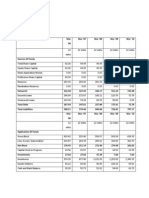

Consolidated Balance Sheet of Divis

------------------- in Rs. Cr. -------------------

Laboratories

Mar '12

Mar '11

Mar '10

Mar '09

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

Total Share Capital

26.55

26.52

26.43

12.95

12.91

Equity Share Capital

26.55

26.52

26.43

12.95

12.91

Share Application Money

0.00

0.00

0.00

0.00

0.00

Preference Share Capital

0.00

0.00

0.00

0.00

0.00

Init. Contribution Settler

0.00

0.00

0.00

0.00

0.00

Preference Share Application Money

0.00

0.00

0.00

0.00

0.00

Sources Of Funds

Employee Stock Opiton

0.00

0.00

0.00

0.00

0.00

Reserves

2,104.98

1,770.96

1,491.38

1,228.43

848.49

Revaluation Reserves

Networth

0.00

2,131.53

0.00

1,797.48

0.00

1,517.81

0.00

1,241.38

0.00

861.40

50.20

20.16

29.85

49.52

82.96

Secured Loans

Unsecured Loans

2.56

2.88

3.00

3.12

3.12

52.76

23.04

32.85

52.64

86.08

Minority Interest

0.00

0.00

0.00

0.00

0.00

Policy Holders Funds

0.00

0.00

0.00

0.00

0.00

Total Debt

Group Share in Joint Venture

Total Liabilities

0.00

0.00

0.00

0.00

0.00

2,184.29

1,820.52

1,550.66

1,294.02

947.48

Mar '12

Mar '11

Mar '10

Mar '09

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

Application Of Funds

Gross Block

1,092.05

885.70

832.93

782.77

642.17

Less: Accum. Depreciation

Net Block

353.64

738.41

295.77

589.93

243.10

589.83

192.90

589.87

145.11

497.06

Capital Work in Progress

181.99

129.33

23.75

19.50

63.08

Investments

477.04

525.64

441.28

171.80

55.57

Inventories

678.96

571.71

498.50

421.28

281.41

Sundry Debtors

495.58

367.41

223.20

266.01

209.45

30.94

14.79

13.69

9.07

7.65

Total Current Assets

1,205.48

953.91

735.39

696.36

498.51

Loans and Advances

153.73

82.03

72.97

71.50

62.15

0.00

2.88

2.77

5.71

6.55

1,359.21

1,038.82

811.13

773.57

567.21

0.00

0.00

0.00

0.00

0.00

Current Liabilities

362.51

301.39

218.91

211.77

198.90

Provisions

209.86

161.80

96.45

48.94

36.56

Total CL & Provisions

572.37

463.19

315.36

260.71

235.46

Net Current Assets

786.84

575.63

495.77

512.86

331.75

Cash and Bank Balance

Fixed Deposits

Total CA, Loans & Advances

Deffered Credit

�Minority Interest

0.00

0.00

0.00

0.00

0.00

Group Share in Joint Venture

0.00

0.00

0.00

0.00

0.00

0.00

2,184.28

0.00

1,820.53

0.00

1,550.63

0.00

1,294.03

0.00

947.46

Miscellaneous Expenses

Total Assets

Contingent Liabilities

101.74

72.70

97.21

86.94

114.67

Book Value (Rs)

160.59

135.56

114.86

191.70

133.43

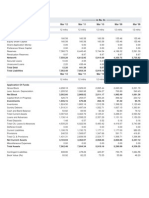

Balance Sheet of Cipla

------------------- in Rs. Cr. ------------------Mar '12

Mar '11

Mar '10

Mar '09

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

Total Share Capital

160.58

160.58

160.58

155.46

155.46

Equity Share Capital

160.58

160.58

160.58

155.46

155.46

Share Application Money

0.00

0.00

0.00

0.00

0.00

Preference Share Capital

Reserves

0.00

7,380.73

0.00

6,443.40

0.00

5,744.54

0.00

4,186.32

0.00

3,591.39

Sources Of Funds

Revaluation Reserves

Networth

8.97

8.97

8.97

8.97

8.97

7,550.28

6,612.95

5,914.09

4,350.75

3,755.82

Secured Loans

10.00

2.95

0.41

2.79

16.98

Unsecured Loans

Total Debt

2.20

12.20

438.44

441.39

4.66

5.07

937.45

940.24

563.55

580.53

7,562.48

7,054.34

5,919.16

5,290.99

4,336.35

Mar '12

Mar '11

Mar '10

Mar '09

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

Gross Block

4,298.18

3,929.00

2,895.44

2,693.29

2,201.79

Less: Accum. Depreciation

Net Block

1,295.52

3,002.66

1,060.98

2,868.02

884.27

2,011.17

700.80

1,992.49

540.43

1,661.36

Capital Work in Progress

Investments

420.73

1,035.15

253.07

570.28

684.24

265.10

366.32

81.32

233.12

94.75

Inventories

Sundry Debtors

1,824.50

1,519.31

1,883.16

1,497.04

1,512.58

1,552.71

1,398.32

1,837.15

1,120.49

1,393.91

Total Liabilities

Application Of Funds

Cash and Bank Balance

53.82

83.56

60.32

52.84

79.12

Total Current Assets

3,397.63

3,463.76

3,125.61

3,288.31

2,593.52

Loans and Advances

1,136.14

2,558.23

2,357.29

1,131.10

1,150.30

1.48

0.57

0.52

0.16

0.16

4,535.25

6,022.56

5,483.42

4,419.57

3,743.98

Fixed Deposits

Total CA, Loans & Advances

�Deffered Credit

Current Liabilities

Provisions

0.00

0.00

0.00

0.00

0.00

1,190.78

1,150.72

1,177.11

1,177.00

980.05

240.53

1,508.87

1,347.66

391.71

416.81

Total CL & Provisions

1,431.31

2,659.59

2,524.77

1,568.71

1,396.86

Net Current Assets

3,103.94

3,362.97

2,958.65

2,850.86

2,347.12

Miscellaneous Expenses

Total Assets

0.00

7,562.48

0.00

7,054.34

0.00

5,919.16

0.00

5,290.99

0.00

4,336.35

608.80

478.26

423.87

730.75

1,664.58

93.92

82.25

73.55

55.86

48.20

Contingent Liabilities

Book Value (Rs)

