Mutual Funds

Uploaded by

cayashrajkhannahMutual Funds

Uploaded by

cayashrajkhannahCHAPTER

1110

MUTUAL FUNDS

LEARNING OUTCOMES

After going through the chapter student shall be able to understand

Basics of Mutual Funds- Including its concepts and benefits etc.

Evolution of the Indian Mutual Fund Industry

Types of Mutual Funds

(1) Structural Classification (2) Portfolio Classification

Evaluating performance of Mutual Funds

(1) Net Asset Value (NAV) (2) Costs incurred by Mutual Fund

(3) Holding Period Return (HPR)

The criteria for evaluating the performance

(1) Sharpe Ratio (2) Treynor Ratio

(3) Jensen’s Alpha (4) Sortino Ratio

Advantages and Disadvantages of Mutual Fund

Factors influencing the selection of Mutual Funds

Signals highlighting the exit of the investor from the Mutual Fund Scheme

Money Market Mutual Funds (MMMFS)

Exchange Traded Funds

Side Pocketing

Tracking Error

Real Estate Investment Trusts (ReITs)

Infrastructure Investment Trusts (InvITs)

©The Institute of Chartered Accountants of India

10.2 FINANCIAL SERVICES AND CAPITAL MARKETS

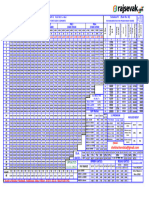

CHAPTER OVERVIEW

Mutual Funds

Basics of Mutual

Funds

Meaning Evolution Organization

Sponsor

Trustee

Asset Management

Company

Types of Mutual Funds

On the basis of

Based on On the basis of

On the basis of clasification of

Investment Investment

Structure portfolio

objective Portfolio

Management

Open Close

Active Equity

Ended Ended

Passive Debt

Hybrid

Solution Oriented &

other Funds

Multi Asset Funds

Arbitrage Funds

©The Institute of Chartered Accountants of India

MUTUAL FUNDS 10.3

Explanation of Importants Terms

Net Assets Value (NAV) and Indicative NAV

Performance Measurement

Jenson

Cost Point to Rolling Sharp & Alpha & Alpha &

Incurred Point Return Return Treynor ratio Sortino Benchmarking

Ratio

Advantages and Disadvantages

Factors Influencing the Selection of Mutual Funds

Signals Highlighting the Exit of the Investor from the Mutual Fund Scheme

Money Market Mutual Funds

Separation of Distribution and Advisory Functions in the MF Industry

Exchange Traded Funds

Side Pocketing

Tracking Error

Real Estate Investment Trusts (REITs) & Infrastructure Investment Trusts (INVITs)

©The Institute of Chartered Accountants of India

10.4 FINANCIAL SERVICES AND CAPITAL MARKETS

1. MEANING

A Mutual Fund is a pool of funds from a diverse cross section of society, that imparts the benefits of

scale and professional management to the investors, which otherwise would not have been available

to them. The rationale for any pooling of service is two-fold: affordability and convenience. Office

commuters can go to the office by own vehicle or taxicab, which is the synonym for do-it-yourself in

the context of investments. The other way of doing the office commute is by public transport like bus

or train, which essentially is the pooling concept, bringing transport within the reach of those people

who cannot afford their own vehicle. The synonym here is the Mutual Fund. To be noted, it is not

just affordability due to which people may take to public transport; there could be reasons like saving

the hassles of maintaining and driving own vehicle. The other benefit in the mutual fund context is

professional management and tracking of investments.

The diagram above illustrates that a mutual fund is a common pool of investments of a cross section

of investors. To understand the concept better, please look at the following diagram:

©The Institute of Chartered Accountants of India

MUTUAL FUNDS 10.5

A Mutual Fund is a pool of investment funds of several investors who have a common investment

objective. The asset management company that manages the day-to-day running of the fund invests

the money collected in securities like stocks, bonds etc. The investors, called unit holders as they

hold units in the pool proportionate to their investment, earn from the appreciation in the investments

and dividend / coupon received in the fund. Thus, a Mutual Fund is the most suitable investment for

the common man as well as HNIs since it offers an opportunity to invest in a diversified,

professionally managed basket of securities at a relatively low cost.

2. EVOLUTION

2.1 History of Mutual Funds (Global)

A mutual fund, as the term suggests, is a pooling of resources of many investors and is managed

by professionals. The concept of pooling money for investments has been there for a long time. It

began in the Netherlands in the 18th century; today it is a growing, international industry with fund

holdings accounting for trillions of dollars in the United States alone. The closed-end investment

companies launched in the Netherlands in 1822 by King William I is supposedly the first mutual

funds. Another theory says a Dutch merchant named Adriaan van Ketwich whose investment trust

created in 1774 may have given the king the idea. The concept spread to Great Britain and France,

and then to the United States in the 1890s.

©The Institute of Chartered Accountants of India

10.6 FINANCIAL SERVICES AND CAPITAL MARKETS

2.2 Expansion

By the late 1920s, there were quite a few mutual funds in the USA. With the stock market crash of

1929, some funds were wiped out, particularly the leveraged ones. The creation of the Securities

and Exchange Commission (SEC), and the Securities Act of 1933 put certain safeguards for investor

protection.

Despite the global financial crisis of 2008-2009, the story of the mutual fund is far from over. In fact,

the industry is still growing. In the U.S. alone there are more than 10,000 mutual funds and fund

holdings are measured in the trillions of dollars.

2.3 History of Mutual Funds in India

The evolution of the mutual fund industry in India has been relatively more ‘administered’ i.e., there

have been quite a few administrative interventions. The history, as delineated by Association of

Mutual Funds of India (AMFI), is as follows:

The mutual fund industry in India started in 1963 with the formation of Unit Trust of India, at the

initiative of the Government of India and Reserve Bank of India. The history of mutual funds in India

can be broadly divided into four distinct phases:

2.3.1 First Phase – 1964-87

Unit Trust of India (UTI) was established in 1963 by an Act of Parliament. It was set up by the

Reserve Bank of India and functioned under the Regulatory and administrative control of the

Reserve Bank of India. In 1978 UTI was de-linked from the RBI and the Industrial Development Bank

of India (IDBI) took over the regulatory and administrative control in place of RBI. The first scheme

launched by UTI was Unit Scheme 1964. At the end of 1988, UTI had ` 6,700 crore of assets under

management.

2.3.2 Second Phase – 1987-1993 (Entry of Public Sector Funds)

1987 marked the entry of non- UTI, public sector mutual funds set up by public sector banks and

Life Insurance Corporation of India (LIC) and General Insurance Corporation of India (GIC). SBI

Mutual Fund was the first non- UTI Mutual Fund established in June 1987 followed by Canbank

Mutual Fund (Dec 87), Punjab National Bank Mutual Fund (Aug 89), Indian Bank Mutual Fund (Nov

89), Bank of India (Jun 90), Bank of Baroda Mutual Fund (Oct 92). LIC established its mutual fund

©The Institute of Chartered Accountants of India

MUTUAL FUNDS 10.7

in June 1989 while GIC had set up its mutual fund in December 1990. At the end of 1993, the mutual

fund industry had assets under management of `47,004 crore.

2.3.3 Third Phase – 1993-2003 (Entry of Private Sector Funds)

With the entry of private sector funds in 1993, a new era started in the Indian mutual fund industry,

giving the Indian investors a wider choice of fund families. Also, 1993 was the year in which the first

Mutual Fund Regulations came into being, under which all mutual funds, except UTI, were to be

registered and governed. The erstwhile Kothari Pioneer (now merged with Franklin Templeton) was

the first private sector mutual fund registered in July 1993.

The 1993 SEBI (Mutual Fund) Regulations were substituted by a more comprehensive and revised

Mutual Fund Regulations in 1996. The industry now functions under the SEBI (Mutual Fund)

Regulations, 1996.

The number of mutual fund houses went on increasing, with many foreign mutual funds setting up

funds in India and the industry has witnessed several mergers and acquisitions. As at the end of

January 2003, there were 33 mutual funds with total assets of ` 1,21,805 crore. The Unit Trust of

India with `44,541 crore of assets under management was way ahead of other mutual funds.

