0% found this document useful (0 votes)

80 views5 pagesCashFlowStatement Problems

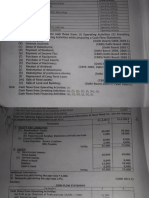

The document contains multiple illustrations of financial statements, including balance sheets and income statements for various companies. Each illustration requires the preparation of cash flow statements based on the provided financial data and additional information. The examples cover different scenarios, including asset sales, dividend payments, and changes in liabilities and equity.

Uploaded by

Maha lakshmiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

80 views5 pagesCashFlowStatement Problems

The document contains multiple illustrations of financial statements, including balance sheets and income statements for various companies. Each illustration requires the preparation of cash flow statements based on the provided financial data and additional information. The examples cover different scenarios, including asset sales, dividend payments, and changes in liabilities and equity.

Uploaded by

Maha lakshmiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 5