0 ratings0% found this document useful (0 votes)

1K views38 pagesChapter 5 Practices

wrw

Uploaded by

kakaoCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF or read online on Scribd

0 ratings0% found this document useful (0 votes)

1K views38 pagesChapter 5 Practices

wrw

Uploaded by

kakaoCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF or read online on Scribd

You are on page 1/ 38

Basic Fj

Financial Accounting & Reporting

Worksheet and Financial Statements

earning Objectives:

aner studying this chapter, you should be able to:

1, Describe the flow of accountin;

balance into the adjusted trial

statement and balance sheet col

18 Information from the unadjusted trial

I balance ‘and finally, into the income

lumns of the worksheet. :

2, Prepare accurately and in good form a ten-column worksheet.

3. Understand and appreciate the usefulness of financial statements.

4. Develop skills in the preparation of financial statements.

5. Explain how the financial statements are interrelated.

THE WORKSHEET *

Accountants often use a worksheet to help transfer data from the unadjusted trial

balance to the financial statements. This multi-column document provides an efficient

way to summarize the data for financial statements. The accountant generally prepares

aworksheet when it is time to adjust the accounts and prepare financial statements.

Note, however, that it is possible to prepare financial statements directly from the

adjusted trial balance at the end of the accounting period if the business. has relatively

few accounts.

e worksheet simplifies the adjusting and closing process. It can also reveal errors.

worksheet is not part of the ledger or the journal, nor is it a financial statement. It

$a summary device used by the accountant for his convenience. The basic structure of

orksheet is presented in Exhibit 5-1.

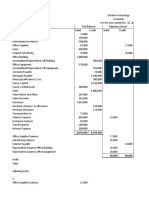

ING THE WORKSHEET (Step 5)

teps in the preparation of a worksheet will be illustrated using the Weddings “R”

e account’ balances in the unadjusted trial balance columns and total the

re —

at May 31 are |;

ounts as

titles and balances of the acc

The numbers, titles

Gir,

d. The account,

wis are prepare Total debits nae ie

the adjusting ent! ar in the ledger. Muse Sey

from the ledger before 2%

St g

pt h zero balances (e, gly

in the worksheet in the ot Accounts ay Listing all the accor

Ree Seameiesshown tn a are also Diced adjustments. This Pract it

Preneintens: persis, ihe accounts that ni and accuracy in the adjuss

their balances helps , nt of completeness me

help ensure the achievem

Process.

¥

entries in the adjustments columns ani total the am,

ng entries in the adjustment: J and

ter the adjustit

first entered in the Worksheg ;

When a worksheet is used, all i Rea i wee explained in the Previous chan

required adjustments for Se the adjustments ee the wor te

Ewa mG cat eguieat Is entered, a water ‘the acne f a

entry and the corresponding credit entry. Note Ir

Sei © nyt

journalized until after the worksheet is completed and the financial Statemen

Prepared,

Compute each account’s adjusted balance by combining the unadjusteq

and the adjustm

trial balance

ent figures. Enter the at

balance columns,

idjusted amounts in the adjusteg trial

Exhibit 5-3 exhibited the adjusted trial balance

_line by line, the ai

balance; a debi

balances a P17,300 debit in the adjusted

Spates, on the third line, showed a debit of P18,009 in the unadjusted trial balance

‘umns and a credit Of P3,000 ji a ‘columns, The ps ase aa

P15,000 debit in the adjusted ta

Teported a P62,400 credit in

© adjustments columns. The!

Mis entered in the credit colum

d through all the accounts. The

eck the Accuracy of the fos

trial balance.

+

‘add when the type of a ust

balance. Ment (debit or credit) i

it]

subtract when the ty ) is the same as the unadjusted

e 4 Pe of adjus

unadjusted balance, Justment (debit or credit) is different from the

ptend the asset, liability ang

palance columns to the bala,

amounts to the Income state,

owner’.

ce Sheet oc guy Tmounts from the adjusted trial

ment colui columns. Extend the income and expense

mns. Total the statement columns.

ery account is either a

very liability, capi balance sheet account or an i

asset, , capital and withdr, income statement account.

al

oe accounts are extended to the balance sheet

eae are moved to the income statement

rate balance remain as debits in the statement

ch account's adjusted bal: should i

ly one statement col jjusted balance should appear in

only ba lumin as shown in Exhibit 5-4. At this stage, the initial totals of

the inc ‘ment and balance sheet columns are not equal

columns. Income and expense

columns. Debits in the adjusted

columns while credits as credits,

ute profit o

ae ee es _ a as the difference between total revenues and total expenses

in Sead pps Enter profit or loss as a balancing amount in the income

statement and in the balance sheet, and compute the final column totals.

profit or loss is equal to the difference between the debit and credit columns of the

income statement. i

Revenues (Income Statement credit column total) P71,700

Expenses (Income Statement debit column total) 36,700

Profit P35,000

The profit or loss should always be the amount by which the debit and credit

columns for income statement, and the debit and credit columns for balance sheet

differ. The profit figure of P35,000 is entered in the debit column of the income

statement and the credit column of the balance sheet. After completion, total

debits and total credits in the income statement and balance sheet columns must

equal. i

d to the credit column of the balance sheet because

and increases in owner's equity are recorded as

“redits, Observe that the capital account amount of P250,000 shown in the

rksheet reflects the beginning rather than the ending balance. Profit must be

led and withdrawals subtracted to arrive at the ending capital balance; this is

e when the statement of changes in equity is prepared.

The profit figure is extende

profit increases owner's equity

OTT BARRON — ET

= 7 T T y \

y L \

ii iE ] [

1 1 joos'sas [oog’sss \

iY 06S _|

08s

C OLS

4 SPINEA SaINlas-dxg uoNepaITag] 99s

C i joow'y ‘asuadkg seMminn| OSS

f T ssuedg soueansull —ovs

ah ES

+ ‘ruediy says] ozs

t joower sosuadhy sonejes] OTS

f rt Sanam os

[oow'Z9 ‘senueAsy SunInsuGD| —OTb

I BS

1 [ooo Oze

[ooorosz Ore

1 [ooo'or 092.

