0% found this document useful (0 votes)

70 views8 pagesVenture Capital Guide for Entrepreneurs

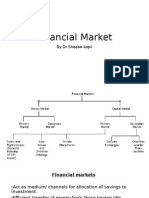

Venture capital firms provide financing to startup companies and growing businesses that cannot obtain traditional bank loans. They obtain funds from wealthy individual investors and use those funds to invest in risky but potentially high-growth companies. Venture capital firms work with businesses according to an investment profile that outlines the types of companies they will fund. They provide startup capital, expansion funding, and financing for acquisitions, expecting to be repaid within 3-7 years if the businesses succeed. Venture capital is a good option for entrepreneurs who need funding but cannot get traditional loans.

Uploaded by

sanket sunthankarCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

70 views8 pagesVenture Capital Guide for Entrepreneurs

Venture capital firms provide financing to startup companies and growing businesses that cannot obtain traditional bank loans. They obtain funds from wealthy individual investors and use those funds to invest in risky but potentially high-growth companies. Venture capital firms work with businesses according to an investment profile that outlines the types of companies they will fund. They provide startup capital, expansion funding, and financing for acquisitions, expecting to be repaid within 3-7 years if the businesses succeed. Venture capital is a good option for entrepreneurs who need funding but cannot get traditional loans.

Uploaded by

sanket sunthankarCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 8