SESSION 45.

PROBLEM SEATWORK

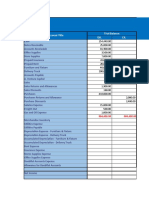

SEATWORK. The following are transactions of Sparta Company for the month of May.

May 3. Sparta Company deposited P225,000 in the checking account with Silver Bank.

5. Bought merchandise from Troy Trading. Issued Check No. 0901 in the amount of ₱56,250.

7. Sparta Company deposited P168,750 in the checking account

8. Deposited P146,250 in the checking account

9. Bought merchandise from various suppliers and issued the following checks:

Payee Check No. Amount

Zeus Co. 902 ₱94,500

Sphinx Trading 903 208,125

15. Purchased merchandise from various suppliers and issued the following checks:

Payee Check No. Amount

Chronos Co. 904 ₱72,000

Eros Co. 905 29,250

29. Issued Check No. 0906 to Pontus Merchandising, P37,125

31. Deposited P54,000 in the checking account

Presented below is the statement of account received from Silver Bank:

Sparta Company Account No. 00789

1111 Athena Road, Quezon City May 31, 2017

Date Debit Credit Balance

Apr.30 ₱57,750

May. 3 225,000 282,750

May. 5 Chk No. 0901 56,250 226,500

May. 7 168,750 395,250

May. 8 146,250 541,500

525 DM 540,975

May. 9 Chk No. 0902 94,500 446,475

16-May-17 Chk No. 0905 29,250 417,225

17-May-17 Chk No. 0903 208,125 209,100

29-May-17 75,000 CM 284,100

600 BSC 283,500

30-May-17 NSF 28500 255,000

19,500 274,500

Legend: DM- Debit Memo, CM- Credit Memo, NSF- No Sufficient Funds, BSC- Bank Service charges

Note: The P525 debit memo is the cost of the checkbook. The P75,000 credit memo is a collection of a noninterest bearing

note and the 600 is the bank service charge for the collection.

Presented below are the amounts entered in the cash receipts book and cash payments book respectively.

03-May 225,000 Check No. 0901 ₱56,250

7 168,750 902 94,500

8 146,250 903 208,125

31 54,000 904 72,000

905 29,250

Note: In the bank statement, the P19,500 credit on May 30 is a deposit of Hades Company erroneously recorded by the bank

under the account of Sparta Company.

Beginning cash balance per general ledger is P20,625.

Required:

1. Prepare a bank reconciliation.

2. Prepare the necessary adjusting journal entries.