Balance Sheet of Dr

Reddys

------------------- in Rs. Cr. -------------------

Laboratories

Mar '12

Mar '11

Mar '10

Mar '09

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

Total Share Capital

84.80

84.60

84.40

84.20

84.09

Equity Share Capital

Share Application Money

84.80

0.00

84.60

0.00

84.40

0.00

84.20

0.00

84.09

0.00

Preference Share Capital

Reserves

0.00

6,633.00

0.00

5,935.60

0.00

5,830.20

0.00

5,174.90

0.00

4,727.72

Revaluation Reserves

Networth

0.00

6,717.80

0.00

6,020.20

0.00

5,914.60

0.00

5,259.10

0.00

4,811.81

Sources Of Funds

Secured Loans

0.50

0.70

0.80

2.60

3.40

1,532.90

1,533.40

8,251.20

1,444.10

1,444.80

7,465.00

562.40

563.20

6,477.80

637.70

640.30

5,899.40

458.91

462.31

5,274.12

Mar '12

Mar '11

Mar '10

Mar '09

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

Gross Block

3,507.80

3,025.00

2,425.70

2,157.30

1,750.21

Less: Accum. Depreciation

Net Block

1,611.00

1,896.80

1,334.00

1,691.00

1,110.10

1,315.60

946.50

1,210.80

762.80

987.41

Capital Work in Progress

Investments

637.60

2,477.70

570.40

2,462.00

745.40

2,652.70

411.20

1,865.10

245.71

2,080.71

Inventories

1,326.70

1,063.20

897.40

735.10

640.93

Sundry Debtors

Cash and Bank Balance

1,943.50

93.10

1,770.50

66.20

1,060.50

47.90

1,419.70

84.30

897.71

67.19

Total Current Assets

3,363.30

2,899.90

2,005.80

2,239.10

1,605.83

Unsecured Loans

Total Debt

Total Liabilities

Application Of Funds

�Loans and Advances

Fixed Deposits

1,291.40

755.90

1,663.80

0.00

1,321.40

320.10

1,331.20

300.10

1,272.02

470.15

Total CA, Loans & Advances

5,410.60

4,563.70

3,647.30

3,870.40

3,348.00

0.00

0.00

0.00

0.00

0.00

1,534.30

1,565.20

1,543.80

1,163.30

786.36

637.20

256.90

339.40

294.80

601.38

Total CL & Provisions

Net Current Assets

2,171.50

3,239.10

1,822.10

2,741.60

1,883.20

1,764.10

1,458.10

2,412.30

1,387.74

1,960.26

Miscellaneous Expenses

Total Assets

0.00

8,251.20

0.00

7,465.00

0.00

6,477.80

0.00

5,899.40

0.00

5,274.09

Contingent Liabilities

2,018.90

1,526.00

2,016.10

1,934.80

1,892.55

396.19

355.69

350.30

312.17

286.1

Deffered Credit

Current Liabilities

Provisions

Book Value (Rs)

Balance Sheet of Biocon

------------------- in Rs. Cr. ------------------Mar '12

Mar '11

Mar '10

Mar '09

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

Total Share Capital

100.00

100.00

100.00

100.00

50.00

Equity Share Capital

100.00

100.00

100.00

100.00

50.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

1,995.50

1,845.86

1,465.34

1,273.93

1,277.25

0.90

0.95

0.95

0.95

0.95

2,096.40

1,946.81

1,566.29

1,374.88

1,328.20

Sources Of Funds

Share Application Money

Preference Share Capital

Reserves

Revaluation Reserves

Networth

Secured Loans

5.60

74.06

89.68

162.61

143.57

141.70

147.30

94.57

168.63

102.12

191.80

1.33

163.94

0.32

143.89

2,243.70

Mar '12

2,115.44

Mar '11

1,758.09

Mar '10

1,538.82

Mar '09

1,472.09

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

1,197.10

1,105.91

1,020.21

987.50

880.11

Less: Accum. Depreciation

Net Block

512.10

685.00

426.22

679.69

341.81

678.40

273.33

714.17

200.65

679.46

Capital Work in Progress

Investments

113.80

657.00

103.29

485.82

58.33

418.64

37.69

346.69

64.63

477.26

Inventories

340.40

274.74

244.80

194.52

167.74

Unsecured Loans

Total Debt

Total Liabilities

Application Of Funds

Gross Block

�Sundry Debtors

Cash and Bank Balance

445.00

37.80

418.10

185.20

383.64

77.11

310.17

5.29

225.66

4.91

Total Current Assets

823.20

878.04

705.55

509.98

398.31

Loans and Advances

543.10

412.41

407.33

270.33

123.55

Fixed Deposits

2.20

25.03

0.01

0.76

3.21

1,368.50

1,315.48

1,112.89

781.07

525.07

Deffered Credit

Current Liabilities

0.00

431.80

0.00

358.64

0.00

426.92

0.00

264.79

0.00

206.18

Provisions

148.80

110.19

83.25

76.00

68.17

Total CL & Provisions

Net Current Assets

580.60

787.90

468.83

846.65

510.17

602.72

340.79

440.28

274.35

250.72

0.00

2,243.70

0.00

2,115.45

0.00

1,758.09

0.00

1,538.83

0.00

1,472.07

Contingent Liabilities

204.40

154.90

261.74

173.88

146.17

Book Value (Rs)