2.3.4 Fourth Phase – since February 2003

In February 2003, following the repeal of the Unit Trust of India Act 1963, UTI was bifurcated into

two separate entities. One is the Specified Undertaking of the Unit Trust of India with assets under

management of ` 29,835 crore as at the end of January 2003, representing broadly, the assets of

US 64 scheme, assured return, and certain other schemes. The Specified Undertaking of Unit Trust

of India, functioning under an administrator and under the rules framed by Government of India does

not come under the purview of the Mutual Fund Regulations.

The second is the UTI Mutual Fund, sponsored by SBI, PNB, BOB and LIC. It is registered with SEBI

and functions under the Mutual Fund Regulations. With the bifurcation of the erstwhile UTI which

had in March 2000 more than `76,000 crore of assets under management and with the setting up of

a UTI Mutual Fund, conforming to the SEBI Mutual Fund Regulations, and with recent mergers taking

place among different private sector funds, the mutual fund industry has entered its current phase

of consolidation and growth.

Growth in terms of quantum of funds managed.

©The Institute of Chartered Accountants of India

10.8 FINANCIAL SERVICES AND CAPITAL MARKETS

[Source: Website of Association of Mutual Funds (AMFI)]

2.4 Mutual Fund Organization

©The Institute of Chartered Accountants of India

MUTUAL FUNDS 10.9

There are various entities involved in the overall structure. They are explained as below:

Sponsor

Sponsor is the entity that creates a mutual fund. The rules are set by the Securities and Exchange

Board of India, in the Mutual Fund Regulations of 1996. Sponsor is defined under the SEBI

regulations as any person who, acting alone or in combination with another body corporate,

establishes a mutual fund. Sponsor is the promoter of the fund. A Sponsor could be a bank, a

corporate or a financial institution. Sponsors then form a Trust and appoint a Board of Trustees. The

sponsor also appoints Custodian.

As per SEBI regulations, a sponsor must contribute at least 40% of the net worth of the Asset

Management Committee (AMC) and possess a sound financial track record over five years prior to

registration. Sponsor signs the trust deed with the trustees. Sponsor creates the AMC and the trustee

company and appoints the board of directors of companies, with SEBI approval. Sponsor should

have at least a 5-year track record in the financial services business and should have made a profit

in at least 3 out of the 5 years. The AMC’s capital is contributed by the sponsor. Sponsor should

contribute at least 40% of the capital of the AMC.

Trust

The Mutual Fund is a trust under the Indian Trusts Act, 1882. The trust deed is registered under the

Indian Registration Act, 1908. The Trust oversees the safekeeping of the unit holders’ investments.

Trustee

The Board of Trustees i.e., the body of individuals, looks after safeguarding the interest of the unit

holders. At least 2/3rd of the Trustees is independent i.e. not associated with the Sponsor. A mutual

fund in India is form as Trust under Indian Trust Act, 1882. The trust-mf is managed by the Board of

Trustees. The Board of Directors i.e. Trustees do not manage the portfolio of securities directly

rather they supervise the work of AMC (Asset Management Company) and ensure that the fund is

managed by stated objectives and as per SEBI regulations.

Trusts always work for the interest of unit holders, and it is created through a document called Trust

Deed that is executed by sponsors in favor of Trustees. The Trustees being the primary guardians

of unit holder’s funds and assets, they must ensure that the investor’s interests are safeguarded and

that the AMC operations are as per regulation laid down by SEBI. SEBI mandates a minimum of

2/3rd independent directors on the board of the trustee company. Trustees are appointed by the

sponsor with SEBI approval. The trustees make sure that the funds are managed according to the

investor’s mandate.

©The Institute of Chartered Accountants of India

10.10 FINANCIAL SERVICES AND CAPITAL MARKETS

Asset Management Company (AMC)

The AMC is that part of the mutual fund system that looks after the operations and investments of

the MF. Formation of the AMC requires approval by SEBI. The AMC needs to have a net worth of `

50 crore. The role of AMC is to act as investment manager of trust. The AMC (as appointed by

trust/sponsor) requires approval by SEBI.

The AMC is under the supervision of its own board of directors and the directors of trustees and

SEBI. The trustees are empowered to terminate the appointment of AMC and appoint a new AMC

with prior approval of SEBI and unit holders. The AMC, in the name of the Trust, manages different

investment schemes as per the investment management agreement with the trustees. A Director of

AMC should have complete professional experience in finance.

The AMC cannot act as a trustee of any other MF. The AMC always acts in the interest of unit

holders (investor). The AMC gets a fee for managing the funds, according to the mandate of the

investors. At least ½ of the AMC’s Board should be of independent members. An AMC cannot

engage in any business other than portfolio advisory and management. An AMC of one fund cannot

be Trustee of another fund. AMC should be registered with SEBI. Also, AMC signs an investment

management agreement with the trustees.

3. TYPES OF MUTUAL FUNDS

There are various types of mutual funds, classified primarily based on the underlying portfolio.

3.1 On the basis of Structure

3.1.1 Open Ended Funds

It is a commonly used term in the mutual fund industry; let us understand the term for the investor.

Most of the funds (or Schemes, technically) are open ended, ones that are available for purchase

from the AMC and redemption with the AMC on an on-going basis, round the year on all working

days, till it is wound up.

What it means for the investor is, there is liquidity round the year - can be purchased anytime and

can be sold (redeemed, technically) anytime i.e. the investor can enter and exit anytime. AMC issues

new units when investor enters/purchase units form AMC and redeem/sells the units back to AMC.

Listed open-ended funds can be sold at the Exchange as well, but in case of redemption with the

AMC, liquidity is assured. There is no additional cost for this liquidity as AMCs do not charge any

premium for redemption.

©The Institute of Chartered Accountants of India

MUTUAL FUNDS 10.11

Sometimes there is an exit load in an open-ended fund. It means if the investor exits within that

period, there will be a penalty charged on the exit value, but liquidity is available nonetheless at the

cost of the exit load. It is a matter of discipline so that the investor comes in with the requisite horizon

in mind and if she exits within that period, she pays adequate compensation to the other investors

who are staying back.

The implications of open-ended funds for the AMC are fund (or Scheme) corpus size volatility; fund

size increases when investors purchase units from the AMC and fund size comes down when

investors redeem units.

An open-ended fund comes into existence through the New Fund Offer (NFO) process and the Fund

(or Scheme) parameters are decided by the NFO documents - Scheme Information Document (SID)

and Key Information Memorandum (KIM). There is another document called Scheme Additional

Information (SAI).

There is no defined maturity date for open-ended funds. If there is a single investor- the Scheme

continues to be in existence. There are limitations on maximum holding by a single investor: it is

referred to commonly as the 20/25 rule i.e., there must be a minimum 20 investors to float a Scheme

and maximum permissible holding per investor is 25%.

3.1.2 Close Ended Funds

Close ended funds are available for subscription only during the New Fund Offer (NFO) period and

not beyond that. The initial subscription amount is collected from investors and the fund is ‘closed’

after the NFO closure date i.e., no further purchase is allowed. There is no redemption possible with

the AMC. Hence from the AMC’s perspective, the fund (or Scheme) corpus size is stable and there

is no need to keep some portion in liquid or easily marketable securities to meet sudden redemption

pressure.

Close ended funds may have a defined maturity date e.g., fixed maturity plans (FMPs) that have a

maturity date. In an open-ended structure, it is practically not feasible to have a maturity date as it

is meant to be available for investment and redemption on an on-going basis. Closed ended funds

are listed at the Exchange but are not as liquid as open-ended funds as there is no defined liquidity

like redemption with the AMC.

Broadly, open-ended funds are much more popular than closed ended as the mutual fund industry

is supposed to provide investment solutions along with liquidity that is available at any point of time.

Close Ended Funds are meant to fulfil a particular requirement.

©The Institute of Chartered Accountants of India

10.12 FINANCIAL SERVICES AND CAPITAL MARKETS

Difference between Open Ended Funds and Close Ended Funds

Particulars Open-Ended Mutual Funds Close-ended Mutual Funds

Lock-In Period Such funds have no lock-in Close-ended mutual funds have

period. The units of open- a specific lock-in period.

ended funds can be bought

and sold at any point in time.

