0% found this document useful (0 votes)

152 views2 pagesDid You Know That You Can Claim Tax Relief On Your RCN Subscription?

1) Under UK tax law, subscriptions paid to the Royal College of Nursing are eligible for tax relief. Members can claim relief on their annual RCN subscription and the additional subscription paid for the Nursing Standard journal.

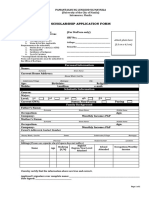

2) UK tax law also provides tax relief of up to £100 per year for costs nurses pay out of pocket to clean their work uniforms, if their employer does not provide free laundry services.

3) To claim these tax reliefs, nurses should complete the provided form with their personal and employment details, the amounts they are claiming relief for, and send it to the address specified.

Uploaded by

Shibu KalayilCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

152 views2 pagesDid You Know That You Can Claim Tax Relief On Your RCN Subscription?

1) Under UK tax law, subscriptions paid to the Royal College of Nursing are eligible for tax relief. Members can claim relief on their annual RCN subscription and the additional subscription paid for the Nursing Standard journal.

2) UK tax law also provides tax relief of up to £100 per year for costs nurses pay out of pocket to clean their work uniforms, if their employer does not provide free laundry services.

3) To claim these tax reliefs, nurses should complete the provided form with their personal and employment details, the amounts they are claiming relief for, and send it to the address specified.

Uploaded by

Shibu KalayilCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 2