104.78

97.29

78.27

68.70

132.72

Total CA, Loans & Advances

Miscellaneous Expenses

Total Assets

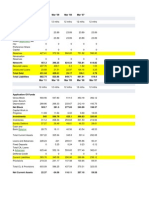

Balance Sheet of

Aurobindo Pharma

------------------- in Rs. Cr. ------------------Mar '12

Mar '11

Mar '10

Mar '09

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

Total Share Capital

29.11

29.11

27.86

26.88

26.88

Equity Share Capital

29.11

29.11

27.86

26.88

26.88

Share Application Money

Preference Share Capital

Reserves

0.00

0.00

2,464.06

0.00

0.00

2,540.50

0.00

0.00

1,886.50

0.00

0.00

1,293.95

0.00

0.00

1,193.72

Revaluation Reserves

Networth

0.00

2,493.17

0.00

2,569.61

0.00

1,914.36

0.00

1,320.83

0.00

1,220.60

Secured Loans

Unsecured Loans

Total Debt

2,346.33

95.62

2,441.95

1,038.01

1,279.71

2,317.72

702.25

1,242.53

1,944.78

813.02

1,301.66

2,114.68

581.87

1,173.78

1,755.65

Total Liabilities

4,935.12

4,887.33

3,859.14

3,435.51

2,976.25

Mar '12

Mar '11

Mar '10

Mar '09

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

Gross Block

2,359.40

1,955.17

1,526.88

1,258.70

1,132.01

Less: Accum. Depreciation

Net Block

732.66

1,626.74

605.28

1,349.89

481.54

1,045.34

385.83

872.87

304.93

827.08

563.56

582.92

499.47

285.96

124.69

Sources Of Funds

Application Of Funds

Capital Work in Progress

�Investments

629.00

493.09

379.24

277.74

290.04

Inventories

Sundry Debtors

1,219.26

1,426.28

1,261.02

1,480.71

944.82

1,151.35

735.52

1,105.67

651.23

798.97

Cash and Bank Balance

Total Current Assets

14.01

2,659.55

4.21

2,745.94

4.02

2,100.19

79.03

1,920.22

3.42

1,453.62

677.41

0.12

568.61

118.12

593.67

0.54

696.60

7.91

584.78

235.90

Total CA, Loans & Advances

Deffered Credit

3,337.08

0.00

3,432.67

0.00

2,694.40

0.00

2,624.73

0.00

2,274.30

0.00

Current Liabilities

Provisions

1,159.59

61.67

913.82

57.42

719.94

39.37

595.02

30.77

506.06

33.80

Total CL & Provisions

Net Current Assets

1,221.26

2,115.82

971.24

2,461.43

759.31

1,935.09

625.79

1,998.94

539.86

1,734.44

Miscellaneous Expenses

Total Assets

0.00

4,935.12

0.00

4,887.33

0.00

3,859.14

0.00

3,435.51

0.00

2,976.25

Contingent Liabilities

74.59

219.10

139.04

90.03

180.41

Book Value (Rs)

85.64

88.27

343.51

245.67

227.02

Loans and Advances

Fixed Deposits

P&L A/c

�Profit & Loss account of Divis Laboratories

------------------- in Rs. Cr. ------------------Mar '12

Mar '11

Mar '10

Mar '09

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

1,862.74

1,323.69

937.20

1,201.07

1,043.29

Income

Sales Turnover

Excise Duty

17.92

13.99

5.57

7.71

7.90

Net Sales

1,844.82

1,309.70

931.63

1,193.36

1,035.39

Other Income

Stock Adjustments

Total Income

Expenditure

64.34

10.89

1,920.05

34.12

-34.59

1,309.23

23.94

99.07

1,054.64

-13.85

98.54

1,278.05

-6.04

32.16

1,061.51

Raw Materials

Power & Fuel Cost

798.77

86.13

508.58

62.65

410.06

45.13

557.81

49.93

458.40

38.31

Employee Cost

Other Manufacturing Expenses

145.16

22.39

112.06

15.66

93.22

10.31

89.34

10.35

65.92

10.47

Selling and Admin Expenses

Miscellaneous Expenses

82.17

23.06

56.26

19.25

37.51

13.15

43.59

13.64

47.25

10.61

Preoperative Exp Capitalised

Total Expenses

0.00

1,157.68

Mar '12

0.00

774.46

Mar '11

0.00

609.38

Mar '10

0.00

764.66

Mar '09

0.00

630.96

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

Operating Profit

698.03

500.65

421.32

527.24

436.59

PBDIT

762.37

534.77

445.26

513.39

430.55

4.34

2.19

2.76

7.23

10.18

PBDT

Depreciation

758.03

62.03

532.58

53.35

442.50

51.45

506.16

47.82

420.37

35.65

Other Written Off

Profit Before Tax

0.00

696.00

0.00

479.23

0.00

391.05

0.00

458.34

0.00

384.72

Extra-ordinary items

PBT (Post Extra-ord Items)

-1.11

694.89

-0.01

479.22

-0.10

390.95

0.16

458.50

-1.59

383.13

Tax

Reported Net Profit

148.05

545.97

43.48

435.57

44.14

344.20

34.09

424.46

29.54

353.56

Total Value Addition

Preference Dividend

Equity Dividend

358.90

0.00

172.55

265.88

0.00

132.60

199.33

0.00

79.29

206.86

0.00

38.91

172.56

0.00

25.82

27.99

21.51

13.17

6.62

4.39

1,327.34

1,325.95

1,321.44

647.58

645.57

Interest

Corporate Dividend Tax

Per share data (annualised)

Shares in issue (lakhs)

�Earning Per Share (Rs)

Equity Dividend (%)

Book Value (Rs)

41.13

32.85

26.05

65.54

54.77

650.00

163.85

500.00

137.87

300.00

116.70

300.00

194.85

200.00

135.38

Profit & Loss account of Cipla

------------------- in Rs. Cr. ------------------Mar '12

Mar '11

Mar '10

Mar '09

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

7,074.73

97.23

6,977.50

6,368.06

48.71

6,319.35

5,657.85

52.16

5,605.69

5,295.33

61.04

5,234.29

4,293.95

90.66

4,203.29

96.50

109.80

125.71

-139.51

134.92

-11.24

7,062.76

125.74

6,554.89

184.09

5,915.49

113.55

5,208.33

41.37

4,379.58

2,903.95

3,085.90

2,687.54

2,513.11

2,162.48

188.18

164.42

92.15

91.71

96.90

644.79

259.56

1,217.79

464.20

270.08

999.68

318.87

259.67

867.98

271.33

262.65

887.28

255.45

233.90

547.10

154.27

179.49

182.64

76.92

96.66

0.00

0.00

0.00

0.00

0.00

5,368.54

Mar '12

5,163.77

Mar '11

4,408.85

Mar '10

4,103.00

Mar '09

3,392.49

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

Operating Profit

1,597.72

1,281.32

1,380.93

1,244.84

852.17

PBDIT

Interest

PBDT

1,694.22

12.13

1,682.09

1,391.12

10.87

1,380.25

1,506.64

28.30

1,478.34

1,105.33

52.23

1,053.10

987.09

18.05

969.04

Income

Sales Turnover

Excise Duty

Net Sales

Other Income

Stock Adjustments

Total Income

Expenditure

Raw Materials

Power & Fuel Cost

Employee Cost

Other Manufacturing Expenses

Selling and Admin Expenses

Miscellaneous Expenses

Preoperative Exp Capitalised

Total Expenses

Depreciation

261.08

228.86

165.25

151.79

130.68

Other Written Off

0.00

0.00

0.00

0.00

0.00

Profit Before Tax

1,421.01

1,151.39

1,313.09

901.31

838.36

0.45

0.00

11.90

0.00

0.00

PBT (Post Extra-ord Items)

