SUMMER INTERNSHIP TASK

||MODULE -2||

FINANCE DOMAIN TASK- 1

Undertaken At

Outlook Publishing (India) Pvt. Ltd.

||PAYMENT GATEWAY ANALYSIS||

MASTER IN BUSINESS ADMINISTERATION-(2023-2025)

Under the Guidance of-

MS DINAKAR

BY

REETA

ADD.NO (MBA23218)

1

� ||Module 2||

FINANCE DOMAIN TASK

PAYMENT GATEWAY ANALYSIS

PART 1 SUBMISSIPON

Q1.What do you mean by Payment

Gateways?

Ans. A payment gateway is like a cashier at a store. When you want to buy something

online, like a book or a ticket, you need to pay for it. The payment gateway is the system that

helps you pay safely and securely over the internet.

Think of it like this:

1. You choose what you want to buy online.

2. You go to the checkout page and enter your payment details (like your credit card

number).

3. The payment gateway takes those details and checks if they're correct.

4. If everything is okay, it sends the money to the seller's account.

5. Then, you get a confirmation that your payment was successful!

Payment gateways help keep our payment information safe and secure, so we can

shop online with confidence

2

�Q2. How does Payment Gateways facilitate

Online Business?

Ans. Payment gateways facilitate online businesses in several ways:

1. Secure Transactions: They ensure that online transactions are secure, protecting sensitive customer

information.

2. Easy Payment Processing: They simplify the payment process, making it easy for customers to pay online.

3. Increased Conversions: By offering multiple payment options, businesses can increase sales and conversions.

4. Reduced Cart Abandonment: Easy checkout processes reduce cart abandonment rates.

5. Global Reach: Payment gateways enable businesses to accept payments from customers worldwide.

6. Automated Processing: They automate payment processing, saving businesses time and resources.

7. Real-time Notifications: They provide instant notifications of successful transactions.

8. Dispute Resolution: They help resolve payment disputes and chargebacks.

9. Compliance: They ensure businesses comply with industry security standards (e.g., PCI-DSS).

10. Analytics: They provide insights into sales and customer behavior.

By facilitating smooth and secure transactions, payment gateways help online businesses grow and succeed.

Q3. How does Payment Gateways help in

increasing the competency of an online

business?

Ans. Payment gateways help increase the competency of an online business in several ways:

1. Enhanced Customer Experience: By offering multiple payment options and a smooth checkout process,

businesses can improve customer satisfaction.

2. Increased Conversion Rates: Easy payment processing leads to higher conversion rates and more sales.

3. Improved Security: Payment gateways ensure secure transactions, protecting businesses and customers from

fraud.

4. Reduced Operational Costs: Automated payment processing saves businesses time and resources.

5. Scalability: Payment gateways can handle high transaction volumes, supporting business growth.

6. Competitive Advantage: Offering a seamless payment experience can differentiate a business from

competitors.

3

� 7. Data Insights: Payment gateways provide valuable transaction data, helping businesses make informed

decisions.

8. Compliance and Risk Management: Payment gateways help businesses comply with industry regulations and

manage payment risks.

9. Faster Payment Settlements: Payment gateways ensure timely payment settlements, improving cash flow.

10. Global Expansion: Payment gateways enable businesses to accept international payments, expanding their

market reach.By leveraging these benefits, online businesses can increase their competency, drive growth, and

stay competitive in the market.

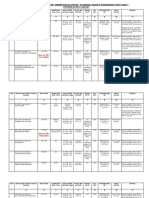

PART 2 .SUBIMISSION

Q .With respect to the below attributes,

perform a detailed secondary research of any

10 Payment Gateways:-

a) Description

b) Competencies

c) Pros

d) Cons

e) Top business tie ups

f) Cost structure (which client has to pay)

Ans. To perform secondary research on payment gateways, we will collect and analyze information from publicly

available resources such as websites, industry reports, articles, financial documents, customer reviews, and other

existing publications. The research methodology for this task would follow these steps

: Research Methodology

Literature Review : Review academic journals, white papers, and market research reports on the payment

gateway industry. Explore technical documentation and user guides provided by the gateway companies. Analyze

third-party evaluations and comparisons of payment gateways by industry analysts.

