MORE REVISION – STUDY WEEK

QUESTION 1

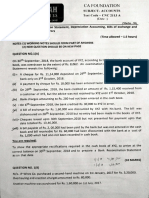

Faridah is a newly appointed accountant assistant for Putra Enterprise. Upon comparing the

bank statement and the cash book of the business for the month of October 2023, she found

that there were differences cash book and bank statement as shown below:

BANK BAHAGIA

Bank Statement as at 31 October 2023

Date Particulars Debit Credit Balance

(RM) (RM) (RM)

October 1 Balance 2,679.00 CR

2 299513 250.00 2,429.00 CR

3 Deposit 543.00 2,972.00 CR

6 Bank services charges 50.00 2,922.00 CR

9 463029 173.00 2,749.00 CR

12 463028 356.00 2,393.00 CR

17 Standing order 166.00 2,227.00 CR

20 Deposit 580.00 2,807.00 CR

23 463030 259.00 2,548.00 CR

23 463032 190.00 2,358.00 CR

25 Credit transfer 468.00 2,826.00 CR

30 463033 342.00 2,484.00 CR

Cash Book Tasek Enterprise

Date Particulars Total Date Particulars Cheque Total

(RM) no. (RM)

Oct. 1 Balance b/f 2,150.00 Oct. 15 Purchases 463030 200.00

2 Sales 543.00 18 KL Trading 463031 160.00

18 Suria Ent. 420.00 19 Purchases 463032 190.00

24 Hanny Ent. 580.00 22 Sykt. Bumi 463033 342.00

30 Raja Ent. 583.00 28 Rental 463034 1,940.00

30 Balance c/f 1,444.00

4,276.00 4,276.00

Additional information:

1. Payment cheque no.463030 amounting to RM259.00 was wrongly recorded in the cash

book as RM200.00.

2. Cheque no. 299513 in the bank statement was wrongly debited by the bank. The

cheque actually belongs to Puteri Enterprise.

3. Cheque from Suria Ent. is returned by the bank and stated as “Non-sufficient fund”.

REQUIRED:

i. Prepare a Bank Reconciliation Statement for Putra Enterprise as at 31 October 2023.

ii. Prepare journal entries to record the adjustment.

�QUESTION 2

Padu Sdn. Bhd. began its operations on 1 January 2022. During its first two years of

operation, the company completed a number of transaction involving credits sales, account

receivables collections and bad debt. These transactions are summarized as follows:

2022

1. Sales on credit was RM320,000.

2. Received RM285,000 cash in payment of accounts receivable.

3. Sales return was RM1,360.

2023

1. Sales on credit was RM335,000.

2. Sales return was RM1,200.

3. Write-off RM1,870 uncollectable account receivable.

4. Received RM271,000 cash in payment of account receivable.

5. In adjusting entry for the year ended 31 December 2023, the company estimated

that 2% of the account receivable would be uncollectible.

REQUIRED:

i. Prepare journal entries to record bad debts written-off in 2023.

ii. Show Accounts Receivable and Allowance for Doubtful Account for the year ended 31

December 2023.

iii. Prepare journal entries to record the adjustment of Accounts Receivable if the

company estimated that 1.5% on net credit sales would be uncollectible.

QUESTION 3

The following information is obtained from Badrul Sdn. Bhd. record on 1st April 2023 :

Account RM

Equipment (cost) 180,000

Accumulated depreciation – Equipment 88,000

Equipment’s depreciation is at a rate of 10% per annum using the straight-line method.

Depreciation is charged on yearly basis and no depreciation is charged at the disposal date.

Badrul Sdn. Bhd’s accounting period ends every 31st December.

Additional information :

1. On 1st March 2023, Badrul Sdn. Bhd sold one of the equipment at price RM27,000. The

equipment is bought on 1st January 2018 at cost RM66,000 and residual value RM4,000.

2. On 1st August 2023, Badrul Sdn. Bhd. purchased a new equipment worth RM48,000.

This purchase is done by exchange one of the old equipment with cost of RM32,000 and

book value of RM12,000. Badrul Sdn. Bhd. receives trade-in allowances of RM15,000.

Payment is made in cash.

REQUIRED:

i. Prepare journal entries to record the transaction on 1 st March and 1st August 2023.

(Omit explanation)

ii. Prepare journal entries to record depreciation expenses in the financial year ended

31st December 2023. Show all the calculations. (omit explanation)

iii. Prepare the extract of the Statement of Financial Position as at 31 December 2023.