Tax

Reported Net Profit

1,421.46

297.50

1,123.96

1,151.39

191.00

960.39

1,324.99

243.50

1,081.49

901.31

124.50

776.81

838.36

136.93

701.43

Total Value Addition

Preference Dividend

2,464.59

0.00

2,077.87

0.00

1,721.31

0.00

1,589.89

0.00

1,230.01

0.00

Extra-ordinary items

�Equity Dividend

Corporate Dividend Tax

Per share data (annualised)

Shares in issue (lakhs)

Earning Per Share (Rs)

Equity Dividend (%)

Book Value (Rs)

160.58

26.05

224.81

36.72

160.58

26.67

155.46

26.42

155.46

26.42

8,029.21

14.00

8,029.21

11.96

8,029.21

13.47

7,772.91

9.99

7,772.91

9.02

100.00

140.00

100.00

100.00

100.00

93.92

82.25

73.55

55.86

48.20

Profit & Loss account of Dr Reddys

Laboratories

------------------- in Rs. Cr. ------------------Mar '12

Mar '11

Mar '10

Mar '09

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

Sales Turnover

6,780.20

5,285.80

4,469.60

4,080.40

3,428.40

Excise Duty

Net Sales

93.90

6,686.30

97.30

5,188.50

74.00

4,395.60

80.90

3,999.50

84.51

3,343.89

-191.90

117.00

254.00

212.20

197.29

104.80

6,599.20

79.00

5,384.50

117.30

4,766.90

64.10

4,275.80

93.87

3,635.05

Income

Other Income

Stock Adjustments

Total Income

Expenditure

Raw Materials

2,122.90

1,749.50

1,599.40

1,534.00

1,347.33

Power & Fuel Cost

177.50

144.60

104.10

90.00

77.12

Employee Cost

831.20

702.70

516.40

412.50

366.28

Other Manufacturing Expenses

163.10

129.50

117.30

105.90

130.35

1,554.40

1,256.70

1,036.60

1,117.90

896.54

80.30

65.00

50.60

45.30

37.44

0.00

0.00

0.00

0.00

0.00

4,929.40

Mar '12

4,048.00

Mar '11

3,424.40

Mar '10

3,305.60

Mar '09

2,855.06

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

Operating Profit

1,861.70

1,219.50

1,088.50

758.00

582.70

PBDIT

1,669.80

1,336.50

1,342.50

970.20

779.99

69.20

9.90

16.00

27.40

14.69

PBDT

Depreciation

1,600.60

301.10

1,326.60

247.90

1,326.50

222.40

942.80

193.60

765.30

161.99

Other Written Off

Profit Before Tax

40.30

1,259.20

26.80

1,051.90

19.30

1,084.80

19.70

729.50

20.71

582.60

-0.30

-0.40

-0.10

-0.10

-0.06

1,258.90

1,051.50

1,084.70

729.40

582.54

346.80

158.50

238.70

168.60

108.88

Selling and Admin Expenses

Miscellaneous Expenses

Preoperative Exp Capitalised

Total Expenses

Interest

Extra-ordinary items

PBT (Post Extra-ord Items)

Tax

�Reported Net Profit

912.40

893.40

846.10

560.90

475.22

Total Value Addition

2,806.50

2,298.50

1,825.00

1,771.60

1,507.73

Preference Dividend

0.00

0.00

0.00

0.00

0.00

233.10

190.40

190.00

105.30

63.06

37.80

115.20

31.60

17.80

10.72

1,695.60

53.81

1,692.53

52.78

1,688.45

50.11

1,684.69

33.29

1,681.73

28.26

Equity Dividend (%)

275.00

225.00

225.00

125.00

75.00

Book Value (Rs)

396.19

355.69

350.30

312.17

286.12

Equity Dividend

Corporate Dividend Tax

Per share data (annualised)

Shares in issue (lakhs)

Earning Per Share (Rs)

Profit & Loss account of Biocon

------------------- in Rs. Cr. ------------------Mar '12

Mar '11

Mar '10

Mar '09

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

Sales Turnover

Excise Duty

1,605.30

50.00

1,365.29

38.96

1,158.35

29.90

929.90

25.69

860.23

26.24

Net Sales

1,555.30

1,326.33

1,128.45

904.21

833.99

66.60

293.00

94.70

-15.59

409.77

41.40

1,663.30

27.84

1,647.17

38.95

1,262.10

26.77

915.39

11.96

1,255.72

818.90

694.62

608.77

442.85

410.66

Income

Other Income

Stock Adjustments

Total Income

Expenditure

Raw Materials

Power & Fuel Cost

97.70

81.63

67.25

71.22

76.12

191.50

145.43

99.84

80.42

66.81

19.00

16.29

12.32

13.67

12.79

120.40

15.70

0.00

1,263.20

Mar '12

86.62

12.38

0.00

1,036.97

Mar '11

105.37

10.60

0.00

904.15

Mar '10

102.71

10.83

0.00

721.70

Mar '09

87.92

15.38

0.00

669.68

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

Operating Profit

333.50

317.20

263.25

209.28

176.27

PBDIT

Interest

400.10

1.70

610.20

2.38

357.95

1.99

193.69

4.94

586.04

3.09

PBDT

398.40

607.82

355.96

188.75

582.95

94.00

90.70

79.73

74.28

69.00

Employee Cost

Other Manufacturing Expenses

Selling and Admin Expenses

Miscellaneous Expenses

Preoperative Exp Capitalised

Total Expenses

Depreciation

Other Written Off

0.00

0.00

0.00

0.00

0.00

Profit Before Tax

304.40

517.12

276.23

114.47

513.95

�Extra-ordinary items

PBT (Post Extra-ord Items)

