100% found this document useful (1 vote)

175 views2 pagesPayroll Setup and Calculation Guide

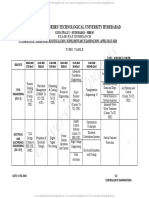

This document contains instructions for setting up multiple sheets in an Excel workbook to calculate employee payroll. Sheet 1 (SETUP) contains fields to set up payroll parameters like month, year, and employee details. Sheet 2 (ATT) will pull employee details from Sheet 1 and include fields to track hours worked. Sheet 3 (TBL) will contain contribution tables for social security and philhealth. Sheet 4 (PAYROLL) will use formulas to calculate elements of each employee's paycheck like basic pay, overtime, deductions, and net pay based on data from the other sheets. Formulas are provided as examples.

Uploaded by

Aries VeeCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

100% found this document useful (1 vote)

175 views2 pagesPayroll Setup and Calculation Guide

This document contains instructions for setting up multiple sheets in an Excel workbook to calculate employee payroll. Sheet 1 (SETUP) contains fields to set up payroll parameters like month, year, and employee details. Sheet 2 (ATT) will pull employee details from Sheet 1 and include fields to track hours worked. Sheet 3 (TBL) will contain contribution tables for social security and philhealth. Sheet 4 (PAYROLL) will use formulas to calculate elements of each employee's paycheck like basic pay, overtime, deductions, and net pay based on data from the other sheets. Formulas are provided as examples.

Uploaded by

Aries VeeCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 2