0% found this document useful (0 votes)

35 views15 pagesGetting Paid

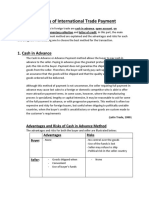

1. Getting paid is often the hardest part of international trade transactions. This document outlines various payment methods and how to manage risks when exporting goods internationally.

2. Key risks include non-payment, communication issues, and foreign exchange fluctuations. Payment methods like cash in advance or letters of credit can reduce risks, but may increase costs.

3. Proper invoices and understanding payment terms and foreign exchange is also important for international trade. Familiarizing yourself with options and building relationships can help determine the best payment method for each transaction.

Uploaded by

tranlamtuyen1911Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

35 views15 pagesGetting Paid

1. Getting paid is often the hardest part of international trade transactions. This document outlines various payment methods and how to manage risks when exporting goods internationally.

2. Key risks include non-payment, communication issues, and foreign exchange fluctuations. Payment methods like cash in advance or letters of credit can reduce risks, but may increase costs.

3. Proper invoices and understanding payment terms and foreign exchange is also important for international trade. Familiarizing yourself with options and building relationships can help determine the best payment method for each transaction.

Uploaded by

tranlamtuyen1911Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 15