0% found this document useful (0 votes)

569 views12 pagesConceptual Framework First Problem

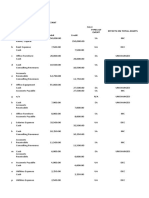

1) The document contains journal entries recording various financial transactions of a medical business from October 1 to November 1, 2020, including the initial investment, acquisition of assets, revenues and expenses.

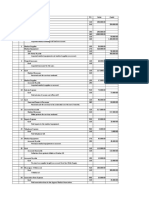

2) Adjusting entries were made on October 31 to allocate prepaid insurance, adjust supplies inventory, record depreciation expense and interest expense.

3) Closing entries on October 31 transferred revenue and expense accounts to an income summary account and capital account. Reversing entries on November 1 removed accrued salaries and interest from expense accounts.

Uploaded by

John JosephCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

569 views12 pagesConceptual Framework First Problem

1) The document contains journal entries recording various financial transactions of a medical business from October 1 to November 1, 2020, including the initial investment, acquisition of assets, revenues and expenses.

2) Adjusting entries were made on October 31 to allocate prepaid insurance, adjust supplies inventory, record depreciation expense and interest expense.

3) Closing entries on October 31 transferred revenue and expense accounts to an income summary account and capital account. Reversing entries on November 1 removed accrued salaries and interest from expense accounts.

Uploaded by

John JosephCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 12