t = 052

ovr ‘ove

y ‘Byaerea soueres| Oke

—| “oars Seeteg Tea Oe

t + | foon'are ‘siaeKersaron| Ofe

TWaUIROG IO ud Ty] SCT

a aT |

BPRDA soles -Udog wy] ST

[poo ore 0st

foov'vr ‘ost

food's OFF

ooo'sr S903] OFT

looo'zr BRENT AURETY| eT

+ joo'zz use3| "OTT

mena EC ELE wD | weer SRE "ON

Yoong e0eeG —[ wouereg swoon | souea WL PART SUPT RUL

GfOe Te Ae Papua WOW OYA 105

TOURLOM

1 .W. SuIpPOM,

‘swaUASMipy ZS NaS

Ft =

= arte bes

joos"e

: y

; a EESTI

S r 00% BpISA aaINIas- ag

= joob’y

2 + area

2 [o00"y 2

= 000"E 2

os joos"t ‘i Joos ET

= [ooo T

5 oes [7 sor zs

$

fooorrr

[ooo

[o00"r TF [ooo'or

loose [4

[oot

joer |

— jo0ores

Jooo'ore

[ooo'os

w

P

joooorr

joort__ [a oor’

fooo' [2] [000"e:

> [o00'sT

ooes a fooo'et

jooz'zz

70 we wed

SUSURENIPY souerea red

we _[_yeea__ [wey _[_ aaa wpa

Bae Soeies | wawejagouoruy | souejeg jel pasnipy

Pa

EXOE TE Ae PORUS LOW Suh I6d

aaoUOHOM

= Sa, SUIT

TTT Pay ES WATS T

7 L } E

¢-—|—-F f si

= 7 7 ; S

T loow'zos foow'z09 Joos Zz oor = foos’sss —_[oos"oe: saueary STE] “OSE

j00s"€: { ‘asuadxg snoaUeleosiN| OBS

wor mot TS “adinb3 a0140- xq uonepardag] OZs

00 coo Te ‘SPIUBA SdIAlas-“dxg Uone|erdag] 09S

= _|oor'y joor’y oss

fran ica * 1 BsUsGKy saueinsui] Ops

ooo" ooo“ [e ‘ssuedey Wau] OES

lo00"e 000" ‘asuadyy saydans| ozs

joos’st Joost | loog’Er sesuadyg salseles] OTS

jo00'y [ooo 7 ‘Senuanay [eajau] OZP

-t |00L"49 JOOE'S 1 joov'z9 ‘Sanuahay Sulynsuo>, ‘Oly

Areununs awl] “OFF

t looo'rr joo0'et SIEMEIDURIM “Oleue-FaIoq] OLE

jooo"osz: joooosz Teildeo “ojeuew-t0154] OTE

f [oo0’9. [000 7 [oor Senuanay (ealojou pauleaun| oar

\ pose loose a siqeked werawui] ose

port — loor'T aigeked saniinn] Ope

1000'S 2iqekeg Saise[es| oer

TE oo Braeheg sana) ee

jo0'r [ooot fa aqekeg SdjON] OTe

[o00’0s juewidinby 83i4j70-udaq ‘N20 SZT

ooo [ooo Pa 00°08 wawanby Bio] —OzT

joo0’ozy DONOR APIVRA S3IAlas -U% 190 ‘M9¥] SOT

loozer oar" 7 SPIUPA 2078S] —O9T

000% Te joor'er Soueinsu1 predsig] ger

st foon'e Ps foovsr Weu piedaig] opr

TaD looree pore looove saudans| “oer

Ta Sa sre) | Wao pay wed | apa looz’zz SENDA SUuNOSy] OFT

a Paieipy Te ee WP | ya8G a uses] Orr

asnpy Sauer Tea TET InODW “OW

Ste Te RW Pe HOR TT a07

ous OM,

$0 tie Tuippary

foou"9e

joos"e jsa7e0i| 065

IW |_085

T [ooo (o00r sidag] OLS

foo” | [0007 095)

[oor [oov’y 055)

joozt jor [ooe't Ops.

[o00'y [o00"r [0007 OES)

[ooo [oo0"e [000"E. ins} 02S

jo0s’st loos’st [ooet ors.

jooo"y [0007 ooo’ 3 ozr_|

[ooz"23, joe jooe’s ory

OEE

[O00 EF coor | ~Jo00%r semespaum orevenrraied| OZE

[ooorose jooorost fe O|eueWFeI0d) OTE

[0009 [o00"s 09%

loos’€ loose loos" sz

foowr [oor joorr ‘ove

Joos i [o08'T [008 T Ez

[000"ES + [000s 000s Bigeked swunorv] _Oce

fooo’orz, -} [o0o°Tz, [ooo"ore Biqehed SjON| OTZ

[ooo"t [000 quaudnby s5yjo-wdeg nav] SZE

E [ooor0s T quauidinbs 53470] OT

[o00"r - [o0o"r SpRPA sanres “udag N2v]_S9T

oo0'ozy fee BPIMOA a2100S| OST

fooz'er_— “4 ‘Bouemsuj piedasd| OST

000" C e ad

[000'st 2 ‘sayedans| _OET

je a elit [oOe’S 7 Siqenresay swunozv] Oct

[ fooe'ez fooe'ez C ysea] Ort

we [| waa para [_uaeo Wa | uaea wpaD We UP: Bp TUNOII “ON

Yous aUeIeG quauayers swoou | Souerea lev PeIsnIPY Huswnsnipy ET 0

GrOz Te Kew popua WOW Om 303

JSSUSOM

Aa, Suppo

ime eee ere ee oe TU

P15,600

Expenses

Salaries Expense 4,400

Utilities Expense 4,000

Rent Expense 4,000

Depreciation Expense-Service Vehicle 3500

Interest Expense 3,000

f Supplies Expense 1,200

\ Insurance Expense i 1,000

Depreciation Expense-Office Equipment —— a

| Total : — 2200

| : P35,00

Profit \ 000

| Exhibit $5 Income Statement.

Information about the performance of an enterprise, in ‘particular its Profi

Tequired in order to assess potential changes in the economic resources tha

to control in the future. It is also useful in predicting the capacity of the en

Benerate cash flows from its existing resource base.

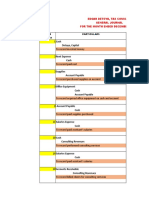

Statement Of Changes in Equity

The statement of

equity, This

© from additions|

Decreases result from

ie beginning balance and

int in the 8eneral ledger,

income Statement while the

ksheet.

Weddings “p»

Statement of en US

P285,000.

