0% found this document useful (0 votes)

96 views1 pageSalarySlipwithTaxDetails

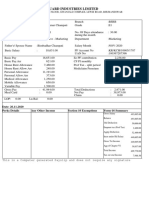

K Chandrasekhar's pay slip for April 2023 from One97 Communications shows:

- Gross earnings of INR 220927 including basic pay, allowances and arrears

- Deductions of INR 33533 for income tax, PF, and professional tax

- Net pay of INR 187394

- Income tax worksheet calculates annual taxable income at INR 1306130 and total tax as INR 115675 to be deducted monthly at INR 7649 plus INR 23884 for non-recurring earnings.

Uploaded by

abhigopal444Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

96 views1 pageSalarySlipwithTaxDetails

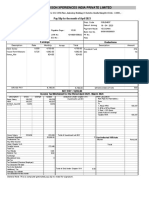

K Chandrasekhar's pay slip for April 2023 from One97 Communications shows:

- Gross earnings of INR 220927 including basic pay, allowances and arrears

- Deductions of INR 33533 for income tax, PF, and professional tax

- Net pay of INR 187394

- Income tax worksheet calculates annual taxable income at INR 1306130 and total tax as INR 115675 to be deducted monthly at INR 7649 plus INR 23884 for non-recurring earnings.

Uploaded by

abhigopal444Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 1