Website Review and Documentation: Visit the official websites of each payment gateway to gather data

regarding features, pricing, and client onboarding processes. Examine customer support documents, FAQs, and API

references.

Competitor Analysis: Study industry competition and market trends, looking at each payment gateway’s

competitive edge. Analyze how each gateway differentiates itself from competitors in terms of features and

technology.

4

�User Reviews and Feedback: Gather feedback from customer forums, review sites (such as Trustpilot, G2),

and case studies. Understand user sentiment about the pros and cons of different payment gateways .

Industry Case Studies :Identify key business tie-ups and partnerships. Look for real-world applications of

payment gateways in different industries (e-commerce, retail, SaaS, etc.).

.Cost Structure Analysis: Study pricing models by reviewing public documents, pricing pages, and any

additional information on fees, transaction charges, and hidden costs. Compare the cost structures of different

gateways based on client needs (small businesses, enterprises).

Here is a detailed secondary research analysis of 10 major payment gateways ,covering their description,

competencies ,pros cons ,top business tie -ups and cost structure for clients. Such as specific payment gateways ,

here are 10 examples:

1. PayPal 4.Google Pay

2. Stripe 5. Braintree

3. Amazon Pay 6. WorldPay

8. Authorize.Net 7. Adyen

9. Apple Pay

10. Square

Here, result of secondary research :

1. *PayPal*

Description: One of the most widely used payment gateways, PayPal allows both merchants and customers to make

transactions securely and swiftly in multiple currencies.

- Competencies: Global reach, strong fraud protection, and user trust.

- Pros:

- Easy integration.

- Accepts multiple currencies.

- Strong buyer/seller protection.

- Brand recognition.

5

� - Cons:

- High fees for international payments.

- Account freezes without notice.

- Top business tie-ups: eBay, Shopify, BigCommerce, Etsy.

- Cost structure:

- Domestic transaction fee: 2.9% + $0.30 per transaction.

- International fee: 4.4% + fixed fee depending on currency.

Currency conversion fee: 3-4%.

2. *Stripe*

- Description: Stripe is a developer-focused payment platform known for offering customizable APIs to enable

online payments for businesses.

- Competencies: Advanced API support, wide range of payment methods, and global payments.

- Pros:

- Customizable.

- Strong developer tools.

- Handles recurring billing easily.

- Fast payouts.

- Cons:

- Not as beginner-friendly.

- Limited customer support for small merchants.

- Top business tie-ups: Shopify, Amazon, Zoom, Lyft.

- Cost structure:

- Standard fee: 2.9% + $0.30 per transaction.

- International cards: 3.9% + $0.30.

- Additional charges for currency conversion and recurring payment

n.

3*Amazon Pay*

- Description: A popular choice for e-commerce merchants, Amazon Pay allows customers to pay using their

Amazon credentials, providing a familiar and secure checkout experience.

- Competencies: Integration with Amazon's massive customer base, strong brand recognition.

- Pros:

6

� - Trusted by millions of Amazon users.

- Easy for customers to use.

- Secure, as it uses Amazon's payment infrastructure.

- Cons:

- Only available for businesses in specific countries.

- Limited features compared to other gateways.

- Top business tie-ups: Lenovo, Allbirds, Canon.

- Cost structure:

- 2.9% + $0.30 per transaction.

- Cross-border transactions: additional 3% fee

4* Google Pay*

Description:

Google Pay is a mobile payment service that allows users to make payments online and in-store using their mobile

devices. It uses Near Field Communication (NFC) technology to enable contactless payments.

