50% found this document useful (2 votes)

3K views4 pagesCandlestick Patterns

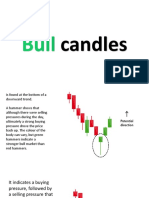

The document defines and describes various candlestick patterns used in technical analysis for stock trading, including bullish patterns like the hammer, inverse hammer, bullish engulfing, piercing line, morning star, and three white soldiers, as well as bearish patterns like the hanging man, shooting star, bearish engulfing, evening star, three black crows, and dark cloud cover. It also covers neutral/indecision patterns like the doji and spinning top, as well as continuation patterns like the falling three methods and rising three methods.

Uploaded by

hanri7Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

50% found this document useful (2 votes)

3K views4 pagesCandlestick Patterns

The document defines and describes various candlestick patterns used in technical analysis for stock trading, including bullish patterns like the hammer, inverse hammer, bullish engulfing, piercing line, morning star, and three white soldiers, as well as bearish patterns like the hanging man, shooting star, bearish engulfing, evening star, three black crows, and dark cloud cover. It also covers neutral/indecision patterns like the doji and spinning top, as well as continuation patterns like the falling three methods and rising three methods.

Uploaded by

hanri7Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 4