14,000

P271,000

r

atom of Financial Position Worksheet ang ‘nancial Statements |

e statement Of finan

Al posit

iti al i ;, ion

ition of n entity by listi Sa Statement that sh

te. The information ne, ets, labilties a lows the fi

jod, rather than the total for the S statement ah Owner's

in

icalso called the balance sl Period as j ‘i

sal heet, the ing

nancial position or

equity as at a specific

'e net balances at the end of the

‘Ome statement. This statement

ers of financial Statements anal

‘ ibili 'Y2e the b;

its financial flexibility, and its =n/e alance sheet toe ity’s liquid

vis to the availability oF as| shy to generate Profits, a ae ‘wa

commitments over this perigg, ina © near future after taking account of the financial

woater the amounts and timings of en extty is the ability to take effective actions

reeds and opportunities, thy. includes jos $9 that it can respond to uneepected

unused lines of credit, Solven; eee

ility to raise new capital or tap into

. ref an

mneet financial commitments 2 they fala” availability of cash over the longer term to

h Eouiecoe sheet I tiay not belt esry +9 make any further analysis of

— oc! data—that is, the balances of the asset, liability, and owner's

equity accounts—are already available from the balance sheet columns of the

worksheet. However, the interim balance for owner's equity must be revised to include

profit or loss and owner's withdrawals for the accounting period. The adjusted amount

for ending owner's equity is shown in the statement of changes in equity.

Format :

The balance sheet can be presented in either the report format or the account format.

The report format simply lists the assets, followed by the liabilities then by the owner's

equity in vertical sequence. The account format lists the assets on the left and the

liabilities and owner’s equity on the right. Either balance sheet format is acceptable.

revised: PAS No. 1 does not prescribe the order or format in which an entity

nts items in the statement of financial position; what is required is the current and

irrent distinction for assets and liabilities. Assets can be presented current then

Tent, or vice versa. Liabilities and equity can be presented current liabilities then

nt liabilities then equity, or vice versa.

to present a classified balance sheet; that is, the assets and liabilities are

into various categories. Assets are sub-classified as current assets and non-

; abilities as current liabilities and non-current liabilities, At this

See read chee teiiors ot tie foresee (iors Chapter 2).

gb a in the analysis of financial statement data.

lance she

iting INnrormation that is

ates accoun'

fiquidtY provides entity shall present aj ass,

ion based on NaN then

When presentation bas

aananal ;

ard more relevant to decision tt le, of liquidity. Cash ;

liabilities in order of liquidity. reasing are listed last,

liabilities in - oe

ed in deci f

if jert time of maturi

Assets are classified and seo be cv ted based on tim: Y sucy

liquid, Assets that are at ‘ed and el 7

Liabilities are generally tly due are liste spate

obligations which are current assets of P546,700 in the bay

ance

: Coles lance sheet colymn® Shey

: 5-7 that the in the ba Sof

It can be cher eee aaea ine and owner's equity dg ny

does not tal

ikewise, the total hese differen uy

worksheet in Exhibit 5-4. pagal The reason for tl fe

ie

the total credits in the sam

thay

lateq

ibtracted from their re} coup

drawals are sul in the works

accumulated deprecation Se a respective vento feet. 1

in the balance sheet t ort :

classed balance sheet of Weddings “R” Us in reps

aay

"S

'S the My

h tha,

Weddings “R” Us

Balance Sheet _

May 31,2019

Assets

ie amet 22,200

st

Accounts Receivable 37,300

* 15,000

Supplies

eae 4,000

Paid Rent on

Prepaid insurance ,

Total Current Assets P 71,700

Property and Equipment (Net)

Service Vehicles 420,000

Less: Accumulated Depreciation 4000 416,000

Office Equipment 60,0007

Less: Accumulated Depreciation 1,000

Assets

PS46,700

Uabilities ee

P210,000

Uunts Payable , .

laries Payable * 53,000

ilties Payable 1,800

1,400

3,500

—5,000_

Owner's Equity 275,700

2019

271,000

P546,700

nt of Cash Flows

statement of cash flows provi

ft i : Vides ji 4

of an enti inf

- ents 7 a ty during a periog, oe about the cash receipts and cash

its (inflows) and cash payments four? formal statement that classifies cash

vawities: This statement shows the nee into operating, investing and financing

spine cash balance at the end ofthe penceane oy Seerease in cash during the period

ws of the entity. The discussion below ; it also helps project the future net cash

invowed in the preparation of the cash flew aceeea ee ee ae

. ent.

cosh Flows. from Operating Activities

ing activities gene: i

ove Jon ae fe Providing services, and producing and delivering

eS candother acne eae activities are generally the cash effects of

rans. f ‘at enter into the determination of profit or loss. This

ash flow can be presented using either the direct or the

indirect method.

De anee ,

sing the direct method, the entity’s net cash provided by (used in) operating activities

is obtained by adding the individual operating cash inflows and then subtracting the

individual operating cash outflows.

The indirect method derives the net cash provided by (used in) operating activities by

adjusting profit for income and expense items not resulting from cash transactions. The

adjustment begins with profit followed by the addition of expenses and charges (eg.

depreciation) that did not entail cash payments. Then, increases in current assets and

decreases in current liabilities involved in the determination of profit but which did not

actually increase or decrease cash, are subtracted from profit. Finally, decreases in

current assets and increases in current liabilities are added to profit to obtain net cash

provided by (used in) operating activities.

Profit

P xxx

Adjustments for:

Non-Cash Expenses (e.g. Depreciation) sax

Increases in Current Asset Accounts (x)

Decreases in Current Liability Accounts (x)

Decreases in Current Asset Accounts x

Increases in Current Liability Accounts x

Cash Flows from Operating Activities P Xxx

r example, increases in accounts receivable from ‘sale of services or goods

resented an increase in profit without the corresponding increase in cash—for itis

@ receivable. Since these revenues are already included in the computation of

fit, the increase in accounts receivable should be deducted from the profit figure. To

te further, assume that salaries payable increased. Increases in salaries payable

that the entity did not pay the full amount of salaries expense for the period.

a flow purposes, is verse,

for cash fit i Atay

statement, ted, then profit is Understar | by

The expense in the ee expense is ae is added to profit, "Stateg wh

amount of ae rete in current liability 4

Same amount; hence,

enterprises are €Ncoura,

Per Philippine Accounting Standards (PAS) No: 7,

Inge to

tivities using.the direct method but the Mdiregy ok

Cash flows from operating a

Rh

follows Meg

ly the direct method is ustrated | ae The following are thet

acceptable. Only the me' * iy,

classes, of operating cash flows using the direct

Cash Inflows f services

| : ret from sale of goods and eae other revenues

| * receipts from royalties, fees, commissions

| Cash Outfiows 4

+ sine to suppliers of goods and services

* payments to employees

* payments for taxes

* payments for interest expense,

* payments for other operating expenses

Cash Flows from Investing Activities

Investing Activities include making and collecting loans;

investments in debt

OF equity securities; and obtaining

quipment and other

acquiring and isposin,

Productive assets,

and selling of Property ant

Cash inflows :