Redemption of the units of such

Sometimes the only exception

funds is only possible after the

to this is the Equity Linked

expiry of the said lock-in.

Savings Scheme. It is an open-

ended mutual fund that has a

3-year lock-in.

Liquidity Open-ended funds are highly Close-ended mutual funds have

liquid since the units can be no liquidity since they can only

bought and sold freely without be redeemed after the expiry of

any restrictions. the lock-in period.

For liquidity they have to be

liquidated by selling through

Markets where they trade.

Mutual Fund Units and There’s no limit on either the The number of units and the

Fund Size number of units in open-ended fund size in close-ended mutual

mutual funds or the fund size. funds is limited.

New units are created by the Investors cannot invest in such

fund house as and when funds once all the listed units

individuals invest money into have been subscribed.

the fund.

Investment Method Open-ended mutual funds Since you can only subscribe to

support both lump-sum the units of a close-ended fund

investments as well as during the New Fund Offer

Systematic Investment Plans (NFO) period, only lump-sum

(SIPs). investments are allowed.

Track Record of Since open-ended mutual Close-ended funds do not have

Performance funds are perpetual by nature, any track record of

track records of past performance.

performances are available

©The Institute of Chartered Accountants of India

MUTUAL FUNDS 10.13

3.2 On the basis of Classification of Portfolio Management

Active Funds:

Active Funds are mutual funds where the fund manager plays an active role in deciding whether to

buy, sell or hold the investments. Active funds employ a variety of strategies to construct and

manage their portfolios. For example, to outperform the entire market and others acting as powerful

hedges against unforeseen market declines or corrections. In an Active Fund, the Fund Manager is

‘Active’ in deciding whether to Buy, Hold, or Sell the underlying securities and in stock selection.

Active funds adopt different strategies and styles to create and manage the portfolio.

The investing strategy and style are explicitly available in the Scheme Information document (offer

document). Active funds seek to outperform their benchmark index in terms of returns. Furthermore,

the fund strategy determines its risk and return characteristics. Active funds are expected to

generate better returns (alpha) than the benchmark index. The risk and return in the fund will depend

upon the strategy adopted. Active funds implement strategies to ‘select’ the stocks for the portfolio.

Passive Funds:

Passive funds are the index funds which track the market index and try to generate returns in line

with the index. Fund managers of the passive funds invest in the components of the underlying index

in the same proportion as the index. The objective of the passive funds is to generate market like

returns. Passive Equity funds are the index funds which follow equity indices like Nifty 50 index or

any of the sectoral indices.

If you are a beginner and find it challenging to choose the right equity investment for your portfolio,

passive equity funds are the ideal choice for you. These are simple, low cost and easy to track.

Passive Funds hold a portfolio that replicates a stated Index or Benchmark, for example, Index

Funds and Exchange Traded Funds (ETFs)

In a Passive Fund, the fund manager has a passive role, as the stock selection / Buy, Hold, Sell

decision is driven by the Benchmark Index and the fund manager / dealer merely needs to replicate

the same with minimal tracking error.

Difference Between Active and Passive Funds:

(i) Active Funds

• Rely on professional fund managers who manage investments.

• Aim to outperform Benchmark Index.

©The Institute of Chartered Accountants of India

10.14 FINANCIAL SERVICES AND CAPITAL MARKETS

• Suited for investors who wish to take advantage of fund managers' potential for

generating higher income.

(ii) Passive Funds

• Investment holdings mirror and closely track a benchmark index, e.g., Index Funds or

Exchange Traded Funds (ETFs).

• Suited for investors who want to allocate exactly as per market index.

• Lower Expense ratio hence lower costs to investors and better liquidity.

3.3 Investment based on Investment Objective

Mutual funds offer products that cater to the different investment objectives of the investors such

as–

• Capital Appreciation (Growth)

• Capital Preservation

• Regular Income

• Liquidity

• Tax-Saving

Mutual funds also offer investment plans, such as Growth and Dividend options, to help tailor the

investment to the investors’ needs.

(Source: https://www.amfiindia.com/investor-corner/knowledge-center/types-of-mutual-fund-schemes.html)

3.4 On the Basis of Investment Portfolio

The Schemes would be broadly classified in the following groups:

a. Equity Schemes

Equity Schemes are those schemes which invest in Equity Shares. The target here is capital

appreciation and they are riskier due to equity component. Markets are considered to have

cycles thus these funds are considered better from the long-term perspective, as in the short

term, markets can be volatile.

©The Institute of Chartered Accountants of India

MUTUAL FUNDS 10.15

b. Debt Schemes

Debt Schemes invest in fixed income securities thus target fixed income. The idea here is

diversification and they are safer than equity funds. But the quality of debt instrument in which

the fund is investing is always to be considered and selected. If the quality, i.e. safety of

investment, is more then obviously the returns will be lower and vice versa. Thus, there are

different types of debt funds which are differentiated based on safety and returns they offer.

“The more the credit risk, the greater the return and less the credit risk lessor the return”.

c. Hybrid Schemes

Hybrid funds Invest in a mix of equities and debt securities. SEBI has classified Hybrid funds

into 7 sub-categories as follows:

(i) Conservative Hybrid Fund - 10% to 25% investment in equity & equity related

instruments; and 75% to 90% in Debt instruments.

(ii) Balanced Hybrid Fund - 40% to 60% investment in equity & equity related

instruments; and 40% to 60% in Debt instruments.

(iii) Aggressive Hybrid Fund - 65% to 80% investment in equity & equity related

instruments; and 20% to 35% in Debt instruments.

(iv) Dynamic Asset Allocation or Balanced Advantage Fund -Investment in equity/ debt

that is managed dynamically (0% to 100% in equity & equity related instruments; and

0% to 100% in Debt instruments).

(v) Multi Asset Allocation Fund - Investment in at least 3 asset classes with a minimum

allocation of at least 10% in each asset class.

(vi) Arbitrage Fund - Scheme following arbitrage strategy, with minimum 65% investment

in equity & equity related instruments.

(vii) Equity Savings Fund - Equity and equity related instruments (min.65%); debt

instruments (min.10% and derivatives (min. for hedging to be specified in the SID).

d. Solution-oriented & Other funds

(i) Retirement Fund - Lock-in for at least 5 years or till retirement age whichever is

earlier.

(ii) Children’s Fund - Lock-in for at least 5 years or till the child attains age of majority

whichever is earlier.

©The Institute of Chartered Accountants of India

10.16 FINANCIAL SERVICES AND CAPITAL MARKETS

(iii) Index Funds/ ETFs - Minimum 95% investment in securities of a particular index.

(iv) Fund of Funds (Overseas/ Domestic) - Minimum 95% investment in the underlying

fund(s).

(v) Hybrid funds - Invest in a mix of equities and debt securities. They seek to find a

‘balance’ between growth and income by investing in both equity and debt.

e. Multi Asset Funds

A multi-asset fund offers exposure to a broad number of asset classes, often offering a level

of diversification typically associated with institutional investing. Multi-asset funds may invest

in several traditional equity and fixed income strategies, index-tracking funds, financial

derivatives as well as commodities like gold. This diversity allows portfolio managers to

potentially balance risk with reward and deliver steady, long-term returns for investors,

particularly in volatile markets.

f. Arbitrage Funds

“Arbitrage” is the simultaneous purchase and sale of an asset to take advantage of the price

differential in the two markets and profit from price difference of the asset on different markets

or in different forms. An arbitrage fund buys a stock in the cash market and simultaneously

sells it in the Futures market at a higher price to generate returns from the difference in the

price of the security in the two markets. The fund takes equal but opposite positions in both

the markets, thereby locking in the difference.

The positions must be held until expiry of the derivative cycle and both positions need to be

closed at the same price to realize the difference. The cash market price converges with the

Futures market price at the end of the contract period. Thus, it delivers risk-free profit for the

investor/trader. Price movements do not affect the initial price differential because the profit

in one market is set off by the loss in the other market. Since mutual funds invest their own

funds, the difference is the return.

