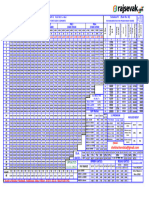

STRUCTURE OF INTEREST RATES

www.fpindia.in

(Per cent per annum)

Call/Notice

Money

Rates

Commercial Bank Rates

Deposit Rates

Year

1 to 3 yrs.

Over 3 yrs. &

upto 5 yrs.

Above 5 yrs.

SBI Advance

Rate

Lending Rates

Key Lending

Rates as

Prescribed by

RBI (All

Commercial

Banks

including SBI)

1970-71

6.38

6.00-6.50

7.00

7.25

7.00-8.50

1971-72

5.16

6.00

6.50

7.25

8.50

1972-73

4.15

6.00

6.50

7.25

8.50

1973-74

7.83

6.00

7.00

7.25

8.50-9.00

1974-75

12.82

6.75-8.00

7.75-9.00

8.00-10.00

9.00-13.50

1975-76

10.55

8.00

9.00

10.00

14.00

16.50

1976-77

10.84

8.00

9.00

10.00

14.00

16.50

1977-78

9.28

6.00

8.00

9.00

13.00

15.00

1978-79

7.57

6.00

7.50

9.00

13.00

15.00

1979-80

8.47

7.00

8.50

10.00

16.50

18.00

1980-81

7.12

7.50-8.50

10.00

10.00

16.50

19.40-19.50

1981-82

8.96

8.00-9.00

10.00

10.00

16.50

19.50

1982-83

8.78

8.00-9.00

10.00

11.00

16.50

19.50

1983-84

8.63

8.00-9.00

10.00

11.00

16.50

18.00

1984-85

9.95

8.00-9.00

10.00

11.00

16.50

18.00

1985-86

10.00

8.50-9.00

10.00

11.00

16.50

17.50

1986-87

9.99

8.50-9.00

10.00

11.00

16.50

17.50

1987-88

9.88

9.00-10.00

10.00

10.00

16.50

16.50

1988-89

9.77

9.00-10.00

10.00

10.00

16.50

1989-90

11.49

9.00-10.00

10.00

10.00

16.50

1990-91

15.85

9.00-10.00

11.00

11.00

16.50

1991-92

19.57

12.00

13.00

13.00

16.50

1992-93

14.42

11.00

11.00

11.00

19.00

1993-94

6.99

10.00

10.00

10.00

19.00

1994-95

9.40

11.00

11.00

11.00

15.00

1995-96

17.73

12.00

13.00

13.00

16.50

1996-97

7.84

11.00-12.00

12.00-13.00

12.50-13.00

14.50

1997-98

8.69

10.50 -11.00

11.50-12.00

11.50-12.00

14.00

�1998-99

7.83

9.00-11.00

10.50-11.50

10.50-11.50

12.00-14.00

1999-00

8.87

8.50-9.50

10.00-10.50

10.00-10.50

12.00

2000-01

9.15

8.50-9.50

9.50-10.00

9.50-10.00

11.50

2001-02

7.16

7.50-8.50

8.00-8.50

8.00-8.50

11.50

2002-03

5.89

4.25-6.00

5.50-6.25

5.50-6.25

10.75

2003-04

4.62

4.00-5.25

5.25-5.50

5.25-5.50

10.25

2004-05

4.65

5.25-5.50

5.75-6.25

5.75-6.25

10.25

2005-06

5.60

6.00-6.50

6.25-7.00

6.25-7.00

10.25

2006-07

7.22

7.50-9.00

7.75-9.00

7.75-9.00

12.25

2007-08

6.07

8.25-8.75

7.50-9.00

7.50-9.00

12.25

2008-09

7.06

8.00-8.75

7.75-8.50

7.75-8.50

12.25

2009-10

3.24

6.00-7.00

6.50-7.50

6.50-7.50

11.75

2010-11

5.75

8.25-9.00

7.75-9.50

7.75-9.50

8.25

2011-12

8.12

