0% found this document useful (0 votes)

57 views3 pagesTaxcomputation

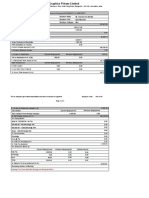

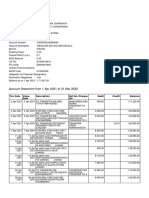

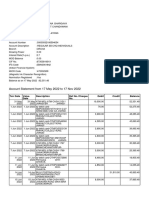

This document is a tax computation sheet for Vipin Sharma for the period of April 2022 to March 2023. It details his monthly earnings, deductions, tax exemptions claimed, and tax liability. His total gross salary for the year is Rs. 20,43,932. After claiming exemptions of Rs. 15,00,000 under Section 80C and Rs. 2,40,000 for HRA, his total taxable income is Rs. 16,01,532. His total tax liability for the year is Rs. 30,46,78 of which Rs. 90,872 has already been deducted. The tax to be deducted for the month of August 2022 is Rs. 26

Uploaded by

VIPIN SHARMACopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

57 views3 pagesTaxcomputation

This document is a tax computation sheet for Vipin Sharma for the period of April 2022 to March 2023. It details his monthly earnings, deductions, tax exemptions claimed, and tax liability. His total gross salary for the year is Rs. 20,43,932. After claiming exemptions of Rs. 15,00,000 under Section 80C and Rs. 2,40,000 for HRA, his total taxable income is Rs. 16,01,532. His total tax liability for the year is Rs. 30,46,78 of which Rs. 90,872 has already been deducted. The tax to be deducted for the month of August 2022 is Rs. 26

Uploaded by

VIPIN SHARMACopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 3