Hence, Arbitrage funds are a good choice for cautious investors who want to benefit from a

volatile market without taking on too much risk.

(Source:https://www.amfiindia.com/investor-corner/knowledge-center/types-of-mutual-

fund-schemes.html)

©The Institute of Chartered Accountants of India

MUTUAL FUNDS 10.17

A. Equity Schemes:

Sl. Category of Scheme Characteristics Type of scheme

No. Schemes

(uniform description of

scheme)

1 Multi Cap Fund Minimum investment in equity Multi Cap Fund – An open-

& equity related instruments – ended equity scheme

65% of total assets investing across large cap,

mid cap, small cap stocks

2 Large Cap Fund Minimum investment in equity Large Cap Fund – An open-

& equity related instruments of ended equity scheme

large cap companies – 80% of predominantly investing in

total assets large cap stocks

3 Large & Mid Cap Minimum investment in equity Large & Mid Cap Fund – An

Fund & equity related instruments of open-ended equity scheme

large cap companies – 35% of investing in both large cap and

total assets mid cap stocks

Minimum investment in equity

& equity related instruments of

mid cap stocks – 35% of total

assets

4 Mid Cap Fund Minimum investment in equity Mid Cap Fund – An open-

& equity related instruments of ended equity scheme

mid cap companies – 65% of predominantly investing in mid

total assets cap stocks

5 Small Cap fund Minimum investment in equity Small Cap Fund – An open-

& equity related instruments of ended equity scheme

small cap companies – 65% of predominantly investing in

total assets small cap stocks

6 Dividend Yield Fund The scheme should An open-ended equity scheme

predominantly invest in predominantly investing in

dividend yielding stocks. dividend yielding stocks

Minimum investment in equity

– 65% of total assets

7 Value Fund Scheme should follow a value An open-ended equity scheme

investment strategy. following a value investment

strategy

Minimum investment in equity

& equity related instruments –

65% of total assets

©The Institute of Chartered Accountants of India

10.18 FINANCIAL SERVICES AND CAPITAL MARKETS

8 Contra Fund The scheme should follow a An open-ended equity scheme

contrarian investment strategy. following contrarian

investment strategy

Minimum investment in equity

& equity related instruments –

65% of total assets

9 Focused Fund A scheme focused on the An open-ended equity scheme

number of stocks (maximum investing in maximum 30

30) stocks (mention where the

scheme intends to focus, viz;

Minimum investment in equity

multi cap, mid cap, small cap)

& equity related instruments –

65% of total assets

10 Sectoral / Thematic Minimum investment in equity An open-ended equity scheme

& equity related instruments of investing in - sector (mention

a particular sector/ particular the sector)

theme – 80% of total assets

An open-ended equity scheme

following – theme (mention the

theme)

11 ELSS Minimum investment in equity An open-ended equity linked

& equity related instruments – saving scheme with a statutory

80% of total assets (in lock in of 3 years and tax

accordance with Equity Linked benefit

Saving Scheme, 2005 notified

by Ministry of Finance)

For classification of companies as per market capitalization, the definition is as follows:

• Large Cap: 1st -100th company in terms of full market capitalization

• Mid Cap: 101st -250th company in terms of full market capitalization

• Small Cap: 251st company onwards in terms of full market capitalization

B. Debt Schemes:

Sr. Category of Scheme Characteristics Type of scheme

No. Schemes (uniform description of

scheme)

1 Overnight Fund Investment in overnight An open-ended debt

securities having maturity of 1 scheme investing in

day overnight securities

©The Institute of Chartered Accountants of India

MUTUAL FUNDS 10.19

2 Liquid Fund Investment in Debt and An open-ended liquid

money market securities with scheme

maturity of upto 91 days only

3 Ultra-Short Duration Investment in Debt & Money An open ended ultra –

Fund Market instruments such that short term debt scheme

the Macaulay duration of the investing in instruments

portfolio is between 3 months with Macaulay duration

– 6 months between 3 months and 6

months

4 Low Duration Fund Investment in Debt & Money An open-ended low

Market instruments such that duration debt scheme

the Macaulay duration of the investing in instruments

portfolio is between 6 months with Macaulay duration

– 12 months between 6 months and 12

months

5 Money market Fund Investment in Money Market An open-ended debt

instruments having maturity scheme investing in money

upto 1 year market instruments

6 Short Duration Fund Investment in Debt & Money An open-ended short-term

Market instruments such that debt scheme investing in

the Macaulay duration of the instruments with Macaulay

portfolio is between 1 year – duration between 1 year

3 years and 3 years

7 Medium Duration Fund Investment in Debt & Money An open-ended medium-

Market instruments such that term debt scheme

the Macaulay duration of the investing in instruments

portfolio is between 3 years – with Macaulay duration

4 years between 3 years and 4

years

8 Medium to Long Investment in Debt & Money An open-ended medium-

Duration Fund market instruments such that term debt scheme

the Macaulay duration of the investing in instruments

portfolio is between 4 – 7 with Macaulay duration

years between 4 years and 7

years

9 Long Duration Fund Investment in Debt & Money An open-ended debt

Market Instruments such that scheme investing in

the Macaulay duration of the instruments with Macaulay

portfolio is greater than 7 duration greater than 7

years years

©The Institute of Chartered Accountants of India

10.20 FINANCIAL SERVICES AND CAPITAL MARKETS

10 Dynamic Bond Investment across duration An open-ended dynamic

debt scheme investing

across duration

11 Corporate Bond Fund Minimum investment in An open-ended debt

corporate bonds – 80% of scheme predominantly

total assets (only in highest investing in highest rated

rated instruments) corporate bonds

12 Credit Risk Fund Minimum investment in An open-ended debt

corporate bonds – 65% of scheme investing in below

total asset (investment in highest rated corporate

below highest rated bonds

instruments)

13 Banking and PSU Fund Minimum investment in Debt An open-ended debt

instrument of banks, Public scheme predominantly

Sector Undertakings, Public investing in Debt

Financial Institutions – 80% of instruments of banks,

total assets Public Sector

Undertakings, Public

Financial Institutions

14 Gilt Fund Minimum investment in An open-ended debt

Gsecs – 80% of total assets scheme investing in

(across maturity) government securities

across maturity

15 Gilt Fund with 10-year Minimum investment in G An open-ended debt

constant duration secs – 80% of total assets scheme investing in

such that the Macaulay government securities

duration of the portfolio is having a constant maturity

equal to 10 years of 10 years

16 Floater Fund Minimum investment in An open-ended debt

floating rate instruments – scheme predominantly

65% of total assets investing in floating rate

instruments

For debt funds, the classification is based on Macaulay Duration, and not based on Average Maturity

of Modified Duration.

The calculation of Macaulay Duration has been dealt with in the Chapter – Security Valuation in the

Advanced Financial Management Paper of CA Final Course.

©The Institute of Chartered Accountants of India

MUTUAL FUNDS 10.21

C. Hybrid Schemes:

Sr. Category of Scheme Type of scheme

No. Schemes Characteristics (uniform description of scheme)

1 Conservative Investment in equity & An open-ended hybrid scheme

Hybrid Fund equity related investing predominantly in debt

instruments – between instruments

10% and 25 % of total

assets

Investment in Debt

instruments – between

75% and 90% of total

assets

2 Balanced Hybrid Equity & Equity related An open-ended balanced scheme

Fund instruments – between investing in equity and debt

40% and 60 % of total instruments

assets.

