0% found this document useful (0 votes)

2K views2 pagesMS Excel Exercise

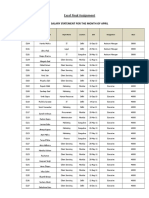

This document provides a payroll template for ABC Company for June 2019. It includes columns for name, salary, allowance, evaluation, bonus, gross pay, tax, pension, deductions, total deductions, and net pay. Formulas are provided to calculate bonus based on evaluation, tax based on salary, pension based on salary, and to calculate gross pay, total deductions, and net pay. The worksheet is to be renamed to "Payroll".

Uploaded by

AgatCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

2K views2 pagesMS Excel Exercise

This document provides a payroll template for ABC Company for June 2019. It includes columns for name, salary, allowance, evaluation, bonus, gross pay, tax, pension, deductions, total deductions, and net pay. Formulas are provided to calculate bonus based on evaluation, tax based on salary, pension based on salary, and to calculate gross pay, total deductions, and net pay. The worksheet is to be renamed to "Payroll".

Uploaded by

AgatCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

/ 2