Assumptions of Technical Analysis

Market discounts every thing

The ‘how’ is more important than ‘why’

Price moves in trend

History tends to repeat itself

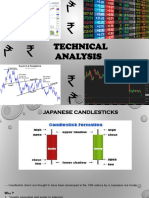

Japanese Candlestick

Long bodied candle - Depicts strong buying or selling activity

Short bodied candle - Depicts less trading activity – less price movement

Rules specific to candlesticks

Buy strength & Sell weakness – Buy on a blue candle day & Sell on a red candle day

Be flexible with patterns

Look for a prior trend – If you look for a bullish trend the prior trend should be bearish & vice versa

Trade trap

One should avoid trading during extremely small candle (below 1% range) or long candle range

(above 10% range)

Single Candle Stick Patterns

1. The Marubozu

Textbook definition – No upper & lower shadow – just the real body

Violates the Rule 3 – Can appear anywhere in the chart irrespective of the prior trend

The Bullish Marubozu

o Open = Low & High = Close

o Indicates that there is so much buying interest in the stock that the market participants

were willing to buy the stock at any price point during the day.

o It does not matter what the prior trend is

o This action suggests that the sentiment has been changed and the stock is now bullish.

o The trader should look at buying oppurtunities

o In reality there can be minor variations from the definition (The variation is price is not

much when measured in %).

o Buy price – H - around the closing price of the

marubozu

Stop loss – L - Low

The Bearish Marubozu

o Open = High & Close = Low

o Indicates so much selling pressure on the stock

indicating that the market participants sold at

every point during the day

o This action suggests that the sentiment has been changed and the stock is now bearish.

o One should look at Shorting opportunities

o Selling Price – C – Closing price of the candle

Stop loss – H

�2. The Spinning Top

Have Small Real body

The Upper & Lower shadows are almost equal

It just conveys indecision as both bulls & bears were not able to

influence the markets

Spinning Top in downtrend

o Either there will be another round of selling

o Or the markets could reverse the direction & the prices

could increase

Spinning Top in uptrend

o The bulls could be consolidating their positions before initiating another leg of up move

o Or the bulls may give way to bears – Correction could be around the corner

3. The Dojis

Very similar to the spinning tops except that – doesnot have a real body at all

Open & Close are equal and there can be wafer thin body

Upper and Lower shadows can be of any length

Color does not matter

The dojis and spinning tops appear in clusters – Indecision in the market

4. Paper Umbrella

It is characterized by Long lower shadow & Small upper body (open & close should be almost same

i.e, within 1-2% range)

Shadow to real body ration shall be atleast 2

(Length of real body = Close - Open & Length of lower shadow = Open/Close – Low)

Helps the traders in setting up directional trades

It consists of two trend reversal patterns

Can be of any color.

The Hammer formation

o The prior trend should be down trend & it occurs at the

bottom of the trend

o The longer the shadow – the more bullish the pattern

o Stoploss - L - Low of the hammer formation

The Hanging man

o Appears at the top end of a trend & it is preceded by an uptrend

o For a case of Short Sell

o Stoploss – H

5. The Shooting Star

An inverted paper umbrella

It has a long upper shadow and length of the shadow should be atleast twice

the length of the body

Color doesn’t matter

It is a bearish pattern & hence the prior trend shall be bullish

Stoploss – H

�Multiple Candle Stick Patterns

1. The Engulfing Pattern

It needs Two trading sessions to evolve

The Bullish Engulfing Pattern

o Its appears at the bottom of the trend & the prior trend should be a downtrend

o P 1 : Should be a Red candle

P 2 : Should be a Green Candle – Long enough to engulf the red candle

o Stoploss – Lowest Low between P1 & P2

o As the long as the real bodies are engulfed, can be classified

as bullish engulfing pattern

o Validation : CMP at 3:20 on P2 > P1’s Open

Open on P2 <= P1’s Close

The Bullish Engulfing Pattern

o It appears at the top end of the trend

o P 1 : Should be a Green candle

P 2 : Should be a Red Candle – Long enough to engulf the Green candle

o Validation : Open on P2 > Closing of P1

CMP at 3.20 on P2 < P1’s Open

o Stoploss : Highest high of P1 & P2

2. The Piercing Pattern

Very similar to bullish engulfing

In this pattern, P2’s blue candle partially engulfs P1’s red candle & such engulfing

shall be >50% & <100% ( if P1 range = 6, P2’s range = 6 to 12)

Stoploss : Low of the pattern

3. The Dark Cloud Cover

Similar to bearish engulfing pattern

The Red candle on P2 engulfs on P1’s Blue Candle about to 50% to 100%

2. The Harami Pattern

The Bullish Harami

o It appears at the bottom end of the trend

o P1 : Red Candle

P2 : Blue Candle

o Validations : Open of P2 > Close of P2

CMP at 3.20 on P2 < Opening of P1

o Stoploss : Lowest low of the pattern

The Bearish Harami

o Appears at the top end of the trend

o P1 : Blue Candle

P2 : Red Candle

o Validation : Open of P2 < Close of P1

Close on P2 > Open of P1

o Stoploss : Highest between P1 & P2

o