Debt instruments –

between 40% and 60% of

total assets

No arbitrage would be

permitted in this scheme

Aggressive Hybrid Equity & Equity related An open-ended hybrid scheme

Fund instruments – between investing predominantly in equity

65% and 80% of total and equity related instruments

assets;

Debt instruments –

between 20% and 35% of

total assets

3 Dynamic Asset Investment in equity / An open-ended dynamic assets

Allocation or debt that is managed allocation fund

Balanced dynamically

Advantage

4 Multi Assets Invests in at least three An open-ended scheme investing

Allocation asset classes with a in the three different asset classes

minimum allocation of at

least 10% each in all

three asset classes

5 Arbitrage Fund Scheme following An open-ended scheme investing

arbitrage strategy. in arbitrage opportunities

Minimum investment in

©The Institute of Chartered Accountants of India

10.22 FINANCIAL SERVICES AND CAPITAL MARKETS

equity & equity related

instruments – 65% of

total assets

6 Equity Savings Minimum investment in An open-ended scheme investing

equity & equity related in equity, arbitrage and debt

instruments – 65% of

total assets and minimum

investment in debt – 10%

of total assets

Minimum hedged &

unhedged to be stated in

the SID

D. Solution Oriented Schemes:

Sr. No. Category of Scheme Type of scheme

Schemes Characteristics (Uniform description of scheme)

1 Retirement Fund Scheme having a lock – An open ended retirement solution

in for at least 5 years or oriented scheme having a lock – in

till retirement age of 5 years or till retirement age

whichever is earlier (whichever is earlier)

2 Children’s Fund Scheme having a lock – An open-ended fund for investment

in for at least 5 years or for children having a lock – in for at

till the child attains age of least 5 years or till the child attains

majority whichever is age of majority (whichever is

earlier earlier)

E. Other Schemes:

Sr. No. Category of Scheme Type of scheme

Schemes Characteristics (Uniform description of scheme)

1 Index Funds / Minimum investment in An open-ended scheme replicating

ETFs securities of a particular / tracking an index

index (which is being

replicated / tracked) –

95% of total assets

2 FOFs (Overseas / Minimum investment in An open-ended fund of fund

Domestic) the underlying fund – scheme investing in a particular

95% of total assets fund (mention the underlying fund)

©The Institute of Chartered Accountants of India

MUTUAL FUNDS 10.23

3.5 SEBI Allowed Flexicap Plans in Relief to Fund Houses Facing Tight

Regulation

The Securities and Exchange Board of India introduced flexicap schemes under the broader equity

mutual fund category. The move came as a relief to fund houses which operated multicap schemes

after the capital markets regulator tightened investment norms for this category. The majority of the

large multicap schemes were shifted to the new flexicap category. Kotak Standard Multicap Fund,

the largest scheme in the category was renamed Kotak Standard Flexicap. The fund manager,

investment process and fund portfolio remained the same. The new category gave the fund manager

flexibility to invest in a mix of large, midcap and smallcap stocks. The scheme needs to invest at

least 65% of the corpus to equity, SEBI said in a circular.

The decision to introduce flexicap schemes followed protests from a section of the mutual fund

industry after the regulator on September 11, 2020, unexpectedly asked multicap funds to allocate

at least 25% of their portfolios to large-, mid- and smallcap stocks each. Till then, there were no

investment restrictions for this product, resulting in many of these schemes holding as much as 75%

of their portfolios in largecap stocks, resembling large and midcap schemes as per SEBI’s

classification. Multicap portfolios manage 20% of the industry's equity assets under management.

Motilal Oswal Multicap Fund, another large scheme in the category, was also being shifted to the

flexicap category. Most multicap funds got their schemes reclassified into the flexicap category.

Fund managers of large multicap funds were opposed to staying in this category under the new

investment rules, which would require them to shift a large chunk of their corpus in largecap stocks

to small and midcaps. They feared the rush to make obligatory purchases of illiquid smaller stocks

to meet the norms that would drive up these stocks and be detrimental to the multicap investor.

4. DIRECT PLAN AND REGULAR PLAN

One may invest in mutual funds directly i.e., without involving or routing the investment through any

distributor/agent in a ‘Direct Plan’. Or one may choose to invest in mutual funds with the help of a

Mutual Fund distributor/agent in what is termed as a ‘Regular Plan’. 'Direct Plan' and 'Regular Plan’

are both part of the same mutual fund scheme, have the same/common portfolio, and are managed

by the same fund manager, but have different expense ratios (recurring expenses that are incurred

by the mutual fund scheme).

The Direct Plan has a lower expense ratio than the Regular Plan, as there is no distributor/agent

involved, and hence there are savings in terms of distribution cost/commissions paid out to the

distributor/agent, which is added back to the returns of the scheme. Hence, a Direct Plan has a

separate NAV, which is higher than the “Regular” Plan’s NAV. In due course, the lower expense

©The Institute of Chartered Accountants of India

10.24 FINANCIAL SERVICES AND CAPITAL MARKETS

ratio of the Direct Plan translates to higher returns on the investments which keep compounding

over the years. Thus, the investment in the Direct Plan would be worth more over a period, in

comparison to investment in the Regular Plan of the same scheme. It should be however borne in

mind that the difference between NAV of Direct Plan and Regular Plan tends to be marginal.

Direct Plans are for those who prefer to invest DIRECTLY in a mutual fund scheme without the help

of any distributor/agent. Investing in a Direct Plan is like buying a product from the manufacturer

directly, whereby the cost to the customer would be lower. Except that, investing in a mutual fund

scheme directly is not as simple as buying some item from a factory outlet, because choosing a

mutual fund scheme requires adequate knowledge and awareness of the mutual fund product,

especially the risks that are associated with the potential rewards. Choosing a Direct Plan means

making your own decisions about fund/scheme selection (and the related execution work) which not

everyone may be capable of.

In short, Direct Plan is suited for those who understand what kind of mutual funds are needed for

different kinds of investment needs, can research these independently, and are able to

identify/shortlist the funds to invest in, and then go through the process of investing without the help

of an intermediary. However, when the markets fall and investment values come under pressure,

independent advice from a professional advisor can help one stay the course. Thus, a Direct Plan

makes sense only if you have adequate knowledge and capability to select good funds yourself; or

are willing to seek professional advice from a registered investment adviser for a fee.

While the Direct Plan makes sense for knowledgeable, Do-it-Yourself (DIY) investors, it may not be

suited for all investors, especially new and inexperienced investors. So, if you are a new and

inexperienced investor or unsure of which scheme to invest in and need guidance/assistance in

investing, you may be better off seeking the help of a mutual fund distributor and investing in a

Regular Plan.

5. EXPLANATION OF IMPORTANT TERMS USED IN

MUTUAL FUNDS

New Fund Offer (NFO): A mutual fund house, also known as an asset management company, will

issue a New Fund Offer (NFO) when they choose to introduce a new mutual fund scheme. It's a mutual

fund scheme's initial offer that gives investors the chance to invest early and earn substantial profits.

A mutual fund house can raise the necessary funds through an NFO to buy stocks or debt

instruments. Customers can purchase units at INR 10 per unit NAV for a subscription duration

ranging from ten (10) to fifteen (15) days offered by AMCs. Investors receive units from AMCs

according to a first-come, first-served policy.

©The Institute of Chartered Accountants of India

MUTUAL FUNDS 10.25

Expense Ratio: Under SEBI (Mutual Funds) Regulations, 1996, Mutual Funds are permitted to

charge certain operating expenses for managing a mutual fund scheme – such as sales & marketing/

advertising expenses, administrative expenses, transaction costs, investment management fees,

registrar fees, custodian fees, audit fees – as a percentage of the fund’s daily net assets.

All such costs for running and managing a mutual fund scheme are collectively referred to as ‘Total

Expense Ratio’ (TER). The TER is calculated as a percentage of the Scheme’s average Net Asset

Value (NAV). The daily NAV of a mutual fund is disclosed after deducting the expenses.

(Source: Amfi Website)

Scheme Information Document (SID):

Scheme Information Document contains basic information about the scheme which investors should

know about before investing. The scheme information document usually runs into several pages and

may seem too technical for novice investors. However, it has very useful scheme related information,

which can help investors make informed investment decisions. However, some key information

which investors should look for and read in the scheme information document are as follows:

• Fund management team details

• Risks factors

• Scheme details

• Other information

Statement of Additional Information (SAI):

This document is essentially an addendum to the SID. Information provided in the SAI includes the

following: -

(i) Constitution of the mutual fund i.e. the Asset Management Company of the scheme,

scheme sponsors and trustees. The sponsor is the promoter of the Asset Management

Company. The sponsor provides capital, creates a board of trustees and sets up the Asset

Management Company (AMC). The role of the trustees is to protect the interest of investors,

monitoring the AMC and ensuring compliance with regulations.

