0% found this document useful (0 votes)

77 views6 pagesSolution Aassignments CH 2

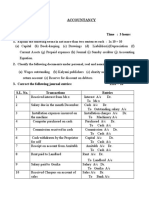

The document provides a balance sheet for Spencer Playhouse and identifies several issues with the balance sheet. It discusses which assets and liabilities should and should not be included based on whether they belong to the business entity or the owner personally. It also addresses the proper valuation and classification of several items and calculates the correct owner's equity figure.

Uploaded by

RuturajPatilCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

77 views6 pagesSolution Aassignments CH 2

The document provides a balance sheet for Spencer Playhouse and identifies several issues with the balance sheet. It discusses which assets and liabilities should and should not be included based on whether they belong to the business entity or the owner personally. It also addresses the proper valuation and classification of several items and calculates the correct owner's equity figure.

Uploaded by

RuturajPatilCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

/ 6