0.00

304.40

0.00

517.12

0.00

276.23

7.73

122.20

-68.39

445.56

Tax

Reported Net Profit

48.90

255.50

57.87

459.25

27.87

248.36

10.40

111.80

10.64

434.92

Total Value Addition

Preference Dividend

Equity Dividend

444.30

0.00

100.00

342.35

0.00

90.00

295.38

0.00

70.00

278.85

0.00

60.00

259.01

0.00

50.00

16.20

9.08

7.41

10.20

8.50

2,000.00

12.78

2,000.00

22.96

2,000.00

12.42

2,000.00

5.59

1,000.00

43.49

Equity Dividend (%)

100.00

90.00

70.00

60.00

100.00

Book Value (Rs)

104.78

97.29

78.27

68.70

132.72

Corporate Dividend Tax

Per share data (annualised)

Shares in issue (lakhs)

Earning Per Share (Rs)

Profit & Loss account of Aurobindo Pharma

------------------- in Rs. Cr. ------------------Mar '12

Mar '11

Mar '10

Mar '09

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

4,378.73

94.10

4,284.63

4,229.99

99.54

4,130.45

3,319.60

67.54

3,252.06

2,885.25

90.35

2,794.90

2,351.12

116.49

2,234.63

-525.06

17.61

112.22

-193.56

155.32

-89.87

3,669.70

136.37

4,284.43

147.48

3,511.76

28.94

2,630.28

31.18

2,421.13

2,599.02

225.54

2,487.19

184.55

2,010.02

135.48

1,750.75

118.32

1,491.36

96.32

Employee Cost

Other Manufacturing Expenses

364.10

75.61

303.60

79.03

232.62

59.14

177.18

46.08

148.70

43.04

Selling and Admin Expenses

Miscellaneous Expenses

234.56

74.07

207.53

37.22

186.29

18.71

195.12

19.52

120.96

47.90

Preoperative Exp Capitalised

Total Expenses

0.00

3,572.90

Mar '12

0.00

3,299.12

Mar '11

0.00

2,642.26

Mar '10

0.00

2,306.97

Mar '09

0.00

1,948.28

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

Income

Sales Turnover

Excise Duty

Net Sales

Other Income

Stock Adjustments

Total Income

Expenditure

Raw Materials

Power & Fuel Cost

Operating Profit

621.86

967.70

757.28

516.87

317.53

PBDIT

96.80

985.31

869.50

323.31

472.85

Interest

93.11

55.02

62.58

81.20

59.01

3.69

930.29

806.92

242.11

413.84

PBDT

�Depreciation

Other Written Off

Profit Before Tax

Extra-ordinary items

142.94

125.04

95.46

82.41

74.60

0.00

-139.25

-16.52

0.00

805.25

-0.95

0.00

711.46

-1.61

0.00

159.70

4.29

0.00

339.24

5.60

PBT (Post Extra-ord Items)

-155.77

804.30

709.85

163.99

344.84

Tax

Reported Net Profit

-113.16

-42.61

210.50

593.80

184.09

525.76

35.45

128.54

54.06

290.78

Total Value Addition

973.88

811.93

632.24

556.22

456.92

Preference Dividend

Equity Dividend

Corporate Dividend Tax

Per share data (annualised)

Shares in issue (lakhs)

Earning Per Share (Rs)

Equity Dividend (%)

Book Value (Rs)

0.00

0.00

0.00

0.00

0.00

29.11

4.72

58.72

9.64

27.74

4.67

24.20

4.11

17.57

2.98

2,911.21

-1.46

2,911.21

20.40

557.29

94.34

537.65

23.91

537.65

54.08

100.00

200.00

100.00

90.00

65.00

85.64

88.27

343.51

245.67

227.02

Financial Ratios

�Consolidated Key Financial Ratios of Divis

Laboratories

------------------- in Rs. Cr. -------------------

Mar

'12

Mar '11

Mar '10

Mar '09

Mar '08

2.00

2.00

2.00

2.00

2.00

--

--

--

--

--

Investment Valuation Ratios

Face Value

Dividend Per Share

Operating Profit Per Share (Rs)

52.01

37.40

31.20

80.89

66.59

140.43

--

98.90

133.45

71.43

112.51

182.70

186.28

160.33

128.33

Bonus in Equity Capital

Profitability Ratios

49.42

49.47

49.64

1.15

1.16

Operating Profit Margin(%)

37.03

37.82

43.67

44.27

41.53

Profit Before Interest And Tax Margin(%)

Gross Profit Margin(%)

32.72

33.70

32.96

33.74

37.28

38.21

39.57

40.22

37.66

38.08

Cash Profit Margin(%)

Adjusted Cash Margin(%)

Net Profit Margin(%)

31.00

31.00

27.77

35.88

35.88

31.97

40.10

40.10

35.17

41.93

41.93

34.64

38.50

36.65

33.21

Adjusted Net Profit Margin(%)

Return On Capital Employed(%)

27.77

31.33

31.97

26.01

35.17

24.66

34.64

38.03

33.21

42.03

Return On Net Worth(%)

Adjusted Return on Net Worth(%)

25.01

25.01

23.88

23.83

22.42

22.04

33.56

36.49

40.35

39.52

Return on Assets Excluding Revaluations

160.59

135.56

114.86

191.70

133.43

Return on Assets Including Revaluations

Return on Long Term Funds(%)

Liquidity And Solvency Ratios

160.59

31.33

135.56

26.21

114.86

24.75

191.70

38.09

133.43

42.88

Current Ratio

2.37

2.41

2.98

2.92

2.08

Quick Ratio

Debt Equity Ratio

1.19

0.02

1.13

0.01

1.17

0.02

1.33

0.04

1.20

0.10

Long Term Debt Equity Ratio

Debt Coverage Ratios

0.02

0.01

0.02

0.04

0.08

182.83

714.45

321.35

122.73

48.54

0.02

0.01

0.02

0.04

0.10

Financial Charges Coverage Ratio

199.42

239.20

156.81

75.02

43.31

Financial Charges Coverage Ratio Post Tax

Management Efficiency Ratios

160.05

220.05

142.67

65.60

39.34

Inventory Turnover Ratio

2.77

2.54

1.96

2.96

3.80

Debtors Turnover Ratio

Investments Turnover Ratio

4.32

2.77

4.44

2.54

3.86

1.96

4.98

2.96

5.58

3.80

Fixed Assets Turnover Ratio

1.71

1.48

1.13

1.51

1.61

Total Assets Turnover Ratio

0.85

0.70

0.59

0.91

1.09

Asset Turnover Ratio

1.71

1.48

1.13

1.51

1.61

---

126.40

17.21

98.54

47.27

80.12

60.96

89.42

36.15

151.96

174.21

209.89

156.05

115.39

Net Operating Profit Per Share (Rs)

