0% found this document useful (0 votes)

163 views23 pagesPersonal Budgeting Skills Guide

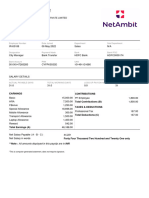

This document outlines the process for developing and using a personal budget, including analyzing budgeting as a financial tool, developing a personal budget by recording income and expenses, implementing and monitoring the budget, and discussing handy hints for managing personal finances. Key steps involve identifying sources of income and expenses, creating a spreadsheet to track budget information, determining a surplus or deficit, and modifying the budget based on actual spending compared to planned amounts. Maintaining an accurate personal budget allows individuals to plan spending and saving each month and track financial habits over time.

Uploaded by

Nigussie BerhanuCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

163 views23 pagesPersonal Budgeting Skills Guide

This document outlines the process for developing and using a personal budget, including analyzing budgeting as a financial tool, developing a personal budget by recording income and expenses, implementing and monitoring the budget, and discussing handy hints for managing personal finances. Key steps involve identifying sources of income and expenses, creating a spreadsheet to track budget information, determining a surplus or deficit, and modifying the budget based on actual spending compared to planned amounts. Maintaining an accurate personal budget allows individuals to plan spending and saving each month and track financial habits over time.

Uploaded by

Nigussie BerhanuCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 23