(ii) Key information about the AMC i.e. Key personnel of the AMC, key associates of the AMC

like Bankers, Custodians, Registrars, Auditors and Legal Counsel, Financial and legal issues

etc.

©The Institute of Chartered Accountants of India

10.26 FINANCIAL SERVICES AND CAPITAL MARKETS

Key Information Memorandum (KIM):

KIM is Key Information Memorandum. As the name suggests, it has key scheme related information.

The KIM is essentially a concise version of the SID. The KIM is available with all mutual fund scheme

application forms. It is recommended to read the KIM carefully before investing, especially if you

have not gone through the SID.

(Source : https://www.miraeassetmf.co.in/quiz-module-list/topic-2/intermediate-level/investor-rights-

obligations/sid-sai-kim-before-investing

Systematic Investing Plan (SIP):

It is designed to aid you in achieving your financial objectives over time. It offers a straightforward

way to regularly invest a predetermined sum in your chosen mutual funds. SIP, with its promise to

make investing accessible to everybody, has become a major change in financial planning and asset

management. But besides understanding the meaning of SIP, it is also important to understand how

it works and how it can play a huge role in the success of your wealth-building journey. Let's discuss

SIP in detail.

How does SIP work?

SIP offers a convenient method for investing in mutual funds, allowing you to determine your desired

regular investment amount easily. This amount is automatically deducted from your bank account to

buy mutual fund units. Over time, these investments grow due to compounding. There are two

principles on which the SIP works. They are as follows:

(i) Regular Investing

SIPs offer a strategic shield against the unpredictable tides of the financial markets. By adhering to

consistent investments, SIPs ensure that the average purchase cost remains stable over the long

term.

In practical terms, when market conditions are buoyant, you acquire fewer units of your chosen

investment, and during market downturns, you secure more units for your investment. This key

difference between SIP and mutual fund investing can provide investors with a risk-mitigation

strategy and potentially higher returns over time.

(ii) Power of Compounding

The power of compounding in SIP refers to reinvesting the returns generated by your mutual fund

investments back into the same fund. Over time, this process leads to exponential growth as your

returns earn additional returns.

©The Institute of Chartered Accountants of India

MUTUAL FUNDS 10.27

The longer you stay invested, the more significant the compounding effect becomes, potentially

resulting in substantial wealth accumulation, making SIP an effective strategy for long-term financial

goals.

Let's consider two friends, Alice and Bob. Alice started investing `10,000 annually in an SIP at 25,

with an expected SIP return rate of 10% per annum. Over 30 years, she has made a total contribution

of ` 3,00,000. On the other hand, Bob started his investments at the age of 35 and invested ` 10,000

annually, expecting a 10% annual return. Over 20 years, Bob's total investment amounted to

` 2,00,000.

(Source: https://www.kotak.com/en/stories-in-focus/mutual-funds/what-is-sip.html)

(iii) Law of averages:

If NAV of the units comes down SIP helps in averaging, as investor is investing the same amount of

money every month (period) the no. of units he/she can buy with that amount is more as the NAV

has come down, which will reduce the overall cost of the portfolio of mutual fund. When the NAV

starts recovering again the breakeven point arrives early because of law of averages.

Lump Sum Investment:

In a lump sum, it means a single, bulk amount invested a one-time mutual fund investment. It is just

like FD. It is different than SIP where the money was pumped in periodically. In Lump sum money is

invested in one shot and without the intention to repeat it periodically.

The Systematic Transfer Plan (STP): It eliminates the additional burden involved in moving or

transferring funds between mutual fund schemes. When you have a large quantity of money to invest

in one go, this is the option you should pick. It does assist you in distributing your money over time

to lessen the effects of dealing with the market at its highest point. It is preferable to go from equity

plans to debt schemes and vice versa when you want to be risk-adverse with a plan.

Systematic Withdrawal Plan (SWP): One can periodically take out a predetermined amount of

money from one’s assets by using a systematic withdrawal plan. Retirees benefit most from this plan

because they may require a consistent income stream most of the time. But they also use this

technique to invest in new schemes or adjust their existing investments.

6. NET ASSET VALUE (NAV)

There is a valuation of the fund done at the end of every business day, so that the investor knows

the value of his/her investments as on that date. The term ‘value’ here refers to the market value

©The Institute of Chartered Accountants of India

10.28 FINANCIAL SERVICES AND CAPITAL MARKETS

i.e., if hypothetically the entire portfolio were to be liquidated, how much would be realized. Since

each investor holds units in the pool of funds, the valuation is published in terms of per unit, so that

the value of one’s holdings can be computed. The formula for computation of NAV is:

Market Value of Investments heldby the Fund+ Value of Current Assets -

Value of Current Liabilities andProvisions

NAV=

No.of Units on the valuation date before redemption

or creation on units

From the above formula, it can be observed that from the market value of the investments as on that

day, we must add the cash equivalents or other current assets and need to deduct any expenses

that have accrued but not paid out, so that the NAV represents a true and fair picture. That is the

reason it is called ‘net’ asset value i.e., it is net of liabilities, expenses, etc.

Example

From the following information in respect of a mutual fund, calculate the NAV per unit:

`

Cash and Bank Balance 6,00,000

Bonds and Debenture (unlisted) 7,50,000

Equities (current market value) 13,00,000

Quoted Government Securities 10,50,000

Accrued Expenses 1,25,000

Number of outstanding units 2,50,000

Solution

Cash and Bank Balance 6,00,000

Bonds and Debenture (unlisted) 7,50,000

Equities (current market value) 13,00,000

Quoted Government Securities 10,50,000

Total Assets (Realizable Value) 37,00,000

Less: Accrued Expenses 1,25,000

Net Assets 35,75,000

©The Institute of Chartered Accountants of India

MUTUAL FUNDS 10.29

Number of outstanding units 2,50,000

Net Assets Value (NAV)/unit 14.30

NAV is published on every business day for all funds; for Liquid Funds, NAV is published on Sundays

as well. In equity funds, returns come mostly from price movement. Hence the differential in NAV

between two dates is mostly the difference in market value of the investments. In debt funds, returns

come mostly from interest accrual. Hence the differential in NAV between two dates is mostly the

accrual, provided the period is sufficiently long to absorb short term volatilities.

7. INDICATIVE NET ASSET VALUE

A measurement of an investment's intraday net asset value (NAV) is called indicative net asset value

(iNAV). Approximately every 15 seconds, INAV is reported. It provides investors with a gauge of the

investment's worth throughout the day.

(i) Key characteristics

Indicative net asset value (iNAV) is a measurement of an investment's intraday net

asset value (NAV).

An agent that calculates indicative net asset value (iNAV)—typically the exchange

where the investment is traded—reports it roughly every 15 seconds.

Both exchange-traded funds and closed-end mutual funds can publish indicative net

asset value (iNAV) (ETFs).

The calculation agent will utilise the established prices of all securities in the portfolio to

get the overall asset value, which is then reduced by the fund's liabilities and divided by

the number of shares to determine the indicative net asset value (iNAV).

(ii) Comparing net asset value and indicative net asset value (NAV)

The iNAV is a tool that aids in preserving trading of assets close to par value. It provides a

glimpse of a fund's worth that is almost real-time thanks to iNAV reports that are sent out every

15 seconds. A fund may be able to avoid considerable premium and discount trading by reporting

an iNAV.

Because they fall under the Investment Company Act of 1940's definition of a mutual fund

investment, closed-end funds, and ETFs compute net asset values. The funds trade like stocks

on the open market, with transactions taking place at the market price, while they determine a

daily net asset value.

©The Institute of Chartered Accountants of India

10.30 FINANCIAL SERVICES AND CAPITAL MARKETS

8. PERFORMANCE MEASUREMENT

It comes as a statutory warning that “mutual fund investments are subject to market risks . . . past

performance is not an indication of future performance”. Very few people read it or understand the

importance of the statement. The implication of the statement is that the performance we are looking

at today is the result of certain investment decisions taken by the fund manager in the past. The

fund manager is ultimately a human being, and future decisions may or may not be as effective and

hence future returns from that fund may or may not be as good.

