Ex. 7.8 a.

Uncollectible Accounts Expense … 200,000

Allowance for Doubtful Acco 200,000

To record estimated uncollectible accounts expense

at 2.5% of net credit sales ($8,000,000 x 2.5% =

$200,000).

b. Uncollectible Accounts Expense ……… 155,000

Allowance for Doubtful Acco 155,000

To increase balance in allowance account to

required $84,000:

Credit balance at b $ 25,000

Write-offs during (96,000)

Temporary debit $ 71,000

Required year-end cr 84,000

Required adjustme $ 155,000

c. Uncollectible Accounts Expense………………… 96,000

Accounts Receivable…………… 96,000

To record as uncollectible expense only those accounts

determined during the year to be uncollectible.

d. Adjusting the balance in the Allowance for Doubtful Accounts account based

upon the aging schedule will provide to investors and creditors the most

accurate assessment of the company’s liquidity. This method is the only

approach to take into consideration the underlying declining probability of

collecting outstanding accounts as they become increasingly past due.

�Ex. 7.13 a. The amount of unrealized holding gain included in the securities’ current market

value will appear as an element of stockholders’ equity. The securities also will

appear in the balance sheet at current market value, with their cost disclosed as

supplemental information.

b. As of December 31, Year 1, Wharton Inc. still owns the marketable securities.

Therefore, it has not yet paid any income taxes on the increase in the securities’ value.

Unrealized gains on investments are not subject to income taxes. Taxes are owed only

in the year in which the gains are realized through the sale of investments.

c. Jan. 4 Cash ……………………………………………… 520,000

Marketable Securities 180,000

Gain on Sale of Investment 340,000

To record sale of investments at a price above

cost.

d. The sale of securities on January 4, Year 2, will increase Wharton’s taxable income

for that year by $340,000, the amount of the gain. As the company pays income taxes

at the rate of 30% on capital gains, Year 2 income taxes will be increased by $102,000

($340,000 capital gain x 30% tax rate).

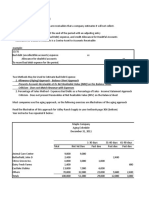

� PROBLEM 7.1A

BANNER, INC.

a.

BANNER, INC.

Bank Reconciliation

July 31

Balance per bank statement, July 31 $ 114,828

Add: Deposit in transit 16,000

$ 130,828

Deduct: Outstanding checks

no. 811 $ 314

no. 814 625

no. 823 175 1,114

Adjusted cash balance $ 129,714

Balance per accounting records, July 31 $ 125,568

Add: Note receivable collected by bank $ 4,000

Check no. 821 for office equipment:

Recorded as $ 915

Actual amount 519 396 4,396

$ 129,964

Deduct: Service charges $ 50

NSF check, Howard Williams 200 250

Adjusted cash balance (as above) $ 129,714

b.

General Journal

July 31 Cash 4,396

Notes 4,000

Receivable

Office 396

Equipment

To record collection by bank of note

receivable

from Rene Manes, and correct recorded

cost

officeofequipment.

July 31 Bank Service Charge 50

Accounts Receivable (Howard Williams) 200

Cash 250

To adjust accounting records for bank

service charges

charges and the and

customer's check

charged

NSF. back as NSF.

c. The amount of cash that should be included in the balance sheet at July 31 is the

adjusted balance of $129,714.

d. The balance per the company’s bank statement is often larger for two reasons: (1)

There are checks outstanding which have been deducted in the company’s

records but which have not yet cleared the bank, and (2) the bank periodically

makes collections and deposits them into the company’s account.

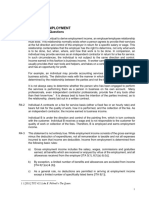

� PROBLEM 7.3A

PUTNAM & PUTNAM

a.

Accounts Receivable by Age Group

Percentage Estimated

Considered

Amount Uncollectible

Accounts

a. Not yet due $ 300,000 Uncollectible

1% $ 3,000

b. 1-30 days past due 126,000 3% 3,780

c. 31-60 days past due 48,000 10% 4,800

d. 61-90 days past due 9,000 20% 1,800

e. Over 90 days past due 18,000 50% 9,000

Totals $ 501,000 $ 22,380

b.

General Ledger

Dec 31 Uncollectible Accounts 15,300

Expense Allowance for Doubtful 15,300

Accounts

To increase the valuation account to the

estimated

required total of $22,380 computed as

follows:

Required credit balance for valuation $ 22,380

account:

Present credit balance 7,080

Current provision ($22,380 - $7,080) $ 15,300

c.

Jan 10 Allowance for Doubtful Accounts 5,160

Accounts Receivable 5,160

To write-off as(Safeland Co,.) the account

uncollectible

receivable from Safeland Co.

d. Such a policy would compensate the company for having to wait extended periods

of time to collect its cash. It also provides the company with additional “leverage”

in a court of law should it decide to press charges against customers with

delinquent accounts.

� PROBLEM 7.6A

EASTERN SUPPLY

a.

General Journal

Sept 1 Notes Receivable 75,000

Accounts 75,000

Receivable

Accepted a 9-month, 10%

account (Partyofdue

note in settlement

receivable Plus)

an

today.

Dec 31 Interest Receivable 2,500

Interest 2,500

Revenue

To accrue interest for four

months (September

through December) on

Party

4/12 xPlus

10% note ($75,000 x

= $2,500).

June 1 Cash 80,625

Notes 75,000

Receivable

Interest 2,500

Receivable

Interest 3,125

Revenue

Collected 9-month, 10%

note fromx Party

($75,000 9/12 xPlus

10% =

$5,625, of which

was earned $3,125

in current

year).

b. Assuming that note was

defaulted.

June 1 Accounts Receivable 80,625

(Party Plus) Notes 75,000

Receivable

Interest 2,500

Receivable

Interest 3,125

Revenue

To reclassify as an

account receivable

defaulted 9-month, 10%the

note from Party Plus

($75,000 x 9/12 x 10% =

($75,000

$5,625

$3,125,interest,

was earnedof which,

in

current year).

c. There are two reasons why the company adopts this policy: (1) The

interest earned on the note compensates the company for delaying

the collection of cash beyond the standard due date, and (2) should

the company have to take a customer to court, written contracts

always are preferred over verbal agreements.