0% found this document useful (0 votes)

2K views20 pagesProgress Billing

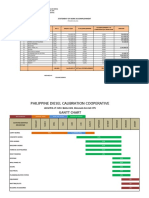

The document presents a series of problems and solutions related to progress billing in construction projects, covering various scenarios such as percentage completion, retention, VAT, withholding tax, liquidated damages, and subcontractor payments. Each problem includes a clear calculation to determine the amounts to be billed or received by contractors. The scenarios are tailored to the context of construction engineering in the Philippines.

Uploaded by

Thalia MorpheusCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

2K views20 pagesProgress Billing

The document presents a series of problems and solutions related to progress billing in construction projects, covering various scenarios such as percentage completion, retention, VAT, withholding tax, liquidated damages, and subcontractor payments. Each problem includes a clear calculation to determine the amounts to be billed or received by contractors. The scenarios are tailored to the context of construction engineering in the Philippines.

Uploaded by

Thalia MorpheusCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 20