Free Reserves Per Share (Rs)

Interest Cover

Total Debt to Owners Fund

Average Raw Material Holding

Average Finished Goods Held

Number of Days In Working Capital

�Profit & Loss Account Ratios

Material Cost Composition

Imported Composition of Raw Materials

Consumed

42.98

38.91

43.59

47.25

44.42

--

--

--

--

--

Selling Distribution Cost Composition

--

2.40

2.11

1.67

2.33

Expenses as Composition of Total Sales

Cash Flow Indicator Ratios

--

--

--

--

--

Dividend Payout Ratio Net Profit

Dividend Payout Ratio Cash Profit

37.60

33.68

35.89

31.92

27.16

23.48

10.92

9.73

8.69

7.73

Earning Retention Ratio

Cash Earning Retention Ratio

62.40

66.32

64.03

68.02

72.38

76.18

89.96

90.98

91.13

92.13

0.09

0.05

0.08

0.10

0.22

AdjustedCash Flow Times

Key Financial Ratios of Cipla

Mar

'12

Mar '11

Mar '10

Mar '09

Mar '08

Face Value

Dividend Per Share

Operating Profit Per Share (Rs)

Net Operating Profit Per Share (Rs)

Free Reserves Per Share (Rs)

Bonus in Equity Capital

Profitability Ratios

2.00

2.00

19.90

86.90

91.92

94.44

2.00

2.80

15.96

78.70

80.25

94.44

2.00

2.00

17.20

69.82

71.54

94.44

2.00

2.00

16.02

67.34

53.86

97.55

2.00

2.00

10.96

54.08

46.20

97.55

Operating Profit Margin(%)

Profit Before Interest And Tax Margin(%)

Gross Profit Margin(%)

Cash Profit Margin(%)

Adjusted Cash Margin(%)

Net Profit Margin(%)

Adjusted Net Profit Margin(%)

Return On Capital Employed(%)

Return On Net Worth(%)

Adjusted Return on Net Worth(%)

Return on Assets Excluding Revaluations

Return on Assets Including Revaluations

Return on Long Term Funds(%)

Liquidity And Solvency Ratios

22.89

18.94

19.15

19.37

19.37

15.92

15.92

18.74

14.90

14.67

93.92

94.04

18.77

20.27

16.41

16.65

18.25

18.25

14.98

14.98

16.22

14.54

14.25

82.25

82.36

17.29

24.63

21.32

21.68

21.11

21.11

18.97

18.97

22.16

18.31

17.57

73.55

73.66

22.16

23.78

20.52

20.88

21.75

21.75

14.58

14.58

22.39

17.89

23.17

55.86

55.97

26.79

20.27

16.90

17.16

17.85

17.85

16.43

16.43

18.17

18.72

16.85

48.20

48.32

18.24

3.12

1.89

---

1.94

1.56

0.07

--

2.17

1.57

---

1.81

1.93

0.22

0.02

2.62

1.88

0.15

0.15

Investment Valuation Ratios

Current Ratio

Quick Ratio

Debt Equity Ratio

Long Term Debt Equity Ratio

Debt Coverage Ratios

�Interest Cover

Total Debt to Owners Fund

Financial Charges Coverage Ratio

Financial Charges Coverage Ratio Post Tax

Management Efficiency Ratios

116.74

0.00

138.27

115.18

222.40

0.07

126.22

110.41

57.08

0.00

52.13

45.05

35.92

0.22

25.56

18.78

67.27

0.15

50.81

47.10

Inventory Turnover Ratio

Debtors Turnover Ratio

3.88

4.63

3.73

4.14

4.18

3.31

3.79

3.24

3.83

3.47

Investments Turnover Ratio

3.88

3.73

4.18

3.79

3.83

Fixed Assets Turnover Ratio

1.62

1.61

1.94

1.94

1.91

Total Assets Turnover Ratio

0.92

0.90

0.95

0.99

0.97

Asset Turnover Ratio

1.62

1.61

1.94

1.94

1.91

Average Raw Material Holding

177.56

110.90

113.47

203.30

181.28

Average Finished Goods Held

39.66

43.20

41.38

41.54

37.36

160.15

191.58

190.01

196.07

201.02

Material Cost Composition

Imported Composition of Raw Materials

Consumed

Selling Distribution Cost Composition

41.61

48.83

47.94

48.01

51.44

38.68

40.63

43.85

42.63

44.03

6.66

6.10

5.82

7.17

6.77

Expenses as Composition of Total Sales

Cash Flow Indicator Ratios

53.43

54.08

54.54

56.55

53.65

Dividend Payout Ratio Net Profit

16.60

27.23

17.31

23.41

25.92

Dividend Payout Ratio Cash Profit

13.47

21.99

15.01

19.58

21.85

Earning Retention Ratio

83.14

72.22

81.97

81.93

71.20

Cash Earning Retention Ratio

AdjustedCash Flow Times

86.36

0.01

77.65

0.38

84.44

0.00

84.30

0.81

76.14

0.76

Mar

'12

Mar '11

Mar '10

Mar '09

Mar '08

Earnings Per Share

14.00

11.96

13.47

9.99

9.02

Book Value

93.92

82.25

73.55

55.86

48.20

Mar

'12

Mar '11

Mar '10

Mar '09

Mar '08

5.00

13.75

109.80

5.00

11.25

72.05

5.00

11.25

64.47

5.00

6.25

44.99

5.00

3.75

34.65

Number of Days In Working Capital

Profit & Loss Account Ratios

Key Financial Ratios of Dr Reddys

Laboratories

Investment Valuation Ratios

Face Value

Dividend Per Share

Operating Profit Per Share (Rs)

