0% found this document useful (0 votes)

279 views2 pagesColmar Ltd Cash Flow Statement

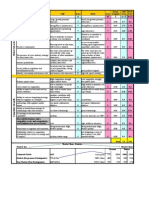

Colmar Ltd's financial statements for the previous and current year are presented, including the income statement and statement of financial position. The statement of cash flows for the current year is then required. It shows an operating profit of £31,000 for the current year. Non-cash expenses include £36,000 of depreciation. Cash generated from operations is adjusted for changes in working capital items. The statement also accounts for interest and tax payments, dividend paid, capital expenditures, and changes in debt.

Uploaded by

aminahCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

279 views2 pagesColmar Ltd Cash Flow Statement

Colmar Ltd's financial statements for the previous and current year are presented, including the income statement and statement of financial position. The statement of cash flows for the current year is then required. It shows an operating profit of £31,000 for the current year. Non-cash expenses include £36,000 of depreciation. Cash generated from operations is adjusted for changes in working capital items. The statement also accounts for interest and tax payments, dividend paid, capital expenditures, and changes in debt.

Uploaded by

aminahCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 2