Competencies:

- Secure transactions

- Easy setup and integration

- Wide acceptance (online and in-store)

- Fast checkout process

Pros:

- Convenient and easy to use

- Secure transactions with tokenization and encryption

- Wide acceptance by merchants

- Fast checkout process

- No fees for transactions

Cons:

- Limited customization options

- Requires Google account and compatible device

- Some users may be hesitant to adopt new payment methods

Top business tie-ups:

- Googl,YouTube, Google Play, Walmart, Target, Starbuck- Airbnb

Cost structure (which client has to pay)

- No fees for transactions

7

�- No setup or integration fees

- No monthly or annual fees

5*Braintree*

Description: A PayPal service, Braintree is known for supporting a wide range of payment options and providing

strong developer tools for seamless integration

Competencies: Flexible payment methods, seamless PayPal integration, subscription management.

Pros- Recurring billing support.

- Strong support for multiple payment options.

- Good for tech-savvy businesses.

Cons:

- High international transaction fees.

- Developer-focused; not as user-friendly for non-developers.

- Top business tie-ups: Airbnb, Uber, Dropbox, GitHub.

- Cost structure:

- 2.9% + $0.30 per transaction for domestic cards.

- International cards: 3.9%.

- Additional 1% for currency conversion.

6. *Worldpay (FIS)*

- *Description*: Worldpay is a global payment processing service known for handling both in-person and online

payments for businesses of all sizes.

- *Competencies*: Global scale, strong fraud protection, and multi-channel payment options.

- *Pros*:

- Supports multiple payment methods.

- Good for businesses of all sizes.

- Strong fraud detection and data analytics.

- *Cons*:

- Complicated fee structure.

- Lengthy contract terms.

- *Top business tie-ups*: Starbucks, Best Buy, Vodafone.

- *Cost structure*:

- Custom pricing based on business size and volume.

- Average rate: 2.75% + $0.30 per transaction.

8

� - Additional fees for international transactions.

7*Adyen*

- *Description*: Adyen is a global payment company that provides in-person and online payment solutions to some

of the world’s biggest brands.

- *Competencies*: Global reach, wide range of payment methods, and scalability.

- *Pros*:

- Unified payment solution across channels.

- Multi-currency support.

- Strong fraud detection.

- *Cons*:

- Complex fee structure.

- High fees for small businesses.

- *Top business tie-ups*: Uber, Spotify, Facebook, Microsoft.

- *Cost structure*:

- Fees depend on the transaction volume and payment method.

- Standard credit card fees: 2.9% + $0.30.

- Custom pricing for high-volume merchants. 4.

8*Authorize.Net*

- *Description*: A payment gateway provider focusing on secure online credit card transactions for small and

medium-sized businesses.

- *Competencies*: Established reputation, robust security features, fraud detection tools.

- *Pros*:

- Strong fraud prevention tools.

- Supports recurring billing.

- QuickBooks integration.

- *Cons*:

- Monthly gateway fee.

- Additional fees for advanced fraud detection tools.

- *Top business tie-ups*: Adobe, Volusion, Xero.

- *Cost structure*:

- Monthly gateway fee: $25.

- Transaction fee: 2.9% + $0.30.

- Additional fees for advanced fraud detection.

9

� 9*Apple Pay*

Description: Apple Pay is a mobile payment service that allows users to make payments online and in-store using

their Apple devices (iPhone, Apple Watch, iPad, or Mac).

Competencies:

- Secure transactions with Touch ID, Face ID, or passcode

- Easy setup and integration

- Wide acceptance (online and in-store)

- Fast checkout process

Pros:

- Convenient and easy to use

- Secure transactions with tokenization and encryption

- Wide acceptance by merchants

- Fast checkout process

- No fees for transactions

Cons:

- Limited to Apple devices

- Requires iCloud account and compatible device

- Some users may be hesitant to adopt new payment methods

Top business tie-ups:

- Apple, Walgreens ,Starbucks, Target , Macy's, Bloomingdale's, Disney

Cost structure (which client has to pay):

- No fees for transactions

- No setup or integration fees

- No monthly or annual fee

Additional apple pay offer

- In-app purchases

- Online payments

- In-store payments

- Person-to-person payments (Apple Cash)

- Rewards and loyalty programs integration

10*Square*

- *Description*: Square provides both point-of-sale hardware and online payment solutions, focusing on small

businesses.

