100% found this document useful (1 vote)

546 views10 pagesSyllabus Auditing and Assurance Principles

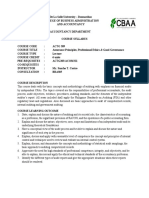

This document outlines the course syllabus for Auditing and Assurance Principles. The 3-unit course introduces students to financial statement audits and other assurance services. Topics covered include the nature of auditing and different types of audits and engagements. The course also addresses professional standards, regulations, and ethics. Upon completing the course, students are expected to understand auditing fundamentals, evaluate internal controls, and apply professional values. The syllabus provides learning outcomes, assessment methods, and a weekly course schedule over 7 weeks addressing topics like pre-engagement procedures, audit planning and supervision.

Uploaded by

Reymark Kenneth AbeciaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

100% found this document useful (1 vote)

546 views10 pagesSyllabus Auditing and Assurance Principles

This document outlines the course syllabus for Auditing and Assurance Principles. The 3-unit course introduces students to financial statement audits and other assurance services. Topics covered include the nature of auditing and different types of audits and engagements. The course also addresses professional standards, regulations, and ethics. Upon completing the course, students are expected to understand auditing fundamentals, evaluate internal controls, and apply professional values. The syllabus provides learning outcomes, assessment methods, and a weekly course schedule over 7 weeks addressing topics like pre-engagement procedures, audit planning and supervision.

Uploaded by

Reymark Kenneth AbeciaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 10