Even though past performance may not be repeated in future, there is no logic to go for a Fund that

has been an underperformer, because that fund manager could not prove himself / herself efficient

over the period under consideration. The outperformer has something going for himself / herself.

Hence, let us look at past performance also as a hygiene factor.

What should be avoided is,

• looking at past performance over a short period of time

• looking at returns only till a particular date and comparing the numbers.

• basing a decision on a ranking system, ranked only by returns till a particular date.

Let us now understand why the above practices should be avoided.

A short period of time is not adequate to judge the performance of a fund manager, just like the runs

scored or wickets taken by a cricketer in 5 matches is not enough to judge his class - at best it shows

his current form. Similarly, if a bond fund is outperforming the peer group over a period of say 1 or

2 months, it may be that the calls (investment decisions) taken by the fund manager over 1 or 2

months have proved better than other fund managers and that’s it. Fund managers who have proven

herself over a long period of time should be preferred.

As discussed earlier, a Fund may have done well over say a 1-year period which makes it eligible

for ‘5 stars’ (performance ranking done by some agencies / websites) as against another Fund which

is say ‘4 stars’ or ‘3 stars’ and you take the decision to invest in the 5-star rated Fund, it may not be

an entirely correct decision. Nothing wrong about a fund doing well, more so if the performance-

based ranking is over an adequate period and it is done on a ‘Risk-Adjusted Basis’ i.e., adjusted for

volatility in returns.

The point is, there are certain ‘hygiene factors’ which should be considered. Lay investors would be

attracted by the ‘5 stars’ and would not be aware that a 5-star rated Fund may be low on the hygiene

factors. For example, a Fund with a corpus of `1,000 crore from a leading AMC / sponsor with 4-

©The Institute of Chartered Accountants of India

MUTUAL FUNDS 10.31

star performance should be preferred over a 5-star rated Fund with a corpus of `20 crore which is

from an AMC that ranks among the bottom 5 in terms of corpus / their sponsor is not so well known

or if the credit quality of the Fund is relatively poor.

8.1 Performance Measures

There are various ways of measuring performance; what is most used is looking at point to point

returns (i.e., returns from one date to today’s date) over various time periods e.g., 1 month, 3 month,

6 months, 1 year, 2 years, etc.

As a matter of regulation, returns from fixed income funds for a period of less than 1 year should be

annualized on a simple basis and for a period of more than 1 year, it should be annualized on a

compounded basis. There are more refined methods of looking at point to point returns, which are

• looking at risk-adjusted (i.e., adjusted for volatility) returns.

• looking at various statistical ratios e.g., Sharpe Ratio, Alpha Ratio, Treynor Ratio, etc.

8.1.1 Costs incurred by Mutual Fund

Costs, when high, reduce the returns of an investor. High Costs are the cause of below par performance

of some mutual funds. Costs carry two components: (1) Initial Expenses attributable to establishing a

scheme under a Fund and (2) Ongoing recurring expenses (Management Expense Ratio) which is made

up of (a) Cost of employing technically sound investment analysts (b) Administrative Costs (c)

Advertisement Costs involving promotion and maintenance of Scheme funds. The Management Expense

Ratio is measured as a % of average value of assets during the relevant period.

Expense Ratio = Expense / Average value of Portfolio

If Expenses are expressed per unit, then Expense Ratio = Expenses incurred per unit /

Average Net Value of Assets.

For example, a mutual fund has paid annual expenses of Rs. 20 lakhs. The assets under

management in the beginning and at the end of year were Rs. 200 lakhs and Rs. 400 lakhs

respectively.

Rs.20 lakhs

Expense Ratio = x100 = 6.67%

(Rs.200 + Rs. 400 lakhs) / 2

The Expense Ratio relates to the extent of assets used to run the Mutual Fund. It is inclusive of

travel costs, management consultancy and advisory fees. It, however, excludes brokerage expenses

for trading as purchase is recorded with brokerage while sales are recorded without brokerage.

©The Institute of Chartered Accountants of India

10.32 FINANCIAL SERVICES AND CAPITAL MARKETS

8.1.2 Point to Point Returns

Point to point simply measures returns from a past date to the current date, by taking the NAV at

these two dates. For measurement of returns, the growth option NAV should be taken and not the

dividend option as there would be complications of adding back dividend. As an example, the return

over one year from 31 December 2017 to 31 December 2018 is the increment in the growth option

NAV divided by the NAV as on 31 Dec 2017.

Similarly, returns over three months from 30 September 2018 to 31 December 2018 is the increment

in the growth option NAV divided by the NAV as on 31 December 2017. The return over three years

from 31 December 2015 to 31 December 2018 is the increment in the growth option NAV divided by

the NAV as on 31 December 2015. To be noted, returns from equity funds over a period of less than

one year is expressed as absolute and for more than one year, it is annualized on a compounded

basis. Further, fixed income funds for a period of less than one year should be annualized on a

simple basis and for a period of more than one year, it should be annualized on a compounded

basis.

Point to point return explained.

Example: Yash Vardhan Large Cap Equity Investment began on January 2, 2015. Initial investment

amount is ` 10,00,000. NAV at the start of the fund Rs 100.54. Ending on January 2, 2017 - Closing

NAV ` 172.95. If you were requested to find out the returns, you probably could without much trouble.

Let's calculate -

Solution – By dividing `10,00,000 by `100.54, you get 9946.290 units. The final investment value

is equal to 9946.290 units x ` 172.95 (or `17,20,210.86).

The CAGR method can be used to determine the growth of this lump sum investment over a two-

year period: = [Ending Value/Beginning Value] ^ (1/2) - 1 = [17,20,210.86/10,00,000] ^ (1/2) - 1

= 31.16%. It would be considered as a tremendous growth rate.

8.1.3 Rolling Returns

The method to iron out the possible skew in point-to-point returns which may result from

outperformance / underperformance in the recent past, is to look at rolling returns. Measurement of

rolling returns works like this - For a period under consideration, it takes many short periods of fixed

frequency, measures the return from the Fund over these shorter time periods and take the average

of all the data over the entire period.

©The Institute of Chartered Accountants of India

MUTUAL FUNDS 10.33

Performance of a Liquid Fund over a 3-month period:

• Point-to-point: Simply measure the performance of the growth option NAV from the start

date to today’s date, annualized.

• Rolling return of daily frequency: Measure the return from the start date to next date, from

next date to next-to-next date and so on and take the average of all these observations.

• Rolling return of weekly frequency: Measure the return from the start date to next week,

from next week to next-to-next week and so on and take the average of all these observations.

Performance of an Equity / Bond Fund over a 3-year period:

• Point-to-point: Simply measure the performance of the growth option NAV from the start

date to today’s date, annualized on a compounded basis.

• Rolling return of monthly frequency: Measure the return from the start date to one-month-

later date, from next month to next-to-next month and so on and take the average of all these

observations.

• Rolling return of quarterly frequency: Measure the return from the start date to three-

month-later date, from next quarter to next-to-next quarter and so on and take the average of

all these observations.

The superiority of rolling return as a performance measurement over simple point-to-point return is

that it irons out the various smaller pockets of outperformance and underperformance against the

peer group and throws up a more dependable (smoothened out) data.

Rolling Returns explained

The objective is to find the fund's 2-year rolling return. So, let us start in 2015 to do this.

Firstly, calculate the return between the NAV on January 2, 2015, and the NAV on January 2, 2013,

which is two years ago. Secondly, shift the date by one day, i.e., between January 3, 2015, and

January 3, 2013, and then compute the return between these dates using the NAV for these two

dates. Once again change the date to January 4th, 2013, or 2015, and compute the return.

So, the purpose is to keep on going in this manner until a time series with a 2-year return is arrived

at.

Let's figure out the initial rolling return:

NAV as of January 2nd, 2013, was 100.54.

NAV on January 2nd, 2015, was 172.95.

©The Institute of Chartered Accountants of India

10.34 FINANCIAL SERVICES AND CAPITAL MARKETS

Since the period is two years, we use CAGR: [172.95/100.54] ^ (1/2)-1 = 31.16%.

NAV on January 3, 2013, would be the second rolling return in this series, at 101.75.

