0% found this document useful (0 votes)

303 views4 pagesCost Accounting Assessment Guide

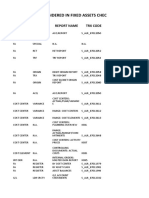

The document is a 3-question assessment on cost accounting concepts. The questions calculate labor charged to work in process, prime costs for the year, and total payroll amounts distributed to work in process and factory overhead. Details provided include inventory balances, manufacturing costs, direct materials purchases, overhead rates, and payroll data like wage rates and overtime hours. Solutions show the step-by-step work and explanations for determining the requested amounts.

Uploaded by

Sarah Nicole S. LagrimasCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

303 views4 pagesCost Accounting Assessment Guide

The document is a 3-question assessment on cost accounting concepts. The questions calculate labor charged to work in process, prime costs for the year, and total payroll amounts distributed to work in process and factory overhead. Details provided include inventory balances, manufacturing costs, direct materials purchases, overhead rates, and payroll data like wage rates and overtime hours. Solutions show the step-by-step work and explanations for determining the requested amounts.

Uploaded by

Sarah Nicole S. LagrimasCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 4