* receipts from sale Of property and equipment

* receipts from sale of

investments in debt or equity securities

* receipts from Collections on Notes receivable

Cash Outflows

* payments to acquire Property and equipment

© payments to acquire debt or equity Securities

* payments to make loans to Others, 8enerally in the form of ni

‘otes receivable

receipts from investments

ceipts from issuance Of no

Weddings “R” Us

fa pe of Cash Flows

r the Month Ended May 31, 2019

ost Flows from Operating Activities:

cash received from clients

payments to suppliers Pp se

payments to employees (20,000)

ents for office rent . (13,800)

payments for insurance ih

payments for utilities (3,000)

P 11,200

Net cash provided by (used in) operating activities

sh Flows from Investing Activities:

payments to acquire service vehicle P (420,000)

payments to acquire office equipment (15,000)

Net cash provided by (used in) investing activities (435,000)

cash Flows from Financing Activities:

Cash received as investments by owner 250,000 ;

Cash received from borrowings 210,000

payments for withdrawals by owner 4 (14,000) >

net cash provided by (used in) financing activities 446,000_

Net Increase (Decrease) in Cash > P.22,200

Cash balance at the beginning of the period Rusan

Cash balance at the end of the period P. 22,200

Exhibit 5-8 Statement of Cash Flows

RELATIONSHIPS AMONG THE FINANCIAL ST. ‘ATEMENTS

based on the same underlying data and are fundamentally

The financial statements are

hows the basic interrelationships among the financial

related. The following s

Date at End

of Period

Statement of »

Financial Position

Income Statement

‘Statement of Cash Flows

JONG OF eae

iS Site, BOSC Financial Accounting and Rep enses during the pe.

! 1 reports all income ia ba tio The

+ The income statement statement,

Profit or loss is the final figure in this

iders the profit or loss figure To,

ity considers e my

2. sine ene ere vreernining factors that explains the chon

income statement a:

SSS

owner's equity. ending owner's o, ui

ial position reports the aan ake,

3. The statement of financial pe es in equity.

directly from the statement of chang

i r decrease jn Cash

the net increase o Sh dug

. it of cash flows reports in the balan, ng

: the period and ends with the cash balance reported) oe ee Sheet. qe

statement is prepared based on information from lent ang the

balance sheet,

—_ =

DISCUSSION QUESTIONS

1. Inwhat Ways is the worksheet useful to accountants?

2. Discuss the steps in preparing a worksheet,

3. After accomplishing the worksheet, the debit and credit columns of the trial

balance, adjustments, adjusted trial balance, income statement and balance sheet

balance. Does it ‘mean that the worksheet is free from error? Prove Your answer,

What useful information does an income statement provide to the business Owner?

5. What are the obje

Jectives achieved in the Preparation of the statement of changes in

equity?

from income statement to

eet and to Statement of cash flows:

Worksheet and Financial otOve ss

‘l inthe Blanks

N gjustments are the result of

transactions.

will

—— ill increase accumulated depreciation.

affes i

‘ct both the income statement and balance sheet.

the adjustment for supplies reflects the amount of supplies

eee

lies Expense i i

plies Expense is found on the income statement. Supplies are foun

5. 5uP don

a .

eee

. pepreciation Expense is found on the

reflects the cost of equipment at time of purchase.

. —_—_—_ is a contra asset that has a credit balance.

accumulated Depreciation, a contra asset, is found on the 3

reflect the book

Historical or original cost of a vehicle less

value of the vehicle.

¥. _ column of the balance sheet

41. Withdrawals are found in the

section of the worksheet.

Salaries Payable is a liability that will appear in the of

the worksheet.

13. The figure for Profit on the worksheet is carried over the

of the balance sheet.

column

14. Aworksheet is a(n) report.

prepared after the completion of the worksheet.

b. are

reports how well a business performs for a period

16. The

is a report that shows changes in capital.

jing figure for capital from the statement of changes in equity is placed on

True or False he statement of financial Position,

own as the

be assessed by referring to a balance sheet,

2. Financial position may

mi

3. The heading for an income statement

| 1, The balance sheet is also kn‘

| 2019."

ight include the line "As at Decemy

i,

5 tatement to th,

ement ii ity relates the income s\ e Sy

4. The stat it of changes in fee cil account changed during the acco

sheet by showing how the owni

Period.

5S. The statement of changes in equity discloses the withdrawals du: ring the eto,

The purchase of equipment isan example of a financing activity.

7. Financial statements cannot be Prepared correctly until'all the accounts have bes

adjusted.

8. Total assets, total liabilities

the totals of the Balance

's and owrier's equity on the bal:

ance sheet are the Samex

Sheet columns on the workshee!

The worksheet is Prepared after the formal adjusting and closing entries,

e balances of the Accu

of the worksheet's Bi

mulated D,

epreciation a

alance She,

counts will appear on the cred!

et columns.

Worksheet and Financial Statements | 5-19

qhe worksheet is a type

: of Accountant's ‘Working paper.

qhe amount placed opposit

| ® columns of the worksheet aes Owner's Capital account in the Balance Sheet

palance sheet. Smount to be reflected for owner's Capital on the

hase my

yp The pure! of land is an exa Ple of an investing activity.

jount of owner's wi ~

, The amount of owner's thdrawals'can be found on the worksheet.

The balance sheet may

# ¥ be prepared by referring solely to the Balance Sheet

" columns of the worksheet,

pu. The worksheet should be

prepared. Prepared after the formal financial statements have been

yi. The amount for owner's Withdrawals will i

ofa worksheet. I appear in the Income Statement columns

n. Buying and producing goods and services are examples of operating activities.

23, The statement of cash flows discloses significant events related to the operating,

investing, and financing activities of a business,

24, When adjusting entries are entered onto a worksheet, it is not necessary to record

them in the general journal.

3, An important use of the worksheet is as an aid in the preparation of financial

statements.

46. The Adjusted Trial Balance columns of the worksheet are prepared by combining the

"Trial Balance and Adjustments columns of the worksheet.

hen the Income Statement columns of the worksheet are initially footed, they

uld be out of balance by the amount of profit or loss.

account Commissions Earned would appear on the balance sheet.

unt Wages Payable would appear on the income statement.

eet is more useful for a small entity than for a large one.