NAV on January 3, 2015, was 173.65; So, the CAGR in this situation = [173.65/101.75] ^ (1/2)-1 =

30.64.

Next, it will be calculated from January 4, 2013, to January 4, 2015, and so on.

8.2 Statistical Ratios

8.2.1 Sharpe Ratio (Reward to Variability)

The Sharpe ratio evaluates the relationship between an investment's return and risk. The idea that

excess returns over time may indicate greater volatility and risk rather than investment expertise is

expressed mathematically in this way.

As a result of his work on the capital asset pricing model (CAPM), economist William F. Sharpe

proposed the Sharpe ratio in 1966 under the name reward-to-variability ratio.

The numerator of the Sharpe ratio is the difference over time between realised or predicted returns

and a benchmark, such as the performance of a certain investment category or the risk-free rate of

return. The standard deviation of returns over the same period, which serves as a gauge of volatility

and risk, serves as its denominator.

Furthermore, investors prefer stocks or portfolios with relatively less risk or less volatility. But how

do we evaluate portfolios with different returns and different levels of risk? Let us take an example.

Portfolio A Portfolio B Benchmark

Annualized return 7.9% 6.9% 7.5%

Annualized risk 5.5% 3.2% 4.5%

©The Institute of Chartered Accountants of India

MUTUAL FUNDS 10.35

Sharpe ratio

(Risk-free rate = 2%) 7.9% - 2.0% 6.9% - 2.0% 7.5% - 2.0%

rP - rF 5.5% 3.2% 4.5%

SR =

σP = 1.07 = 1.53 = 1.22

rP is the portfolio return

rF is the risk-free rate

σP is the SD of the portfolio

SR = Sharpe Ratio

As we see in the table above, though the return of portfolio A (7.9%) is higher than portfolio B (6.9%)

and Benchmark (7.5%), variability also is higher. The Sharpe Ratio of portfolio A (1.07) is much

lower than portfolio B (1.53) and lower than benchmark portfolio (1.22).

The higher the Sharpe ratio, the better because the portfolio has given that much higher return to

compensate for the higher variability. The Sharpe ratio is a very popular method for measuring risk-

adjusted return.

8.2.2. Treynor Ratio

The output of Treynor ratio is like Sharpe Ratio, the difference being that in the denominator, instead

of taking standard deviation, it takes beta of the portfolio i.e., systematic risk.

rP - rF

Treynor Ratio (TR) =

βP

βP = Beta of the portfolio

The Treynor ratio measures excess return generated per unit of risk in the portfolio i.e. excess return

©The Institute of Chartered Accountants of India

10.36 FINANCIAL SERVICES AND CAPITAL MARKETS

earned above the risk-free investment. Treasury bills are usually taken as the proxy for risk-free

return as it is issued by the Government and duration is not very long. Risk refers to the portfolio

beta i.e. the extent to which the portfolio performance varies along with the relevant market.

Let's consider the following example to understand Treynor Ratio:

Portfolio Return: 10%

Risk-Free Rate: 6%

Portfolio Beta: 1.2

Treynor Ratio = (10% - 6%) / 1.2 = 3.33%

In this example, the portfolio generated a Treynor Ratio of 3.33%, which shows its performance in

comparison to its exposure to systematic risk.

8.2.3 Jensen’s Alpha

This is the difference between a fund’s actual return and those that could have been made on a

benchmark portfolio with the same risk- i.e., beta. It measures the ability of active management to

increase returns above those that are purely a reward for bearing market risk. Caveats apply

however since it will only produce meaningful results if it is used to compare two portfolios which

have similar betas.

Assume Two Portfolios

A B Market Return

Return 12 14 12

Beta 0.7 1.2 1.0

Risk Free Rate = 9%

The return expected = Risk Free Return + Beta portfolio (Return of Market - Risk Free Return)

Using Portfolio A, the expected return = 0 .09 + 0.7 (0.12 - 0.09) = 0.09 + 0.021 = 0.111

Jensen Alpha = Return of Portfolio- Expected Return= 0.12 - 0.111 = 0.009

If “apples are compared to apples”- in other words a computer sector fund A is compared with

computer sector fund B - it is a viable number. But if taken out of context, it loses meaning. Alphas

are found in many rating services but are not always developed the same way- so you can’t compare

©The Institute of Chartered Accountants of India

MUTUAL FUNDS 10.37

an alpha from one service to another. However, we have usually found that their relative position in

the rating service is to be viable. Short-term alphas are not valid. A minimum time frame of one to

three years is preferable.

8.2.4 Sortino Ratio

Sortino ratio is a variation of the concept of Sharpe or Treynor ratios; instead of measuring it against

any type of risk, Sortino measures it against only downside risk in the portfolio.

rP - rF

SR =

σD

Here,

σD is the standard deviation on the downside i.e., not just the entire deviations in the portfolio but

the downside deviations only.

Sortino ratio penalizes only returns below a specified rate. Sharpe and Sortino measure risk-

adjusted return, but they are different. Sortino ratio differentiates negative volatility from entire

volatility by taking the standard deviation of negative returns, called downside, rather than total

standard deviation.

For example, assume Mutual Fund A has an annualized return of 14% and a downside deviation of

10%. Mutual Fund B has an annualized return of 12% and a downside deviation of 7%. The risk-free

rate is 5.5%. The Sortino ratios for both funds would be calculated as:

14% - 5.5%

Mutual Fund A Sortino = 10% = 0.85

12% - 5.5%

Mutual Fund B Sortino = 7% = 0.93

©The Institute of Chartered Accountants of India

10.38 FINANCIAL SERVICES AND CAPITAL MARKETS

Even though Mutual Fund A is returning 2% more on an annualized basis, it is not earning that return

as efficiently as Mutual Fund B, given their downside deviations. Based on this metric, Mutual Fund

B is the better investment choice.

8.2.5 Portfolio or Fund Alpha

The Alpha is the excess return over broad market, represented by the benchmark. Beta is the

systematic return or return along with the market whereas Alpha is the return over and above the

market generated by active fund management and by taking risks i.e., unsystematic risks. To gauge

the excess return over the market, the index or benchmark is taken to represent the market return

and the excess return over the index / benchmark is the Alpha. Alpha may be positive or negative

i.e., active portfolio calls or portfolio churning can go either way.

8.2.6 Benchmarking

For any performance evaluation, benchmarking is very important. However, the question is, what is

the correct benchmark? In most literature on mutual funds and on communications from AMCs, the

standard / official benchmark is mentioned. For example, for a large cap equity fund, the Nifty 50

Index can be used or if it is a Short-Term Bond Fund, the CRISIL index for Short Term Bond Funds

(STBex) would be mentioned.

9. ADVANTAGES AND DISADVANTAGES OF MUTUAL

FUND

9.1 Advantages

(i) Professional expertise: Except for some large corporate investors with dedicated treasury

departments, it is not possible for an investor to replicate the expertise and professional fund

management skills of MFs. The market is dynamic and portfolio reshuffling calls must be

taken as and when required. Active tracking of portfolio is not the job of the archetype

investor.

(ii) Risk Diversification — Buying shares in a mutual fund is an easy way to diversify your

investments across many securities and asset categories such as equity, debt, and gold,

which helps in spreading the risk - so you won't have all your eggs in one basket. This proves

to be beneficial when the underlying security of a given mutual fund scheme experiences

market headwinds.

©The Institute of Chartered Accountants of India

MUTUAL FUNDS 10.39

With diversification, the risk associated with one asset class is countered by the others. Even

if one investment in the portfolio decreases in value, other investments may not be impacted

and may even increase in value. In other words, you don’t lose out on the entire value of your

investment if a particular component of your portfolio goes through a turbulent period. Thus,

risk diversification is one of the most prominent advantages of investing in mutual funds.

(iii) Operational / Transaction ease: The process of buying and selling an instrument in the

secondary market is quite cumbersome as compared to the process of investing / redeeming

in MFs. For a similar / comparable return, the investor would rather settle for an easier

process.

(iv) Affordability & Convenience (Invest Small Amounts) — For many investors, it could be

more costly to directly purchase all the individual securities held by a single mutual fund. By