0% found this document useful (0 votes)

112 views3 pagesFinancial Ratios & Analysis Guide

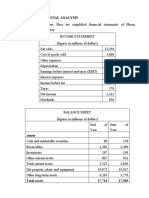

The document provides information to calculate various financial ratios for Happy Company and Amber Company. It includes their statement of financial position, income statement, and selected financial data. It asks to compute 17 different ratios for Happy Company including earnings per share, price-earnings ratio, dividend payout ratio, and current ratio. It also asks to calculate profitability ratios for Amber Company from the financial data provided. Finally, it asks to determine the effect on the current ratio for 7 different transactions.

Uploaded by

132345usdfghjCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

112 views3 pagesFinancial Ratios & Analysis Guide

The document provides information to calculate various financial ratios for Happy Company and Amber Company. It includes their statement of financial position, income statement, and selected financial data. It asks to compute 17 different ratios for Happy Company including earnings per share, price-earnings ratio, dividend payout ratio, and current ratio. It also asks to calculate profitability ratios for Amber Company from the financial data provided. Finally, it asks to determine the effect on the current ratio for 7 different transactions.

Uploaded by

132345usdfghjCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 3