> Multiple choice

ion is not found in fi

1. Which of the following types of information is no

iNancial stay

bs ents

Profits

Revenue

Selling prices

Assets

anos

Accounting data flow from the

Balance sheet to the income statement

s equi

Mcome statement to the statement of owner's eqi ity

St

‘atement of owner's equity to the balance sheet

Both band care correct.

apogee

Consider the Steps in the accounting cycle,

Provides information to help a business decide

Post-Closing Trial Balance

Adjusting Entries

Closing Entries

Financial Statements

Which part of 4 Ie ac ir

hi Counting Oe

whether to expand its Oper;

ations)

poo

* Which columns Of the accounting work sheet show unadjusted amounts?

. Trial Balance

by Adjustments

Income Statement

| Balance Sheet

heet show Profit?

a. Trial Balance

Adjustments

Income Statement

| Bothbande

ies has a P60,000 Unadjusted bai

. Es nt supplies of P20,000. What adj lance on your trial balance. At year-end you

istment will appear on your work sheet?

“supplies

P: Supplies Expense 40,000

; 40,000

ie Supplies Expense

Supplies 20,000

: 20,000

«Supplies Expense

Supplies 40,000 a

No adjustment i

a pre ssnee is needed because the Supplies account already has a

£ which of the following is a cash inflow from financing activities?

a. Receipt from collections on notes receivable.

bp. Receipt from interest on notes receivable,

¢. Receipt from issuance of notes payable.

g, Receipt from sale of property and equipment.

Inthe adjusted trial balance, the owner’s equity account reflects

. the beginning-of-the-period balance.

.. the increase to income and expense.

the period ending balance.

|, the results of adjusting entries.

eose

40. Which of the following steps comes first in worksheet preparation?

a. Compute each account's adjusted balance by combining the trial balance and

adjustment figures.

b. Compute profit or loss as the difference between total revenues and total

expenses on the income statement.

c. Enter the account balances in the unadjusted trial balance columns and total

the amounts. -

d. Enter the adjusting entries in the adjustment columns and total the amounts.

if the income statement debit and credit columns are not equal after adding the

respective columns,

an error has been made.

‘the entity either generated a profit or incurred a loss.

the entity generated a profit.

e entity incurred a loss.

i liabilities must exceed the assets.

Le ssheat Canin’ Ss

the worl

umn of

12,

it co!

The Income Statement Debit

a. asset account balances. :

b. expense account bane oe

¢. contra asset account balat

d. lability account pean

. revenue account balances.

i Income St

ill appear on the debit side of the Income tatement ay,

13, The amount of profit will a

‘on a worksheet,

be wil als.

a. if profit exceeds the owner's ee the period.

b. iftotal assets exceeded total liabili Eee the eevee

c if total expenses exceeded total revent for thé par

4. iftotal revenue exceeded Se

©. if withdrawals have been made during

14. IF total credits exceed total debits in the Balance Sheet columns of a Worksheet

a loss has occurred.

@ mistake has been made.

@ profit has occurred.

assets exceed liabilities.

No conclusion can be drawn until the closing entries have been made,

aooe

35. In which columns of a worksheet would the adjusted balance of Accumulaty

Depreciation appear?

a. Adjusted Trial Balance Cre

b. Adjusted Trial Balance Credit, income Statement Credit

¢. Adjusted Trial Balance Debit, Balance Sheet Debit

Trial Balance Credit,

1 Adjustments Credit, Adjusted Trial Balance Credit, ani

Balance Sheet Credit

Trial Balance Debit, Adjusted Trial Balance Debit

dit, Balance Sheet Debit

16. Worksheets are Prepared because

a. they aid in the Preparation of the financial Statements, adjusting entries, #!

closing entries, i

they are necessary for the Preparation of the financial statements.

they are required by generally accepted accounting principles,

they constitute permanent Oe

Tecord of alj adjusting entries made for the pet

in the current Period, the total of the balancest®*

will be

balance sheet debit column,

‘income Statement Credit cols.

Assuming an entity is Profitable j

Credit column in the Worksheet

larger than the

_larger than the

"4. smaller than the balance sheet debit co}

jumn.

s

Worksheet and Financial 2

Pe torger than the income statement debit ca

column.

qhe usefulness of the worksheet is in

aiding the preparation of financi;

: gth cial stat

identifying the accounts that need to pale

a

b ‘

summarizing the effects :

f Sof the above. Of all the transactions of the period.

initié im

the Le sul i the balance sheet credit column on a worksheet is greater than

the initial sum of the balance sheet debit column, then

loss occurred during the period

p, anerror was made on the worksheet.

the sum of the income statement credit column must

income statement debit column.

q. allof the above.

exceed the sum of the

statement of changes in equity

has no relationship with the balance sheet.

b. indicates whether the cash position of the entity will permit wit!

owner. :

provides a link between the income statement and the bal

d, shows the income and expenses of the entity fora given period.

hdrawals by the

lance sheet.

|. Which of the following is an example of an investing activity?

a. Obtaining a bank loan

b. Paying taxes to the government

¢. Producing goods and services

d. Purchasing a building

Which of the following is an ‘example of a financing activity?

a. Acquiring land

. Employing workers

_¢. Paying off a loan

Selling equipment

statement of changes in equity would not show

revenues and expenses.

‘the owner's ending capital balance.

e owner's initial capital balance. °

‘owner's withdrawals for the period.

Ballado

ag by Prof We

ting.

ing ond RECS statements excent th,

ose iancOl SESS

ppears in allt

ng financial

5-24 | he followi

24, The profit figure 2

sheet.

a. balances! ;

e statement

b. incom tof cash flows.

é statement of changes In equity.

5 yws would disclos

25, Thestatement of cash flo

in the financing activi

b. inthe investing activitie

c._ inthe notes to the finan

d, inthe operating activities 5

e the withdrawal of cash by the Orin

jes section.

5 section.

cial statements.

ection.

ing activity?

26. Which of the following is an ‘example of an operating

a. Obtaining capital from owners:

b. Purchasing equipment

c._ Selling goods and services to customers

d,

|. Selling land

27. The owner's Capital account is found on the

‘a. balance sheet debit column and nowhere else.

b. trial balance credit column, adjusted trial balance credit column, and balatc

sheet credit column of a worksheet. :

¢. trial balance credit column, adjustments credit column, adjusted trial balang

credit column, and balance sheet credit column of a worksheet.

d. trial balance credit column and income statement debit column of a worksheet

e. trial balance debit column, adjustments debit column, adjusted trial balan:

credit column, and income statement credit column of a worksheet.

