0% found this document useful (0 votes)

141 views7 pagesTVS Personal Loan Application Guide

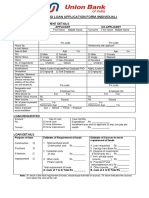

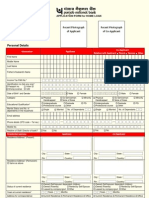

The document is a personal loan application form for TVS Solutions Loan System. It provides details about key things to know regarding the personal loan such as maximum loan amount of Rs. 20,000-5 lakh depending on credit policy, fixed interest rate over loan tenure, importance of reading loan agreement terms carefully before signing, EMI payment options and consequences of late or non-payment. It also lists the documents required for identity, address, income and financial proofs for salaried and self-employed applicants. The applicant is then required to provide personal details, residence and office address details, minority community details if applicable, loan amount and tenure required.

Uploaded by

juned shaikhCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

141 views7 pagesTVS Personal Loan Application Guide

The document is a personal loan application form for TVS Solutions Loan System. It provides details about key things to know regarding the personal loan such as maximum loan amount of Rs. 20,000-5 lakh depending on credit policy, fixed interest rate over loan tenure, importance of reading loan agreement terms carefully before signing, EMI payment options and consequences of late or non-payment. It also lists the documents required for identity, address, income and financial proofs for salaried and self-employed applicants. The applicant is then required to provide personal details, residence and office address details, minority community details if applicable, loan amount and tenure required.

Uploaded by

juned shaikhCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 7