�Net Operating Profit Per Share (Rs)

394.33

306.55

260.33

237.40

198.84

Free Reserves Per Share (Rs)

380.00

346.32

341.13

304.97

278.46

65.87

66.03

66.19

66.34

66.43

Operating Profit Margin(%)

27.84

23.50

24.76

18.95

17.42

Profit Before Interest And Tax Margin(%)

23.11

18.31

18.92

13.28

12.01

Gross Profit Margin(%)

23.34

18.72

19.70

14.11

12.58

Cash Profit Margin(%)

22.38

21.99

22.17

19.10

17.59

Adjusted Cash Margin(%)

22.38

21.99

22.17

19.10

17.59

Net Profit Margin(%)

13.51

16.84

18.48

13.20

13.57

Adjusted Net Profit Margin(%)

13.51

16.84

18.48

13.20

13.57

Return On Capital Employed(%)

19.22

14.20

15.87

13.46

10.55

Return On Net Worth(%)

13.58

14.84

14.30

10.66

9.87

Bonus in Equity Capital

Profitability Ratios

Adjusted Return on Net Worth(%)

17.42

14.81

13.07

11.37

9.00

Return on Assets Excluding Revaluations

396.19

355.69

350.30

312.17

286.12

Return on Assets Including Revaluations

396.19

355.69

350.30

312.17

286.12

21.93

16.22

17.36

15.08

11.54

Current Ratio

1.70

1.66

1.49

1.85

1.82

Quick Ratio

1.84

1.91

1.45

2.13

1.94

Debt Equity Ratio

0.23

0.24

0.10

0.12

0.10

Long Term Debt Equity Ratio

0.08

0.09

--

--

--

25.22

220.90

250.76

53.32

85.79

Return on Long Term Funds(%)

Liquidity And Solvency Ratios

Debt Coverage Ratios

Interest Cover

Total Debt to Owners Fund

0.23

0.24

0.10

0.12

0.10

Financial Charges Coverage Ratio

27.86

134.85

79.36

36.78

50.33

Financial Charges Coverage Ratio Post Tax

19.12

118.99

68.99

29.26

45.79

Inventory Turnover Ratio

5.54

5.36

5.39

6.09

5.90

Debtors Turnover Ratio

3.60

3.67

3.54

3.45

3.42

Investments Turnover Ratio

5.54

5.36

5.39

6.09

5.90

Fixed Assets Turnover Ratio

1.94

1.75

1.86

1.91

1.97

Total Assets Turnover Ratio

0.82

0.70

0.69

0.69

0.64

Asset Turnover Ratio

1.94

1.75

1.86

1.91

1.97

Average Raw Material Holding

109.87

134.48

104.48

108.84

104.05

Average Finished Goods Held

19.27

22.23

18.28

15.37

14.65

174.40

190.22

144.48

217.13

211.04

Material Cost Composition

31.74

33.71

36.38

38.35

40.29

Imported Composition of Raw Materials

Consumed

27.05

42.76

30.36

38.75

26.37

9.34

9.19

10.09

11.21

11.22

73.83

72.23

71.92

78.09

70.77

Dividend Payout Ratio Net Profit

29.69

34.20

26.19

21.94

15.52

Dividend Payout Ratio Cash Profit

21.60

26.16

20.37

15.90

11.21

Earning Retention Ratio

76.86

65.74

71.35

79.43

82.97

Management Efficiency Ratios

Number of Days In Working Capital

Profit & Loss Account Ratios

Selling Distribution Cost Composition

Expenses as Composition of Total Sales

Cash Flow Indicator Ratios

�Cash Earning Retention Ratio

AdjustedCash Flow Times

Earnings Per Share

Book Value

82.08

73.81

78.17

84.84

88.02

1.01

1.24

0.55

0.79

0.75

Mar

'12

Mar '11

Mar '10

Mar '09

Mar '08

53.81

52.78

50.11

33.29

28.26

396.19

355.69

350.30

312.17

286.12

Mar

'12

Mar '11

Mar '10

Mar '09

Mar '08

5.00

5.00

16.68

77.77

95.15

93.47

5.00

4.50

15.86

66.32

88.18

93.47

5.00

3.50

13.16

56.42

70.17

93.47

5.00

3.00

10.46

45.21

61.63

93.47

5.00

5.00

17.63

83.40

124.09

86.94

21.44

15.00

15.39

20.30

20.30

16.00

16.00

12.52

12.19

10.98

104.78

104.82

13.02

23.91

14.21

17.07

32.88

32.88

28.82

28.82

23.34

23.60

22.26

97.29

97.34

24.45

23.32

14.92

16.26

27.18

27.18

20.20

20.20

16.18

15.86

16.25

78.27

78.31

17.42

23.14

13.66

14.92

28.09

28.09

11.31

11.31

14.21

8.13

14.79

68.70

68.74

15.21

21.13

11.51

12.86

27.89

27.89

46.70

46.70

13.90

32.76

14.37

132.72

132.82

14.80

2.03

1.76

0.07

0.03

2.06

2.21

0.09

0.04

1.53

1.69

0.12

0.04

1.44

1.71

0.12

0.05

1.16

1.30

0.11

0.04

165.18

488.04

241.91

55.30

92.93

Key Financial Ratios of Biocon

Investment Valuation Ratios

Face Value

Dividend Per Share

Operating Profit Per Share (Rs)

Net Operating Profit Per Share (Rs)

Free Reserves Per Share (Rs)

Bonus in Equity Capital

Profitability Ratios

Operating Profit Margin(%)

Profit Before Interest And Tax Margin(%)

Gross Profit Margin(%)

Cash Profit Margin(%)

Adjusted Cash Margin(%)

Net Profit Margin(%)

Adjusted Net Profit Margin(%)

Return On Capital Employed(%)

Return On Net Worth(%)

Adjusted Return on Net Worth(%)

Return on Assets Excluding Revaluations

Return on Assets Including Revaluations

Return on Long Term Funds(%)