. Ifthe amount of profit for the current

: Period is less than cownets

withdrawals, there will be a(n) al

3. decrease in the Cash account,

b. decrease in the owner's Capital account. ’

increase in liabilities on th

i e balance

increase in the Cash account. oe

=. increase in the owner's Capital account.

for Jeffrey Franco's Treasures is P2so,

P30,000 per mo;

eh for personal

000 for the current year. The o™” i

t will show a n

living expenses. The owner's

“increase of P110,000, Ss

= increase Of P360,000,

which of the following is a cash Outflow fi

TOI Stee,

payment for interest expense ™ operating activities?

: payment to acquire Prope

payment to settle notes Cae equipment.

de payment to owners in the form of withdra :

wals,

o

trial balance debit i.

gy Mm °F credit amount of each account is combined with the

amount of any debit or credit adjustmen

tt

balance of the account. This process is know ae account to determine the new

a. balancing.

p. cross-footing. c. footing.

d. totaling.

4. which of the following comes first in the accounting process?

journalizing external transactions

preparation of an adjusted trial balance

preparation of an unadjusted trial balance

worksheet preparation

aoe

3. Which two steps in the accounting cycle are aided by the preparation of a

worksheet? :

adjusting the accounts and preparing financial statements

analyze source documents and preparing financial statements

posting journal entries and adjusting the accounts

journalizing transactions and closing the accounts

pose

34. Posting a P3,000 debit as a credit causes an error

c. thatis divisible by 9.

a, inthe journal.

d. that is divisible by 2.

b. known as transposition.

the following information to answer questions 35 to 39 below. Villanueva Realty

ithe following balance sheet accounts and balances:

Accounts Payable 60,000 Equipment 5 ‘70,000

Accounts Receivable 10,000 Arlyn Villanueva, Capital ?

Building 2? land 70,000 ,

30,000

35.

36.

37.

38.

5-26 | Basic Financial

BP op

: id i 1g account.

were paid in cash, what woul was P80,000 and P30,000 of Accounts Pai

unt was pai

0,000, what w,

ou

ital acc le be

If the balance of the

balance of the Buildint

250,000

40,000

90,000

210,000

),000, what would by

tance of the Building aecount was P170 a)

alance o! Y 3

If the bi

wner's equity?

liabilities and 0

a, P170,000

b, P270,000

cc. P320,000

d. P350,000

If the balance of the Building account was p150,000 and the equipment was so.

70,000, what would be the total of owner's equity?

a. P150,000

b. P160,000

c. P270,000

d. P330,000

If the balance of the Building account was-P140,000 and P30,000 of Accous

t A |

Payable were paid in cash, what would b if i e) .

ld be the balance of the Villanueva, Capit’

a. P210,000

b. P260,000

©. 320,000

d. 340,000

wuld ¥

a. P140,000 he the total liabilities and owner's equity?

- P180,000

P190,000

. P230,000

- — mean eet and Financial Statements | 5-27

amet

reset Extensions

ify each of the accoun

ts listed b

wok revenue (R), oF expenses (E). Hi

‘OW as assets

cate the norm:

‘Ount will a

(A), liabilities (L), owner's equity

val debit or credit balance of each

PPear in the Income Statement columns.

count, Indicate whether each ace

il orthe Balance Sheet columns (B)

Of the work sheet,

Income Statement

Account Classificat Normal or Balance Sheet

ification Balance Columns

imple: Rent Expense 7

pane E Debit 1

2. Accounts Receivable

p. Depreciation Expense-C. Eqpt.

¢. Accounts Payable

d, Supplies

e. Computer Equipment

f. Christopher Biore, Capital

g. Accum. Depreciation- C. Eqpt.

h. Christopher Biore,

Withdrawals

i Consulting Revenues -

j. Prepaid Insurance

haps! & PAP IO

S

bei-le POSSer Pe

Problem #2

Permanent or Temporary Accounts |

anent or temporary, ang in dicate

Classify the accounts listed i aa the financial statement jn Which catty

Not each account is closed, Also, in ws

Will appear.

Closed

Balance ies

Account Title Permanent | Temporary | Yes te See sh

ey

~BEMbe: Bulging 7

Xx xX

~2 Rent Expense

~B Prepaid insuranee ary? z

£. Accounts Receivable x :

2. Supplies Expense re ;

$ Accum. Depreciation F/F Xk f x

£. interest Payable % :

8 Service Revers * x : ee

h. Notes Payable x

i. Depreciation Expense-f/F ale z z meee

Problem #3

nsion of Account Balances to Proper Worksheet Columns

11. Accounts Receivable

2 Buildings 12, Interest Expense

Salaries Expense

20; nts Payable

—

13. Interest Revenues

4. Mortgage Payable 14, Unearned Revenues

Ss. Prepaid Insurance 15. Office Supplies

6. Equipment 16, Withdrawals fence

Utilities Expense vv. Interest Payable eee

a 18, Accum, Depreciation-Bldg. rama

seme renues 1g. Rent Expense ——

laries Payable

in eath

the worksheet the amount in i

eine the following letters: 9, income statem

edit; c. balance hi

Sheet, debit; q, balance sheet, credit.

went!

" atstect Preparation

1, 2019 trial

mre ways "balance for Rosalina Besario Surveyors is presented as follows:

Rosalina Besa rio Surveyors

Trial Balance

May 31, 2019

Cash

Accounts Receivable P 210,000

Prepaid Advertising 930,000

Engineering Supplies 360,000

survey Equipment 1 Snane

Accum. Depreciation-Su i co

pccounts Payable UP #240000

Unearned Survey Revenues ea

Notes Payable 500,000

Besario, Capital 1,120,000

Besario, Withdrawals a 700,000 “one

Survey Revenues 6,510,000

Salaries Expense 3,270,000

Rent Expense 960,000

Insurance Expense 250,000

Utilities Expense 160,000

Miscellaneous Expense 80,000

Totals P9,080,000 _ P9,080,000

_ The following information p

end, salaries in

‘of P60,000 on tl

pare the adju:

ertaining to the year-end adjustments is available:

The P360,000 prepaid advertising represents expenditure made on Nov. 1, 2018 for

nthly advertising over the next 18 months.

unt of the engineering supplies at May 31, 2019 amounted to P90,000.

jation on the surveying equipment amounted to P160,000.

