GTM

DEALER SEGMENTATION FOR

ACTIVATIONS

via targeted salesforce deployment

SGA

Case Study

November, 2019

info@sganalytics.com

www.sganalytics.com

www.linkedin.com/company/sg-analytics

NEWYORK | LONDON | ZURICH | PUNE | HYDERABAD

www.sganalytics.com Page | 1

�GTM ACTIVATIONS

Client

A leading automobile parts manufacturer

Business situation

Our client had over 5,000 dealers across key markets. The client wanted to

achieve 20% increase in sales driven by the launch of a new product line

The client’s 200+ Dealer Representatives (DRs) struggled to achieve quarter-

ly targets for new products as all dealers were not interested in stocking the

new product suite

The client did not have a specific GTM for the newly launched product suite.

www.sganalytics.com Page | 2

�GTM ACTIVATIONS

Benefits and outcomes of our

engagement

• Identified c.1,800 ‘High Potential’ dealers to drive 70% of the targeted sales

from the new product line

• Helped the client design discount structures and dealer schemes specifi-

cally for ‘High Potential’ dealers. The client achieved 15-25% savings in trade

marketing budgeted cost as a % of turnover

• Optimized sales force deployment to focus on select DRs who were as-

signed targets specific to the new products

• Delivered 20%-25% manpower efficiency / effort reduction

www.sganalytics.com Page | 3

�GTM ACTIVATIONS

SGA Approach

We recommended dealership segmentation in order to cluster dealers on

the basis of the Dealer Potential Index. We adopted the followed 5-step ap-

proach:

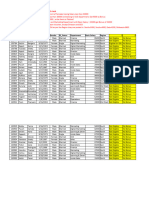

Step 1 – �Derived relevant parameters for dealership clustering using DR sales

force data. Parameters included calls/visit frequency, productive call

rate, journey plan – distance between two calls per day, leave man-

agement system, salary, employment tenure, past history of target

achievement, dealer to DR mapping, etc.

Step 2 – �

Derived parameters for dealership clustering using dealer’s trans-

action data. We assessed parameters including purchase history

by-product lines, discounts, inventory stock-out period, propensity to

adopt new launches in the past, average size of assortment carried,

dealer feedback surveys, post-sale servicing records, locality profile of

dealer’s outlet, popular vs. premium assortment ratio, etc.

Step 3 – �Used K-means clustering to arrive at 6 clusters across dealerships

which were differentiated based on % of sales via premium products,

minimum discount slabs, locality profile, and number of DR visits per

month (servicing frequency)

Step 4 – �Determined Dealer Potential (Target) Sales Index based on scenarios

across key sales influencing triggers at each dealer level – for each

cluster. We built these scenarios in consultation with the client’s strat-

egy and business leads

Step 5 – �Determined the number of DRs and visits per DR based on deal-

er-wise sales targets. Our client used the results of this analysis for

salesforce deployment and to design an incentive plan for the sales

team

www.sganalytics.com Page | 4

�About SG Analytics

We are led by a highly motivated team of internationally experienced professionals, which has catapulted

us among the top India-based research and analytics vendors, thanks to our unremitting focus on client

commitment, consistent quality and a vibrant internal team culture. Our global delivery center in Pune

refl ects our ability to integrate and work with divergent cultures. We hire talent with a strong educati onal

background from top-tier universities. We also have fulltime analysts from countries such as Germany,

Switzerland, France, China, and others. This allows us to understand our clients better and their individual

requirements, irrespective of their nationality and the country of origin.

www.sganalytics.com Page | 5