100% found this document useful (1 vote)

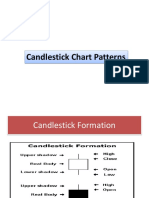

974 views11 pagesBasic Candlestick Formations: Indication That Price May Be Heading Down

This document provides an overview of various candlestick patterns that can be used to analyze price movements and identify potential reversals or continuations in trends. It describes several single, dual, and triple candlestick patterns including hammers, inverted hammers, hanging men, dojis, marubozus, engulfing patterns, and stars. It also covers head and shoulders, triangles, and other patterns that involve groups of candles. The document explains the formation and interpretation of each pattern and when they may indicate that prices are likely to move higher or lower.

Uploaded by

quentin oliverCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

100% found this document useful (1 vote)

974 views11 pagesBasic Candlestick Formations: Indication That Price May Be Heading Down

This document provides an overview of various candlestick patterns that can be used to analyze price movements and identify potential reversals or continuations in trends. It describes several single, dual, and triple candlestick patterns including hammers, inverted hammers, hanging men, dojis, marubozus, engulfing patterns, and stars. It also covers head and shoulders, triangles, and other patterns that involve groups of candles. The document explains the formation and interpretation of each pattern and when they may indicate that prices are likely to move higher or lower.

Uploaded by

quentin oliverCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 11