‘ird of the unearned survey revenues has been earned at year-end.

mount of P140,000 have accrued.

thea

es payable has accrued at year-end.

he not

stments on the worksheet and complete the worksheet.

———= |

NAME:

SECTION:

Problem #5

jondo}

Comprehensive Problem sal balance of the Moises Dondoyang Mot

al

adjusted tria’ © oy

Presented below is ie ui a 31, 2019:

Systems for the year adoyano tformation Systems

Moises Oe ae seg Trial Balance

Dec. 31, 2019

P 45,000

360,000

Cash

Notes Recelvable 156,000

Accounts Receivable 63,000

Office Supplies 300,000

land , 1,590,000

ildit ‘ P 254,000

pommel Depreciation-Building : add

Equipment

pccomulated Depreciation-Equipment paaee

Pesala : 450,000

Unearned Consulting Revenues eo

Dondoyano, Capital, 1/1/2019 : 655,000

Dondoyano, Withdrawals 600,000

Consulting Revenues 2,108,000

Salaries Expense 875,000

Repairs Expense 116,000

Miscellaneous Expense : 37,000

¢ —

Totals 6,292,000 6,292,000

292,000

Additional information:

Office supplies on hand as at Dec,

._ One-third of the unearned Tevenu

Depreciation for the year amouny

F. 31, 2019 is P21,000.

gether with a 20% interest on Ma

Tes 3).

Si m9 4

is

41.4

er account for each iF the account inthe u

d Post the adjusting entri

; Nadjusted trial balance:

ies,

ted trial balance,

yg

em #6

or “events on Financial Statements

2018, the acc .

pee. 34, 2028, the accounting re

8 53 ined the following balances: cords for Esperanza Nolasco Outdoor Ad ConcePts

assets F

quities

h P180,000

ons Receivable 110,000 Accounts Payable p 34,000

nd - 90,000 Nolasco, Capital 346,000

fa 380.000. Total 380,000,

—_—_—

refallowing accounting events apply to 2019:

san iors additional cash investments from the owne?-

1 Purchased a service vehicle that cost P80,000. The vehicle has 2”

p8,000 salvage value and a 3-year useful life.

Borrowed P100,000 by issuing a note that carried a 9% annual

interest rate and a 1-year term.

1 Paid P24,000 cash in advance for a 1-year lease for office space.

Mar. 1 Nolasco withdrew P30,000 for emergency

April 1 Acquired land that cost P70,000 cash.

May 1 Made a cash payment on accounts payable amounting to 15,000.

July Received P42,000 cash in advance as a retainer for services to be

performed monthly over the coming year.

Sold land for P100,000 cash. The lan originally cost 90,000.

Purchased P20,000 of supplies on account.

Purchased a 1-year 50,000 certificate of d

annual rate of interest.

Total earned service rev

sh collections from accoun'

ses on account during the year that

‘feb.

personal use.

Sept. 1

Oct. 1

Nov. 1

leposit that paid a 6%

account) for the year, 250,000.

enues (on

ts receivable amounted to

Dec. 31

: 31 Total ca:

P200,000.

31 Incurred other operating expen’

a3 amounted to pgo,000.

Accrued salaries amounted to P32,000.

ined on hand at the end of the period.

1,000 of supplies rem

oul xy 2a

ee the following questions, AN

7

Based on the preceding information, answe! au

Pertain to the 2019 financial statements. -

What is the total amount of revenues appearing on the income Statement,

J What is the amount of supplies expense that would appear on the income

jtatement?

na is the amount of interest expense that would appear on the income

statement?

4, MUhat is the amount of rent expense that would appear.on the income

statement?

5/ What is the amount of total expenses that would appear on the income

Statement?

6. MWvhat is the amount of the gain from the sale of land ‘appearing On the income

Statement? '

ve on the statem ent of cash lows? 2 i

12. fat is the amount of Net cash flow from ve Sti ci a es tha

ae 8 activities th t would appe:

Mount of cash flow ingn fi

Of cash flo) from financing activities that would appear on

m #7

ple

ancl Statements

ate whether each “

indica of the followi

moment of changes in equi following would appear i

ty or Balaneerchee ne ae on the income statement, the

sa Mortola Skincare.

Item

Zxample: Total liabilities at the end of th

e year.

Supplies on hand at the end of the year.

Total insurance expired during the veal

‘Accounts receivable at the end of the year.

Total revenues earned during the year.

Total withdrawals by the owner.

The book value of the entity's equipment.

The amount of depreciation taken on

equipment during the year.

The cost of supplies used during the year.

Owner's. equity at the beginning of the year.

Profit for the year.

Balance

Income

Sheet

x

‘Statement

of Changes

Statement _|_in Equity

\.

\

\ \

t \

it \

{ rai

\

\

|

|

NAM

SECTION

Problem #8 ' a

Comparing Income with Cash Flo\

al

‘ was ores

Michelle Ogatis Delivery tes

quarter of operations, Ogatis Pl

Income

‘summary of Transactions ren

of whic! -

( formed for customers, pgg0,000, es

Behrens end of the qual

gonJan. 2, 2029. At the end of

Oe ry of her transactions as shown is ing

Ploy.

ret Computation of

* +P880,000

[es

eight remained uncollected at the

nk, P300,000 (one-year note).

i iness: ,000;

(c) Service vehicle acquired for use in the business: cost, P90,

paid 30% down, balance on credit.

(d) Expenses, P360,000, of which one-sixth remained unpaid at

the end of the quarter.

(e) Service supplies purchased for use in the business, P30,000.

One-fourth remained unpaid at the end of the quarter. Also,

one-fifth of these supplies were unused at the end of the

(b) Cash borrowed from the local ba

Salaries earned by employees, P210,000, of which one-| -half

remained unpaid at the end of the quarter,

ions, compute the

_| score: a i

PROFESSOR:

Pa lem rn

ration of the Income st;

pre ‘atement and the Statement of Changes In Equity

income and expense accounts of

e és Not

pelo represent the activities for th ra Maniquiz Real Estate Agency, which are listed

€ month of June 2019:

Advertising Expense

Commissions Expense P 163,000

Office Supplies Expense 7 475,000

Real Estate Revenues 27,000

Rent Expense 1,250,000

Salaries Expense 48,000

utilities Expense 264,000

Depreciation Expense aa

required: %

1, Prepare an income statement for the month ended June 30, 2019.

2, On June 1, 2019, Maniquiz has a P123,000 capital balance. During the month,

Maniquiz invested an additional P16,000 in the business and withdrew 250,000

Prepare astatement of changes in equity for the month ended June 30, 2019.