10

�- *Competencies*: Integration of in-person and online payments, free POS software.

- *Pros*:

- No monthly fees for online transactions.

- Easy setup.

- Excellent for small retail businesses.

- Free online store builder.

- *Cons*:

- Limited support for larger businesses.

- Account holds during risk review.

- *Top business tie-ups*: Weebly, Instagram, Postmates.

- *Cost structure*:

- 2.6% + $0.10 per swipe/dip/tap.

- Online sales: 2.9% + $0.30 per transaction.

- 3.5% + $0.15 for manually entered transactions.

11

�PART 4 SUBMISSION

Q. Perform a proper analysis and recommend

to Outlook 3 Payment Gateways in order of

preference.

Ans. Based on the research, I recommend the following top 3 payment gateways

to Outlook in order of preference:

1.Stripe

*Transaction Fees*: Stripe charges 2.9% + 30¢ per successful card charge (in the

U.S.). It also charges extra for international transactions and currency conversions.

*Ease of Integration*: Stripe provides comprehensive APIs, making it developer-

friendly. Many online platforms and businesses already use Stripe because of its simple

integration capabilities.

*Security*: Stripe offers advanced fraud prevention with tools like Radar, ensuring

PCI-DSS Level 1 compliance. It uses tokenization and secure encryption for payment

data.

*Global Reach*: Stripe supports over 135 currencies, and multiple payment

methods like credit cards, wallets (Apple Pay, Google Pay), and international payment

methods.

*User Experience*: Known for providing a smooth and fast checkout experience.

*Payment Methods*: Supports credit/debit cards, wallets, and local payment

methods in various regions.

12

� *Recommendation: **Top choice* for its balance of scalability, global reach,

security, and ease of integration.

- Pros: Flexible, scalable, developer-friendly, wide acceptance, and robust security features.

- Cons: Limited support for certain industries.

- Cost structure: 2.9% + $0.30 per transaction (online), 2.5% + $0.10 (in-person).

- Integration: Easy integration with Outlook's platform, with a wide range of APIs and

developer tools.

2.PayPal

*Transaction Fees*: 2.9% + 30¢ per transaction for domestic payments in the U.S.,

and additional fees for international and currency conversion.

*Ease of Integration*: PayPal offers plugins for easy integration with various

platforms. It’s widely supported and offers integration through APIs.

*Security*: PayPal has strong fraud detection and compliance with PCI-DSS

standards. Users trust PayPal due to its brand recognition and protection policies.

*Global Reach*: Available in over 200 countries and supports 25+ currencies.

*User Experience*: Widely recognized and trusted, offering customers a familiar

and convenient checkout experience.

- *Payment Methods*: PayPal supports PayPal account payments, credit/debit

cards, and alternative methods such as Venmo.

*Recommendation: **Second choice*, especially for businesses that want to

capitalize on PayPal’s brand and wide acceptance

- Pros: Wide acceptance, trusted brand, easy integration, and robust security features.

- Cons: Higher fees, limited customization.

- Cost structure: 2.9% + $0.30 per transaction (domestic), 4.4% + fixed fee (international).

- Integration: Easy integration with Outlook's platform, with a wide range of APIs and

developer tools.

3. Braintree

-Pros: Flexible, scalable, trusted brand, and robust security features.

- Cons: Higher fees, limited support.

- Cost structure: 2.9% + $0.30 per transaction (domestic), 3.9% + fixed fee (international).

- Integration: Easy integration with Outlook's platform, with a wide range of APIs and

developer tools

13

�This recommendation is based on the following factors:

1. *Transaction Fees*: Costs associated with processing

payments, which impact the business's revenue.

2. *Ease of Integration*: How easily the payment gateway

can be integrated into Outlook's systems and user interface.

3. *Security*: Payment security and fraud prevention measures

like encryption and PCI-DSS compliance.