Liquidity And Solvency Ratios

Current Ratio

Quick Ratio

Debt Equity Ratio

Long Term Debt Equity Ratio

Debt Coverage Ratios

Interest Cover

�Total Debt to Owners Fund

0.07

0.09

0.12

0.12

0.11

Financial Charges Coverage Ratio

220.47

245.71

182.87

59.32

88.45

Financial Charges Coverage Ratio Post Tax

206.59

232.29

165.78

38.69

163.95

Inventory Turnover Ratio

4.90

5.10

4.82

4.91

5.19

Debtors Turnover Ratio

3.60

3.31

3.25

3.38

3.33

Investments Turnover Ratio

4.90

5.10

4.82

4.91

5.19

Fixed Assets Turnover Ratio

1.31

1.21

1.13

0.95

0.98

Total Assets Turnover Ratio

0.70

0.63

0.65

0.60

0.58

Asset Turnover Ratio

1.31

1.21

1.13

0.95

0.98

54.25

48.61

54.39

64.19

71.97

Management Efficiency Ratios

Average Raw Material Holding

Average Finished Goods Held

20.14

11.38

7.87

7.23

6.38

182.37

229.80

192.28

175.29

108.23

Material Cost Composition

52.65

52.37

53.94

48.97

49.24

Imported Composition of Raw Materials

Consumed

61.16

68.06

63.15

64.34

65.34

5.33

4.25

3.56

3.83

3.76

43.54

52.28

44.81

52.17

62.66

Dividend Payout Ratio Net Profit

45.47

21.57

31.17

62.78

13.45

Dividend Payout Ratio Cash Profit

33.24

18.01

23.59

37.72

11.60

Earning Retention Ratio

49.53

77.14

69.59

65.47

69.35

Cash Earning Retention Ratio

64.16

81.10

76.84

74.71

77.49

0.45

0.32

0.57

0.59

0.55

Mar

'12

Mar '11

Mar '10

Mar '09

Mar '08

12.78

22.96

12.42

5.59

43.49

104.78

97.29

78.27

68.70

132.72

Number of Days In Working Capital

Profit & Loss Account Ratios

Selling Distribution Cost Composition

Expenses as Composition of Total Sales

Cash Flow Indicator Ratios

AdjustedCash Flow Times

Earnings Per Share

Book Value

Key Financial Ratios of Aurobindo Pharma

Mar

'12

Mar '11

Mar '10

Mar '09

Mar '08

1.00

1.00

1.00

2.00

5.00

5.00

5.00

4.50

5.00

3.25

Investment Valuation Ratios

Face Value

Dividend Per Share

�Operating Profit Per Share (Rs)

Net Operating Profit Per Share (Rs)

21.36

33.24

135.89

96.13

59.06

147.18

141.88

583.55

519.83

415.63

Free Reserves Per Share (Rs)

84.02

86.64

335.26

237.31

218.67

Bonus in Equity Capital

59.60

59.60

62.28

64.55

64.55

Operating Profit Margin(%)

14.51

23.42

23.28

18.49

14.20

Profit Before Interest And Tax Margin(%)

11.13

20.34

20.25

15.37

10.37

Gross Profit Margin(%)

11.17

20.40

20.35

15.54

10.87

Cash Profit Margin(%)

15.31

17.24

16.09

15.24

13.30

Adjusted Cash Margin(%)

15.31

17.24

16.09

15.24

13.30

Net Profit Margin(%)

-0.99

14.33

16.09

4.54

12.41

Adjusted Net Profit Margin(%)

-0.99

14.33

16.09

4.54

12.41

Return On Capital Employed(%)

10.04

17.48

17.54

13.53

11.76

Return On Net Worth(%)

-1.70

23.10

27.46

9.73

23.82

Adjusted Return on Net Worth(%)

20.69

22.93

22.47

26.38

19.42

Return on Assets Excluding Revaluations

85.64

88.27

343.51

245.67

227.02

Return on Assets Including Revaluations

85.64

88.27

343.51

245.67

227.02

Return on Long Term Funds(%)

14.90

23.31

24.57

18.94

14.80

Current Ratio

0.76

1.21

1.05

1.12

1.35

Quick Ratio

1.60

2.22

2.28

2.99

2.97

Debt Equity Ratio

0.98

0.90

1.02

1.60

1.44

Long Term Debt Equity Ratio

0.33

0.43

0.44

0.86

0.94

Interest Cover

6.79

22.90

12.47

6.44

6.64

Total Debt to Owners Fund

0.98

0.90

1.02

1.60

1.44

Financial Charges Coverage Ratio

6.86

17.81

12.34

6.74

7.20

Financial Charges Coverage Ratio Post Tax

2.08

14.07

10.93

3.60

7.19

Inventory Turnover Ratio

4.09

3.71

3.89

4.36

3.94

Debtors Turnover Ratio

2.95

3.14

2.88

2.93

3.14

Investments Turnover Ratio

4.09

3.71

3.89

4.36

3.94

Fixed Assets Turnover Ratio

1.82

2.12

2.14

2.22

1.98

Total Assets Turnover Ratio

0.87

0.85

0.84

0.81

0.75

Asset Turnover Ratio

1.82

2.12

2.14

2.22

1.98

Average Raw Material Holding

92.66

91.53

81.12

81.40

86.27

Average Finished Goods Held

7.56

17.66

15.49

9.02

6.13

177.77

214.53

214.21

257.48

279.42

60.65

60.21

61.80

62.64

66.73

60.81

65.35

68.69

76.47

72.98

3.28

2.83

3.75

4.55

2.95

69.50

70.99

68.02

66.08

64.34

--

11.51

6.16

22.02

7.06

Profitability Ratios

Liquidity And Solvency Ratios

Debt Coverage Ratios

Management Efficiency Ratios

Number of Days In Working Capital

Profit & Loss Account Ratios

Material Cost Composition

Imported Composition of Raw Materials

Consumed

Selling Distribution Cost Composition

Expenses as Composition of Total Sales

Cash Flow Indicator Ratios

Dividend Payout Ratio Net Profit

Dividend Payout Ratio Cash Profit

Earning Retention Ratio

Cash Earning Retention Ratio

33.71

9.50

5.21

13.42

5.62

--

88.40

92.47

91.88

91.34

94.87

90.43

93.84

93.43

93.41

�AdjustedCash Flow Times

3.71

3.24

3.70

4.91

5.63

Mar

'12

Mar '11

Mar '10

Mar '09

Mar '08

Earnings Per Share

-1.46

20.40

94.34

23.91

54.08

Book Value

85.64

88.27

343.51

245.67

227.02