0% found this document useful (0 votes)

16 views8 pagesExercises Sample

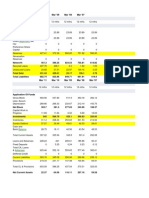

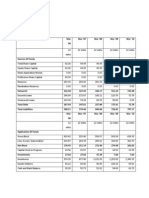

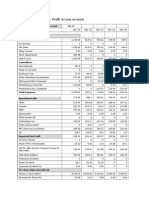

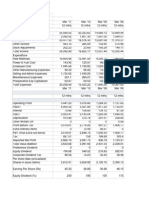

The document presents financial data for a company over five fiscal years, detailing sources and applications of funds, income, and expenses. Key figures include total share capital, net worth, total liabilities, and net profit, with significant increases in reserves and investments noted in recent years. The financial ratios indicate a stable financial position with a current ratio of 1.49 and a debt-to-equity ratio of 0.12.

Uploaded by

viinodkrishnan00Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

16 views8 pagesExercises Sample

The document presents financial data for a company over five fiscal years, detailing sources and applications of funds, income, and expenses. Key figures include total share capital, net worth, total liabilities, and net profit, with significant increases in reserves and investments noted in recent years. The financial ratios indicate a stable financial position with a current ratio of 1.49 and a debt-to-equity ratio of 0.12.

Uploaded by

viinodkrishnan00Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

/ 8