STRACOSMAN: STRATEGIC COST MANAGEMENT

CHAPTER 3: Management Accounting Concepts and Techniques for Performance Measurement

SUMMARY NOTES BY: Mary Joy C. Nala, CB

BS ACCOUNTANCY 3B | 2nd SEMESTER A.Y. 2022-2023

Responsibility Accounting and Transfer Pricing Direct Costs Common Costs

Are organization sustaining

Direct fixed costs are fixed costs fixed costs that are allocated to

TERM DEFINITION that can be directly traced to the the segment. These fixed costs

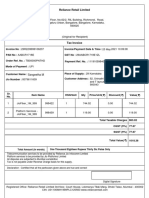

It is a responsibility center in which the segment. Just because a fixed will continue even if the segment

manager has the authority only to incur cost is direct does not mean that has been eliminated; they will

Cost it is avoidable. just be allocated to the

costs and is specifically evaluated on the

Center remaining segments.

basis of how well costs are controlled and

utilized.

Performance Margin (Manager Versus Segment

A revenue center is an organizational unit

Performance)

for which a manager is accountable only

Revenue

for the generation of revenues and has no

Center RESPONSIBILITY CENTER EVALUATION

control over setting selling prices or MANAGER TECHNIQUES

budgeting costs. Cost center manager Cost variance analysis

A profit center is a responsibility center in Revenue center manager Revenue variance analysis

Profit center manager Segment margin analysis

which the manager is responsible for Return on Investment (ROI),

Profit generating revenues, planning and Residual Income Model,

Investment center manager

Center controlling expenses in his center. Most of Economic Value Added

the time a profit center exists rather than (EVA), etc.

a purely revenue center.

Preparation Of ‘Segmented’ Income Statement

An investment center is an organizational

unit in which the manager is responsible Sales xx

for generating revenues, planning and Variable Costs (xx)

Investment controlling expenses, and has the Manufacturing Margin xx

Center authority to acquire, utilize, and dispose of Variable Expenses (xx)

assets in a manner that would seek to Contribution Margin xx

earn the highest feasible rate of return on Controllable Direct Fixed Costs and Expenses (xx)

the center’s investment cost. Controllable Margin xx

Non-controllable Direct Fixed Costs and Expenses (xx)

Concepts Of Decentralization and Segment Reporting Segment (Direct) Margin xx

DECENTRALIZATION SEGMENT REPORTING Indirect (Allocated) Fixed Costs and Expenses (xx)

Segment reporting is the

Operating Income xx

Is a form of organization’s reporting of the operating

management style where segments of a company in

Return on Investment (ROI)

the firm is divided into the disclosures

ROI = Segment Profit / Segment Investment

smaller units. These units accompanying its financial

ROI = Profit / Net Sales x Net Sales / Investment

are called by various statements. Segment ROI = Return on Sales x Assets Turnover

names, such as divisions, reporting is required for

segments, business units, publicly-held entities, and Residual Income (RI)

center, and departments. is not required for privately RI = Segment Income – Minimum Income (MI)

held ones. MI = Investment x Implied Interest Rate

Controllable Costs Non-controllable Costs Economic Value Added (EVA)

The non-controllable costs EVA = Operating Profit after Tax (OPAT) – Minimum Income

If a department has authority

are those costs that a OPAT = PBIT x after-tax rate

and responsibility for certain

department doesn’t have MI = Investment x weighted average cost of capital

costs, those costs are called

authority over and can’t

controllable costs.

change.

SUMMARY NOTES

Prof. Rica M. Quitoriano BSA 3B

� STRACOSMAN: STRATEGIC COST MANAGEMENT

CHAPTER 3: Management Accounting Concepts and Techniques for Performance Measurement

SUMMARY NOTES BY: Mary Joy C. Nala, CB

BS ACCOUNTANCY 3B | 2nd SEMESTER A.Y. 2022-2023

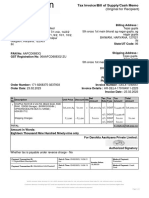

Transfer price is the price at which divisions of a company The four most commonly employed perspectives are as

transact with each other, such as the trade of supplies or labor follows:

between departments. Transfer prices are used when individual

entities of a larger multi-entity firm are treated and measured as a. Financial Perspective – employs financial

separately run entities. A transfer price can also be known as a measures of performance used by most firms.

transfer cost. (i.e., ROI and employee turnover).

TERM DEFINITION b. Customer Perspective – evaluates how well

A company that transfers goods between the company is performing from the viewpoint

Minimum multiple divisions needs to establish a transfer of those people who buy and use its products.

Transfer Price price so that each division can track its own

efficiency.

c. Internal Process Perspective – evaluates all

The best transfer price is market price. Because

critical aspects of the value chain (product

individual business units or segments have to

development, production, delivery and after-

compete with the rest of the world, they have to

Market-Based sale service) to ensure that the company is

beat the prevailing market price to stay

Transfer Price operating effectively and efficiently.

competitive. They have to follow the market

streams of capitalistic model or free enterprise

system. d. Learning and Growth Perspective –

A cost-based transfer price equals cost plus a evaluates how well the company develops and

lump sum or a markup percentage. Cost may retains its employees by evaluating employee

either be standard or actual cost. Standard cost skills and satisfaction, training programs, and

Cost-Based has the advantage of isolating variances. Actual information dissemination.

Transfer Price costs give the selling division a little incentive to

control costs. Actual cost-based transfer pricing

does not promote long-term manufacturing

efficiencies.

Negotiated transfer price may occur when

segments are free to determine the prices at

which they buy and sell internally. It is especially

Negotiated appropriate when market prices are subject to

Price rapid fluctuations. It reflects the best bargain

price acceptable to the selling and buying

divisions without adversely sacrificing their

respective interests.

BALANCED SCORECARD

The primary purpose of the Balanced Scorecard is to translate

an organization’s vision, mission, and strategy into a set of

performance measures that put that strategy into action with

clearly-stated objectives, measures, targets, and initiatives.

PERSPECTIVES OF BALANCED SCORECARD

SUMMARY NOTES

Prof. Rica M. Quitoriano BSA 3B