9.00-9.25

8.50-9.25

8.50-9.25

9.50

�es

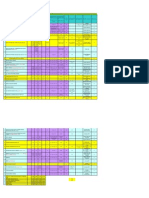

Prime Lending Rates of Term Lending Institutions

Lending Rates

Key Lending

Key Lending

Rates as

Rates as

Prescribed by

Prescribed by

RBI (All

RBI (All

Commercial

Commercial

Banks including

Banks

SBI) - Minimum including SBI) -

IDBI

IFCI

ICICI

IIBI / IRBI

8.50 (7.00-8.50)

9.00

8.50

12.00

8.50 (7.50-8.00)

9.00

8.50

12.00

8.50 (7.50-9.75)

9.00

8.50

10.00-11.00

12.00-13.00

9.00 (7.50-10.50)

9.50

9.00

8.50

11.00-13.00

14.00-15.00

10.25 (8.00-10.50)

11.25

10.25

8.50

12.50

14.00-15.00

11.00 (8.00-11.00)

12.00

11.00

8.50

12.50

14.00-15.00

11.00 (8.00-11.00)

11.00

11.00

8.50

12.50

14.00-15.00

11.00 (8.00-11.00)

11.00

11.00

8.50

12.50

14.00-15.00

11.00 (8.00-11.00)

11.00

11.00

8.50

12.50

15.50-18.00

11.00 (8.00-11.00)

11.00

11.00

8.50

13.50

16.70-19.50 14.00 (12.00-14.50)

14.00

14.00

9.15

17.50-19.50 14.00 (12.50-14.00)

14.00

14.00

9.15

17.50-19.50 14.00 (12.50-14.50)

14.00

14.00

12.50

16.50-18.00 14.00 (11.50-16.50)

14.00

14.00

12.50

16.50-18.00 14.00 (12.50-18.50)

14.00

14.00

12.50

16.50-17.50 14.00 (11.50-16.50)

14.00

14.00

12.50

16.50-17.50 14.00 (11.50-16.50)

14.00

14.00

12.50

16.5 14.00 (11.50-16.50)

14.00

14.00

14.00

16.00

16 14.00 (11.50-16.50)

14.00

14.00

14.00

16.00

16 14.00 (11.50-16.50)

14.00

14.00

14.00

16.00

16

14.00-15.00

14.00-15.00

14.00-15.00

14.00-15.00

19.00

19

18.00-20.00

18.00-20.00

18.00-20.00

18.00-20.00

17.00

17

17.00-19.00

17.00-19.00

17.00-19.00

18.50-21.00

14.00

15

14.50-17.50

14.50-17.50

14.50-17.50

14.50-17.50

15.00

Free

15.00

14.50-18.50

14.00-17.50

14.50-17.50

16.50

Free

16.00-19.00

16.00-20.00

14.00

15.50-18.50

14.50-15.00

Free

16.20

15.00-19.50

16.50

17

14.00

Free

13.30

14.50-18.00

14.00-14.50

12.50-13.50

�12.00-13.00

Free

13.50

13.50-17.00

13.00

12.00-12.50

Free

13.60-17.10

13.50-17.00

12.50

14

11.00- 12.00

Free

14.00

13.00

12.50

13.25

11.00-12.00

Free

11.50

12.50

12.50

11.5

10.75-11.50

Free

10.20

12.50

11

10.25-11.00

Free

8.90

12.50

8.5

10.25-10.75

Free

12.50

8.5

10.25-10.75

Free

12.50

8.5

12.25-12.50

Free

12.25-12.75

Free

11.50-12.50

Free

11.00-12.00

Free

8.25-9.50

Free

9.50-10.75

�g Institutions

Annual (Gross) Redemption Yield of

Government of India Securities

Units of UTI (July-June)

SFCs

Dividend Rate Yield Rate

Short-Term (15yrs.)