4. *Global Reach and Currency Support*: The ability to

support international transactions and multiple currencies.

5. *User Experience*: A seamless and reliable experience for

customers during payment processing.

6. *Support for Different Payment Methods*: Supporting

credit/debit cards, digital wallets (like Apple Pay or Google Pay),

and alternative payment methods.

7. *Compliance*: Adherence to regulatory requirements in

various countries, which may be important depending on

Outlook’s operational markets.

8. *Scalability and Flexibility*: The ability to handle large

14

�Overall means,- Security and reliability

- Scalability and flexibility

- Integration ease and developer support

- Cost structure and fees

- Industry support and acceptance

Outlook can consider these factors and choose the best payment gateway that suits their

specific needs and requirements.

Conclusion

I recommend Stripe as the top choice due to

its flexibility, scalability, and developer-

friendly approach. PayPal and Braintree are

close seconds, offering wide acceptance and

trusted brands, but with slightly higher fees.

15

�PART 5 SUBMISSION

Q. Prepare a detailed EMI strategy to sell

Outlook Groups subscription.

EMI Strategy to Sell Outlook Groups Subscription

A well-executed EMI (Equated Monthly Installment) strategy can

boost sales of Outlook Groups subscriptions, particularly among

SMBs (Small and Medium-sized Businesses) and enterprises that

need collaboration tools but are cautious about upfront costs.

16

�Below is a detailed EMI strategy tailored to selling Outlook

Groups subscriptions:

1. *Target Market Segmentation*

Before launching the EMI strategy, segment the market into different categories to create a

more personalized approach:

*SMBs*: Smaller companies that may need collaboration tools but cannot afford large

upfront payments.

*Startups*: Businesses looking for cost-effective, scalable solutions with low initial

investment.

*Enterprise Clients*: Larger organizations that are focused on spreading out their

subscription costs for better cash flow management.

2. *Flexible EMI Plans*

Offer flexible EMI options that align with the cash flow of different business segments:

*3-Month EMI Plan*: For businesses that prefer short-term commitments and quick

repayments.

*6-Month EMI Plan*: This would be attractive to companies that want a more extended

but still manageable payment period.

*12-Month EMI Plan*: Perfect for businesses that need maximum flexibility and minimal

monthly payments.

Offering these multiple EMI options allows businesses to choose the plan that

best suits their financial situation, ensuring a wider appeal. Here's a detailed EMI

(Equated Monthly Installment) strategy to sell Outlook Groups subscriptions:

EMI Plan Options:

1. 6-Month EMI: Divide the annual subscription fee into 6 equal monthly

installments.

2. 12-Month EMI: Divide the annual subscription fee into 12 equal monthly

installments.

3. 18-Month EMI: Divide the annual subscription fee into 18 equal monthly

installments.

Interest Rates:

- 6-Month EMI: 0% interest

17

�- 12-Month EMI: 5% interest

- 18-Month EMI: 10% interest

Down Payment:- 10% of the annual subscription fee (optional

1. 6-Month EMI:

- Total cost: Annual subscription fee

- Monthly installment: Annual subscription fee / 6

- Interest rate: 0%

- Down payment: 10% of annual subscription fee (optional)

2. 12-Month EMI:

- Total cost: Annual subscription fee + 5% interest

- Monthly installment: (Annual subscription fee + 5% interest) / 12

- Interest rate: 5%

- Down payment: 10% of annual subscription fee (optional)

3. 18-Month EMI:

- Total cost: Annual subscription fee + 10% interest

- Monthly installment: (Annual subscription fee + 10% interest) / 18

- Interest rate: 10%

- Down payment: 10% of annual subscription fee (optional)

3. *Interest-Free EMI Options*

*Interest-Free EMI* offers can incentivize businesses to opt for higher-tier subscriptions.

For example:

Offer *interest-free EMI* for the first six months to encourage more businesses to sign

up for Outlook Groups' premium or enterprise-level subscription packages.

- Partner with payment processors or financial institutions to offer this feature without

burdening the business.

