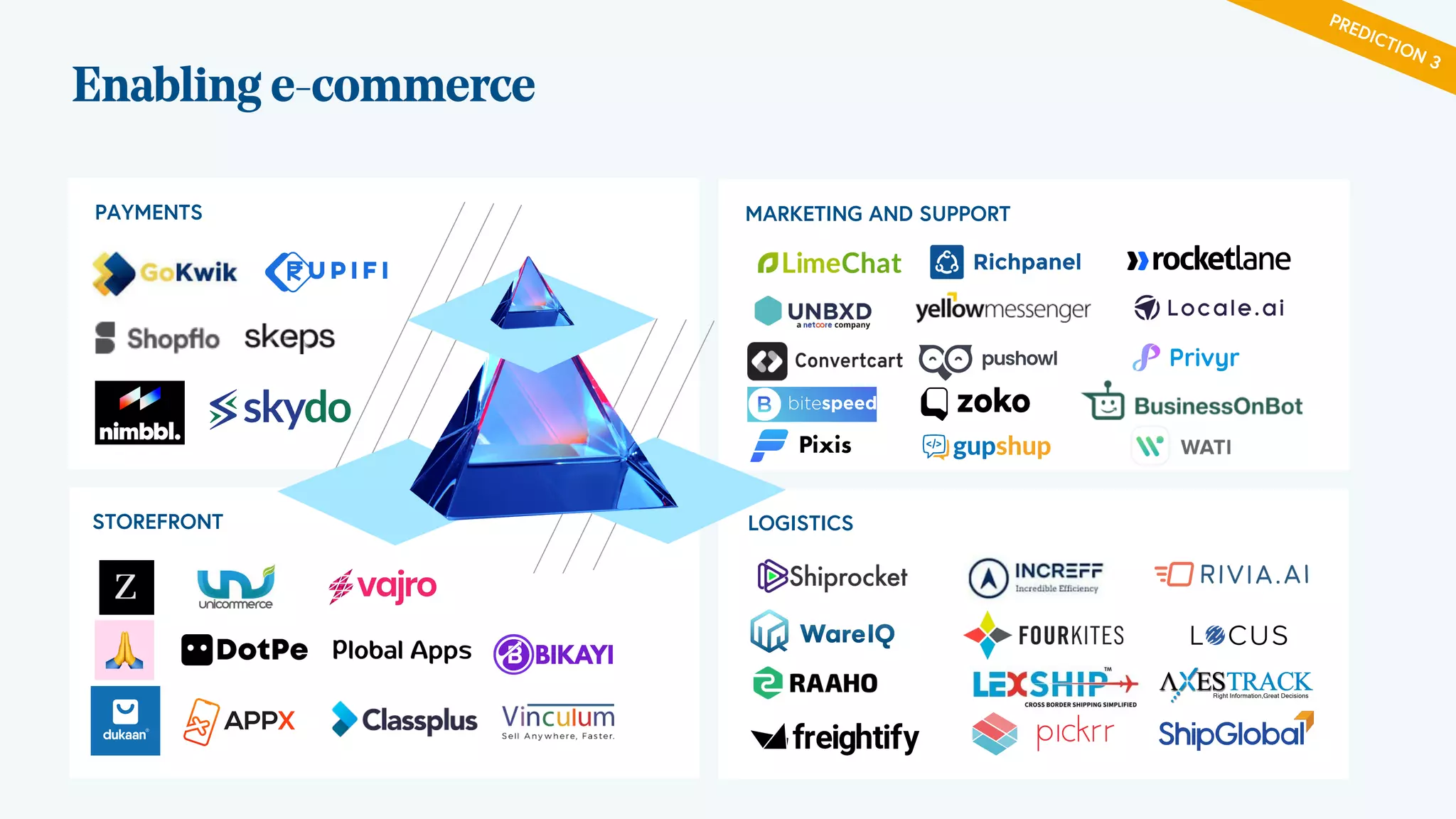

The document discusses the rapid growth and potential of India's SaaS market, forecasting it to reach $50 billion in annual recurring revenue by 2030. It highlights the increasing number of unicorns and centaurs, noting significant investment in the sector and the unique attributes of Indian startups that contribute to their success. Key trends include the rise of global category leaders, advancements in fintech, e-commerce, and healthcare digitization.