MediumTerm (515yrs.)

Long-Term (15

yrs. & Above)

7.50-10.50

8.00

7.55

3.85-4.28

4.32-4.84

4.77-5.53

8.50-11.00

8.25

4.21-4.17

4.53-5.25

5.00-5.74

8.50-10.50

8.50

4.46-4.98

4.08-5.28

5.00-5.74

9.00-11.00

8.50

4.47-5.05

4.74-5.34

5.00-5.74

8.00-13.00

8.60

8.25

5.00-5.65

5.18-5.99

5.93-6.39

8.00-14.50

8.75

8.33

5.20-6.04

5.47-6.02

6.08-6.48

8.00-15.50

9.00

8.51

5.18-5.59

5.43-5.97

6.02-6.47

8.00-15.50

9.00

7.96

5.06-5.59

5.42-5.98

6.03-6.46

8.00-15.50

9.00

7.67

5.12-5.48

5.47-6.25

6.12-6.73

8.00-15.50

10.00

8.56

4.70-5.74

5.70-6.30

6.20-6.98

12.00-16.00

11.50

9.62

4.74-6.01

5.80-6.75

6.44-7.49

11.25-14.00

12.50

10.29

5.32-6.43

5.81-7.02

6.45-8.00

12.50-17.00

13.50

10.65

4.98-8.46

6.25-7.77

6.46-9.00

14.00-18.00

14.00

10.49

4.50-7.08

6.67-9.04

6.47-10.00

14.00-20.00

14.25

10.44

4.20-8.31

6.47-9.04

7.93-10.50

11.50-16.50

15.25

11.75

5.42-9.84

6.49-9.50

8.38-11.50

11.50-16.50

16.00

12.27

5.09-11.60

6.50-10.86

8.88-11.50

11.50-16.50

16.50

12.56

6.86-15.78

6.51-11.73

9.17-11.50

11.50-16.50

18.00

13.58

7.03-23.88

6.76-13.77

9.36-11.73

11.50-16.50

18.00

13.35

7.56-18.36

7.69-15.06

10.05-11.80

9.00-20.00

19.50

14.03

7.04-21.70

9.44-12.70

10.86-12.04

9.00-20.00

25.00

16.40

8.37-26.26

9.50-13.42

9.91-12.38

(11.50-20.00)

26.00

19.06

9.08-23.77

9.50-14.78

8.82-12.47

(11.50-20.00)

26.00

17.68

11.86-12.86

12.70-13.30

12.85-13.43

(12.00-13.50)

26.00

16.33

9.75-11.76

11.30-13.86

11.77-13.47

(12.00-13.50)

20.00

12.66

6.00-14.28

5.75-14.07

11.84-13.02

(12.00-27.50)

20.00

13.95

5.21-16.21

5.75-14.44

9.00-14.20

(12.00-18.00)

20.00

13.85

5.50-17.69

5.20-14.00

9.00-13.17

�12.00-18.50

13.50

9.46

4.45-17.73

5.75-13.74

10.00-13.46

12.00-18.00

13.75

10.19

3.18-14.30

6.50-13.84

9.79-13.11

9.75-17.00

10.00

7.32

4.94-16.66

9.37-12.50

10.58-11.89

9.50-16.75

5.32-10.96

5.14-13.85

7.41-10.86

9.50-14.50

5.12-10.98

5.60-9.27

6.10-8.76

9.50-14.51

3.93-7.16

4.41-6.78

5.44-7.72

9.50-14.51

4.32-8.14

4.71-7.73

5.43-7.83

9.50-13.00

2.84-8.57

6.49-7.92

7.08-7.85

9.50-14.50

6.23-11.37

6.61-8.67

7.47-10.00

9.50-15.00

6.95-9.93

6.87-10.55

6.17-8.88

4.61-11.09

5.50-10.69

6.27-8.26