0% found this document useful (0 votes)

88 views16 pagesTCS Financial Analysis & Accounting Cycle

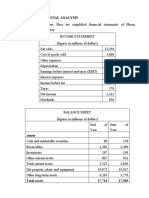

This document contains an accounting assignment submitted by Dhanisha Nitin Lolam for their MBA in Banking and Finance. The assignment includes journal entries, trial balance, and ledger for 15 major monetary transactions of Tata Consultancy Services for the years 2019-2020. It also contains 4 questions analyzing short-term and long-term solvency ratios, profitability and activity ratios, and horizontal analysis of the company's 2018-2019 and 2019-2020 financial statements.

Uploaded by

Sonu LolamCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

88 views16 pagesTCS Financial Analysis & Accounting Cycle

This document contains an accounting assignment submitted by Dhanisha Nitin Lolam for their MBA in Banking and Finance. The assignment includes journal entries, trial balance, and ledger for 15 major monetary transactions of Tata Consultancy Services for the years 2019-2020. It also contains 4 questions analyzing short-term and long-term solvency ratios, profitability and activity ratios, and horizontal analysis of the company's 2018-2019 and 2019-2020 financial statements.

Uploaded by

Sonu LolamCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 16