PROFESSOR:

Problem #10 ;

‘Paration of the Statement of Changes in Equity

The capital, withdrawal and income summary accounts for Leonila ce

ency are shown in T-account form below. The closing entries have been , Ales Ty

the year ended Dec. 31, 2019. Score ,

Generales, Capital

Jan.1 360,000

280,000

430,000

1,280,000

re

ont

——___iworesson,

PROFESSOR:

otowing financial infor

qe mation is known about thes: N

e unrelated entities:

Neo Agluy

Blugub Benedtcta Beatriz Onate

pdb 2018: 7

assets. P450,000

rabilities 235,000 een 290,000

x 140,000

pee. 31, 2019: :

‘assets 480,000

a b 410,000

abilities ? 275,000 190,000

ring 2019:

‘add'l Investments 50,000 15,000 77,500

profit 75,000 a 90,000

withdrawals 25,000 30,000 38, 750

required:

1, Refer to Neo Aglugub:

a. What's the owner's equity as at Dec. 31, 2018?

b. What’s the owner's equity as at Dec. 31, 2019?

. What's the amount of liabilities as at Dec. 31, 2019?

2. Refer to Benedicta Cumagun:

at Dec. 31, 2018?

¢. 31, 2019?

a. What's the owner's equity as

~b, What's the owner's equity as at Det

BY What's the profit for 2019?

ts owned by Beatriz O1

3, What's the amount of asse

| investments in Placid

the amount of additiona!

Placido

Tuddao

800,000

380,000 -

1,250,000

640,000

*?

120,000

0

nate as at Dec. 31, 2019?

lo Tuddao made during 2019?

Problem #12

Preparing the Financial Statements

it of changes in equity, ang,

heet, statemen' in

for the balance s! oy

The accounts . CPA, are as follows:

statement of Alfred Cesar Quinsay,

P 63,500

Accounts Payable 198,000

Accounts Receivable 4 110,000

Accumulated Depreciation-Building ot 120,000

Accumulated Depreciation-Office Equip 1,361,500

Auditing Revenues 750,000

Building 118'500

Cash : 55,000

Depreciation Expense-Building : pe

Depreciation Expense-Office Equipment . a 193,500

Quinsay, Capital, 1/1/2019 ies aoe

Quinsay, Withdrawals 75,000

land ,|

Notes Receivable 60,000

Office Equipment 362,500

Office Supplies Expense 96,000

Office Supplies : 28,000

Professional Development Expense 86,500

Rent Expense 52,500

Salaries Expense 735,000

Salaries Payable 30,500

Travel Expense 41,000

Utilities Expense 18,000

During the year,

Quinsay investeg additional P22,000 inthe business,

v

:

(a _

a

; ———

by

13

ret of Cash Flows

cash received from sal

. le of i

| © Gash paid for salaries. oe

Cash received for interest o1

cosh paid to acquiteanewtrucke

cash loaned out to a customer in the form of

cash received for services rendered. of ee

Cash paid for interest. 5

Cash paid for insurance on equi

. equipment.

h received t

Cas ed from a debtor representing payments of principal

Cash paid out to acquire a building. 5

required?

categorize each ca:

ch flow as (0) for operating, (I) for investing, or (F) for financing.

problem #14

Cash Flows from Operating Acti ties-Indirect Method

19. During the year, the

le increased by P110,000

in 2019 and

a profit of 330,000 in 20

0,000. Accounts receivabl

000. The entity started operations i

nt liabilities.

t assets and curre

imara Andam Business Solutions had

entity had depreciation expense of P71

and accounts payable increased by P50,

the foregoing are the entity's only curren!

wired:

rmine the net cash flows fro

m operating activities using the indirect method.

N

‘SCORE:

NAME:

SECTION:

PROFESSOR:

h Flows

Crotiem #15

lassi

ification of Events on Statement of Cas!

n to the operations of Party Consulta

entity had the following ceed an oy

Ctions

Ui following transactions pertal

planning entity owned by Eleanor Tan. The

the month:

0,000 cash investment from the owner.

5 on account.

nses on account.

1. Received a P18

2. Provided P400,000 service:

Incurred P220,000 of operating expe!

from accounts receivable.

he owner of the business.

3.

4. Collected P320,000 cash

5. Allowed a P30,000 cash withdrawal to t

6. Paid P160,000 cash on accounts payable.

7. Performed services for 30,000 cash.

8. Paid P12,000 cash for expenses-

Required: :

Classify each of these transactions as @ cash flow from operating activities (0A,

IA), or financing activities (FA)- Transactions that do not affect

h flows should be identified as “nfa”. :

_1.

investing activities (1.

the statement of cas

astatement of cash flows.

Prepare

You might also like

- Dores Marie Pateno Hobby Shop FinancialsNo ratings yetDores Marie Pateno Hobby Shop Financials2 pages

- General Journal: (To Purchase Equipment Paid With Cash and Account Payable For The Balance)100% (1)General Journal: (To Purchase Equipment Paid With Cash and Account Payable For The Balance)7 pages

- Business Transactions and Worksheet (Teofila Albay)No ratings yetBusiness Transactions and Worksheet (Teofila Albay)1 page

- Madelyn Rialubin Travel Agency Adjusting EntryNo ratings yetMadelyn Rialubin Travel Agency Adjusting Entry4 pages

- Exercise 3 Adjusting Entries - Service Business75% (4)Exercise 3 Adjusting Entries - Service Business2 pages

- Activity No. 3 - Principles of Accounting: Answers100% (1)Activity No. 3 - Principles of Accounting: Answers2 pages

- John Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditNo ratings yetJohn Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit Credit3 pages

- FAR Closing Entry Quiz - With Answer and ExplanationNo ratings yetFAR Closing Entry Quiz - With Answer and Explanation3 pages

- Account Transactions: Cresencio LaurenteNo ratings yetAccount Transactions: Cresencio Laurente12 pages

- Moises Dondoyano Information Systems Company Trial Balance: Accounts Dr. CRNo ratings yetMoises Dondoyano Information Systems Company Trial Balance: Accounts Dr. CR5 pages

- Financial Analysis: Equity & Assets 2019No ratings yetFinancial Analysis: Equity & Assets 20191 page

- Journal Entries for Business TransactionsNo ratings yetJournal Entries for Business Transactions3 pages

- ACT1101 Handouts On The Completion of Accounting ProcessNo ratings yetACT1101 Handouts On The Completion of Accounting Process5 pages