0% found this document useful (0 votes)

116 views37 pagesPattern

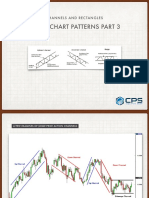

This document provides a comprehensive guide on candlestick patterns, including their application, types, and decision-making processes based on these patterns. It explains the anatomy of candlesticks, various formations like Doji, Engulfing, and Harami patterns, and how to interpret them for trading decisions. Additionally, it emphasizes the importance of volume in confirming patterns and making informed trading choices.

Uploaded by

chucha ayanaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

116 views37 pagesPattern

This document provides a comprehensive guide on candlestick patterns, including their application, types, and decision-making processes based on these patterns. It explains the anatomy of candlesticks, various formations like Doji, Engulfing, and Harami patterns, and how to interpret them for trading decisions. Additionally, it emphasizes the importance of volume in confirming patterns and making informed trading choices.

Uploaded by

chucha ayanaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 37