This strategy makes the Outlook Groups subscription more affordable, especially

for cash-strapped startups or SMBs.

3.*Collaborate with Financial Partners*

18

� Partner with financial institutions, banks, or payment gateways that can offer smooth EMI

processing at a minimal or no extra cost. These partnerships can provide:

- *Instant credit checks* and approval for businesses.

- *Automated EMI payments*, ensuring businesses don’t default or miss their payments.

- Lower transactional or processing fees that make EMIs more attractive to the customer.

5. *Discounts for Annual Subscriptions with EMI*

Offering a *discount on annual subscriptions* can further encourage businesses to opt

for EMI payments:

- Provide a 10-15% discount if they subscribe annually but pay through EMI.

- Discounts can be tiered based on subscription level (e.g., greater discounts for

enterprise-level packages).

This strategy ensures customer retention for a more extended period while

giving them financial flexibility.

6. *Incorporate Subscription Bundles*

Bundle the Outlook Groups subscription with other Microsoft services, such as Office 365,

Microsoft Teams, or SharePoint, and offer EMI on the entire package:

*This increases the value proposition for businesses and ensures that the business is

getting a comprehensive suite of tools.

19

� *Bundled pricing* on an EMI basis will make the overall package more affordable in

monthly installments, increasing the likelihood of higher-tier package adoption.

7. *EMI Calculator on Website*

Add an *EMI calculator* to the Outlook Groups subscription page to give businesses a

clear understanding of their financial commitment:

* The calculator can show different payment options based on their preferred plan (monthly,

quarterly, or annually).

*Users can adjust the subscription levels and see how much they would need to pay every

month based on their choice of EMI.

This feature will improve transparency and help businesses make informed

decisions about their subscription choices.

8. *Marketing & Promotion Strategy*

Promote the EMI strategy aggressively to reach the right audience:

*Email Campaigns*: Targeted email campaigns highlighting the ease of payments through

EMIs and the interest-free period (if applicable).

*Social Media Advertising*: Create ads that target SMBs and startups, showcasing the

flexibility of EMI options.

*Webinars and Demos*: Host webinars to demonstrate how businesses can maximize

Outlook Groups’ capabilities while also benefitting from easy payment plans.

Use case studies of existing businesses that have used EMI plans to scale up

their subscription.

20

�9. *Channel Partner Collaboration*

Collaborate with Microsoft’s existing channel partners or resellers to introduce EMI options

to their clients. Incentivize these partners with:

*Higher commissions* for closing EMI-based deals.

Offering special partner rates that they can pass on to clients, making EMI-based

Outlook Groups subscriptions an easy sell for their networks.

10. *Cashback and Loyalty Points*

Offering *cashback* or *loyalty points* for businesses that opt for EMI payments can

further sweeten the deal:

* Businesses can receive a small percentage of their monthly EMI as cashback to be used

for other Microsoft services.

* Loyalty points for each EMI payment could be redeemed for discounts on future

upgrades or services.

11. *Risk Mitigation and Credit Check*

While offering EMI is attractive, *risk mitigation* is essential to ensure payment

continuity:

- Conduct a *credit check* on businesses applying for EMI options to assess risk.

- Use subscription management tools that allow *automatic renewal* or alert

businesses before they miss a payment.

12. *Customer Support and Payment Flexibility*

21

� Offering dedicated *customer support* for businesses opting for EMI is crucial for

maintaining a positive relationship:

- Provide flexible options like changing EMI plans mid-term or deferring one payment

for businesses going through cash flow issues.

- Create a self-service portal for managing their EMI schedules and payments.

*Conclusion*

By offering flexible EMI plans, interest-free periods, and

promotional discounts, this strategy makes Outlook

Groups subscriptions more affordable and attractive to

businesses of all sizes. Partnering with financial

institutions, leveraging bundles, and aggressively

promoting these plans will help maximize the uptake of

Outlook Groups through EMI options. This approach not

only boosts subscription sales but also improves

customer retention and satisfaction.

22