0% found this document useful (0 votes)

445 views4 pagesMod 2

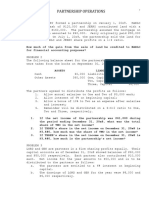

The document outlines the rules for profit and loss distribution in partnerships, detailing the order of priority for both profits and losses. It includes specific agreements for profit sharing, provisions for salaries, interest, and bonuses, as well as examples of calculations for various partnership scenarios. Additionally, it contains multiple-choice questions related to partnership accounting principles.

Uploaded by

Ceasar CoronaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

445 views4 pagesMod 2

The document outlines the rules for profit and loss distribution in partnerships, detailing the order of priority for both profits and losses. It includes specific agreements for profit sharing, provisions for salaries, interest, and bonuses, as well as examples of calculations for various partnership scenarios. Additionally, it contains multiple-choice questions related to partnership accounting principles.

Uploaded by

Ceasar CoronaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 4