0% found this document useful (0 votes)

48 views5 pagesCorporate Rescue: CVA vs JM

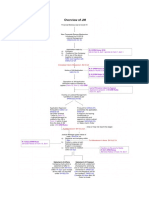

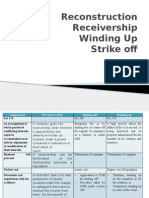

This document provides a comparison of the key differences between a Corporate Voluntary Arrangement (CVA) and Judicial Management (JM) in Malaysia.

The CVA allows private companies experiencing financial difficulties to enter into an arrangement with creditors without court approval, while JM allows for the court-appointed management of an insolvent company to preserve it as a going concern if creditors' interests are better served than winding up.

Some key differences include CVA being available only to private companies while JM can apply to any company, CVA requiring approval by 75% of creditors while JM is court-ordered, and CVA having a 28-day automatic moratorium while JM's moratorium applies until

Uploaded by

Marvin GoshanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

48 views5 pagesCorporate Rescue: CVA vs JM

This document provides a comparison of the key differences between a Corporate Voluntary Arrangement (CVA) and Judicial Management (JM) in Malaysia.

The CVA allows private companies experiencing financial difficulties to enter into an arrangement with creditors without court approval, while JM allows for the court-appointed management of an insolvent company to preserve it as a going concern if creditors' interests are better served than winding up.

Some key differences include CVA being available only to private companies while JM can apply to any company, CVA requiring approval by 75% of creditors while JM is court-ordered, and CVA having a 28-day automatic moratorium while JM's moratorium applies until

Uploaded by

Marvin GoshanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 5