0% found this document useful (0 votes)

2K views14 pagesProblem 1. The Mexico Company Manufactures A Single Product That Goes Through Two Departments. The Data Relating To

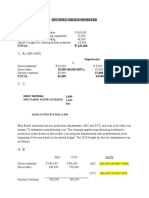

The document provides information about 7 process costing problems. Each problem includes data on units started and completed, work in process inventory levels and percentages of completion, and calculations of equivalent units and costs under both weighted average and FIFO costing methods. The problems require calculating equivalent units, preparing quantity schedules, computing costs per equivalent unit, and reconciling costs.

Uploaded by

TokkiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

2K views14 pagesProblem 1. The Mexico Company Manufactures A Single Product That Goes Through Two Departments. The Data Relating To

The document provides information about 7 process costing problems. Each problem includes data on units started and completed, work in process inventory levels and percentages of completion, and calculations of equivalent units and costs under both weighted average and FIFO costing methods. The problems require calculating equivalent units, preparing quantity schedules, computing costs per equivalent unit, and reconciling costs.

Uploaded by

TokkiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 14